Global Military Sensors Market Size, Share, and COVID-19 Impact Analysis, By Platform (Ground, Airborne, Naval, Space), By Component (Hardware, Software), By Application (Navigation and Communication, Intelligence and Reconnaissance, Electronic Warfare, Command & Control, Monitoring and Surveillance, Target Recognition), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Aerospace & DefenseGlobal Military Sensors Market Insights Forecasts to 2033

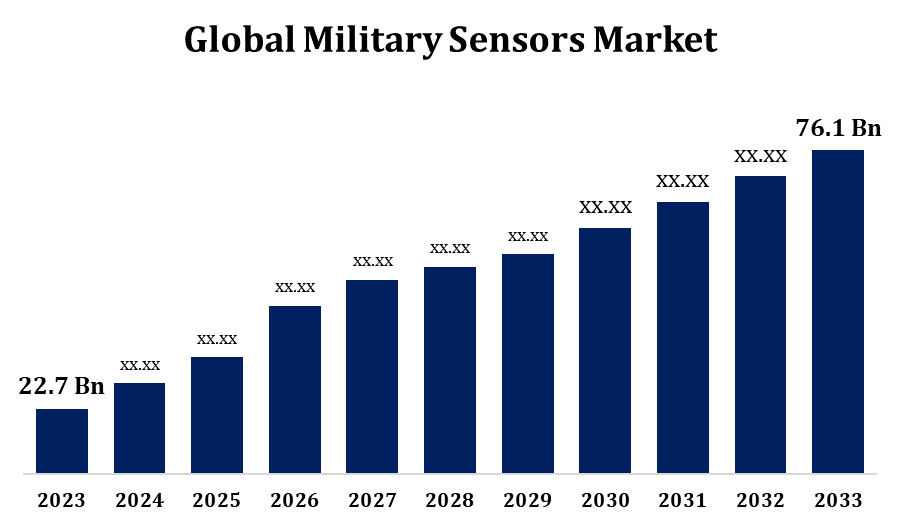

- The Military Sensors Market Size was valued at USD 22.7 Billion in 2023.

- The Market Size is Growing at a CAGR of 12.86% from 2023 to 2033.

- The Global Military Sensors Market Size is expected to reach USD 76.1 Billion By 2033.

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Military Sensors Market Size is Expected to reach USD 76.1 Billion By 2033, at a CAGR of 12.86% during the forecast period 2023 to 2033.

The military sensors market is experiencing significant growth, driven by advancements in defense technology and increasing global security concerns. These sensors play a critical role in surveillance, intelligence, reconnaissance, and combat operations by enhancing situational awareness and threat detection. Key types include radar, infrared, acoustic, and biochemical sensors, integrated into land, naval, airborne, and space-based systems. The demand is fueled by rising defense budgets, modernization programs, and the growing adoption of unmanned systems. Additionally, innovations in artificial intelligence, IoT, and miniaturization are further boosting sensor capabilities. North America leads the market due to heavy defense spending, while Asia-Pacific is rapidly expanding due to regional conflicts and military upgrades. Major players include Lockheed Martin, Raytheon, and BAE Systems. The market is expected to witness steady growth in the coming years.

Military Sensors Market Value Chain Analysis

The military sensors market value chain comprises several key stages, from raw material procurement to end-user deployment. It begins with component suppliers providing essential materials like semiconductors, microelectronics, and specialized alloys. Sensor manufacturers then design and develop radar, infrared, acoustic, and biochemical sensors, integrating advanced technologies such as AI and IoT. These sensors are then assembled into defense systems by integrators and defense contractors like Lockheed Martin and Raytheon. Governments and defense agencies act as primary buyers, procuring sensors through contracts and tenders. Maintenance, repair, and upgrades ensure operational efficiency throughout the product lifecycle. Collaborations between defense firms, research institutions, and governments drive innovation. The growing need for real-time battlefield intelligence and security advancements continues to shape the military sensors market value chain.

