Global Mining Truck Market Size, Share, and COVID-19 Impact Analysis, By Type (Bottom Dump, Rear Dump, Lube, Tow, Water, and Others), By Capacity (Less Than 200 Metric Tons, and More Than 200 Metric Tons), By Application (Coal Mining, Iron Mining, Copper Mining, Aluminum Mining, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Automotive & TransportationGlobal Mining Truck Market Insights Forecasts to 2033

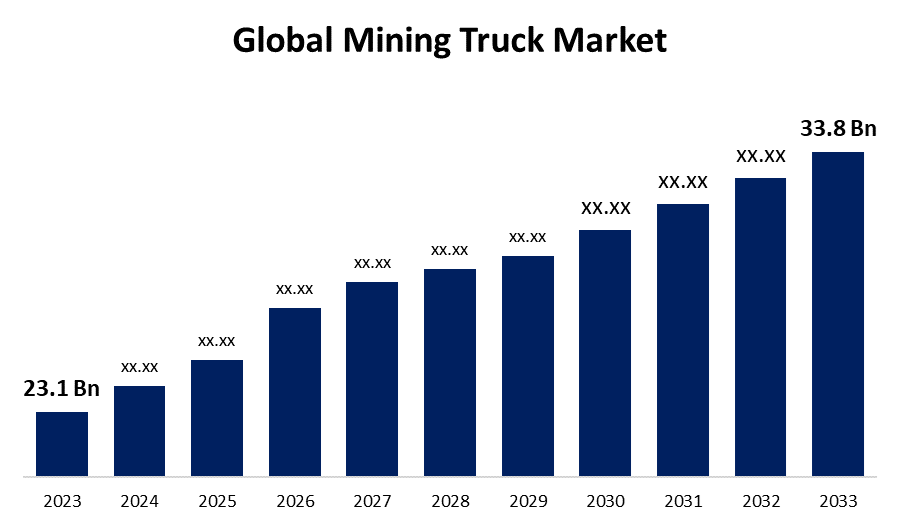

- The Global Mining Truck Market Size was Valued at USD 23.1 Billion in 2023

- The Market Size is Growing at a CAGR of 3.88% from 2023 to 2033

- The Worldwide Mining Truck Market Size is Expected to Reach USD 33.8 Billion by 2033

- North America is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Mining Truck Market Size is Anticipated to Exceed USD 33.8 Billion by 2033, Growing at a CAGR of 3.88% from 2023 to 2033.

Market Overview

Large trucks known as mining trucks are utilized to transport large amounts of extracted minerals from mining sites. These giant trucks can transport hundreds of tons of coal, ores, or minerals in one journey. They are constructed to be durable, with solid frames, powerful engines, and durable tires that enable them to easily navigate steep slopes and rugged landscapes. They are designed for harsh environments. The industry has transformed because of autonomous technology and advanced safety measures, which have reduced human risk and increased efficiency. The product makes large-scale mining operations much more efficient, guaranteeing a constant supply of materials and supporting the global underpinnings of contemporary industries. Transporting massive quantities of extracted materials from excavation sites is the purpose of the massive mining truck. Strong frames, strong motors, and long-lasting tires give them the ability to effortlessly traverse rough terrain and steep inclines because they are designed for harsh environments. By improving productivity and lowering human danger, autonomous technologies and advanced safety measures have completely transformed the industry. By guaranteeing a consistent flow of resources and supporting the fundamentals of contemporary industries across the globe, the product considerably improves the efficiency of large-scale mining operations.

Report Coverage

This research report categorizes the market for the global mining truck market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global mining truck market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global mining truck market.

Global Mining Truck Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 23.1 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 3.88% |

| 2033 Value Projection: | USD 33.8 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Capacity, By Application, By Region |

| Companies covered:: | Atlas Copco, BharatBenz, KRESS CORPORATION, MAN Truck & Bus, Doosan, Terex Trucks, Scania, Hitachi, Caterpillar, BELAZ, Yutong, Deere & Company, Beml, Komatsu, Others, and |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The necessity for mining trucks in sectors including electronics, automotive, and construction is driving growth in the mining truck industry. The growing population and the trend of people moving into cities create a need for resources and buildings, which in turn drives up prices. The industry is growing due to the introduction of new tools and technologies as well as the rising need for renewable energy. Mineral resource-rich nations can increase their market share in this industry. Growth in the mining industry will also be aided by government investments. Quick advancements in product design are providing the market with a lot of opportunities. Technological, material, and engineering advances have produced incredibly robust and efficient products that can handle larger weights, negotiate difficult terrain, and increase production. The market is being strengthened by an increase in exploration and mining activity in isolated and difficult terrain.

Restraining Factors

Expansion is challenging due to certain limitations in the market. The mining industry's carbon footprint is receiving increased focus because of environmental worries and the call for sustainable mining methods. This has compelled mining companies to explore greener options, potentially presenting a challenge for traditional mining truck manufacturers.

Market Segmentation

The global mining truck market share is classified into type, capacity, and application.

- The bottom dump segment is expected to hold the largest share of the global mining truck market during the forecast period.

