Global Military Trainer Aircraft Market Size By Type (Fixed Wing, Rotary Wing), By Solution (OEM, Aftermarket), By End User (Air Forces, Naval Forces, Land Forces), By Region, And Segment Forecasts, By Geographic Scope And Forecast to 2033

Industry: Aerospace & DefenseGlobal Military Trainer Aircraft Market Insights Forecasts to 2033

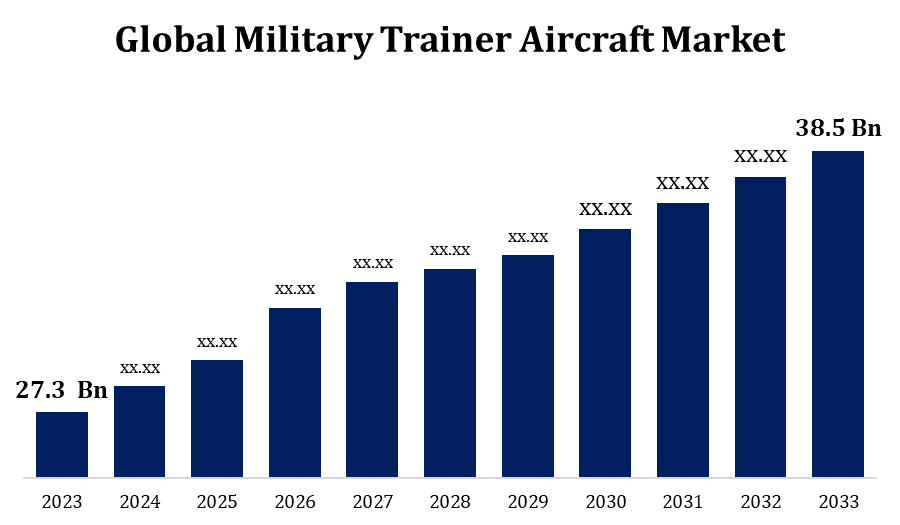

- The Global Military Trainer Aircraft Market Size was valued at USD 27.3 Billion in 2023

- The Market Size is growing at a CAGR of 3.50% from 2023 to 2033

- The Worldwide Military Trainer Aircraft Market Size is expected to reach USD 38.5 Billion by 2033

- Asia Pacific Market is expected to grow the fastest during the forecast period

Get more details on this report -

The Global Military Trainer Aircraft Market Size is expected to reach USD 38.5 Billion by 2033, at a CAGR of 3.50% during the forecast period of 2023–2033.

The purpose of military trainer aircraft is to replicate the capabilities and flight characteristics of sophisticated fighter jets and other military aircraft. They give aspiring pilots practical practice with emergency situations, weapon system operation, tactical procedures, and flight manoeuvres. The market for military trainer aircraft is impacted by a number of variables, including geopolitical tensions, defence budgets, procurement initiatives, and technology developments. The main consumers are the armed forces and government defence departments, which drive demand with programmes for fleet modernization and training needs. Worldwide investment in training programmes to sustain military readiness and capabilities has created a demand for military trainer aircraft. In order to improve their defence capabilities, emerging markets in Latin America, the Middle East, and Asia-Pacific are especially active in acquiring new trainer aircraft.

Military Trainer Aircraft Market Value Chain Analysis

In order to meet changing training requirements, aerospace corporations and defence contractors spend in research and development to create new models of trainer aircraft with cutting-edge features and technology. Airframes, avionics systems, engines, and other subsystems needed for trainer aircraft construction are produced by manufacturers and suppliers. Tight military specifications and performance standards must be met by these components. Supplier-sourced parts are used by original equipment manufacturers (OEMs) to assemble trainer aircraft. Avionics, propulsion, flight control, and other subsystems are integrated by aircraft manufacturers to create finished aircraft that are prepared for delivery and testing. In order to integrate several subsystems and components into training aircraft that are completely operational, system integrators are essential. In order to confirm their performance, safety, and adherence to military regulations, trainer aircraft must pass stringent testing and certification procedures. After certification, military clients receive trainer aircraft via direct sales or government procurement initiatives. The final customers of trainer aircraft include government agencies, military departments, and defence companies. For a variety of training programmes and exercises, they use trainer aircraft for pilot training, competency building, mission rehearsing, and operational preparedness.