Military Sensors Market Opportunity Analysis

The military sensors market presents significant opportunities driven by evolving defense needs, technological advancements, and rising geopolitical tensions. The increasing demand for advanced surveillance, intelligence, and reconnaissance systems fuels the adoption of cutting-edge sensors in land, air, naval, and space-based platforms. Unmanned systems, such as drones and autonomous vehicles, offer growth potential for miniaturized and high-performance sensors. Advancements in AI, machine learning, and IoT integration enhance sensor capabilities, enabling real-time data processing and threat detection. Emerging markets in Asia-Pacific and the Middle East are witnessing increased defense budgets and modernization programs, creating lucrative opportunities for defense contractors. Additionally, the growing emphasis on electronic warfare, cybersecurity, and stealth technologies drives innovation. Companies investing in R&D and strategic partnerships will gain a competitive edge in this expanding market.

Global Military Sensors Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 22.7 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 12.86% |

| 2033 Value Projection: | USD 76.1 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Platform, By Component, By Application, By Region |

| Companies covered:: | Honeywell International Inc., Lockheed Martin Corporation, BAE Systems plc, L3Harris Technologies; Inc., Leonardo S.p.A., Teledyne Technologies Incorporated, Safran S.A., Textron Inc., Curtiss-Wright Corporation, TE Connectivity Ltd., Thales Group, General Electric Company, Crane Aerospace & Electronics, IMPERX; INC., RTX Corporation, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Military Sensors Market Dynamics

Increasing demand for military aircraft and armored vehicles

The rising demand for military aircraft and armored vehicles is a key driver of growth in the military sensors market. Modern defense forces require advanced sensor technologies to enhance situational awareness, targeting accuracy, and threat detection capabilities. Aircraft, including fighter jets, UAVs, and transport planes, rely on radar, infrared, and electro-optical sensors for navigation, surveillance, and combat missions. Similarly, armored vehicles are increasingly equipped with advanced sensor systems for battlefield awareness, missile defense, and communication. The push for next-generation warfare, coupled with increasing defense budgets and military modernization programs, is accelerating the adoption of high-performance sensors. Additionally, advancements in AI and IoT integration further enhance sensor efficiency. As military operations become more technology-driven, the demand for sophisticated sensor solutions will continue to grow.

Restraints & Challenges

The military sensors market faces several challenges despite its growth potential. High development and integration costs pose a significant barrier, as advanced sensor technologies require substantial investment in R&D. Cybersecurity threats are another major concern, as military sensor networks are vulnerable to cyberattacks and data breaches. Additionally, interoperability issues arise when integrating new sensors with existing defense systems, requiring complex upgrades and standardization efforts. Stringent regulatory requirements and export restrictions further limit market expansion, especially in international defense deals. The increasing complexity of modern warfare also demands real-time data processing, straining sensor performance and reliability. Moreover, supply chain disruptions, particularly in semiconductor and electronic components, can impact production timelines. Addressing these challenges through innovation, cybersecurity enhancements, and policy reforms is crucial for market sustainability.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Military Sensors Market from 2023 to 2033. The United States, in particular, leads the region with extensive investments in sensor-based defense systems, including radar, infrared, electro-optical, and biochemical sensors. The growing demand for intelligence, surveillance, and reconnaissance (ISR) systems, along with the integration of AI and IoT in military applications, further fuels market growth. Additionally, the U.S. Department of Defense (DoD) and key defense contractors like Lockheed Martin, Northrop Grumman, and Raytheon contribute to the region’s strong market position. Ongoing procurement of advanced fighter jets, unmanned systems, and missile defense systems enhances sensor adoption.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. The rising demand for fighter jets, unmanned aerial vehicles (UAVs), and missile defense systems is accelerating sensor adoption. Additionally, geopolitical tensions in the South China Sea and border disputes are prompting nations to enhance their defense capabilities. Advancements in AI, IoT, and electronic warfare are further boosting sensor efficiency. Domestic defense industries and collaborations with global manufacturers are expanding the market. With continuous technological advancements and strategic defense initiatives, the Asia-Pacific region is expected to be a key growth driver in the military sensors market.

