Global Milk Powder Market Size, Share, and COVID-19 Impact Analysis, by Type (Whole Milk Powder, Skimmed Milk Powder, Dairy Whitener, Buttermilk Powder, Fat-Filled Milk Powder, and Other Milk Powder) and by Application (Nutritional Food, Infant Formulas, Confectionaries, Backed Sweets, and others) by region (North America, Europe, Asia-Pacific, Middle East and Africa, South Africa) Analysis and Forecast 2021 – 2030.

Industry: Food & BeveragesThe Global Milk Powder Market Size is expected to reach US$ 65.3 Billion by 2030, at a CAGR of 7.33 % during the forecast period 2021 to 2030. In the forecast period of 2021 to 2030, urban population growth will be a major element in the expansion of the milk powder market.

A factory-produced dairy product called milk powder is made by dehydrating liquefied milk through a number of drying processes until it is a powder. The milk powder is convenient to travel with and is readily consumed by simply adding water to it. Making milk powder has the purpose of extending milk's shelf life without the use of a refrigerator. Whole milk powder, skim milk powder, dairy whitener, and other varieties of milk powder are among them. Similar to this, milk powder can be produced with the aid of science and technology and retain all of the natural qualities of milk, including flavour, colour, solubility, and nutritional content.

Get more details on this report -

Increased use of milk powder in infant foods, the presence of various nutrients like vitamin C, vitamin B12, thiamine, and high levels of protein, as well as the need for less storage and lower transportation costs, are all anticipated to have a positive impact on the milk powder market's growth during the forecast period. In addition, it is projected that rising consumer awareness of the benefits of maintaining a healthy lifestyle would increase demand for goods made from milk powder.

Driving Factor

Customers use milk powders as fresh milk alternatives for both in-home and out-of-home usage. Applications include instant milk powders, which consumers use in a variety of beverage combinations and easily dissolve in water. Additionally, fortified milk powders, which are milk powders that have been nutritionally enhanced, are offered to meet the extra nutritional requirements at various stages of life. The milk powder products sold on the market are typically fortified with calcium, iron, and folate minerals.

The availability of numerous minerals, including vitamin C, vitamin B12, thiamin, and high amounts of protein, as well as the rising use of milk powder in infant diets, are key market drivers for milk powder worldwide. Additionally, as storage and delivery costs decline, the milk powder industry is expanding. On the other hand, the market expansion for milk powder is constrained by the presence of preservatives, adulteration, and strict infant food regulations. New economic opportunities have emerged as a result of the introduction of flavoured milk powder.

Global Milk Powder Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2021 |

| Market Size in 2021: | USD 30 Billion |

| Forecast Period: | 2021 - 2030 |

| Forecast Period CAGR 2021 - 2030 : | 6.33% |

| 2030 Value Projection: | USD 65.3 Billion |

| Historical Data for: | 2017 - 2020 |

| No. of Pages: | 198 |

| Tables, Charts & Figures: | 136 |

| Segments covered: | by Type, by Application, by region |

| Companies covered:: | Nestlé S.A., Lactalis Group, Fonterra Co-operative Group Limited, Dean Foods, Dairy Farmers of America Inc., Arla Foods, Kraft Heinz Company, Saputo, Inc., Parmalat S.p.A., Danone S.A. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Restraining Factor

Milk powder is used in sports nutrition products like nutrition bars and drinks because it has the same nutritional value as regular milk. The increased demand for these products, which is being driven by an increase in fitness awareness, has stimulated the market for milk powder.

The taxation, tariff structures, subsidies, and export/import of milk powder are subject to stringent rules set forth by the governments of many nations, which may have a detrimental effect on the financial stability of milk powder producers and limit market growth.

COVID 19 Impact

As the COVID-19 effect on the food and beverage industry grows, food and beverage businesses around the world—from proprietors of cafes and restaurants to well-known food producers and retailers—continue to be affected. Manufacturers are having trouble obtaining raw materials, and a scarcity of labour has led to a poor production of the goods. To stop the spread of the COVID-19, governments all over the world are urging people to stay at home. Additionally, people are concentrating on buying the basic food items they will need to survive the epidemic and avoid making numerous trips to the store. The longer shelf life and ready-to-use qualities of milk powder have made it a priority for the consumer. Thus, as the impact of this pandemic spreads over the world, the market for milk powder is seeing a significant growth rate. This increase is predicted to continue until the pandemic returns to normal in all affected countries.

