Global Military Truck Market Size, Share, and COVID-19 Impact Analysis, By Truck (Light-Duty Trucks, Medium-Duty Trucks, Heavy-Duty Trucks), By Application (Cargo & Troop Transportation, Utility), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Automotive & TransportationGlobal Military Truck Market Insights Forecasts to 2033

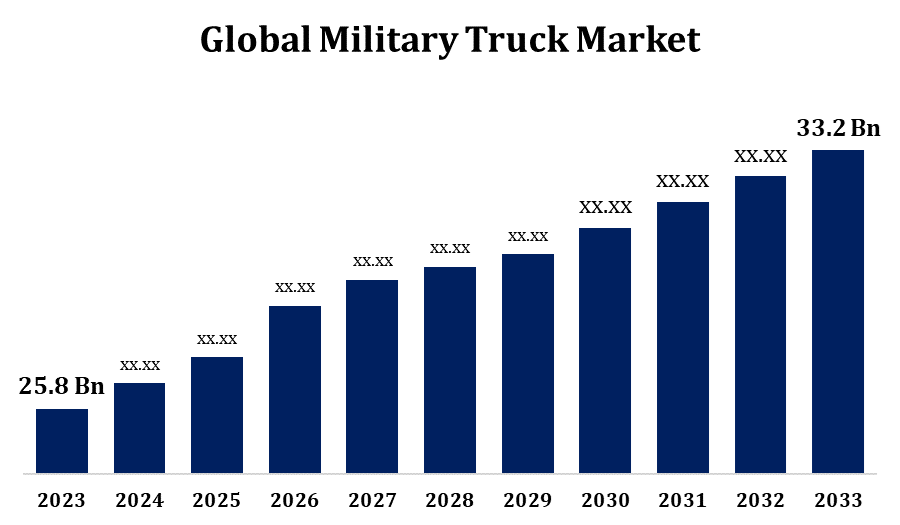

- The Military Truck Market Size was valued at USD 25.8 Billion in 2023.

- The Market is Growing at a CAGR of 2.55% From 2023 to 2033.

- The Global Military Truck Market Size is Expected to reach USD 33.2 Billion By 2033.

- Asia Pacific Size is Expected to Grow the Fastest during the Forecast period.

Get more details on this report -

The Global Military Truck Market Size is Expected to reach USD 33.2 billion By 2033, at a CAGR of 2.55% during the Forecast period 2023 to 2033.

The military truck market is experiencing steady growth due to rising defense budgets, increasing geopolitical tensions, and the need for modernized military logistics. Governments worldwide are investing in advanced, multi-purpose military trucks to enhance mobility, payload capacity, and survivability in diverse terrains. Key trends include the integration of hybrid-electric powertrains, autonomous driving technology, and enhanced armor protection. North America and Europe lead the market, driven by defense modernization programs, while Asia-Pacific sees rapid expansion due to growing military expenditures in China and India. Major players like Oshkosh Corporation, Rheinmetall, and Tata Motors focus on innovation and strategic partnerships. Additionally, demand for all-terrain and tactical transport vehicles is rising, particularly in regions facing security challenges, boosting market growth in the coming years.

Military Truck Market Value Chain Analysis

The military truck market value chain involves several key stages, from raw material procurement to end-user deployment. It begins with sourcing high-strength materials like steel, composites, and advanced electronics, supplied by manufacturers specializing in military-grade components. Next, original equipment manufacturers (OEMs) such as Oshkosh, Rheinmetall, and Tata Motors design and assemble military trucks, integrating advanced technologies like armored protection, hybrid powertrains, and autonomous capabilities. Tier 1 and Tier 2 suppliers provide critical subsystems, including engines, transmission systems, and defense electronics. Distributors and defense contractors manage procurement and logistics, ensuring compliance with military standards. Finally, governments and defense organizations deploy these trucks for various operations, including combat, logistics, and disaster relief. Continuous innovation and maintenance services sustain the lifecycle of military trucks, ensuring long-term operational efficiency.

Military Truck Market Opportunity Analysis

The military truck market presents significant growth opportunities driven by rising global defense budgets, technological advancements, and evolving warfare strategies. Increasing demand for next-generation military trucks with enhanced mobility, survivability, and fuel efficiency is creating opportunities for manufacturers to innovate. The shift towards electric and hybrid-powered military vehicles, driven by sustainability initiatives and reduced fuel dependency, is a key trend. Additionally, the adoption of autonomous and AI-driven logistics vehicles offers a new growth avenue. Emerging markets in Asia-Pacific, the Middle East, and Africa are investing heavily in military modernization, providing lucrative opportunities for OEMs and suppliers. Moreover, partnerships between defense agencies and private manufacturers for localized production and technological advancements further boost market expansion, ensuring long-term profitability in the sector.

Global Military Truck Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 25.8 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 2.55% |

| 2033 Value Projection: | USD 33.2 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 95 |

| Segments covered: | By Truck, By Application, By Region and COVID-19 Impact Analysis |

| Companies covered:: | Tatra Trucks A.S., Krauss-Maffei Wegmann GmbH & Co. KG, KrAZ, AB Volvo, Oshkosh Corporation, Kia Motors Corporation, Mitsubishi Heavy Industries, Ltd., Arquus, Daimler AG, General Dynamics Land Systems, Iveco Defence Vehicles, Mahindra Emirates Vehicle Armouring, Tata Motors, Rheinmetall MAN Military Vehicles GmbH, and others key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Military Truck Market Dynamics

The deployment of military units is expanding across various regions due to a rise in military missions

The growth of the military truck market is driven by the increasing deployment of military units across various regions due to rising military missions. Geopolitical tensions, peacekeeping operations, and border security concerns are prompting defense forces to enhance their logistical and tactical mobility. This surge in deployments has led to higher demand for advanced military trucks with enhanced durability, payload capacity, and off-road capabilities. Additionally, governments are investing in next-generation military vehicles equipped with hybrid powertrains, autonomous technologies, and advanced communication systems to support modern warfare needs.

