Global Military Rotorcraft Market Size, Share, and COVID-19 Impact Analysis, By Type (Attack helicopters, Transport helicopters, and Multi-mission and Training Helicopters), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Aerospace & DefenseGlobal Military Rotorcraft Market Insights Forecasts to 2033

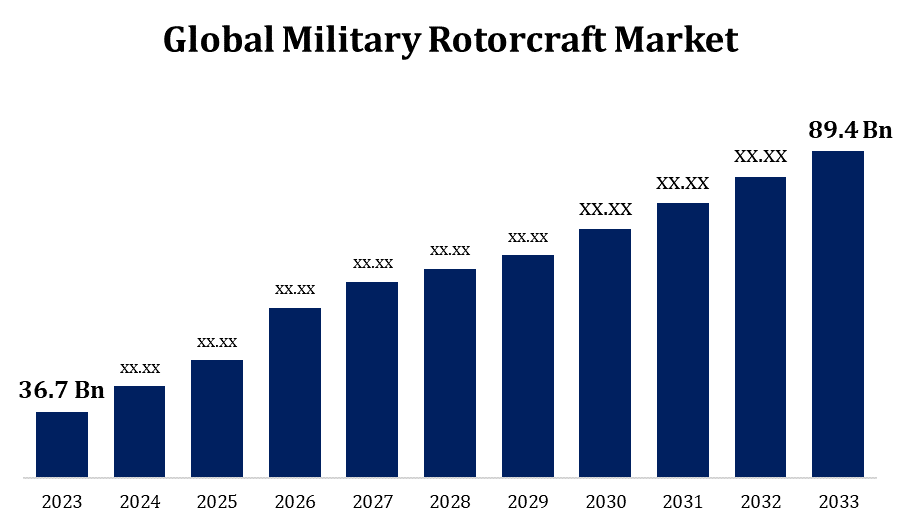

- The Global Military Rotorcraft Market Size was valued at USD 36.7 Billion in 2023.

- The Market Size is Growing at a CAGR of 9.31% from 2023 to 2033

- The Worldwide Military Rotorcraft Market Size is expected to reach USD 89.4 Billion by 2033

- Asia Pacific is expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Military Rotorcraft Market Size is expected to reach USD 89.4 Billion by 2033, at a CAGR of 9.31% during the forecast period 2023 to 2033.

The military rotorcraft market is witnessing robust expansion due to several key factors. Increasing defense budgets globally, geopolitical tensions, and the need for modernizing aging military fleets are primary drivers. The market encompasses various segments, including attack helicopters, transport helicopters, and multi-mission helicopters. These aircraft are seeing significant technological advancements, such as improved stealth capabilities, autonomous operations, advanced avionics, and enhanced survivability features, which are critical for modern warfare. Overall, the military rotorcraft market is poised for sustained growth, driven by the continuous need for versatile and technologically advanced aircraft to meet the evolving demands of global military operations.

Military Rotorcraft Market Value Chain Analysis

The military rotorcraft market value chain involves several key stages, from raw material procurement to final product delivery and maintenance. It begins with sourcing specialized materials, including high-strength alloys and composite materials, essential for manufacturing durable and lightweight components. The design and development phase integrates advanced technologies such as avionics, propulsion systems, and weaponry. Manufacturing encompasses assembling airframes, engines, and systems, requiring precision engineering and stringent quality control. Leading aerospace companies collaborate with a network of suppliers and subcontractors to streamline production. Once manufactured, rotorcraft undergo rigorous testing and certification before deployment. Post-delivery, the value chain extends to maintenance, repair, and overhaul (MRO) services, ensuring operational readiness and extending the aircraft's lifecycle, supported by continuous upgrades and technological advancements.

Military Rotorcraft Market Opportunity Analysis

The military rotorcraft market presents significant growth opportunities driven by evolving defense strategies and technological advancements. Rising defense budgets and geopolitical tensions prompt nations to invest in modernizing their helicopter fleets. Key opportunities lie in the development of next-generation rotorcraft with enhanced stealth, autonomy, and multi-mission capabilities. Emerging markets, particularly in Asia-Pacific, Latin America, and the Middle East, offer substantial potential as countries in these regions seek to bolster their defense capabilities. Additionally, the increasing demand for unmanned aerial systems (UAS) and the integration of advanced avionics and weapon systems provide avenues for innovation and expansion. Partnerships and collaborations among leading aerospace companies and defense contractors further facilitate market growth, making the military rotorcraft sector a dynamic and lucrative field.