Segmentation

The global Milk Powder market is segmented Type, Application, Distribution Channel and region

Global Milk Powder Market, By Type

Based on the Product type the market has been divided into two segments based on the kind of product: whole milk powder and skimmed milk powder. The most popular of them is whole milk powder, which is a frequently used component in the culinary business. Whole milk is less popular among people who are worried about their weight or who are on a particular diet, but many consumers believe that it is the most natural type of milk. For people who need a lot of calories, whole milk powder is superior because it has a larger calorie content. Additionally, it is used as a culinary additive.

Global Milk Powder Market, By Application

Based on use, the confectionery sector dominated the global milk powder market. Milk powder is used to make soft candies, milk chocolate, malted milk, nougat centres, caramel confections, caramel confections, caramel confections, and different confection coatings. Other significant application segments include those for infant formula, sports and nutrition foods, bread goods, dry mixes, fermented milk goods, meat goods, and others.

The infant formulas segment is anticipated to expand quickly throughout the forecast period at a CAGR of xx%. The rise of the infant formula industry has been fueled by an increase in the number of women working outside the home as a result of increased female labour force participation. For working women who want to care for their newborns in accordance with their demands and convenience, infant formula is an alluring choice.

Global Milk Powder Market, By Function

The market has been divided into categories for emulsification, foaming, flavouring, and thickening based on function. Milk powder is used as a thickening ingredient in sauces, dairy drinks, yoghurts, puddings, and baked goods as well as an emulsifier in salad dressings, meat emulsions, soups, sauces, and baked goods. It is also used as a foaming agent in the creation of cakes, mousses, and ice creams.