Restraints & Challenges

High development and procurement costs pose financial constraints for many defense agencies, especially in developing nations. Stringent regulatory requirements and complex defense procurement processes often lead to long approval cycles, delaying production and delivery. Additionally, integrating advanced technologies such as hybrid-electric powertrains, autonomous systems, and enhanced armor increases design complexity and maintenance costs. Supply chain disruptions, exacerbated by geopolitical tensions and raw material shortages, further hinder manufacturing efficiency. Moreover, the growing emphasis on sustainability and emissions reduction presents challenges in adapting military trucks to eco-friendly technologies without compromising performance.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Military Truck Market from 2023 to 2033. The United States leads the region, with the Department of Defense (DoD) investing heavily in next-generation tactical and logistics vehicles. Key programs, such as the Joint Light Tactical Vehicle (JLTV) and Family of Medium Tactical Vehicles (FMTV), fuel demand for advanced military trucks. Additionally, the integration of hybrid-electric powertrains, autonomous capabilities, and enhanced survivability features is shaping market growth. Major manufacturers like Oshkosh Corporation and General Dynamics play a crucial role in supplying cutting-edge military trucks. Rising geopolitical tensions and increased military missions further drive procurement activities. Canada also contributes to market expansion, focusing on upgrading its defense fleet for enhanced mobility and operational efficiency.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. China, India, Japan, and South Korea are heavily investing in advanced military vehicles to enhance mobility and logistics capabilities. China leads the region with large-scale production and innovation in military transport vehicles, while India focuses on indigenous manufacturing through programs like “Make in India.” The demand for all-terrain and armored trucks is rising due to ongoing border disputes and counterterrorism operations. Additionally, Australia and Southeast Asian nations are upgrading their defense fleets to improve strategic mobility. Major players like Tata Motors, Ashok Leyland, and NORINCO are driving market growth, with increasing collaborations between defense agencies and private manufacturers.

Segmentation Analysis

Insights by Truck

The heavy duty trucks segment accounted for the largest market share over the forecast period 2023 to 2033. These trucks are essential for carrying troops, weapons, and equipment in challenging environments, making them a critical component of military logistics. Advancements in engine efficiency, reinforced chassis designs, and integration of hybrid-electric powertrains are enhancing their operational capabilities. Rising defense budgets and military modernization programs, particularly in the U.S., China, and India, are fueling procurement. Additionally, the need for resilient, off-road-capable trucks in combat and disaster relief operations is further boosting demand.

Insights by Application

The cargo and troop transportation segment accounted for the largest market share over the forecast period 2023 to 2033. Military forces require versatile and high-capacity transport vehicles to ensure efficient troop movement and supply distribution in diverse terrains and combat zones. Rising defense budgets and modernization programs in countries like the U.S., China, and India are driving demand for advanced military trucks with enhanced payload capacity, mobility, and protection. Additionally, technological advancements such as hybrid-electric powertrains, armored cabins, and autonomous capabilities are improving operational efficiency. Growing military deployments for peacekeeping missions, border security, and disaster relief further boost the demand for reliable transport trucks. Key manufacturers are focusing on innovation and partnerships to develop next-generation military transport vehicles.

Recent Market Developments

- In February 2024, American Rheinmetall Vehicles and GM Defense delivered three prototype trucks for the initial phase of the U.S. Army’s Common Tactical Truck (CTT) Program. Their submission, the HX3 CTT, is based on the combat-proven HX truck family, which has been utilized by multiple NATO and U.S.-allied nations.

Competitive Landscape

Major players in the market

- Tatra Trucks A.S.

- Krauss-Maffei Wegmann GmbH & Co. KG

- KrAZ

- AB Volvo

- Oshkosh Corporation

- Kia Motors Corporation

- Mitsubishi Heavy Industries, Ltd.

- Arquus

- Daimler AG

- General Dynamics Land Systems

- Iveco Defence Vehicles

- Mahindra Emirates Vehicle Armouring

- Tata Motors

- Rheinmetall MAN Military Vehicles GmbH

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Military Truck Market, Truck Analysis

- Light-Duty Trucks

- Medium-Duty Trucks

- Heavy-Duty Trucks

Military Truck Market, Application Analysis

- Cargo & Troop Transportation

- Utility

Military Truck Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Military Truck Market?The global Military Truck Market is expected to grow from USD 25.8 billion in 2023 to USD 33.2 billion by 2033, at a CAGR of 2.55% during the forecast period 2023-2033.

-

2. Who are the key market players of the Military Truck Market?Some of the key market players of the market are Tatra Trucks A.S., Krauss-Maffei Wegmann GmbH & Co. KG, KrAZ, AB Volvo, Oshkosh Corporation, Kia Motors Corporation, Mitsubishi Heavy Industries, Ltd., Arquus, Daimler AG, General Dynamics Land Systems, Iveco Defence Vehicles, Mahindra Emirates Vehicle Armouring, Tata Motors, and Rheinmetall MAN Military Vehicles GmbH.

-

3. Which segment holds the largest market share?The cargo and troop transportation segment holds the largest market share and is going to continue its dominance.

Need help to buy this report?