Global Mirin Market Size, Share, and COVID-19 Impact Analysis, By Type (Aji-mirin, Hon-mirin and Shio mirin), By Application (Residential and Commercial), By Distribution Channel (Hypermarkets & Supermarkets, Convenience stores, Online, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Food & BeveragesGlobal Mirin Market Insights Forecasts to 2033

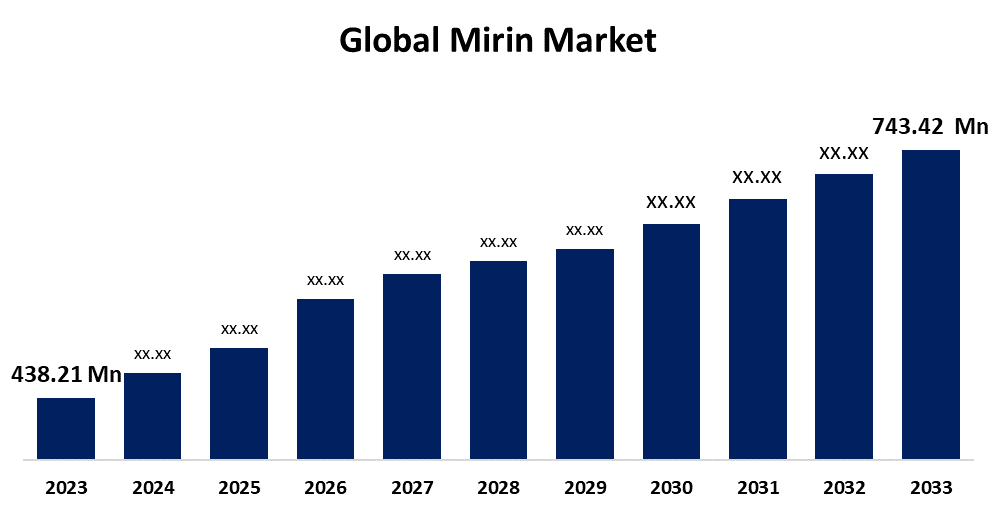

- The Global Mirin Market Size was Valued at USD 438.21 Million in 2023

- The Market Size is Growing at a CAGR of 5.43% from 2023 to 2033

- The Worldwide Mirin Market Size is Expected to Reach USD 743.42 Million by 2033

- Europe is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Mirin Market Size is Anticipated to Exceed USD 743.42 Million by 2033, Growing at a CAGR of 5.43% from 2023 to 2033.

Market Overview

Mirin is a slightly sweet, transparent, gold-tinged Japanese cooking wine created from glutinous rice. It is a staple in Japanese cuisine, and it complements the savouriness of soy sauce, particularly in teriyaki dishes, but it is used in a variety of recipes. Mirin is manufactured by fermenting cultured rice (shio koji) and glutinous rice in a distilled rice alcohol called shochu. It is aged for a few months to several years, producing a rich flavor. It typically contains approximately 14% alcohol by volume. Mirin smells similar to sake but sweeter. Mirin is primarily used to provide many sauces and marinades with a shiny appearance and distinctly Japanese flavor. Growing customer need for adaptable cooking ingredients and a growing interest in authentic Japanese food drive the global mirin market's significant growth. The market for mirin, a naturally fermented rice wine, is driven by consumers' growing health consciousness and preference for food created with natural and less processed ingredients. New developments in the mirin market include superior and reduced-sugar varieties in addition to the growth of distribution channels that include specialty stores and online supermarket platforms. The globalization of food is a significant factor responsible for the rising demand for authentic Japanese ingredients such as mirin. As Japanese foods, including teriyaki, sukiyaki, and different sauces, gain popularity around the world, mirin becomes an essential ingredient in kitchens seeking to replicate these flavors.

Report Coverage

This research report categorizes the market for the mirin market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the mirin market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the mirin market.

Global Mirin Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 438.21 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.43% |

| 2033 Value Projection: | USD 743.42 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 241 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Application, By Distribution Channel, By Region |

| Companies covered:: | Kikkoman Corporation, Eden Foods, Mizkan Holdings, Sakura Foods Corporation, Higashimaru Shoyu Co., Ltd., Takara Sake, Yutaka, Kankyo Shuzo, Urban Platter, Soeos, Marukin Shoyu Co., Ltd., Suzuya Co., Ltd., Shoda Shoyu Co., Ltd., Shinkichi Kogyo Co., Ltd., and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The market is undoubtedly shifting towards more expensive and health-conscious mirin varieties. Customers are increasingly looking for products with less sugar and more natural ingredients as they become more conscious of their dietary choices. One of the major market drivers is mirin's availability on online grocery platforms. It gives the convenience of online purchasing, as well as the growing variety of food products available through these channels, which is driving mirin demand.