Global Milk Powder Market, By Region

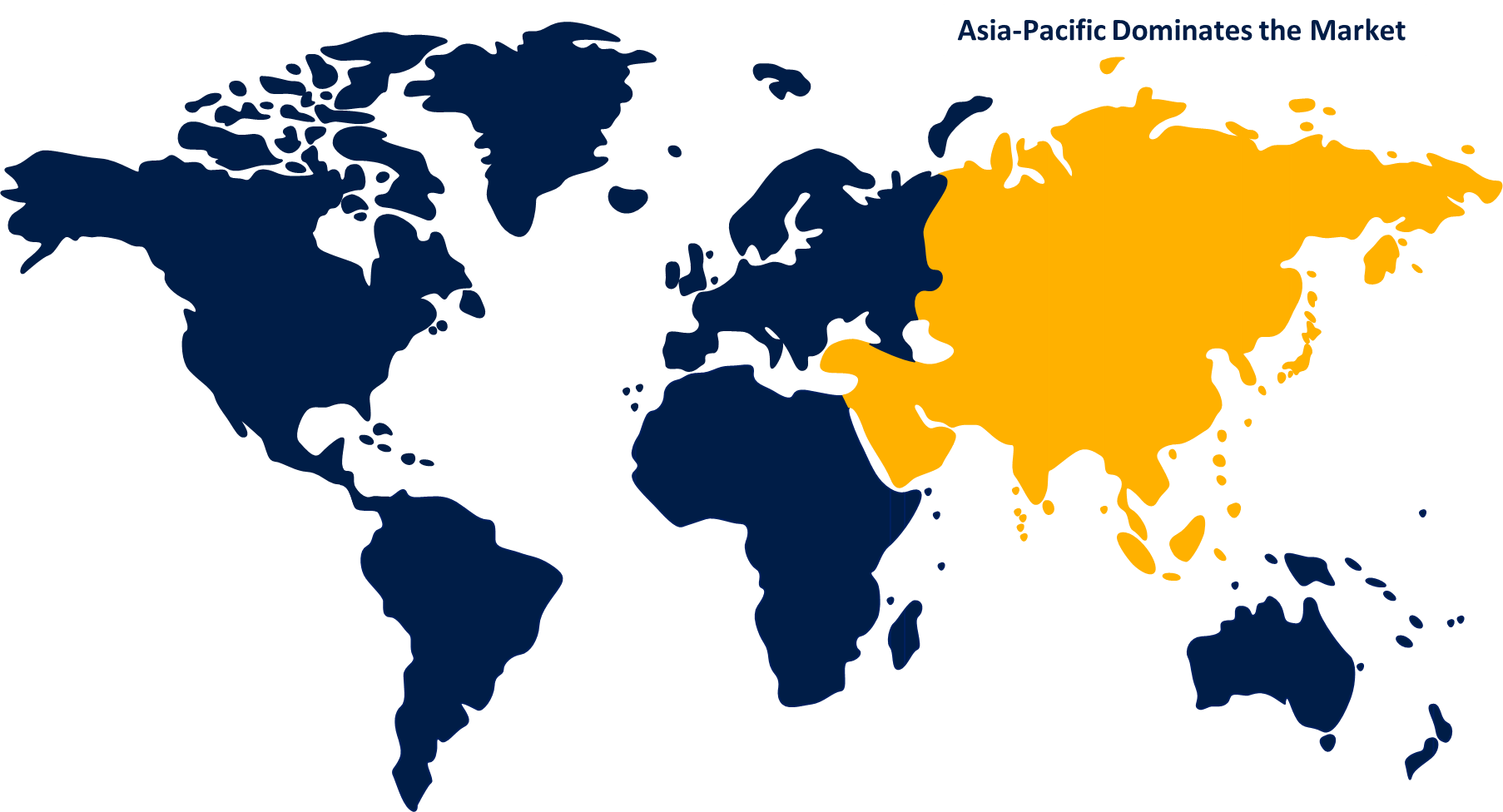

The market for milk powder is dominated by Asia Pacific as a result of lifestyle changes. Additionally, throughout the projection period, the expansion of the milk powder market in the region will be further aided by globalisation, an increase in the working population, and a rise in the penetration of social media and the internet. The market for milk powder is expected to increase significantly in Europe due to advancements in shipping and processing technology. In the upcoming years, it is also projected that the region's milk powder market will expand due to lower transportation costs and the usage of export subsidies.

Get more details on this report -

Geographically speaking, the European Union dominates the global milk powder market and produces more than a fifth of all the milk powder used worldwide. New Zealand, China, the United States, and Brazil are further important geographic areas.

Recent Developments In The Global Milk Powder Market

- According to Z Natural Foods, its brand-new organic oat milk powder won't be available until 2022. Oat milk powder is offered in 1-lb, 5-lb, and 50-lb bags and comes in air-locked, freezer-tight, reusable stand-up foil pouches. It could be kept safely for two years.

- According to Laird Superfood Inc., the first functional powdered Aloha oat and Macadamia nut milk will be available in 2021.

- The daily production capacity of AmulFed Dairy, a division of the Gujarat Cooperative Milk Marketing Federation, has expanded from 35 lakh to 50 lakh litres thanks to the new milk powder factory.

List of Key Market Players

- Nestlé S.A.

- Lactalis Group

- Fonterra Co-operative Group Limited

- Dean Foods

- Dairy Farmers of America Inc.

- Arla Foods

- Kraft Heinz Company

- Saputo, Inc.

- Parmalat S.p.A.

- Danone S.A.

Segmentation

By Product Type

- Whole Milk Powder

- Skimmed Milk Powder

By Function Type

- Emulsification

- Foaming

- Flavouring

- Thickening

By Application Type

- Infant Formula

- Confectionery

- Sports and Nutrition Foods

- Bakery Products

- Dry Mixes

- Fermented Milk Products

- Meat Products

By Region:

North America

- North America, by Country

- U.S.

- Canada

- Mexico

- North America, by Product Type

- North America, by Function Type

- North America, Application

Europe

- Europe, by Country

- Germany

- Russia

- U.K.

- France

- Italy

- Spain

- The Netherlands

- Rest of Europe

- Europe, by Product Type

- Europe, by Function Type

- Europe, by Application

Asia Pacific

- Asia Pacific, by Country

- China

- India

- Japan

- South Korea

- Australia

- Indonesia

- Rest of Asia Pacific

- Asia Pacific, by Product Type

- Asia Pacific, by Function

- Asia Pacific, by Application

Middle East & Africa

- Middle East & Africa, by Country

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

- Middle East & Africa, by Product Type

- Middle East & Africa, by Function

- Middle East & Africa, by Application

South America

- South America, by Country

- Brazil

- Argentina

- Colombia

- Rest of South America

- South America, by Product Type

- South America, by Function Type

- South America, by Application

Need help to buy this report?