Global Military Transport Aircraft Market Size, Share, and COVID-19 Impact Analysis, By Aircraft Type (Fixed Wings and Rotorcraft), By Payload (Below 50 Tons, 51 Tons to 100 Tons, and 101 Tons and Above), By Application (Troop Airlifting, Cargo Supply, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Aerospace & DefenseGlobal Military Transport Aircraft Market Insights Forecasts to 2033

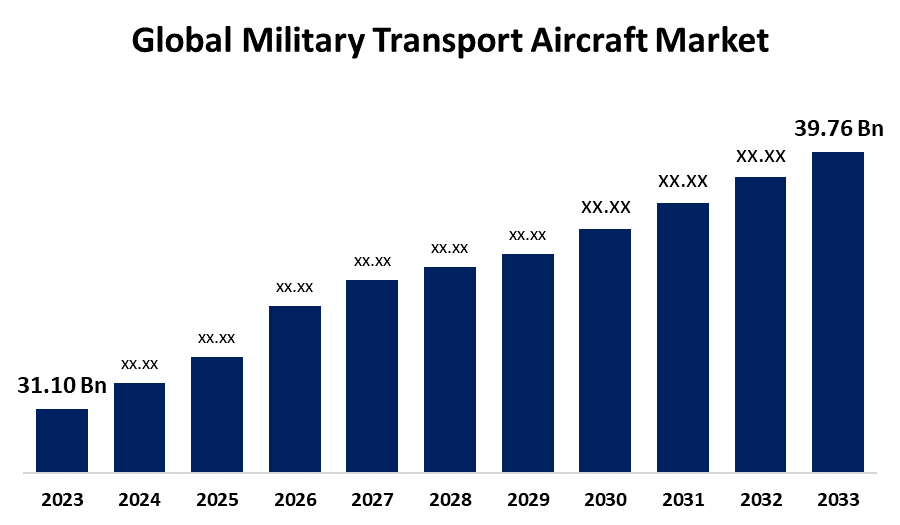

- The Global Military Transport Aircraft Market Size was Valued at USD 31.10 Billion in 2023

- The Market Size is Growing at a CAGR of 2.49% from 2023 to 2033

- The Worldwide Military Transport Aircraft Market Size is Expected to Reach USD 39.76 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Military Transport Aircraft Market Size is Anticipated to Exceed USD 39.76 Billion by 2033, Growing at a CAGR of 2.49% from 2023 to 2033. The market for military transport aircraft is defined by dynamic elements that impact its expansion and advancement. These dynamics include shifting military doctrines, shifting threat scenarios, geopolitical conflicts, and technological developments. Innovation in electronics systems, materials, and aircraft design is fueled by technological breakthroughs, which result in the creation of more capable and efficient military transport aircraft.

Market Overview

A military transport aircraft, generally recognized as a military cargo aircraft or an airlifte, is a type of aircraft that transports soldiers and military supplies during military operations. Due to their complexity of technology, high initial costs, and long lifespans, commercial transport aircraft are the most carefully built non-military modes of transportation. Each year, substantial research and development expenditures are made to improve their layouts. Transport aircraft can be used for both strategic and tactical operations, and they are essential in maintaining supply lines to forward sites that are unreachable by land or water. They are frequently working to provide humanitarian assistance for non-governmental disaster relief efforts. One of the main factors propelling the market's expansion is the growing tension between neighbors worldwide and the growing need to improve aerial combat and support capabilities during conflict or hostile attacks. Accordingly, the market is expanding due to the extensive use of rotorcraft aircraft for airdrop operations, tactical airlifts, and the transportation of litters and ambulant patients during aeromedical evacuations.

The increasing interest in multi-role aircraft offers great opportunities for businesses.

The increasing interest in multi-role aircraft offers great opportunities for businesses that can create adaptable platforms that can carry out different tasks. Military transport aircraft are made more valuable and useful, for example, by including medical evacuation systems, intelligence, surveillance, and reconnaissance (ISR) equipment, including aerial refueling facilities.

Pressure to reduce costs is causing defense spending in major economies to decrease.

The military transport aircraft market faces several challenges that could stymie its expansion. One key constraint is the high expense of developing, producing, and maintaining military transport aircraft. Governments, particularly those with restricted defense budgets, have difficulty allocating funding for the procurement of new aircraft.

Report Coverage

This research report categorizes the market for the military transport aircraft market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the military transport aircraft market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the military transport aircraft market.

Military Transport Aircraft Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 31.10 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 2.49% |

| 2033 Value Projection: | USD 39.76 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Aircraft Type, By Payload, By Application, By Region and COVID-19 Impact Analysis |

| Companies covered:: | Airbus SE, Embraer S.A., Hindustan Aeronautics Limited, Kawasaki Heavy Industries Ltd., Leonardo S.p.A., Lockheed Martin Corporation, General Electric, Textron Inc., The Boeing Company, Rostec, Bell Textron Inc., ANTONOV COMPANY, Sukhoi Corporation, Dassault Aviation, and Others key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growing need for rapid troop and supply deployment in areas affected by disasters and conflicts. Armed forces can react rapidly to crises owing to military transport planes, which provide rapid mobilization. Furthermore, procurement activities in many nations are being driven by the need to replace outdated fleets with contemporary, technologically superior aircraft.

