Global Military Lighting Market Size, Share, and COVID-19 Impact Analysis, By Product (Interior, Exterior, Others); By Type (LED, Non-LED); By End-Use (Ground, Marine, Airborne); and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Aerospace & DefenseGlobal Military Lighting Market Insights Forecasts to 2033

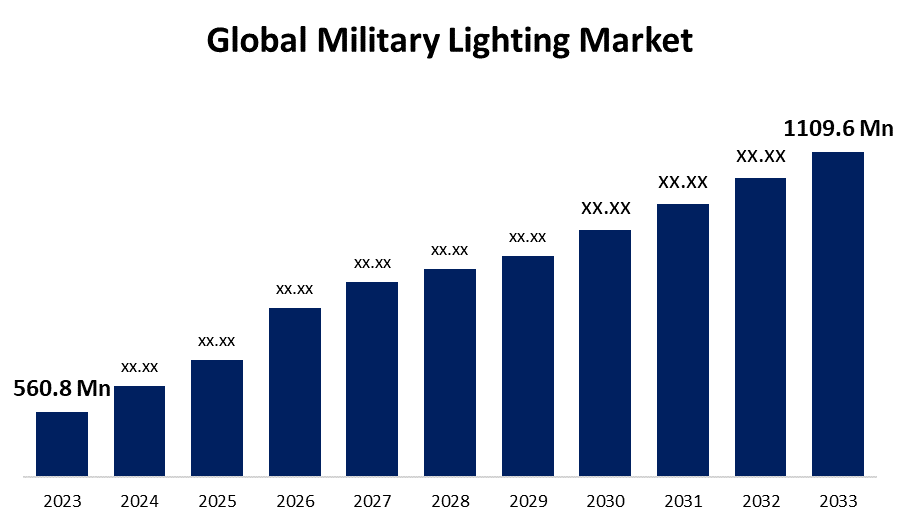

- The Military Lighting Market Size was valued at USD 560.8 Million in 2023.

- The Market Size is growing at a CAGR of 7.06% from 2023 to 2033.

- The Worldwide Military Lighting Market is expected to reach USD 1109.6 Million by 2033.

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Military Lighting Market Size is expected to reach USD 1109.6 Million by 2033, at a CAGR of 7.06% during the forecast period 2023 to 2033.

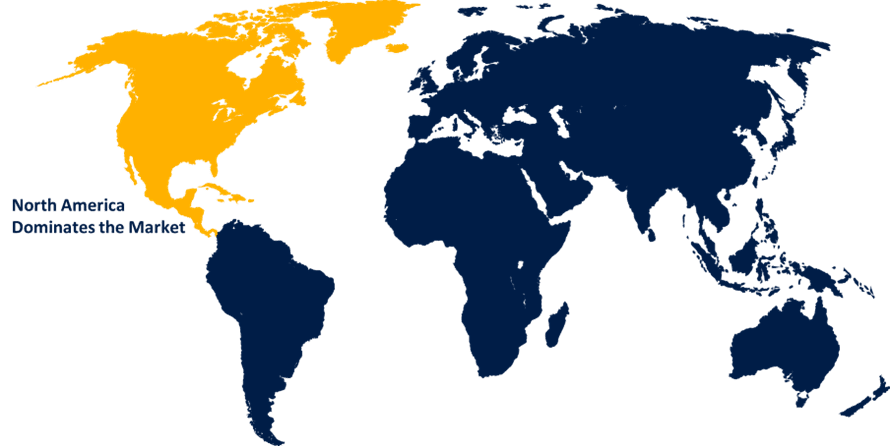

The military lighting market is experiencing steady growth, driven by advancements in LED technology, increasing defense budgets, and the need for energy-efficient, durable lighting solutions. Military lighting is crucial for operations, providing visibility in harsh environments and ensuring safety in combat, naval, and aerospace applications. Key sectors include land, air, and sea platforms, with lighting solutions ranging from vehicle-mounted lights to airfield and ship deck illumination. The demand for night vision-compatible and infrared lighting is rising, enhancing stealth and operational effectiveness. Leading players are investing in smart lighting, ruggedized designs, and cybersecurity-integrated systems. North America dominates the market due to high defense spending, while Asia-Pacific sees rapid growth. Future trends include solar-powered and adaptive lighting, catering to modern warfare needs.

