Global Mobile Payment Technology Market Size, Share, and COVID-19 Impact Analysis, By Mode of Transaction (SMS, NFC, and WAP), By Type of Mobile Payment (Mobile Wallet, Bank Cards, and Mobile Money), By Application (Entertainment, Energy & Utilities, Healthcare, Retail, Hospitality, and Transportation), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Information & TechnologyGlobal Mobile Payment Technology Market Insights Forecasts to 2033

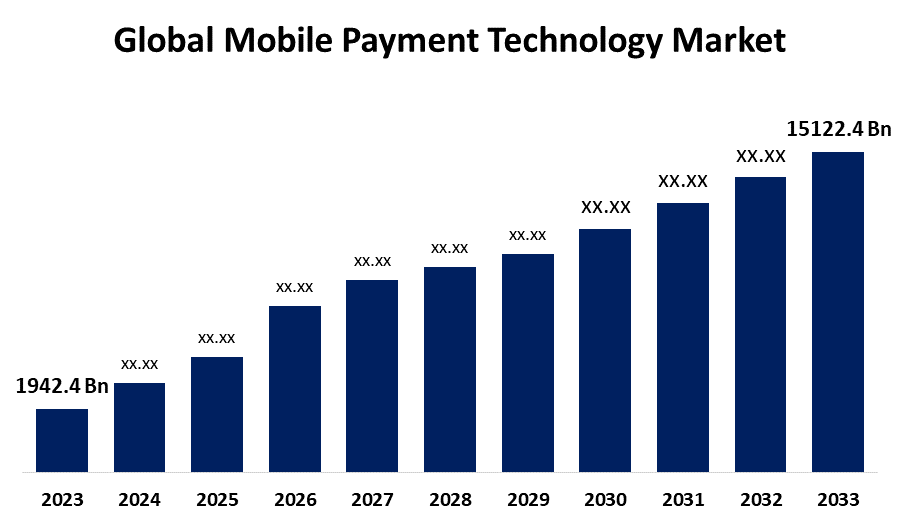

- The Global Mobile Payment Technology Market Size was Valued at USD 1942.4 Billion in 2023

- The Market Size is Growing at a CAGR of 22.78% from 2023 to 2033

- The Worldwide Mobile Payment Technology Market Size is Expected to Reach USD 15122.4 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Mobile Payment Technology Market Size is Anticipated to Exceed USD 15122.4 Billion by 2033, Growing at a CAGR of 22.78% from 2023 to 2033.

Market Overview

Mobile payment is an alternative to traditional payment methods that use cash, checks, or credit cards. Mobile Payment enables customers to obtain any goods or services using wireless devices such as smartphones and tablets. Additionally, Mobile Payment employs a variety of technologies, including NFC (Near Field Communication), SMS-based transactional payments, and direct mobile billing, to enhance transaction security and provide convenient transactions. Once set up, payments can be made in-store by scanning a QR code, tapping the phone against a payment terminal (using Near Field Communication, or NFC), or even sending money directly to another person via peer-to-peer apps such as Venmo or Cash App. The ease with which such forms of payment operate, in terms of speed, is where mobile payment conveniences come from, not to mention greater security features through fingerprint and facial recognition that give them layers of protection. This technology is finding greater traction throughout the world, more particularly in those places where access to mobile phones surpasses the presence of legacy banking systems. It also benefits them by saving them on checkout times, reducing cash handling, and reaching a more tech-savvy customer base. Overall, mobile payment technology is changing the way people use money; seamlessly and quickly, in fact, from your phone, it's completely secure down the line.

Report Coverage

This research report categorizes the market for the global mobile payment technology market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global mobile payment technology market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global mobile payment technology market.

Global Mobile Payment Technology Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1,942.4 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 22.78% |

| 2033 Value Projection: | USD 15,122.4 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 264 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Mode of Transaction, By Type of Mobile Payment, By Application, and By Region |

| Companies covered:: | Bharti Airtel Limited, Econet Wireless Zimbabwe Limited, Visa, Inc., MasterCard Incorporated, Millicom International Cellular SA, MTN Group Limited, Orange S.A., PayPal Holdings Inc., Safaricom Limited, Vodacom Group Limited., Microsoft Corporation, Apple, Inc., American Express, Co., Google, Inc., Boku, Inc., and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Increasing Smart Appliance Penetration and Mobile Data Usage

Smart appliance adoption, as well as the use of mobile data, has increased dramatically in recent years. This is due to the ease of communication and growing demand for convenient transactions among consumers around the world. Smart appliances, such as tablets and smartphones, along with related applications, are essential for mobile payment technology. It enables payment without the use of traditional financial transaction channels. These factors are driving factors for the mobile payment technology market.

Restraining Factors

Consumers are not interested in adopting new technology

Consumer preference is one of the major factors hampering market growth, due to a lack of awareness of specific mobile payment services and features available on smartphones. Consumers are concerned about the security of mobile wallets due to the increasing number of cyber-attacks on financial data.

Market Segmentation

The global mobile payment technology market share is classified into mode of transaction, type of mobile payment, and application.

