Global Nanosatellite and Microsatellite Market Size, Share, and COVID-19 Impact Analysis, By Type (Microsatellite, Nanosatellite), By Component (Service, Hardware, Software), By Application (Earth Observation, Scientific Research, Communication & Navigation, Educational & Technology Training), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Aerospace & DefenseGlobal Nanosatellite and Microsatellite Market Insights Forecasts to 2033

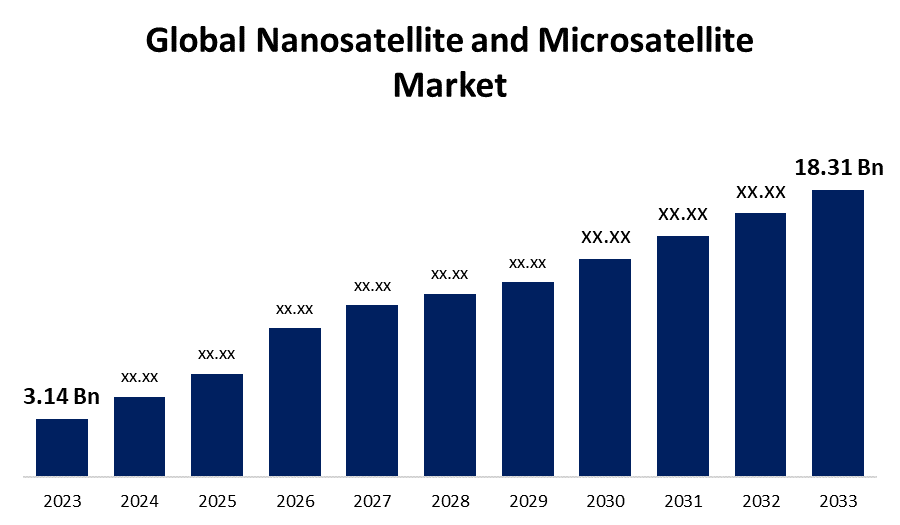

- The Global Nanosatellite and Microsatellite Market Size was Valued at USD 3.14 Billion in 2023

- The Market Size is Growing at a CAGR of 19.28% from 2023 to 2033

- The Worldwide Nanosatellite and Microsatellite Market Size is Expected to Reach USD 18.31 Billion by 2033

- Europe is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Nanosatellite and Microsatellite Market Size is Anticipated to Exceed USD 18.31 Billion by 2033, Growing at a CAGR of 19.28% from 2023 to 2033.

Market Overview

A nanosatellite is a very small, highly technologically sophisticated satellite platform that needs to be built with dependability in mind. A nanosatellite's reliability and lifespan are influenced by its level of technology, development, and advancement of funding constraints. Therefore, every attempt needs to be taken to determine a particular nature and dependability. The power of nanosatellites and microsatellites has increased because to ongoing advancements in electronics and particles. In March 7, 2024, with the addition of OQ Technology's Tiger-7 and Tiger-8 nanosatellites, the first and largest 5G Narrowband-IoT constellation in the world will reach ten satellites in low Earth orbit. The fifth and sixth satellites that NanoAvionics has produced for OQ Technology are the two 6U nanosatellites. Each constellation satellite from OQ Technologies may establish a direct connection with commercially available IoT devices and machinery, in addition to offering tracking and monitoring data. These small satellites can now carry out intricate jobs like communication relays, environmental monitoring, and high-resolution imagery thanks to technological advancements. Small satellites are becoming more dependable and efficient thanks to improved sensor technology, power economy, and propulsion system optimization. The growing applications of nanosatellites and microsatellites will drive demand for advanced solutions across a range of industries as this technology advances.

Report Coverage

This research report categorizes the market for the nanosatellite and microsatellite market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the nanosatellite and microsatellite market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the nanosatellite and microsatellite market.

Global Nanosatellite and Microsatellite Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 3.14 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 19.28% |

| 023 – 2033 Value Projection: | USD 18.31 Billion |

| Historical Data for: | 2021-2022 |

| No. of Pages: | 237 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Component, By Application, By Region |

| Companies covered:: | AAC Clyde Space, GomSpace, Lockheed Martin Corporation, Planet Labs Inc., Sierra Nevada Corporation, Surrey Satellite Technology Ltd., Tyvak Nano-Satellite Systems, Inc., Spire Global, Inc., NanoAvionics, Northrop Grumman Corporation, Others, |

| Pitfalls & Challenges: | Covid-19 Impact, Challenge, Future,Growth and Analysis |

Get more details on this report -

Driving Factors

A rise in industry-wide demand for small satellites: Larger, conventional satellites can be produced significantly more expensively than small satellites that are placed into low-Earth orbit. In recent years, small satellites have changed the face of space missions. They make it possible to access space and data goods more quickly, affordably, and reliably. Nanosatellites can serve the same purposes as bigger ones despite their distinct characteristics. The gathering and analysis of data is essential to effective resource management and the growth of sustainable economies. Microsatellites can be built faster and at a lower cost than conventional full-sized satellites. They will therefore probably be crucial to space business and use.

Restraining Factors

Regulatory barriers also provide difficulties because obtaining relevant permissions and determining distribution frequency can be time-consuming and complicated. Tighter controls may result from growing concerns about space debris and collision danger brought on by the increasing congestion in low-Earth orbits. The market is constrained by all of these obstacles, thus in order to overcome them and maintain growth, the market needs creative solutions and a more robust regulatory framework.

