Global Mobile Energy Storage System Market Size, Share, and COVID-19 Impact Analysis, By Type (Self-Mobile (Electric Vehicles), Containerized Solutions, and Trailers Mounted Solutions), By Application (Construction, Data Centers, Healthcare, Transportation, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Energy & PowerGlobal Mobile Energy Storage System Market Insights Forecasts to 2033

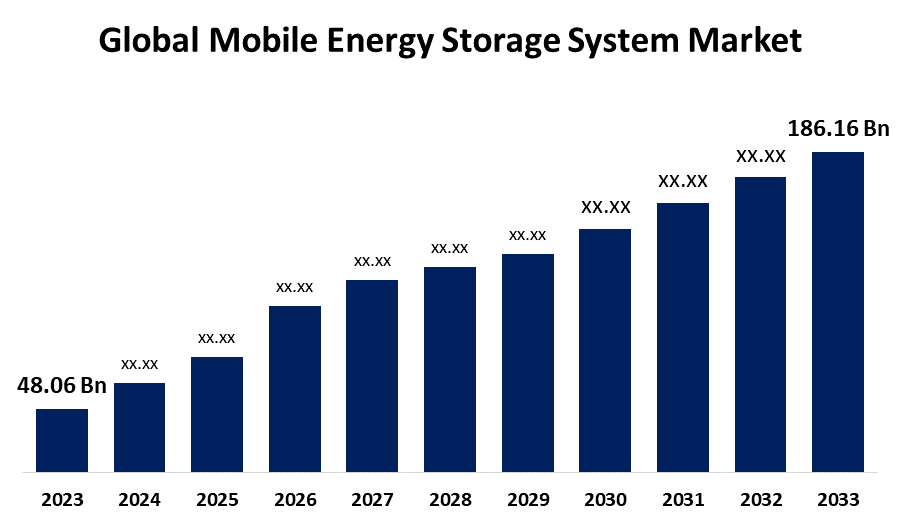

- The Global Mobile Energy Storage System Market Size was Valued at USD 48.06 Billion in 2023

- The Market Size is Growing at a CAGR of 14.50% from 2023 to 2033

- The Worldwide Mobile Energy Storage System Market Size is Expected to Reach USD 186.16 Billion by 2033

- Europe is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Mobile Energy Storage System Market Size is Anticipated to Exceed USD 186.16 Billion by 2033, Growing at a CAGR of 14.50% from 2023 to 2033.

Market Overview

A collection of components put together with the ability to store energy in order to provide electrical energy at a later time is called an energy storage system (ESS). One of these systems is a mobile energy storage system, which can be relocated and is usually used as a temporary electrical power source. In actuality, this is typically a battery storage array that is comparable in size to a semi-trailer. Mobile energy storage systems can be utilized for any purpose where electrical power is required, such as emergency backup power or supplemental electric vehicle charging stations during peak demand.

According to National Fire Protection Association guidelines, mobile energy storage devices can be quite helpful in delivering electricity to locations where it is needed in a variety of applications. It's critical to understand that this technology carries special risks in addition to its many useful applications. Respecting NFPA 855 guidelines can help maintain community safety while utilizing modern technology.

Four government agencies including the National Development and Reform Commission (NDRC), China's economic planner released implementation instructions aimed at improving NEVs' communication with the electricity grid. According to the guidelines' development goals, by 2025, China have developed its technological standard system for vehicle-grid interaction and completely implemented and continually optimized the busy-idle tariff mechanism for charging. According to the document, China will increase its efforts to conduct vehicle-grid interaction pilots, with the goal of having more than 60% of the yearly charging power in participating cities during idle times and more than 80% of the charging power in private charging piles during idle times by 2025. According to the statement, by 2025, the nation hopes to have pilots demonstrate the potential of NEVs as a mobile electrochemical energy storage resource.

Report Coverage

This research report categorizes the market for mobile energy storage systems based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the mobile energy storage system market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the mobile energy storage system market.