Military Lighting Market Value Chain Analysis

The military lighting market value chain comprises several key stages, from raw material sourcing to end-user deployment. It begins with suppliers providing essential components like LEDs, optics, semiconductors, and ruggedized materials. Manufacturers then design and assemble lighting solutions, ensuring compliance with military-grade durability, energy efficiency, and night vision compatibility. System integrators customize and incorporate these lighting solutions into military vehicles, aircraft, ships, and bases. Defense contractors and procurement agencies oversee quality control, regulatory approvals, and contract fulfillment. Distribution channels include direct government contracts, defense suppliers, and specialized vendors. End-users, such as military forces and defense organizations, deploy these lighting solutions in tactical operations, infrastructure, and combat environments. Innovations in smart lighting and cybersecurity integration are reshaping the value chain for enhanced operational efficiency.

Military Lighting Market Opportunity Analysis

The military lighting market presents significant growth opportunities driven by advancements in LED technology, increasing defense modernization programs, and rising demand for energy-efficient solutions. The shift toward smart lighting systems, including IoT-enabled and adaptive lighting, offers new possibilities for improved operational efficiency and security. The growing need for night vision-compatible and infrared lighting enhances stealth and battlefield effectiveness. Expanding defense budgets, particularly in North America and Asia-Pacific, fuel market growth, while emerging markets provide untapped potential. Additionally, the integration of solar-powered and sustainable lighting aligns with military sustainability initiatives. Innovations in cyber-secure lighting solutions further create lucrative prospects. Companies investing in RandD for ruggedized, intelligent lighting solutions tailored for land, air, and sea applications are well-positioned to capitalize on these expanding opportunities.

Global Military Lighting Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 560.8 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 244 |

| Tables, Charts & Figures: | 127 |

| Segments covered: | By Product, By Type, By End-Use, By Region |

| Companies covered:: | Acuity Brands Lighting ADB Safegate Astronics ATG Airports Limited Avlite Systems Carmanah Technologies Cobham Glamox Honeywell L. C. Doane Company Luminator Technology Orion Energy Systems Osram Licht Oxley Developments Company Revolution Lighting Technologies Rockwell Collins Soderberg Manufacturing Company STG Aerospace United Technologies Zodiac Aerospace |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Military Lighting Market Dynamics

The increasing adoption of LED technology in the military sector for improved energy efficiency

The growing adoption of LED technology in the military lighting market is a key factor driving market growth. LEDs offer significant advantages in energy efficiency, durability, and longevity compared to traditional lighting solutions, making them ideal for military applications. As defense forces prioritize reducing energy consumption and operational costs, LEDs provide an effective solution for lighting in various environments, from military vehicles to base infrastructure. Furthermore, LEDs are more reliable in extreme conditions, offering superior performance and reducing the need for frequent replacements. The ability to integrate LED lighting into smart systems also enhances operational capabilities, supporting adaptive and energy-efficient lighting solutions. As defense budgets continue to rise and technological advancements in LED systems evolve, their increasing adoption is expected to further fuel the growth of the military lighting market.

Restraints and Challenges

One major challenge is the high cost of military-grade lighting systems, particularly advanced technologies like smart, energy-efficient, and night vision-compatible lighting. The complex and rigorous requirements for durability, ruggedness, and reliability in harsh environments also drive up costs and complicate manufacturing. Additionally, the integration of new lighting solutions with existing military infrastructure can present technical hurdles, requiring compatibility and extensive testing. Another challenge is the slow adoption of innovative technologies in certain regions due to budget constraints or conservative procurement processes. Cybersecurity concerns regarding smart and connected lighting systems also pose risks, as vulnerabilities could compromise operational security. Lastly, the market's reliance on government contracts makes it susceptible to political and defense budget fluctuations.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Military Lighting Market from 2023 to 2033. The United States, in particular, invests heavily in modernizing its military infrastructure, driving demand for high-performance lighting solutions. With a focus on energy efficiency, durability, and adaptability in extreme environments, LED lighting technology is gaining prominence across military applications, from tactical vehicles to naval and aerospace platforms. Additionally, the integration of smart, adaptive, and night vision-compatible lighting enhances operational effectiveness and security. The region’s growing emphasis on cybersecurity and innovation in lighting solutions further fuels market growth. Leading defense contractors and lighting manufacturers in North America are continually investing in research and development to cater to the evolving needs of modern military forces, ensuring the market remains robust and competitive.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. China, India, and Japan are investing heavily in modernizing their armed forces, which has led to a rising demand for efficient, durable, and high-performance lighting solutions. LED technology is particularly favored due to its energy efficiency, long lifespan, and ability to withstand extreme environments. The region's emphasis on enhancing operational capabilities, such as stealth, night vision, and situational awareness, further supports the demand for specialized lighting solutions. Moreover, as defense modernization programs accelerate, opportunities for smart and adaptive lighting solutions are expanding. The growth of military infrastructure, coupled with strategic regional alliances, is expected to continue driving the market in Asia-Pacific.