Market Segmentation

The nanosatellite and microsatellite market share are classified into type, component and application.

- The nanosatellite segment is expected to hold the largest share of the nanosatellite and microsatellite market during the forecast period.

Based on the type, the nanosatellite and microsatellite market are categorized into microsatellite, and nanosatellite. Among these, the nanosatellite segment is expected to hold the largest share of the nanosatellite and microsatellite market during the forecast period. Nanosatellites, frequently referred to as CubeSats, have been increasingly popular and widely used. These small satellites, which usually weigh between one and ten kilos, provide affordable options for a variety of uses, such as communication, scientific research, Earth observation, and technology demonstration.

- The hardware segment is expected to grow at the fastest CAGR during the forecast period.

Based on the component, the nanosatellite and microsatellite market are categorized into service, hardware, and software. Among these, the hardware segment is expected to grow at the fastest CAGR during the forecast period. Advances in miniaturization and materials research allow for more powerful and compact satellite components. Innovation is fueled by the growing need for high-performance payloads, such as sophisticated sensors, communication systems, and propulsion units. Furthermore, reliable hardware solutions are required due to the increase in governmental and commercial satellite launches for Earth observation, communication, and scientific missions. The capabilities and uses of tiny satellites are growing as a result of new players entering the market and increased investment in space technology.

- The earth observation segment is expected to hold a significant share of the nanosatellite and microsatellite market during the forecast period.

Based on the application, the nanosatellite and microsatellite market are categorized into earth observation, scientific research, communication & navigation, and educational & technology training. Among these, the earth observation segment is expected to hold a significant share of the nanosatellite and microsatellite market during the forecast period. With increased funding going into space missions, more nanosatellites and microsatellites are being used for earth observation. High performance is delivered by the sophisticated technologies used in the development of nanosatellites and microsatellites.

Regional Segment Analysis of the Global Nanosatellite and Microsatellite Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is projected to hold the largest share of the nanosatellite and microsatellite market over the forecast period.

Get more details on this report -

North America is projected to hold the largest share of the nanosatellite and microsatellite market over the forecast period. Small satellite technologies, from communications and scientific research to earth monitoring, are seeing significant investments from U.S. and Canadian companies. In terms of ambitious satellite programs, government organizations like NASA and private businesses like SpaceX are setting the standard. Furthermore, companies in all sectors of North America understand how important small satellites are for enhancing operational effectiveness and gaining a competitive edge. One of the main factors propelling the region's market expansion is a high emphasis on technology development and space exploration.

Europe is expected to grow at the fastest CAGR growth of the nanosatellite and microsatellite market during the forecast period. The rising demand for scientific research, Earth observation, and remote sensing has given the European region a significant market share. This region's market analysis has included the UK, Russia, Germany, Italy, Finland, and the rest of Europe. LakshyaSAT, a 1U CubeSat nanosatellite built and developed by Tenali, Sai Divya, and launched successfully into the stratosphere from the United Kingdom in March 2022. It is anticipated that multiple small satellites will be launched by the European Space Agency (ESA) and other national and regional space agencies to collect data for surveillance, navigation, disaster management, and climate monitoring

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the nanosatellite and microsatellite market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- AAC Clyde Space

- GomSpace

- Lockheed Martin Corporation

- Planet Labs Inc.

- Sierra Nevada Corporation

- Surrey Satellite Technology Ltd.

- Tyvak Nano-Satellite Systems, Inc.

- Spire Global, Inc.

- NanoAvionics

- Northrop Grumman Corporation

- Others

Key Market Developments

- In December 2023, the parent firm of Axelspace Corporation, Axelspace Holdings, was invested in by Seiko Epson Corporation and Epson X Investment Corporation. Axelspace is a startup that was founded at the University of Tokyo and specializes in the design and manufacturing of microsatellites.

- In October 2023, the Korean startup Nara Space declared that it has successfully launched its observation nanosatellite, Observer-1A, into orbit and made contact with Earth. The satellite was launched from California's Vandenberg Space Force Base on a SpaceX Falcon 9 rocket.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the nanosatellite and microsatellite market based on the below-mentioned segments:

Global Nanosatellite and Microsatellite Market, By Type

- Microsatellite

- Nanosatellite

Global Nanosatellite and Microsatellite Market, By Component

- Service

- Hardware

- Software

Global Nanosatellite and Microsatellite Market, By Application

- Earth Observation

- Scientific Research

- Communication & Navigation

- Educational & Technology Training

Global Nanosatellite and Microsatellite Market, By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the nanosatellite and microsatellite market over the forecast period?The Global Nanosatellite and Microsatellite Market Size is Expected to Grow from USD 3.14 Billion in 2023 to USD 18.31 Billion by 2033, at a CAGR of 19.28% during the forecast period 2023-2033.

-

2. Which region is expected to hold the highest share in the nanosatellite and microsatellite market?North America is projected to hold the largest share of the nanosatellite and microsatellite market over the forecast period.

-

3. Who are the top key players in the nanosatellite and microsatellite market?AAC Clyde Space, GomSpace, Lockheed Martin Corporation, Planet Labs Inc., Sierra Nevada Corporation, Surrey Satellite Technology Ltd., Tyvak Nano-Satellite Systems, Inc., Spire Global, Inc., NanoAvionics, Northrop Grumman Corporation, and others.

Need help to buy this report?