- The NFC segment is expected to hold the largest share of the global mobile payment technology market during the forecast period.

Based on the mode of transaction, the global mobile payment technology market is categorized into SMS, NFC, and WAP. Among these, the NFC segment is expected to hold the largest share of the global mobile payment technology market during the forecast period. The NFC segment boosts the mobile payment market due to NFC-enabled smartphones. Mobile payment technology finds its application in BFSI, retail, healthcare, entertainment, IT and telecom, energy and utilities, hospitality and tourism, and others. Increased adoption of mobile payments in the banking sector is likely to surge the share of BFSI within the estimated timeframe.

- The mobile wallet segment is expected to grow at the fastest CAGR during the forecast period.

Based on the type of mobile payment, the global mobile payment technology market is categorized into mobile wallets, bank cards, and mobile money. Among these, the mobile wallet segment is expected to grow at the fastest CAGR during the forecast period. Digitalization is becoming more widely adopted. Mobile wallets are a relatively new payment option that will provide significant benefits. Apple Pay, Samsung Pay, and Android Pay are compatible with all major devices. Mobile wallets reduce both fraud and content within the wallets.

- The entertainment segment is expected to grow at the fastest CAGR during the forecast period.

Based on the application, the global mobile payment technology market is categorized into entertainment, energy & utilities, healthcare, retail, hospitality, and transportation. Among these, the entertainment segment is expected to grow at the fastest CAGR during the forecast period. Digital entertainment industry is going through a revolution. Smartphone proliferation, rapid product innovation, increased consumer connectivity, and thus the growth of social media have propelled the digital entertainment revolution. This has significantly altered the way customers purchase and consume games, movies, and music.

Regional Segment Analysis of the Global Mobile Payment Technology Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is projected to hold the largest share of the global mobile payment technology market over the forecast period.

Get more details on this report -

North America is projected to hold the largest share of the global mobile payment technology market over the forecast period. This large market share can be attributed to the North America region's widespread use of advanced innovative technology. Additionally, the market is expected to grow due to increased awareness of e-wallets in the United States and Canada. The growing use of wearable devices, combined with the growing adoption of NFC in smartphones and wearable devices, is expected to create massive market growth opportunities.

Asia Pacific is expected to grow at the fastest CAGR growth of the global mobile payment technology market during the forecast period. The rapid growth of the Asia Pacific market can be attributed to the increasing trend of digitization, combined with the widespread adoption of various technology payment modes such as mobile wallets, credit/debit cards, and others. Additionally, rapid urbanization, improved living standards, and rising disposable income among the population in the emerging nation all contribute to market growth. Emerging nations such as South Korea, India, Japan, and China are primarily responsible for market growth. The growing number of mobile wallets and population are driving the growth of the manufacturing industries.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global mobile payment technology market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Bharti Airtel Limited

- Econet Wireless Zimbabwe Limited

- Visa, Inc.

- MasterCard Incorporated

- Millicom International Cellular SA

- MTN Group Limited

- Orange S.A.

- PayPal Holdings Inc.

- Safaricom Limited

- Vodacom Group Limited.

- Microsoft Corporation

- Apple, Inc.

- American Express, Co.

- Google, Inc.

- Boku, Inc.

- Others

Key Market Developments

- In March 2022, Visa announced that it acquires Tink, an open banking platform that enables financial institutions and fintech companies to build services and products while also transacting money. Tink and Visa's merger is expected to provide clients with better financial service, data, and money management.

- In February 2022, Apple announced plans to launch Tap to Pay on iPhone. This new feature help businesses use their mobile phones to accept payment via Apple Pay and other contact-free payment methods via the iPhone and iOS apps.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global mobile payment technology market based on the below-mentioned segments:

Global Mobile Payment Technology Market, By Mode of Transaction

- SMS

- NFC

- WAP

Global Mobile Payment Technology Market, By Type of Mobile Payment

- Mobile Wallet

- Bank Cards

- Mobile Money

Global Mobile Payment Technology Market, By Application

- Entertainment

- Energy & Utilities

- Healthcare

- Retail

- Hospitality

- Transportation

Global Mobile Payment Technology Market, By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the global mobile payment technology market over the forecast period?The Global Mobile Payment Technology Market Size is Expected to Grow from USD 1942.4 Billion in 2023 to USD 15122.4 Billion by 2033, at a CAGR of 22.78% during the forecast period 2023-2033.

-

2. Which region is expected to hold the highest share in the global mobile payment technology market?North America is projected to hold the largest share of the global mobile payment technology market over the forecast period.

-

3. Who are the top key players in the mobile payment technology market?The top key players in the global mobile payment technology market are Bharti Airtel Limited, Econet Wireless Zimbabwe Limited, Visa, Inc., MasterCard Incorporated, Millicom International Cellular SA, MTN Group Limited, Orange S.A., PayPal Holdings Inc., Safaricom Limited, Vodacom Group Limited., Microsoft Corporation, Apple, Inc., American Express, Co., Google, Inc., Boku, Inc., Others.

Need help to buy this report?