Restraining Factors

The majority of manufacturers of military transport aircraft worldwide deal with supply chain issues. This is because the supply chains for army aircraft are intricate and include a variety of manufacturers, suppliers, and maintenance companies.

Market Segmentation

The military transport aircraft market share is classified into aircraft type, payload, and application.

- The fixed wings segment dominates the market with the highest market share through the forecast period.

Based on the aircraft type, the military transport aircraft market is categorized into fixed wings and rotorcraft. Among these, the fixed wings segment dominates the market with the highest market share through the forecast period. This dominance is due to the rising military budgets for combat aircraft and rising need for air force fleet growth, the fixed-wing sector is anticipated to have the greatest share of the market. The rise of the fixed wing segment is being promoted by innovative engine designs that enhance fuel efficiency and thrust-to-weight ratios.

- The below 50 tons segment holds the highest market share through the forecast period.

Based on the payload, the military transport aircraft market is classified into below 50 tons, 51 tons to 100 tons, and 101 tons and above. Among these, the below 50 tons segment holds the highest market share through the forecast period. The global market for military aircraft is driven by the increasing need from armed forces throughout the world for aerial surveillance and intelligence gathering. Because they can deploy from short runways close to frontlines and have longer flight endurance, lightweight aircraft weighing less than 50 tons are ideal for such duties.

- The combat segment is anticipated to the largest revenue share over the forecast period.

Based on the application, the military transport aircraft market is divided into combat, military transport, airborne early warning & control, and reconnaissance & surveillance. Among these, the combat segment is anticipated to the largest revenue share over the forecast period. The shifting threat situation across areas compels armed forces to strengthen their fighting capabilities. As novel risks arise from enhanced air defense networks and next-generation fighter jets, there is an urgent need to modernize older combat aircraft fleets.

Regional Segment Analysis of the Military Transport Aircraft Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the military transport aircraft market over the forecast period.

Get more details on this report -

North America is projected to hold the largest share of the military transport aircraft market over the forecast period. This dominance is due to the regions prosperity is mostly fueled by the United States' massive defense spending. Furthermore, the country boasts the greatest fleet of transport helicopters and aircraft. In addition, the US air force is constantly developing and acquiring next-generation aircraft, as well as partnering with key industry companies, to improve military transport capabilities.

Asia Pacific is expected to grow at the fastest CAGR growth in the military transport aircraft market during the forecast period. Growing international conflicts and military modernization have led to significant purchase plans for the next ten years in many countries in the area, including China, India, and Japan. By creating platforms domestically, China in particular has shown that it is willing to lessen its reliance on foreign military hardware.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the military transport aircraft market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Airbus SE

- Embraer S.A.

- Hindustan Aeronautics Limited

- Kawasaki Heavy Industries Ltd.

- Leonardo S.p.A.

- Lockheed Martin Corporation

- General Electric

- Textron Inc.

- The Boeing Company

- Rostec

- Bell Textron Inc.

- ANTONOV COMPANY

- Sukhoi Corporation

- Dassault Aviation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In October 2024, Spanish Prime Minister Pedro Sanchez and his Indian counterpart Narendra Modi launched a military transport aircraft production plant in Vadodara, in the northwest Indian state of Gujarat.

- In February 2024, Embraer, a Brazilian aerospace company, and Mahindra declared that they had signed a deal to jointly complete the Indian Air Force's acquisition of the C-390 multi-mission transportation aircraft.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the military transport aircraft market based on the below-mentioned segments:

Global Military Transport Aircraft Market, By Aircraft Type

- Fixed Wings

- Rotorcraft

Global Military Transport Aircraft Market, By Payload

- Below 50 Tons

- 51 Tons to 100 Tons

- 101 Tons and Above

Global Military Transport Aircraft Market, By Application

- Combat

- Military Transport

- Airborne Early Warning & Control

- Reconnaissance & Surveillance

Global Military Transport Aircraft Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the global military transport aircraft market?The global military transport aircraft market is projected to expand at 2.49% during the forecast period.

-

2. Who are the top key players in the global military transport aircraft market?The key players in the global military transport aircraft market are Airbus SE, Embraer S.A., Hindustan Aeronautics Limited, Kawasaki Heavy Industries Ltd., Leonardo S.p.A., Lockheed Martin Corporation, Textron Inc., The Boeing Company, Rostec, Lockheed Martin Corporation, Bell Textron Inc., ANTONOV COMPANY, Sukhoi Corporation, Dassault Aviation, and others.

-

3. Which region is expected to hold the largest share of the global military transport aircraft market?The North America region is expected to hold the largest share of the global military transport aircraft market.

Need help to buy this report?