Global Modular Data Centre Market Size, Share & Trends, COVID-19 Impact Analysis Report, by Component (Function Module solutions, and services) By Application ( Emergency Data Storage, Temporary Storage Expansion, Disaster Recovery, Edge Computing, and Others)By Data Center size (Small and Medium Data Centre, and large data centre) By Industry (BFSI,IT & Telecom, Government, Healthcare, Media & Entertainment, Others) and By Region ( North America, Europe, Asia-Pacific, South America, Middle East, And Africa), Analysis And Forecast 2021 - 2030

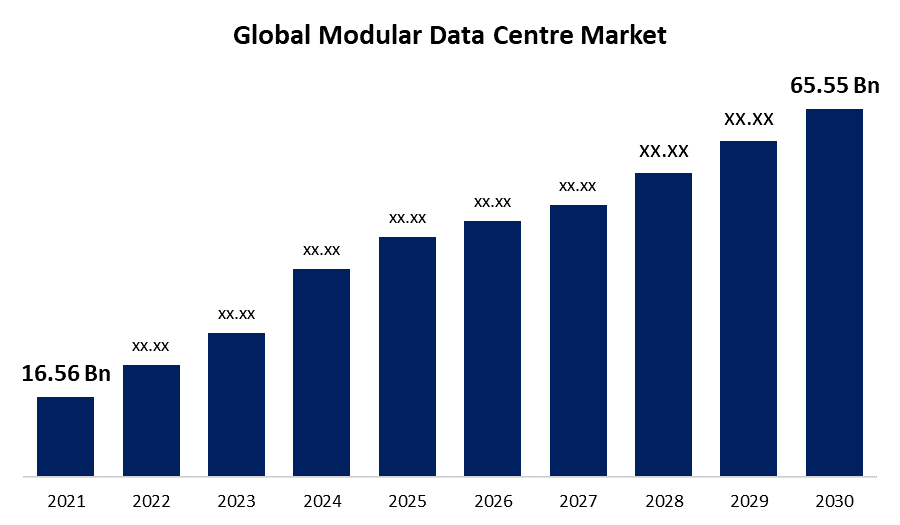

Industry: Information & TechnologyThe Global Modular Data Centre Market Size was valued at USD 16.56 billion in 2021 and is anticipated to grow to USD 65.55 billion by 2030, at a CAGR of 19.00%.

Get more details on this report -

The market for modular data centres is primarily segmented by the increase in demand for cutting-edge prefabricated and green centre infrastructure across IT and telecom, healthcare, and other industries. Organizations can easily progressively increase data halls with modularly constructed colocation data centre’s without losing dependability or the freedom to modify the environment to desired requirements. The modular service model's fundamental elements include continuous security, environmental optimization, redundancy, concurrent maintainability, carrier neutrality, and many more. Thus, it is anticipated that colocation providers would offer numerous alternatives for the deployment of modular data centre’s.

Prefabricated modules that are created at a factory and brought to the customer site. The rise in demand for products and services like cloud-based networking, AI, robotics and automation, and other related ones has aided companies in creating modular data centres.

Driving Factor

Due to the increasing number of environmental protection and energy consumption rules established by various governments throughout the world, the demand for modular data centres is expanding. The modular data center's constrained size is easier to cool than a single huge room, and built-in aisle containment reduces hot and cold air mixing. Modular data centres are 40% more energy efficient than open data centres, according to research from Building Industry Consulting Service International (BICSI). As a result, modular data centres are more power-efficient than traditional data centres and help to address the intrinsic requirement of businesses for lower energy use. Further lowering PUE levels in modular data centres can be accomplished by implementing and utilising renewable energy sources, such as solar energy. Organizations can easily progressively increase data halls with modularly constructed colocation data centres without losing dependability or the freedom to modify the environment to desired requirements. The modular service model's fundamental elements include continuous security, environmental optimization, redundancy, concurrent maintainability, carrier neutrality, and many more. Thus, it is anticipated that colocation providers would offer numerous alternatives for the deployment of modular data centres.

Global Modular Data Centre Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2021 |

| Market Size in 2021: | USD 16.56 Billion |

| Forecast Period: | 2021 - 2030 |

| Forecast Period CAGR 2021 - 2030 : | 19.00%. |

| 2030 Value Projection: | USD 65.55 Billion |

| Historical Data for: | 2017 - 2020 |

| No. of Pages: | 189 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Component, By Application, By Data Center size, By Industry, By Region |

| Companies covered:: | Dell (US), Vertiv (US), Hewlett Packard Enterprise (US), International Business Machines (US), Baselayer Technology (US), Fiberhome Networks (China), Cupertino Electric (US), Eaton Corporate (Ireland), Eltek (Norway), ICTroom Company (Netherlands) |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Restraining Factor

According to the user's environment, data centres were frequently built to order and provided the option of customisation. By using these functionalities, data centre users may order data centres that might change to meet their needs and the organization's overall operational environment. Due to their uniform design and use of prefabricated modules, current modular data centres lack this capability for complete customisation. Further limiting the company to a single vendor, the modular data centre offering's standardisation prevents the user from expanding the data centre with new solutions from other vendors. The expansion of the worldwide modular data centre market is anticipated to be hampered by the limited purchasing options and lack of customization. Although there are several benefits to using a data centre, most consumers still rely on on-site services. The market's expansion is also anticipated to be hampered by the high installation costs and lack of awareness for modular data centres, particularly in rural areas or other places without network connectivity or IT services.