Global Military Rotorcraft Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 36.7 Billion 2023 |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 9.31% |

| 2033 Value Projection: | USD 89.4 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Region |

| Companies covered:: | Airbus SE, Changhe Aircraft Industries Corporation, Hindustan Aeronautics Ltd, Leonardo SpA, Rostec, Kaman Corporation, Turkish Aerospace Industries Inc., Lockheed Martin Corporation, The Boeing Company, Korea Aerospace Industries Ltd, MD HELICOPTERS Inc., Textron Inc., and Others |

| Growth Drivers: | Aging military helicopter fleets require replacement with advanced models |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Military Rotorcraft Market Dynamics

Aging military helicopter fleets require replacement with advanced models

The aging military helicopter fleets across many nations necessitate urgent replacements with advanced models, significantly driving growth in the military rotorcraft market. Older helicopters face escalating maintenance costs, reduced operational efficiency, and limited compatibility with modern warfare requirements. Advanced rotorcraft offer superior performance, incorporating cutting-edge technologies such as enhanced stealth, improved avionics, autonomous capabilities, and multi-mission versatility. These new models ensure better survivability, increased mission effectiveness, and lower lifecycle costs.

Restraints & Challenges

High development and acquisition costs of advanced rotorcraft strain defense budgets, especially for countries with limited financial resources. Stringent regulatory and certification processes add complexity and time to bringing new models to market. Technological challenges, such as integrating cutting-edge avionics, stealth features, and autonomous systems, require significant R&D investment. Geopolitical instability can disrupt supply chains and affect procurement plans. Additionally, the need for extensive pilot training and maintenance infrastructure poses logistical hurdles. Competition from fixed-wing aircraft and unmanned aerial systems (UAS) also presents a market challenge.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Military Rotorcraft Market from 2023 to 2033. The United States, in particular, plays a pivotal role, with significant investments in modernizing its helicopter fleet to enhance capabilities and address evolving threats. Key programs include the development of next-generation attack, transport, and multi-mission helicopters featuring advanced avionics, stealth technology, and autonomous systems. Collaboration between leading aerospace companies like Boeing and Lockheed Martin and the U.S. Department of Defense fuels innovation and market growth. Additionally, the region's strong industrial base, extensive R&D infrastructure, and well-established supply chains support production and sustainment. Canada also contributes to the market, investing in upgrades and new acquisitions to bolster its defense capabilities, further cementing North America's market leadership.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. Indigenous development programs, such as India's HAL and China's AVIC, are also contributing to market expansion. Regional tensions and the need for effective disaster response capabilities drive demand for versatile and advanced rotorcraft. Furthermore, strategic partnerships and collaborations with global aerospace companies facilitate technology transfer and innovation, bolstering the region's market growth. The Asia-Pacific market is thus poised for sustained expansion, driven by both internal developments and external collaborations.

Segmentation Analysis

Insights by Type

The attack helicopters segment accounted for the largest market share over the forecast period 2023 to 2033. Increasing defense budgets and the need for advanced offensive capabilities are propelling demand for these specialized aircraft. Modern attack helicopters feature cutting-edge technology, including advanced avionics, stealth capabilities, precision weaponry, and enhanced survivability systems. These helicopters are crucial for anti-tank missions, close air support, and counter-insurgency operations. Nations worldwide, particularly in regions with ongoing conflicts or high-security threats, are prioritizing the acquisition and modernization of their attack helicopter fleets. Key manufacturers like Boeing, Bell, and Russian Helicopters lead this segment, offering highly capable models such as the AH-64 Apache and the Ka-52.

Recent Market Developments

- In April 2022, the US Department of Defence has awarded a Foreign Military Sales (FMS) deal to provide a new AW119Kx helicopter to Israel. The contract was worth USD 29 million.

Competitive Landscape

Major players in the market

- Airbus SE

- Changhe Aircraft Industries Corporation

- Hindustan Aeronautics Ltd

- Leonardo SpA

- Rostec

- Kaman Corporation

- Turkish Aerospace Industries Inc.

- Lockheed Martin Corporation

- The Boeing Company

- Korea Aerospace Industries Ltd

- MD HELICOPTERS Inc.

- Textron Inc.

- Others

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Military Rotorcraft Market, Type Analysis

- Attack helicopters

- Transport helicopters

- Multi-mission and Training Helicopters

Military Rotorcraft Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Military Rotorcraft?The global Military Rotorcraft Market is expected to grow from USD 36.7 billion in 2023 to USD 89.4 billion by 2033, at a CAGR of 9.31% during the forecast period 2023-2033.

-

2. Who are the key market players of the Military Rotorcraft Market?Some of the key market players of the market are Airbus SE, Changhe Aircraft Industries Corporation, Hindustan Aeronautics Ltd, Leonardo SpA, Rostec, Kaman Corporation, Turkish Aerospace Industries Inc., Lockheed, Martin Corporation, The Boeing Company, Korea Aerospace Industries Ltd, MD HELICOPTERS Inc., Textron Inc.

-

3. Which segment holds the largest market share?The attack helicopters segment holds the largest market share and is going to continue its dominance.

-

4. Which region dominates the Military Rotorcraft market?North America dominates the Military Rotorcraft market and has the highest market share.

Need help to buy this report?