Military Trainer Aircraft Market Opportunity Analysis

Global military departments are updating their training fleets to keep up with changing operational needs and technology developments. This offers defence contractors and OEMs the chance to provide next-generation trainer aircraft with cutting-edge avionics, simulation tools, and training features. In order to improve training efficacy, safety, and efficiency, many nations are retiring their outdated trainer aircraft and switching them out for modern types. Modern trainer aircraft that provide better performance, dependability, and maintainability than legacy platforms become more and more in demand as a result. Manufacturers of trainer aircraft can benefit from the growing need for military pilots due to factors including fleet expansion, pilot attrition, and retiring personnel. To satisfy the rising demand for pilot training, military divisions are investing in enlarging their training capabilities and competences.

Global Military Trainer Aircraft Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 27.3 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 3.50% |

| 2033 Value Projection: | USD 38.5 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Solution, By End User, By Region, By Geographic Scope |

| Companies covered:: | Rostec, Hindustan, Aeronautics Ltd, Diamond Aircraft Industries, Embraer SA, Northrop Grumman Corporation, The Boeing Company, BAE Systems PLC, Pilatus Aircraft Ltd, Textron Inc., Leonardo SpA, Lockheed Martin Corporation, Calidus LLC, and Other Key Vendors. |

| Growth Drivers: | Rise in the modernization of existing fleets |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Military Trainer Aircraft Market Dynamics

Rise in the modernization of existing fleets

Military branches can increase the operating life of their current fleets of trainer aircraft by implementing modernization programmes. Trainers can be used for extended periods of time by improving aircraft performance, safety, and reliability through the upgrade of avionics, propulsion systems, and other essential parts. Military departments can maximise aircraft performance and mission capabilities by updating training aircraft with cutting-edge avionics and systems. Improved flight control systems, more efficient engines, and sophisticated instruments are examples of upgrades that help increase aircraft responsiveness, handling, and mission readiness. Aerospace firms, defence contractors, and aftermarket service providers can all benefit from the growing market for modernization services related to military trainer aircraft. Businesses that offer systems integration, retrofitting, and avionics upgrades can profit from the expanding market need for modernization solutions.

Restraints & Challenges

The acquisition and upgrade of new trainer aircraft may be limited by military budget constraints in different nations. Investment in programmes using trainer aircraft may be delayed or reduced due to shrinking defence budgets or conflicting financing priorities. Purchasing trainer aircraft frequently entails drawn-out and complicated procurement procedures, such as budget approvals, government contracts, and regulatory compliance. Acquisition processes can be extended and market demand may be impacted by bureaucratic obstacles and procurement delays. It might be difficult to update or modernise existing trainer aircraft to include new technology and systems. Careful design, testing, and validation are necessary to ensure smooth integration with contemporary avionics, sensors, and simulation systems in order to prevent incompatibilities and system failures.