COVID 19 Impact

Organizations across industries are speeding up their digital transitions as the COVID-19 epidemic sweeps the globe, and they are looking to technology to help them adjust to a new normal where disruption may lurk around every corner. Modular building techniques have been developing in data centre projects for a while, but COVID-19's effects will surely place them in the spotlight. In addition to cost savings, modular constructions have the advantage of requiring fewer workers on the job site while it is being built. More capacity is required due to the COVID-19 pandemic's fresh increase in the already brisk demand for online services. There have been numerous occasions when data centre building has taken place during COVID-19. For instance, Google has revealed ambitions for growth in 2020. The global economy has been badly harmed by the coronavirus pandemic. The current epidemic situation has compelled businesses to implement a WFH (work from home) policy for their staff.

Segmentation

The global Modular Data center market is segmented into Component, Application, Data Center size, Industry and Region.

Global Modular data Center Market, By Components

The market is segmented into function module solutions and services based on the component.

The biggest market share for modular data centres is anticipated to be accounted for by function module solutions.

Due to the rising usage of public cloud services among startups and SMEs, the services category is anticipated to grow at the greatest CAGR over the forecast period.

Global Modular data Center Market, By Application

The market is divided into edge computing, temporary storage expansion, disaster recovery, and other categories depending on the application.

It is projected that temporary storage expansion will account for the biggest market share.

Global Modular data Center Market, By Data Center Size

The market is divided into small, medium, and large data centres based on the size of the data centre.

Because more startups and SMEs are investing in cloud services, the small and medium data centre is predicted to develop at the fastest rate of compound annual growth (CAGR).

Global Modular data Center Market, By Industry Analysis

The market is segmented into BFSI, IT & Telecom, Government, Healthcare, Media & Entertainment, and Others based on industry.During the forecast period, IT and telecom are anticipated to hold a significant proportion. In order to meet the growing demand across the IT and telecom industries, key market participants are concentrating on building cutting-edge prefabricated data centres.

Global Modular data Center Market, By Region

The global modular data centre market is segmented into 5 primary geographical areas: North America, Europe, Middle East and Africa (MEA), Asia Pacific (APAC), and Latin America. Due to the increased uptake of cutting-edge technologies like edge computing and the Internet of Things, Asia Pacific is predicted to experience the biggest growth.

Get more details on this report -

Recent Developments In The Global Modular data center Market

In February 2020=Dell, Inc. launched the Micro 415, an EMC modular data centre. It offers solutions for regional data processing that are supported by edge computing technology.

In August 2016= Tigo Tanzania invested around USD 2.50 billion in Paraguay to build the country's first cutting-edge modular data centre.

List of Key Market Players

- Dell (US)

- Vertiv (US)

- Hewlett Packard Enterprise (US)

- International Business Machines (US)

- Baselayer Technology (US)

- Fiberhome Networks (China)

- Cupertino Electric (US)

- Eaton Corporate (Ireland)

- Eltek (Norway)

- ICTroom Company (Netherlands)

Segmentation

By Component Type

- Function Module Solutions

- Services

By Application Type

- Emergency Data Storage

- Temporary Storage Expansion

- Disaster Recovery

- Edge Computing

By Data Center size

- Small

- Medium

- Large

By Industry Type

- BFSI

- IT & Telecom

- Government

- Healthcare

- Media & Entertainment

By Region Type

North America

- North America, by Country

- U.S.

- Canada

- Mexico

- North America, By Component Type

- North America, By Application Type

- North America, By Data Center size

- North America, By Industry Type

Europe

- Europe, by Country

- Germany

- Russia

- U.K.

- France

- Italy

- Spain

- The Netherlands

- Rest of Europe

- Europe, By Component Type

- Europe, By Application Type

- Europe, By Data Center size

- Europe, By Industry Type

Asia Pacific

- Asia Pacific, by Country

- China

- India

- Japan

- South Korea

- Australia

- Indonesia

- Rest of Asia Pacific

- Asia Pacific, By Component Type

- Asia Pacific, By Application Type

- Asia Pacific, By Data Center size

- Asia Pacific, By Industry Type

Middle East & Africa

- Middle East & Africa, by Country

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

- Middle East & Africa, By Component Type

- Middle East & Africa, By Application Type

- Middle East & Africa, By Data Center size

- Middle East & Africa, By Industry Type

South America

- South America, by Country

- Brazil

- Argentina

- Colombia

- Rest of South America

- South America, By Component Type

- South America, By Application Type

- South America, By Data Center size

- South America, By Industry Type

Need help to buy this report?