Restraining Factors

Some of the challenges anticipated to restrain the growth of the mirin market. The production cost of mirin is affected by fluctuations in the price of raw materials, particularly rice, which makes it difficult for market participants to remain profitable.

Market Segmentation

The mirin market share is classified into type, application, and distribution channel.

- The aji-mirin segment accounted for the largest revenue share over the forecast period.

Based on the type, the mirin market is categorized into aji-mirin, hon-mirin, and shio mirin. Among these, the aji-mirin segment accounted for the largest revenue share over the forecast period. Due to its accessibility, low cost, and versatility in the kitchen. Aji-mirin is considered a healthier option than other sweeteners and flavor additives. Ajj-mirin, also called "fake" or "sweetened" mirin, is a popular ingredient in processed foods and ordinary cookery that appeals to a wide range of consumers.

- The commercial segment holds the highest market share through the forecast period.

Based on the application, the mirin market is categorized into residential and commercial. Among these, the commercial segment holds the highest market share through the forecast period. Because of its affordability, ease of use, and consistency, mirin is typically used in commercial applications. Efficiency is crucial in packed kitchens because its rapid availability cuts down on preparation time. Besides, commercial mirin is less expensive than homemade versions due to bulk buying and standardized production procedures, particularly in large-scale food production.

- The hypermarkets & supermarkets segment is anticipated to grow at the fastest CAGR during the forecast period.

Based on the distribution channel, the mirin market is categorized into hypermarkets & supermarkets, convenience stores, online, and others. Among these, the hypermarkets & supermarkets segment is anticipated to grow at the fastest CAGR during the forecast period. Large retail stores such as supermarkets and hypermarkets provide customers with a convenient one-stop shopping experience, allowing them to find a wide variety of products, including mirin, alongside other groceries and household items. This convenience saves customers time and effort, as these stores typically stock a variety of mirin companies and forms.

Regional Segment Analysis of the Mirin Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the mirin market over the predicted timeframe.

Get more details on this report -

Asia Pacific is projected to hold the largest share of the mirin market over the predicted timeframe. Japan and other nations in this region have comparable cultures and cuisines, including China, South Korea, and Thailand. Because of this shared culture, substances that include mirin are more widely recognized and regarded. The area's dominant position is largely due to its rich culinary traditions and the predominance of Japanese restaurants and food products. Further supporting Asia Pacific's supremacy is the rising global appeal of Asian cuisine, the growth of the restaurant industry, and the growing need for real cooking ingredients.

Europe is expected to grow at the fastest CAGR growth in the mirin market during the forecast period. Japanese restaurants, cooking schools, and food festivals have become increasingly popular across Europe, contributing to the expanding appeal of Japanese cuisine. Through these platforms, European customers are exposed to real Japanese ingredients such as mirin, which in turn increases their awareness and utilization of this adaptable component. The growing popularity of culinary food and a variety of international cuisines fuels the expansion. Demand is being driven by an increasing number of Asian food individuals and specialty sellers in key European markets such as the UK, Germany, and France.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the mirin market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Kikkoman Corporation

- Eden Foods

- Mizkan Holdings

- Sakura Foods Corporation

- Higashimaru Shoyu Co., Ltd.

- Takara Sake

- Yutaka

- Kankyo Shuzo

- Urban Platter

- Soeos

- Marukin Shoyu Co., Ltd.

- Suzuya Co., Ltd.

- Shoda Shoyu Co., Ltd.

- Shinkichi Kogyo Co., Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In June 2024, Kikkoman revealed a new plan to increase the number of products in its mirin range, emphasizing low-sugar and organic alternatives. This strategy intends to gain a larger proportion of the premium mirin market and is in line with the growing demand from consumers for ingredients that are healthier and more natural.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the mirin market based on the below-mentioned segments:

Global Mirin Market, By Type

- Aji-mirin

- Hon-mirin

- Shio mirin

Global Mirin Market, By Application

- Residential

- Commercial

Global Mirin Market, By Distribution Channel

- Hypermarkets & Supermarkets

- Convenience stores

- Online

- Others

Global Mirin Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the global mirin market?The global mirin market is projected to expand at 5.43% during the forecast period.

-

2. Who are the top key players in the global mirin market?The key players in the global mirin market are Kikkoman Corporation, Eden Foods, Mizkan Holdings, Sakura Foods Corporation, Higashimaru Shoyu Co., Ltd., Takara Sake, Yutaka, Kankyo Shuzo, Urban Platter, Soeos, Marukin Shoyu Co., Ltd., Suzuya Co., Ltd., Shoda Shoyu Co., Ltd., Shinkichi Kogyo Co., Ltd., and others.

-

3. Which region is expected to hold the largest share of the global mirin market?The Asia Pacific region is expected to hold the largest share of the global mirin market.

Need help to buy this report?