Global Mobile Energy Storage System Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 48.06 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 14.50 % |

| 2033 Value Projection: | USD 186.16 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 234 |

| Tables, Charts & Figures: | 116 |

| Segments covered: | By Type, By Application, and By Region |

| Companies covered:: | Power Edison, LG CHEM, Greener Power Solutions, PANASONIC HOLDINGS CORPORATION, Quanta Technology, Renewable Energy Systems Ltd, Nomad Transportable Power System, BOSTON POWER, Socomec, Hamedata Technology, Delta Electronics, GE ENERGY STORAGE, NEC Corporation, Aggreko, Jauch Quartz America, Inc., CHINA AVIATION LITHIUM BATTERY, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market for mobile energy storage systems is expanding due to reasons such as the growing requirement for portable and dependable power sources and the growing demand for renewable energy. The need for transportable energy storage systems has increased dramatically as the globe moves toward more environmentally friendly energy sources, especially for uses like electric cars, off-grid power systems, and disaster relief efforts. Better integration of renewable energy sources and greater energy security are made possible by these systems' adaptable and effective energy distribution and storage capabilities. The market's growth has also been aided by developments in battery technology and the falling costs of energy storage technologies.

Restraining Factors

The market for mobile energy storage systems is being held back by a number of problems, such as the high initial cost of the systems, the low energy density of current battery technologies, and the absence of system interoperability and standards. Adoption of mobile energy storage systems may be hampered by their high initial cost, particularly in countries where consumers are price-sensitive. Furthermore, mobile applications might have restricted endurance and range due to the limited energy density of batteries, which renders them less useful in some situations. Integration and general acceptance may also be hampered by a lack of industry standards and compatibility between systems since users might be reluctant to invest in a system that might not be compatible with other devices or infrastructure.

Market Segmentation

The mobile energy storage system market share is classified into type and application.

- The self-mobile (electric vehicles) segment is estimated to hold the highest market revenue share through the projected period.

Based on the type, the mobile energy storage system market is classified into self-mobile (electric vehicles), containerized solutions, and trailer-mounted solutions. Among these, the self-mobile (electric vehicles) segment is estimated to hold the highest market revenue share through the projected period. This is mostly due to the quick adoption of electric vehicles throughout the world, which is being fueled by consumer and government efforts to cut carbon emissions and switch to more environmentally friendly forms of transportation. To fuel their operations, electric cars need strong and dependable energy storage systems. Adding mobile energy storage solutions gives EV users more flexibility, a longer driving range, and increased energy economy. The self-mobile segment of the market for mobile energy storage systems is expanding due to technological developments in batteries, which have led to enhanced energy density and charging capacities in electric vehicles.

- The transportation segment is anticipated to hold the largest market share through the forecast period.

Based on the application, the mobile energy storage system market is divided into transportation, construction, data centers, healthcare, and others. Among these, the transportation segment is anticipated to hold the largest market share through the forecast period. This is because dependable and portable power sources are becoming more and more necessary for a variety of transportation applications, such as public transportation, commercial vehicles, and electric and hybrid automobiles. Globally, as governments impose more stringent emissions rules and provide incentives for the shift to environmentally friendly mobility solutions, there has been a sharp increase in the need for mobile energy storage systems that enable these cars and meet their energy needs. The domination of this category in the industry as a whole has also been aided by the usage of mobile energy storage in transportation applications, such as enabling vehicle-to-grid (V2G) capabilities and supplying backup power for electric buses.

Regional Segment Analysis of the Mobile Energy Storage System Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia-Pacific is anticipated to hold the largest share of the mobile energy storage system market over the predicted timeframe.