Segmentation Analysis

Insights by Product

The interior lighting segment accounted for the largest market share over the forecast period 2023 to 2033. Interior lighting solutions are critical in military vehicles, aircraft, ships, and base facilities, ensuring proper visibility, enhancing communication, and supporting mission effectiveness. With the increasing adoption of energy-efficient LED technology, interior lighting systems are becoming more durable and cost-effective. Additionally, advancements in adaptive and smart lighting systems allow for better customization, offering features like adjustable brightness and color temperature to support different tasks and environments. The demand for interior lighting solutions is also driven by the growing need for mission readiness and personnel welfare, contributing to improved operational performance in both combat and non-combat settings. This segment is poised for continued growth with ongoing defense modernization.

Insights by Type

The LED segment accounted for the largest market share over the forecast period 2023 to 2033. LEDs offer superior energy efficiency, longer lifespan, and durability, making them ideal for military applications in challenging environments. As military forces focus on reducing operational costs and enhancing energy efficiency, LED lighting provides an effective solution across various platforms, including vehicles, aircraft, naval vessels, and military bases. The ability of LEDs to function in extreme temperatures and withstand vibrations further contributes to their increasing adoption. Additionally, LED technology supports advanced features such as smart lighting systems, night vision compatibility, and adaptive lighting for improved operational effectiveness. As defense budgets grow and technological advancements continue, the LED segment is poised for continued expansion, reinforcing its role as the preferred lighting solution in the military sector.

Insights by End Use

The ground segment accounted for the largest market share over the forecast period 2023 to 2033. Ground-based military lighting is crucial for ensuring visibility during night operations, enhancing safety in low-light conditions, and improving overall mission effectiveness. As military forces seek more energy-efficient, durable, and rugged solutions, LED technology is gaining traction for its longevity and reliability in harsh environments. Additionally, the demand for smart and adaptive lighting systems is rising, enabling tailored illumination for specific tactical needs. These lighting solutions are also integrated into vehicle lighting systems, command posts, and surveillance areas, improving visibility and operational awareness. With ongoing defense modernization programs and increasing security needs, the ground segment is poised for continued expansion, driven by innovation and evolving military requirements.

Recent Market Developments

- In May 2022, Astronics has broadened its CorePower product portfolio and enhanced its capabilities to meet the demands of the growing electric aircraft industry.

Competitive Landscape

Major players in the market

- Acuity Brands Lighting

- ADB Safegate

- Astronics

- ATG Airports Limited

- Avlite Systems

- Carmanah Technologies

- Cobham

- Glamox

- Honeywell

- L. C. Doane Company

- Luminator Technology

- Orion Energy Systems

- Osram Licht

- Oxley Developments Company

- Revolution Lighting Technologies

- Rockwell Collins

- Soderberg Manufacturing Company

- STG Aerospace

- United Technologies

- Zodiac Aerospace

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Military Lighting Market, Product Analysis

- Interior

- Exterior

- Others

Military Lighting Market, Type Analysis

- LED

- Non-LED

Military Lighting Market, End Use Analysis

- Ground

- Marine

- Airborne

Military Lighting Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East and Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East and Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Military Lighting Market?The global Military Lighting Market is expected to grow from USD 560.8 million in 2023 to USD 1109.6 million by 2033, at a CAGR of 7.06% during the forecast period 2023-2033.

-

2. Who are the key market players of the Military Lighting Market?Some of the key market players of the market are Acuity Brands Lighting, ADB Safegate, Astronics, ATG Airports Limited, Avlite Systems, Carmanah Technologies, Cobham, Glamox, Honeywell, L. C. Doane Company, Luminator Technology, Orion Energy Systems, Osram Licht, Oxley Developments Company, Revolution Lighting Technologies, Rockwell Collins, Soderberg Manufacturing Company, STG Aerospace, United Technologies, Zodiac Aerospace.

-

3. Which segment holds the largest market share?The LED segment holds the largest market share and is going to continue its dominance.

Need help to buy this report?