Regional Forecasts

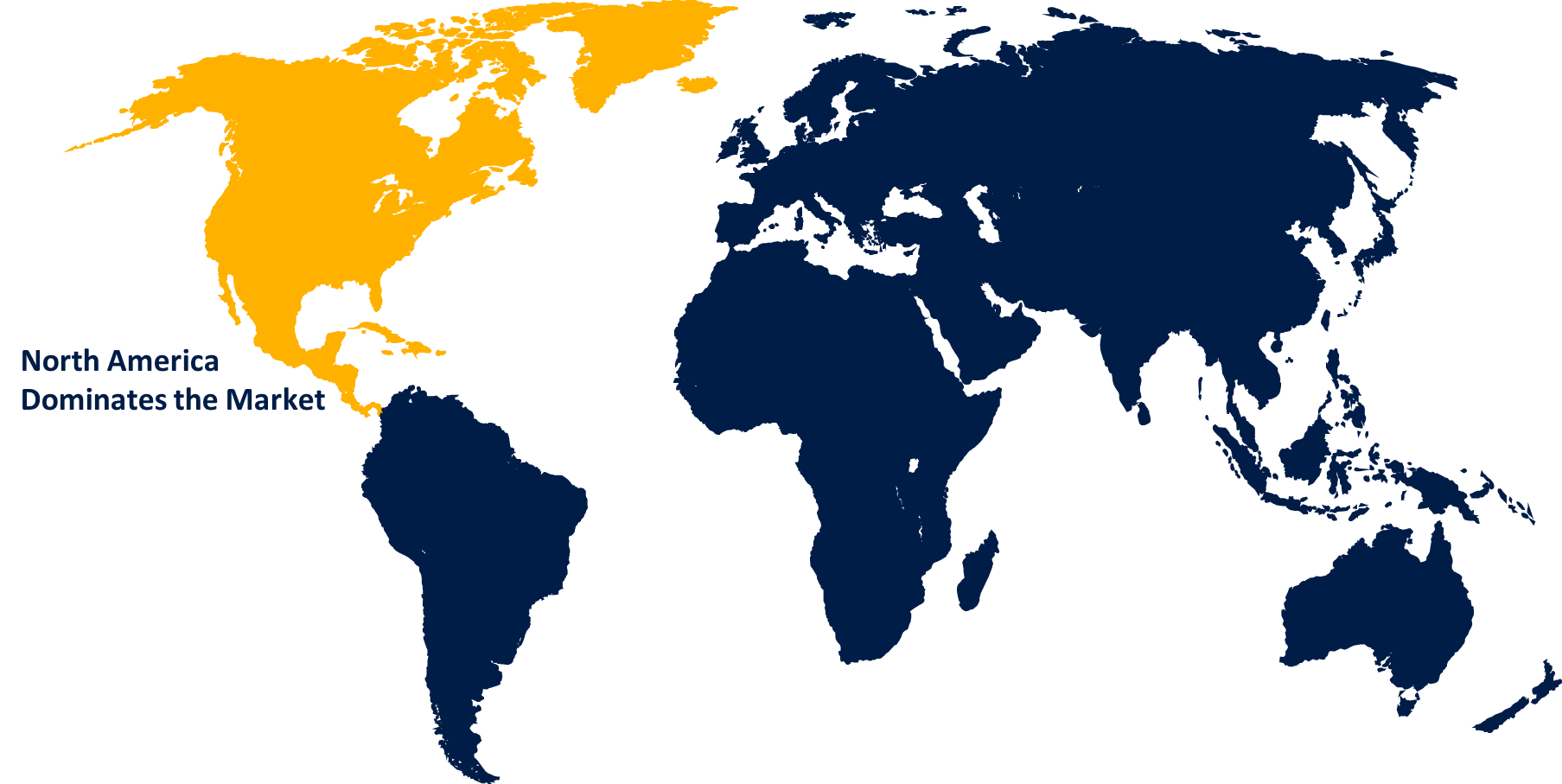

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Military Trainer Aircraft Market from 2023 to 2033. Investing in cutting edge trainer aircraft with the newest avionics, simulation systems, and training technology is one of the ways that North American nations demonstrate their commitment to advanced training capabilities. Because of these cutting-edge skills, military pilots are guaranteed top-notch training to get them ready for operational missions. Aerospace firms in North America take advantage of export prospects to supply military training aircraft to allies across the globe. Trainer aircraft exports support international defence alliances and collaborations while also boosting the economy. To support military pilot training operations, North America has top-notch training facilities and infrastructure. These establishments include flight schools, training ranges, military sites, and simulation centres outfitted with cutting-edge tools and equipment for instruction.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. A lot of the Asia-Pacific region's nations are spending more on defence in order to improve their armed forces and deal with security issues. The demand for trainer aircraft is being driven by the increased defence budget, which also includes investments in military training programmes. A number of Asia-Pacific nations are updating their fleets of trainer aircraft as well as their armed forces and other armaments. The goal of modernization programmes is to swap out outdated trainer aircraft for more modern, up-to-date aircraft with cutting-edge training equipment and avionics. Capabilities for pilot training must rise in tandem with the Asia Pacific region's military modernization and development. In order to enhance operational preparedness, trainer aircraft are essential for both teaching new pilots and keeping up the competency of current staff.

