Global Military Wearables Market Size, Share, and COVID-19 Impact Analysis, By Wearable Type (Headwear, Eyewear, Wristwear, Hearables, and Bodywear), By Technology (Smart Textiles, Network and Connectivity Management, Exoskeleton, Vision & Surveillance, Communication & Computing Monitoring, Power and Energy Source, and Navigation), By End User (Land Forces, Naval Forces, and Air Forces), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Aerospace & DefenseGlobal Military Wearables Market Insights Forecasts to 2033

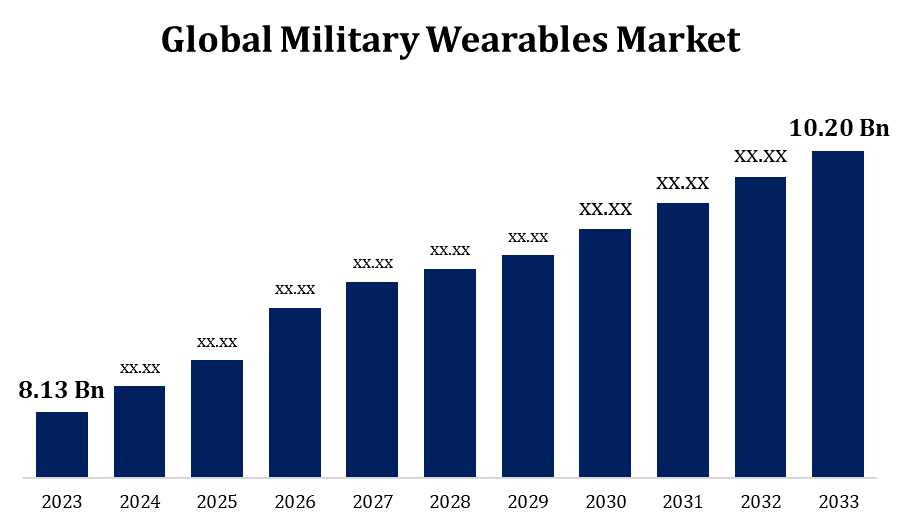

- The Military Wearables Market Size was valued at USD 8.13 Billion in 2023.

- The Market Size is Growing at a CAGR of 2.29% from 2023 to 2033

- The Worldwide Military Wearables Market Size is Expected to reach USD 10.20 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period

Get more details on this report -

The Global Military Wearables Market Size is Expected to reach USD 10.20 billion by 2033, at a CAGR of 2.29% during the forecast period 2023 to 2033.

The military wearables market is experiencing significant growth, driven by advancements in technology and increasing defense budgets globally. These wearables include smart textiles, exoskeletons, augmented reality (AR) devices, and biometric monitoring systems, aimed at enhancing soldier performance, safety, and situational awareness. North America leads the market due to substantial investments in research and development, followed by Europe and the Asia-Pacific region, where rising geopolitical tensions spur demand. Key players in the market focus on innovation and integration of artificial intelligence (AI) to improve functionality. Additionally, the growing need for real-time data and connectivity on the battlefield further propels market expansion. Challenges such as high costs and cybersecurity threats are addressed through ongoing advancements and strategic collaborations among industry leaders.

Global Military Wearables Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 8.13 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 2.29% |

| 023 – 2033 Value Projection: | USD 10.20 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 205 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Wearable Type, By Technology, By End User, By Region |

| Companies covered:: | Arralis (Ireland), Honeywell International Inc. (US), Safran Electronics & Defense (France), BeBop Sensors (US), DuPont (US), Panasonic Corporation (Japan), NXP Semiconductors (Netherlands), Leidos (US), TT Electronics (UK), Xsens (Netherlands), and others key vendors |

| Pitfalls & Challenges: | Covid-19 Impact, Challenge, Future,Growth and Analysis |

Get more details on this report -

Military Wearables Market Value Chain Analysis

The military wearables market value chain encompasses several critical stages, from research and development (R&D) to end-user deployment. Initially, R&D focuses on innovative materials, advanced sensors, and integration technologies, often involving collaborations between defense agencies, technology firms, and academic institutions. Manufacturing follows, where components like smart textiles, AR devices, and exoskeletons are produced, with a strong emphasis on durability and performance. The next stage involves system integration, ensuring seamless connectivity and functionality of wearables with existing military systems. Procurement processes, managed by defense agencies, involve stringent testing and validation. Finally, deployment and maintenance are crucial, requiring continuous support and updates to address evolving threats and operational needs. Throughout the value chain, cybersecurity measures are paramount to protect sensitive data and communications.

Military Wearables Market Opportunity Analysis

The military wearables market presents substantial opportunities driven by the need for advanced technological solutions to enhance soldier efficiency and safety. Innovations in smart textiles, AR, AI, and biometric monitoring open avenues for developing highly functional wearables. The increasing defense budgets worldwide, particularly in North America, Europe, and the Asia-Pacific, fuel demand for such advanced gear. Opportunities also lie in the integration of wearables with existing defense systems to provide real-time data and improved situational awareness. Additionally, the growing emphasis on soldier health and performance monitoring offers prospects for specialized biometric wearables. Collaborative efforts between military organizations, tech companies, and research institutions further stimulate market growth, addressing challenges like high costs and cybersecurity threats through innovation and strategic partnerships.

