Global Minimal Residual Disease Testing Market Size, Share, and COVID-19 Impact Analysis, By Cancer Type (Flow Cytometry, Polymerase Chain Reaction, Next Generation Sequencing, and Others), By Technology (Hematological Malignancy and Solid Tumors), By End-Use (Hospitals & Specialty Clinics, Diagnostic Laboratories, Academic & Research Institutes, and Others), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2032

Industry: HealthcareGlobal Minimal Residual Disease Testing Market Insights Forecasts to 2032

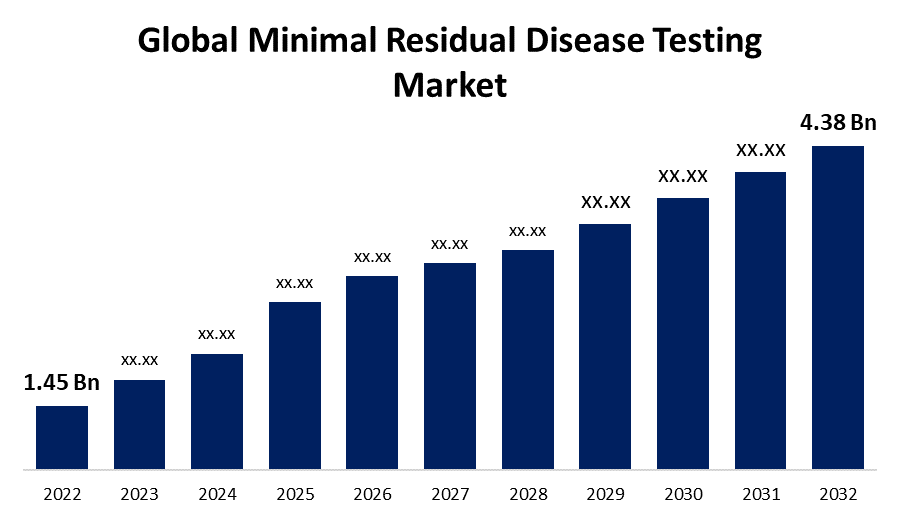

- The Global Minimal Residual Disease Testing Market Size was valued at USD 1.45 Billion in 2022.

- The Global Minimal Residual Disease Testing Market Size is growing at a CAGR of 11.7% from 2023 to 2032

- The Worldwide Minimal Residual Disease Testing Market Size is expected to reach USD 4.38 Billion by 2032

- Asia Pacific is expected to fastest during the forecast period

Get more details on this report -

The Global Minimal Residual Disease Testing Market Size is expected to reach USD 4.38 billion by 2032, at a CAGR of 11.7% during the forecast period 2023 to 2032.

Market Overview

Minimal Residual Disease (MRD) testing is a sensitive diagnostic method used to detect trace amounts of cancer cells remaining in patients after treatment. This highly specialized technique employs advanced technologies, such as flow cytometry, polymerase chain reaction (PCR), or next-generation sequencing (NGS), to identify and quantify these elusive residual cancer cells. By monitoring MRD, clinicians can assess treatment efficacy, predict disease recurrence, and tailor further therapies accordingly. MRD testing plays a crucial role in various hematological malignancies and some solid tumors, enabling early intervention and improved patient outcomes. Its ability to detect minimal disease burden offers a more comprehensive understanding of cancer status, aiding in personalized medicine approaches and ensuring more precise management of cancer patients.

Report Coverage

This research report categorizes the market for minimal residual disease testing market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the minimal residual disease testing market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the minimal residual disease testing market.

Global Minimal Residual Disease Testing Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 1.45 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 11.7% |

| 2032 Value Projection: | USD 4.38 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Cancer Type, By Technology, By End-Use, By Region, and COVID-19 Impact Analysis |

| Companies covered:: | Exact Sciences Corporation, GRAIL, LLC, Veracyte, Inc., Natera, Inc., Guardant Health, F. Hoffmann-La Roche Ltd., Foundation Medicine, Inc., QIAGEN, MdxHealth, and Bio-Techne And Other Key Venders. |

| Pitfalls & Challenges: | COVID-19 has the potential to impact the global market |

Get more details on this report -

Driving Factors

The minimal residual disease (MRD) testing market is driven by several key factors, because the rising prevalence of cancer globally is fueling the demand for accurate and sensitive diagnostic tools to monitor treatment response and predict disease relapse. Advancements in technology, such as next-generation sequencing and digital PCR, have enhanced the efficiency and accuracy of MRD testing, attracting both healthcare providers and patients. The increasing investments in research and development activities by biotechnology and pharmaceutical companies have resulted in the development of innovative MRD testing solutions. Additionally, a growing focus on personalized medicine and targeted therapies has boosted the adoption of MRD testing, as it aids in tailoring treatment plans based on individual patient needs. Overall, supportive government initiatives and reimbursement policies are further propelling the MRD testing market's growth by promoting wider accessibility and affordability of these diagnostic services.