Segmentation Analysis

Insights by Type

The fixed wing segment accounted for the largest market share over the forecast period 2023 to 2033. Across the globe, military forces are allocating resources towards updating their fleets of trainer aircraft to conform to changing training needs and technological breakthroughs. This involves buying brand-new fixed-wing trainer aircraft models that have the most recent avionics, training capabilities, and simulation systems. Fixture-wing trainer aircraft are being retired by many nations and being replaced by more modern, higher-performing variants. The efficacy, safety, and efficiency of training are improved by upgrading to contemporary fixed-wing trainers, guaranteeing that aspiring pilots obtain the instruction required to fly high-tech combat aircraft. Fixed-wing trainer aircraft are in high demand due to military pilot shortages caused by retirements, fleet growth, and pilot attrition. Military branches aim to maintain operational readiness and fulfil the increasing demand for pilot training by increasing their training facilities and capabilities.

Insights by Solution

The aftermarket segment accounted for the largest market share over the forecast period 2023 to 2033. The operational longevity of many military trainer aircraft is being extended by intensive maintenance and repairs as they approach the end of their original service lives. Aftermarket service companies provide structural repairs, component replacements, and system improvements as well as other solutions to ageing aircraft problems. Military operators can improve the capabilities and performance of their trainer aircraft by using aftermarket services. Modernization of the avionics, improved engines, and improved aerodynamics are examples of upgrades that maximise aircraft performance, dependability, and mission effectiveness. The integration of cutting-edge systems and technology into trainer aircraft is supported by aftermarket services, which include mission equipment upgrades, sensor installations, and avionics improvements. These technological linkages expand the capabilities of trainer aircraft, make new mission profiles possible, and boost training efficacy.

Insights by End User

The fixed wing segment accounted for the largest market share over the forecast period 2023 to 2033. In order to meet changing operational objectives, air forces globally are investing in modernising their training capabilities. This involves the purchase of cutting-edge trainer aircraft outfitted with cutting-edge training technologies, simulation systems, and avionics. Due to rising operational needs and geopolitical pressures, the air force is expanding its fleets, necessitating equivalent investments in pilot training. In order to guarantee that air force pilots are prepared for a variety of tasks, trainer aircraft are crucial for skill development and maintenance. Air forces are upgrading to combat aircraft with more advanced systems and avionics. Pilots can transfer to front-line fighter aircraft more quickly and cheaply by using advanced trainer aircraft with comparable capabilities.

Recent Market Developments

- In December 2021, in order to streamline the provision of aerospace education, technical training, and applied research programmes in Malaysia, Turkish Aerospace and the Universiti Kuala Lumpur Malaysian Institute of Aviation Technology (UniKL MIAT) have signed a Memorandum of Cooperation (MoC).

Competitive Landscape

Major players in the market

- Rostec

- Hindustan

- Aeronautics Ltd

- Diamond Aircraft Industries

- Embraer SA

- Northrop Grumman Corporation

- The Boeing Company

- BAE Systems PLC

- Pilatus Aircraft Ltd

- Textron Inc.

- Leonardo SpA

- Lockheed Martin Corporation

- Calidus LLC

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Military Trainer Aircraft Market, Type Analysis

- Fixed Wing

- Rotary Wing

Military Trainer Aircraft Market, Solution Analysis

- OEM

- Aftermarket

Military Trainer Aircraft Market, End User Analysis

- Air Forces

- Naval Forces

- Land Forces

Military Trainer Aircraft Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Military Trainer Aircraft Market?The global Military Trainer Aircraft Market is expected to grow from USD 27.3 billion in 2023 to USD 38.5 billion by 2033, at a CAGR of 3.50% during the forecast period 2023-2033

-

2. Who are the key market players of the Military Trainer Aircraft Market?Some of the key market players of the market are Rostec, Hindustan, Aeronautics Ltd, Diamond Aircraft Industries, Embraer SA, Northrop Grumman Corporation, The Boeing Company, BAE Systems PLC, Pilatus Aircraft Ltd, Textron Inc., Leonardo SpA, Lockheed Martin Corporation, and Calidus LLC.

-

3. Which segment holds the largest market share?The air forces segment holds the largest market share and is going to continue its dominance.

-

4. Which region is dominating the Military Trainer Aircraft Market?North America is dominating the Military Trainer Aircraft Market with the highest market share.

Need help to buy this report?