Market Dynamics

Military Wearables Market Dynamics

Adoption of Advanced Wearable Technology to Drive Market Growth

The adoption of advanced wearable technology is a key driver of growth in the military wearables market. Innovations in smart textiles, augmented reality (AR), and biometric monitoring significantly enhance soldier capabilities, providing real-time data and improved situational awareness. These technologies offer substantial benefits, such as increased operational efficiency, better health monitoring, and superior communication, leading to higher demand. Military organizations globally are investing heavily in research and development to integrate these wearables with existing systems, further propelling market expansion. The focus on developing lightweight, durable, and highly functional wearables that can withstand harsh environments addresses the critical needs of modern warfare. As defense budgets rise, particularly in regions like North America and Asia-Pacific, the accelerated adoption of these advanced technologies continues to drive market growth.

Restraints & Challenges

The military wearables market faces several challenges that impact its growth and adoption. High costs associated with developing and manufacturing advanced wearable technologies are a significant barrier, limiting widespread implementation. Cybersecurity is another critical challenge, as wearables are susceptible to hacking and data breaches, which can compromise sensitive military operations. Ensuring interoperability and seamless integration with existing military systems poses technical difficulties, requiring extensive testing and validation. Durability and reliability in harsh combat environments are essential, yet challenging to achieve consistently. Additionally, the rapid pace of technological advancement necessitates continuous updates and upgrades, straining resources and budgets. Resistance to change within military organizations and the need for extensive training for personnel to effectively use these wearables further complicate market penetration.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Military Wearables Market from 2023 to 2033. The United States, being the largest defense spender globally, plays a pivotal role in this regional market, investing heavily in research and development of advanced wearables. These investments focus on enhancing soldier performance, safety, and situational awareness through innovations like smart textiles, biometric monitoring, and augmented reality (AR) systems. Collaboration between the military, tech companies, and academic institutions further accelerates the development and deployment of cutting-edge wearable technologies. Additionally, North America's focus on modernizing its armed forces and integrating wearables with existing military systems underscores the region's leading position in the market.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. Countries such as China, India, Japan, and South Korea are heavily investing in advanced military technologies to modernize their armed forces. The adoption of smart textiles, augmented reality (AR) devices, and biometric monitoring systems is enhancing soldier performance, safety, and situational awareness. Collaborations between defense agencies, local tech firms, and international companies are fostering innovation and accelerating the development of cutting-edge wearables. The region's focus on integrating these wearables with existing military infrastructure is further propelling market expansion.

Segmentation Analysis

Insights by Wearable Type

The bodywear segment accounted for the largest market share over the forecast period 2023 to 2033. The growth is driven by advancements in smart textiles and the increasing demand for enhanced soldier protection and performance. Bodywear includes items such as smart uniforms, vests, and exoskeletons that are designed to provide real-time health monitoring, improved mobility, and augmented physical capabilities. Innovations in materials science have led to the development of lightweight, durable fabrics embedded with sensors, enabling comprehensive monitoring of vital signs and environmental conditions. This segment's growth is further fueled by the integration of bodywear with communication systems and situational awareness tools, providing soldiers with critical data during operations.

Insights by Technology

The communication and computing segment is dominating the market with the largest market share over the forecast period 2023 to 2033. The growth is driven by the need for enhanced real-time data exchange and decision-making capabilities on the battlefield. This segment includes wearable devices such as advanced headsets, wrist-worn computers, and smart glasses, which facilitate seamless communication and access to critical information. Technological advancements in miniaturization and power efficiency enable the development of lightweight, durable devices that integrate with existing military networks. The increased focus on network-centric warfare and situational awareness significantly boosts demand for these wearables.

Insights by End User

The land forces segment is dominating the market with the largest market share over the forecast period 2023 to 2033. The growth is fueled by the increasing emphasis on soldier modernization programs and the need for enhanced operational capabilities. This segment comprises wearables specifically tailored for ground-based military operations, including infantry soldiers, special forces units, and armored vehicle crews. Innovations such as integrated sensor suites, augmented reality (AR) displays, and advanced body armor systems are driving the adoption of wearables among land forces. These technologies offer improved situational awareness, communication, and protection, thereby enhancing soldiers' effectiveness and survivability on the battlefield.

Recent Market Developments

- In October 2022, L3Harris Technologies introduced a new device dubbed Iridium Distributed Tactical Communications Systems (DTCS). This gadget is utilised for push-to-talk speech and data communication among fighters all over the world.

Competitive Landscape

Major players in the market

- Arralis (Ireland)

- Honeywell International Inc. (US)

- Safran Electronics & Defense (France)

- BeBop Sensors (US)

- DuPont (US)

- Panasonic Corporation (Japan)

- NXP Semiconductors (Netherlands)

- Leidos (US)

- TT Electronics (UK)

- Xsens (Netherlands)

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Military Wearables Market, Wearable Type Analysis

- Headwear

- Eyewear

- Wristwear

- Hearables

- Bodywear

Military Wearables Market, Technology Analysis

- Smart Textiles

- Network and Connectivity Management

- Exoskeleton

- Vision & Surveillance

- Communication & Computing Monitoring

- Power and Energy Source

- Navigation

Military Wearables Market, End User Analysis

- Land Forces

- Naval Forces

- Air Forces

Military Wearables Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Military Wearables Market?The global Military Wearables Market is expected to grow from USD 8.13 billion in 2023 to USD 10.20 billion by 2033, at a CAGR of 2.29% during the forecast period 2023-2033.

-

2. Who are the key market players of the Military Wearables Market?Some of the key market players of the market are Arralis (Ireland), Honeywell International Inc. (US), Safran Electronics & Defense (France), BeBop Sensors (US), DuPont (US), Panasonic Corporation (Japan), NXP Semiconductors (Netherlands), Leidos (US), TT Electronics (UK), Xsens (Netherlands).

-

3. Which segment holds the largest market share?The land forces segment holds the largest market share and is going to continue its dominance.

-

4. Which region dominates the Military Wearables market?North America dominates the Military Wearables market and has the highest market share.

Need help to buy this report?