Restraining Factors

The minimal residual disease (MRD) testing market faces several restraints that impact its growth, the high cost associated with advanced MRD testing technologies and procedures can limit accessibility, particularly in developing regions with limited healthcare resources. The lack of standardized guidelines and protocols for MRD testing may lead to variations in testing methodologies and result interpretations, potentially affecting the reliability of test outcomes. The challenges in sample collection, handling, and processing can introduce errors and impact the accuracy of results. Moreover, the stringent regulatory requirements for approval and commercialization of MRD testing products can hinder market expansion.

Market Segmentation

- In 2022, the flow cytometry segment accounted for around 53.5% market share

On the basis of the technology, the global minimal residual disease testing market is segmented into flow cytometry, polymerase chain reaction, next-generation sequencing, and others. The flow cytometry segment emerged as the dominant force in the minimal residual disease (MRD) testing market due to its exceptional versatility and sensitivity in detecting and analyzing rare cancer cells. Flow cytometry technology enables the identification and quantification of specific cell populations based on their surface markers, making it an ideal tool for MRD assessment. In the context of MRD testing, flow cytometry can detect minimal numbers of residual cancer cells among a vast population of normal cells, achieving high levels of accuracy and precision. Moreover, flow cytometry offers several advantages that have contributed to its market dominance. Its ability to simultaneously analyze multiple parameters allows for comprehensive profiling of cancer cells, aiding in the identification of specific disease signatures. The technique also allows for rapid and real-time analysis, facilitating timely clinical decision-making and patient management. Additionally, continuous advancements in flow cytometry technology have led to improvements in sensitivity and resolution, making it even more effective in detecting low levels of residual disease. Furthermore, the wide availability and acceptance of flow cytometry in clinical settings have bolstered its adoption for MRD testing. Many laboratories and medical centers are equipped with flow cytometry instruments, leading to increased accessibility and convenience for patients and healthcare providers alike. Standardization efforts and guidelines for flow cytometry-based MRD testing have further contributed to its market dominance, ensuring consistent and reproducible results across different laboratories.

- In 2022, the hematological malignancy segment dominated with more than 65.2% market share

Based on the cancer type, the global minimal residual disease testing market is segmented into hematological malignancy and solid tumors. The hematological malignancy segment emerged as the dominant force in the minimal residual disease (MRD) testing market due to several key factors. Hematological malignancies, such as leukemia, lymphoma, and multiple myeloma, are cancers that affect the blood and bone marrow, leading to the abnormal growth of blood cells. MRD testing plays a critical role in these diseases as it allows for the detection and monitoring of residual cancer cells after treatment, which is especially important given the high propensity of these malignancies to relapse. One of the primary reasons for the dominance of the hematological malignancy segment is the prevalence of these cancers globally. Hematological malignancies represent a significant portion of cancer cases, and their incidence continues to rise, particularly in older populations. This high disease burden has driven the demand for accurate and sensitive MRD testing methods to improve patient outcomes through better disease monitoring and personalized treatment strategies. Moreover, advancements in MRD testing technologies, such as flow cytometry, PCR, and NGS, have significantly enhanced their utility in hematological malignancies. These advanced techniques offer high sensitivity and specificity, enabling the detection of minimal disease burden, even in complex and heterogeneous cancer cell populations. Furthermore, clinical research and trials focusing on hematological malignancies have highlighted the importance of MRD testing in guiding treatment decisions. The growing body of evidence supporting the clinical utility of MRD testing has led to its integration into clinical guidelines and treatment protocols for hematological cancers.

Regional Segment Analysis of the Minimal Residual Disease Testing Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America dominated the market with more than 45.2% revenue share in 2022.

Get more details on this report -

Based on region, North America's dominant position in the minimal residual disease (MRD) testing market can be attributed to several factors, the region has a high prevalence of cancer, driving the demand for advanced diagnostic tools like MRD testing to monitor treatment response and disease progression accurately. North America is at the forefront of technological advancements and innovation in healthcare, facilitating the development and adoption of state-of-the-art MRD testing technologies. Additionally, the presence of well-established healthcare infrastructure, research institutions, and pharmaceutical companies enables easier access to MRD testing services and products. Furthermore, supportive government initiatives and favorable reimbursement policies in countries like the United States promote the integration of MRD testing in cancer treatment protocols. Overall, these factors contribute to North America's largest market share in the MRD testing industry.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global minimal residual disease testing market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Companies:

- Exact Sciences Corporation

- GRAIL, LLC

- Veracyte, Inc.

- Natera, Inc.

- Guardant Health

- F. Hoffmann-La Roche Ltd.

- Foundation Medicine, Inc.

- QIAGEN

- MdxHealth

- Bio-Techne

Key Target Audience

- Market Players

- Investors

- End-Users

- Government Authorities

- Consulting and Research Firm

- Venture Capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2032. Spherical Insights has segmented the global minimal residual disease testing market based on the below-mentioned segments:

Minimal Residual Disease Testing Market, By Cancer Type

- Flow Cytometry

- Polymerase Chain Reaction

- Next Generation Sequencing

- Others

Minimal Residual Disease Testing Market, By Technology

- Hematological Malignancy

- Solid Tumors

Minimal Residual Disease Testing Market, By End-Use

- Hospitals & Specialty Clinics

- Diagnostic Laboratories

- Academic & Research Institutes

- Others

Minimal Residual Disease Testing Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?