Global Missiles and Missile Defense Systems Market Size, Share, and COVID-19 Impact Analysis, By Type (Missile Defense Systems, Surface-To-Air Missiles, Air-To-Surface Missiles, Air-To-Air Missiles, and Anti-Ship Missiles), By Application (Military, Simulation Exercises, and Other), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Aerospace & DefenseGlobal Missiles and Missile Defense Systems Market Insights Forecasts to 2033

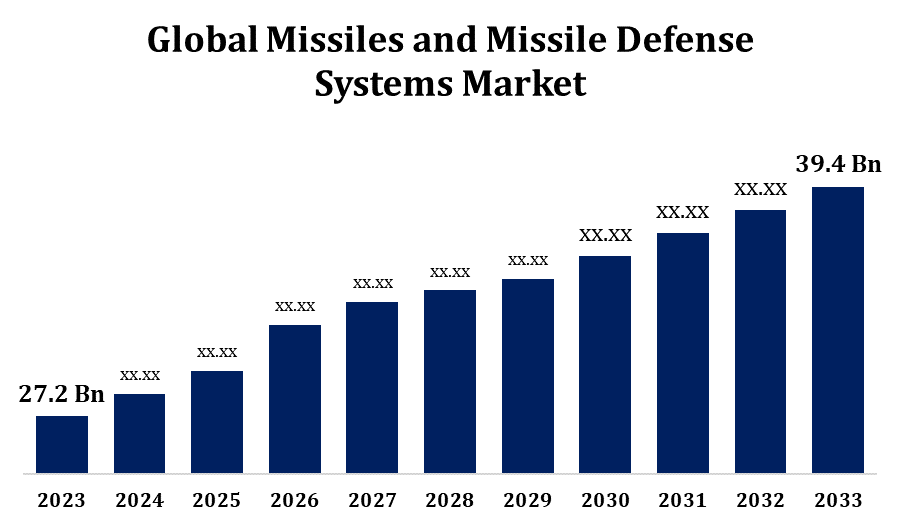

- The Global Missiles and Missile Defense Systems Market Size was valued at USD 27.2 Billion in 2023.

- The Market is Growing at a CAGR of 3.77% from 2023 to 2033

- The Worldwide Missiles and Missile Defense Systems Market Size is expected to reach USD 39.4 Billion by 2033

- Asia Pacific is expected to Grow the fastest during the forecast period

Get more details on this report -

The Global Missiles and Missile Defense Systems Market Size is expected to reach USD 39.4 Billion by 2033, at a CAGR of 3.77% during the forecast period 2023 to 2033.

The global missiles and missile defense systems market is experiencing significant growth due to increasing geopolitical tensions and defense budgets. Key players are investing in advanced technologies, such as hypersonic and precision-guided missiles, to enhance capabilities and meet modern warfare demands. The market is also driven by the need for robust missile defense systems to counter diverse threats, including ballistic and cruise missiles. North America leads the market, with substantial investments from the U.S. Department of Defense, while Asia-Pacific shows rapid growth due to regional conflicts and military modernization efforts. Collaborations, mergers, and acquisitions among defense contractors are further propelling market expansion, focusing on innovation and strategic defense solutions.

Missiles and Missile Defense Systems Market Value Chain Analysis

The missiles and missile defense systems market value chain encompasses several stages, from research and development (R&D) to manufacturing, integration, and maintenance. Initially, R&D focuses on advanced propulsion systems, guidance technologies, and warhead innovations. Manufacturers then source raw materials and components, ensuring quality and compliance with defense standards. Production involves precision engineering and assembly of missile systems, followed by rigorous testing and validation. Integration into defense platforms, such as aircraft, ships, and ground-based systems, is crucial for operational readiness. The final stages include deployment and regular maintenance to ensure reliability and effectiveness. Key stakeholders, including defense contractors, government agencies, and technology providers, collaborate closely throughout the value chain to address evolving threats and enhance defense capabilities.

Missiles and Missile Defense Systems Market Opportunity Analysis

The missiles and missile defense systems market presents significant opportunities driven by technological advancements and rising defense expenditures. The growing threat of sophisticated missile attacks has spurred demand for innovative defense solutions, including hypersonic and AI-integrated systems. Emerging economies are investing heavily in modernizing their military capabilities, creating lucrative opportunities for market expansion. Additionally, the shift towards network-centric warfare and the integration of advanced radar and sensor technologies offer growth potential. Collaborations between defense contractors and technology firms can lead to breakthroughs in missile defense capabilities. The development of cost-effective, versatile missile systems and the growing emphasis on space-based missile defense also present substantial opportunities for stakeholders looking to enhance their strategic and defensive capabilities.

Global Missiles and Missile Defense Systems Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 27.2 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 3.77% |

| 2033 Value Projection: | USD 39.4 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Type, By Application, By Region. |

| Companies covered:: | Raytheon, MBDA, Lockheed Martin Corporation, Boeing, Rafael Advanced Defense Systems, Thales, Bharat Dynamics, Mectron, Sagem, Makeyev Design Bureau, Tactical Missiles, Kongsberg Defense Systems, Denel Dynamics, Saab, BAE Systems, Alliant Techsystems, Rheinmetall Defense, Northrop Grumman, Aerojet Rocketdyne, BrahMos Aerospace and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Missiles and Missile Defense Systems Market Dynamics

Growing defence spending globally is fuelling market growth

Growing global defense spending is a major driver of the missiles and missile defense systems market growth. Governments worldwide are increasing their military budgets to address rising security threats and geopolitical tensions. This surge in spending enables significant investments in advanced missile technologies and defense systems, enhancing national defense capabilities. The demand for cutting-edge solutions, such as hypersonic missiles and sophisticated missile defense systems, is rising as countries seek to bolster their strategic and tactical advantages. Additionally, modernization programs in emerging economies contribute to market expansion, as these nations strive to upgrade their military arsenals. Collaborations among international defense contractors and technology firms further accelerate innovation and deployment of next-generation missile and defense systems, fueling market growth.