Segmentation Analysis

Insights by Platform

The airborne segment accounted for the largest market share over the forecast period 2023 to 2033. The growth is driven by the increasing deployment of advanced fighter jets, unmanned aerial vehicles (UAVs), and surveillance aircraft. Modern airborne platforms require sophisticated sensors such as radar, infrared, electro-optical, and biochemical sensors to enhance situational awareness, targeting accuracy, and threat detection. The rising demand for intelligence, surveillance, and reconnaissance (ISR) missions, along with next-generation combat aircraft development, is fueling sensor adoption. Additionally, advancements in AI and IoT are improving sensor capabilities, enabling real-time data processing and autonomous operations. Countries are heavily investing in airborne early warning systems, electronic warfare, and missile defense technologies, further boosting market growth.

Insights by Component

The hardware segment accounted for the largest market share over the forecast period 2023 to 2033. Military forces worldwide are investing in high-performance sensor hardware, including radar, infrared, electro-optical, acoustic, and biochemical sensors, to enhance surveillance, targeting, and threat detection capabilities. The demand for robust and miniaturized hardware components is rising, particularly for integration into unmanned systems, aircraft, naval vessels, and armored vehicles. Additionally, advancements in semiconductor technology, AI-driven processing units, and sensor fusion techniques are improving the efficiency and durability of sensor hardware. Countries are focusing on indigenous sensor manufacturing to reduce dependency on imports, further driving market expansion.

Insights by Application

The electronic warfare segment accounted for the largest market share over the forecast period 2023 to 2033. EW systems rely on specialized sensors, including radar, signal intelligence (SIGINT), electronic intelligence (ELINT), and jamming technologies, to detect, disrupt, and neutralize enemy communications, radar, and missile guidance systems. The growing need for superior situational awareness, cyber defense, and electromagnetic spectrum dominance is driving investments in EW sensor technologies. Countries are modernizing their defense capabilities by integrating AI-driven and software-defined EW systems into aircraft, naval vessels, and ground-based platforms. Additionally, advancements in electronic countermeasures (ECM) and electronic counter-countermeasures (ECCM) are enhancing the effectiveness of EW operations. With increasing defense budgets and technological innovations, the EW segment will remain a key driver in the military sensors market.

Recent Market Developments

- In July 2021, QinetiQ Inc. secured a USD 24 billion contract from the U.S. Army to develop three SPECTRE next-generation full-spectrum hyperspectral prototype sensors.

Competitive Landscape

Major players in the market

- Honeywell International Inc.

- Lockheed Martin Corporation

- BAE Systems plc

- L3Harris Technologies; Inc.

- Leonardo S.p.A.

- Teledyne Technologies Incorporated

- Safran S.A.

- Textron Inc.

- Curtiss-Wright Corporation

- TE Connectivity Ltd.

- Thales Group

- General Electric Company

- Crane Aerospace & Electronics

- IMPERX; INC.

- RTX Corporation

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Military Sensors Market, Platform Analysis

- Ground

- Airborne

- Naval

- Space

Military Sensors Market, Component Analysis

- Hardware

- Software

Military Sensors Market, Application Analysis

- Navigation & Communication

- Intelligence & Reconnaissance

- Electronic Warfare

- Command & Control

- Monitoring & Surveillance

- Target Recognition

Military Sensors Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Military Sensors Market?The global Military Sensors Market is expected to grow from USD 22.7 billion in 2023 to USD 76.1 billion by 2033, at a CAGR of 12.86% during the forecast period 2023-2033.

-

2. Who are the key market players of the Military Sensors Market?Some of the key market players of the market are the Honeywell International Inc.; Lockheed Martin Corporation; BAE Systems plc; L3Harris Technologies; Inc.; Leonardo S.p.A.; Teledyne Technologies Incorporated; Safran S.A.; Textron Inc.; Curtiss-Wright Corporation; TE Connectivity Ltd.; Thales Group; General Electric Company; Crane Aerospace & Electronics; IMPERX; INC.; RTX Corporation.

-

3. Which segment holds the largest market share?The electronic warfare segment holds the largest market share and is going to continue its dominance.

Need help to buy this report?