Get more details on this report -

Asia-Pacific is anticipated to hold the largest share of the mobile energy storage system market over the predicted timeframe. This is mainly because electric vehicles are being adopted at a rapid pace, especially in China, India, and Japan. The region also has excellent manufacturing capabilities and is home to significant industry players. In addition, there is a boom in the deployment of renewable energy in the Asia-Pacific area, which is increasing the need for dependable and transportable energy storage systems to facilitate off-grid and grid integration. The Asia-Pacific region is expected to dominate the mobile energy storage system market during the forecast period due to a number of factors, including favorable government policies, rising investments in infrastructure development, and rising awareness of the advantages of sustainable energy solutions.

Europe is expected to grow the fastest during the forecast period. This is mostly because of the area's steadfast dedication to cutting carbon emissions and moving toward a more sustainable energy system. The adoption of electric vehicles and renewable energy sources has accelerated due to strict restrictions and targets imposed by the European Union, such as the European Green Deal. This has boosted demand for dependable and effective mobile energy storage solutions. The market for mobile energy storage systems in Europe has expanded quickly due in part to the region's well-developed infrastructure, the presence of significant vehicle and energy storage manufacturers, and the availability of government incentives and subsidies. The integration of renewable energy sources and the decarbonization of the transportation sector remain top priorities for the continent.

For Incidence, the recent updated guidelines published by the Department for Business & Trade named as UK battery strategy in which the government mentioned that the UK government plans to merge R&D Expenditure Credit and SME schemes from April 2024, simplifying the system and supporting innovation. The rate of taxation for loss-making companies will be reduced. The intensity threshold will be reduced from 40% to 30%, allowing 5,000 more SMEs to qualify for relief. This will provide £280 million in additional relief per year by 2028-2029.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the mobile energy storage system market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Power Edison

- LG CHEM

- Greener Power Solutions

- PANASONIC HOLDINGS CORPORATION

- Quanta Technology

- Renewable Energy Systems Ltd

- Nomad Transportable Power System

- BOSTON POWER

- Socomec

- Hamedata Technology

- Delta Electronics

- GE ENERGY STORAGE

- NEC Corporation

- Aggreko

- Jauch Quartz America, Inc.

- CHINA AVIATION LITHIUM BATTERY

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In July 2024, Tecloman presented the aerosol fire extinguishing system-powered Cubox mobile energy storage system. The road construction, peak shaving, and emergency charging scenarios are among the uses for Tecloman's new line of LFP power supply solutions. According to Alexandra Hu, vice president of global markets at Tecloman, the company eventually wants to produce 20 gigawatt hours of Cubox annually.

- In May 2024, The PU130 transportable battery energy storage system is the result of a historic partnership between Volvo Construction Equipment (Volvo CE) and Portable Electric, which aims to completely change how the construction industry approaches off-grid electric equipment charging.

- In April 2024, With the help of UK startup Allye Energy, Land Rover created a mobile energy storage device that it is selling by repurposing plug-in hybrid Range Rover models' batteries.

- In January 2024, Innovative Technologies business CATL signed a long-term supply agreement with Alfen, a leader in energy solutions throughout Europe. With the help of this multi-year agreement, Alfen will be able to secure its supply chain for energy storage systems across Europe and meet the growing demand. By 2024, the utility and commercial energy storage markets are projected to rise by around 60% in terms of megawatt-hours (MWh).

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the mobile energy storage system market based on the below-mentioned segments:

Global Mobile Energy Storage System Market, By Type

- Self-Mobile (Electric Vehicles)

- Containerized Solutions

- Trailers Mounted Solutions

Global Mobile Energy Storage System Market, By Application

- Construction

- Data Centers

- Healthcare

- Transportation

- Others

Global Mobile Energy Storage System Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the mobile energy storage system market over the forecast period?The mobile energy storage system market is projected to expand at a CAGR of 14.50% during the forecast period.

-

2. What is the market size of the mobile energy storage system market?The Global Mobile Energy Storage System Market Size is Expected to Grow from USD 48.06 Billion in 2023 to USD 186.16 Billion by 2033, at a CAGR of 14.50% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the mobile energy storage system market?Asia-Pacific is anticipated to hold the largest share of the mobile energy storage system market over the predicted timeframe.

Need help to buy this report?