Restraints & Challenges

High development and production costs pose significant barriers, limiting the participation of smaller firms and requiring substantial investment from larger players. Technological complexity and the need for continuous innovation demand ongoing research and development, which can strain resources. Additionally, stringent regulatory frameworks and export controls complicate international collaborations and sales. Geopolitical tensions can disrupt supply chains and create uncertainties, impacting market stability. Furthermore, the rapid evolution of missile threats necessitates constant upgrades, making it challenging for defense systems to remain effective. Balancing cost, technological advancements, and regulatory compliance while ensuring timely delivery and reliability remains a critical challenge for stakeholders in this market.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Missiles and Missile Defense Systems Market from 2023 to 2033. The United States, with its significant defense budget, leads the region, focusing on enhancing its missile capabilities and defense systems to counter evolving threats. Key programs, such as the development of hypersonic missiles and sophisticated missile defense shields, underscore the region's commitment to maintaining a strategic edge. Collaboration between government agencies, like the Department of Defense, and leading defense contractors fosters innovation and rapid deployment of advanced systems. Additionally, Canada's investments in modernizing its defense infrastructure contribute to regional market growth. Continuous R&D, coupled with strong political and financial support, ensures North America remains at the forefront of the global missiles and missile defense systems market.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. The development and deployment of advanced missile systems, including hypersonic and precision-guided missiles, are priorities for these nations. Additionally, there is a growing focus on enhancing missile defense systems to protect against ballistic and cruise missile threats. Collaborations and joint ventures with global defense contractors are accelerating technological advancements and indigenous production capabilities. The dynamic geopolitical landscape and the need for robust defense mechanisms drive continuous investments and innovation in the Asia-Pacific missiles and missile defense systems market.

Segmentation Analysis

Insights by Type

The missile defense systems segment accounted for the largest market share over the forecast period 2023 to 2033. This growth is driven by increasing global security concerns and the proliferation of missile threats, including ballistic and cruise missiles. Governments are prioritizing the development and deployment of advanced missile defense technologies to protect critical infrastructure and enhance national security. Innovations in radar, sensor technologies, and interceptors are significantly improving the effectiveness and reliability of these systems. Key players are investing heavily in research and development to create more sophisticated and integrated solutions. Additionally, regional conflicts and military modernization efforts in emerging economies are contributing to the demand for advanced missile defense systems, further propelling segment growth.

Insights by Application

The military segment accounted for the largest market share over the forecast period 2023 to 2033. Increasing geopolitical tensions and evolving warfare tactics drive demand for advanced missile systems and robust defense solutions. Military forces are focusing on modernizing their arsenals with next-generation technologies, including hypersonic missiles and precision-guided munitions, to maintain a tactical edge. The integration of cutting-edge radar, sensors, and AI-driven targeting systems further enhances the efficacy of military missile systems. Additionally, collaborative defense initiatives and joint development programs among allied nations are boosting the production and deployment of sophisticated military missile systems. This growth is further supported by continuous investments in research and development to address emerging threats and ensure operational readiness.

Recent Market Developments

- In September 2023, Germany and Israel agreed to purchase a missile defence system for USD 3.5 billion. Germany's answer to Russia's aggression in Ukraine is the procurement of a missile defence system.

Competitive Landscape

Major players in the market

- Raytheon

- MBDA

- Lockheed Martin Corporation

- Boeing

- Rafael Advanced Defense Systems

- Thales

- Bharat Dynamics

- Mectron

- Sagem

- Makeyev Design Bureau

- Tactical Missiles

- Kongsberg Defense Systems

- Denel Dynamics

- Saab

- BAE Systems

- Alliant Techsystems

- Rheinmetall Defense

- Northrop Grumman

- Aerojet Rocketdyne

- BrahMos Aerospace

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Missiles and Missile Defense Systems Market, Type Analysis

- Missile Defense Systems

- Surface-To-Air Missiles

- Air-To-Surface Missiles

- Air-To-Air Missiles

- Anti-Ship Missiles

Missiles and Missile Defense Systems Market, Application Analysis

- Military

- Simulation Exercises

- Other

Missiles and Missile Defense Systems Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Missiles and Missile Defense Systems?The global Missiles and Missile Defense Systems Market is expected to grow from USD 27.2 billion in 2023 to USD 39.4 billion by 2033, at a CAGR of 3.77% during the forecast period 2023-2033.

-

2. Who are the key market players of the Missiles and Missile Defense Systems Market?Some of the key market players of the market are Raytheon, MBDA, Lockheed Martin Corporation, Boeing, Rafael Advanced Defense Systems, Thales, Bharat Dynamics, Mectron, Sagem, Makeyev Design Bureau, Tactical Missiles, Kongsberg Defense Systems, Denel Dynamics, Saab, BAE Systems, Alliant Techsystems, Rheinmetall Defense, Northrop Grumman, Aerojet Rocketdyne, and BrahMos Aerospace.

-

3. Which segment holds the largest market share?The military segment holds the largest market share and is going to continue its dominance.

-

4. Which region dominates the Missiles and Missile Defense Systems market?North America dominates the Missiles and Missile Defense Systems market and has the highest market share.

Need help to buy this report?