Based on the type, the global mining truck market is divided into bottom dump, rear dump, lube, tow, water, and others. Among these, the bottom dump segment is expected to hold the largest share of the global mining truck market during the forecast period. The bottom of bottom dump trucks' hinged gate design facilitates effective material discharge. They are frequently working in earthmoving and building operations because they are perfect for evenly dispersing materials. These trucks are well-known for having a special unloading mechanism that lets items spill out to the side of the car. Because of this feature, side dump trucks are ideal for jobs requiring careful and regulated material placement, such as filling ditches or building embankments. Side dump trucks are more appealing in mining operations where space is limited because of their ability to maneuver in confined locations.

- The more than 200 metric tons segment is expected to hold the largest share of the global mining truck market during the forecast period.

Based on the capacity, the global mining truck market is divided into less than 200 metric tons, and more than 200 metric tons. Among these, the more than 200 metric tons segment is expected to hold the largest share of the global mining truck market during the forecast period. Mining trucks that can carry more than 200 metric tons provide a distinct set of benefits in terms of efficiency and sheer pulling force. Vast-scale mining operations that require the transportation of vast quantities of commodities over long distances are a good fit for these heavyweight trucks. Their sturdy construction and strong engines let them navigate difficult terrain and haul heavy loads, which boosts output in large-scale mining operations. The prevalence of trucks weighing more than 200 metric tons in several industries emphasizes how crucial size and effectiveness are in meeting the needs of large-scale mining projects.

- The coal mining segment is expected to hold the largest share of the global mining truck market during the forecast period.

Based on the application, the global mining truck market is divided into coal mining, iron mining, copper mining, aluminum mining, and others. Among these, the coal mining segment is expected to hold the largest share of the global mining truck market during the forecast period. Transporting coal from the extraction site to processing or distribution hubs requires the use of coal mining trucks. Their purpose is to manage the large loads and difficult terrain that are frequently encountered in coal mines. An essential part of the extraction and transportation of minerals is the use of mining trucks, which are specially designed for the harsh circumstances of mining operations. These sturdy vehicles provide the effective transportation of commodities within mining sites by being designed to handle difficult terrain and large loads. The ongoing global expansion of the mining industry supports the ongoing need for specialized mining trucks, which spurs innovation and technological improvements in this market.

Regional Segment Analysis of the Global Mining Truck Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the global mining truck market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the global mining truck market over the predicted timeframe. This is attributed to the quick industrialization and infrastructure growth in nations like China, India, Australia, and Indonesia, the Asia Pacific area is a big market. The need for large trucks to transport coal, iron, copper, aluminum, and other commodities is fueled by the fact that these nations are significant producers and consumers of a wide range of minerals and metals. The demand for raw materials is further increased by the expansion of the region's industrial, construction, and automotive sectors, making effective raw material delivery with these trucks necessary. The market in this region is anticipated to expand significantly as Asian nations continue to upgrade their mining operations and invest in mining projects.

North America is expected to grow at the fastest pace in the global mining truck market during the forecast period. Several of the largest mining activities worldwide are situated in this area, particularly in countries such as the US and Canada. These mining operations extract coal, iron ore, gold, copper, and other minerals. Due to the high level of mining operations in this region, there is a significant need for reliable and effective products. Moreover, North America leads in technological advancements, encouraging the adoption of electric and autonomous mining trucks to boost production and reduce their environmental impact. Moreover, the motivation for advanced mining truck technologies in this area is driven by stringent safety regulations and a focus on sustainable mining practices.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global mining truck market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Atlas Copco

- BharatBenz

- KRESS CORPORATION

- MAN Truck & Bus

- Doosan

- Terex Trucks

- Scania

- Hitachi

- Caterpillar

- BELAZ

- Yutong

- Deere & Company

- Beml

- Komatsu

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In December 2023, Komatsu and General Motors (GM) revealed an exciting collaboration to introduce hydrogen fuel cell technology to heavy-duty uses. This collaboration will particularly advantage Komatsu's 930E electric drive mining truck, which holds the title of the top-selling ultra-class haul truck globally. By teaming up with Komatsu, a respected global leader in mining and construction equipment, and leveraging its expertise in hydrogen fuel cell technology, this partnership underscores GM's increased dedication to a fully electric future.

- In June 2022, Fortescue declared its intention to purchase 120 Liebherr zero-emission mining trucks. Zero-emission power solutions developed in collaboration with Williams Advanced Engineering and Fortescue Future Industries are fitted into the vehicles.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global mining truck market based on the below-mentioned segments:

Global Mining Truck Market, By Type

- Bottom Dump

- Rear Dump

- Lube

- Tow

- Water

- Others

Global Mining Truck Market, By Capacity

- Less Than 200 Metric Tons

- More Than 200 Metric Tons

Global Mining Truck Market, By Application

- Coal Mining

- Iron Mining

- Copper Mining

- Aluminum Mining

- Others

Global Mining Truck Market, Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.Which are the key companies that are currently operating within the market?Atlas Copco, BharatBenz, KRESS CORPORATION, MAN Truck & Bus, Doosan, Terex Trucks, Scania, Hitachi, Caterpillar, BELAZ, Yutong, Deere & Company, Beml, Komatsu, and others. 1. Which region is holding the largest share of the market?

-

2.What is the size of the global mining truck market?The Global Mining Truck Market is expected to grow from USD 23.1 Billion in 2023 to USD 33.8 Billion by 2033, at a CAGR of 3.88% during the forecast period 2023-2033.

-

3.Which region is holding the largest share of the market?Asia Pacific is anticipated to hold the largest share of the global mining truck market over the predicted timeframe.

Need help to buy this report?