Global NATO C5ISR Market Size, By Type (Land, Naval, Airborne, and Space), By Application (Electronic Warfare, ISR (Intelligence, Surveillance, and Reconnaissance), Weapon Systems, Theater Command and Control, Information Security and Assurance, Computing, and Others), By Solution (Hardware and Software and Services), By Region, And Segment Forecasts, By Geographic Scope And Forecast to 2033

Industry: Aerospace & DefenseGlobal NATO C5ISR Market Insights Forecasts to 2033

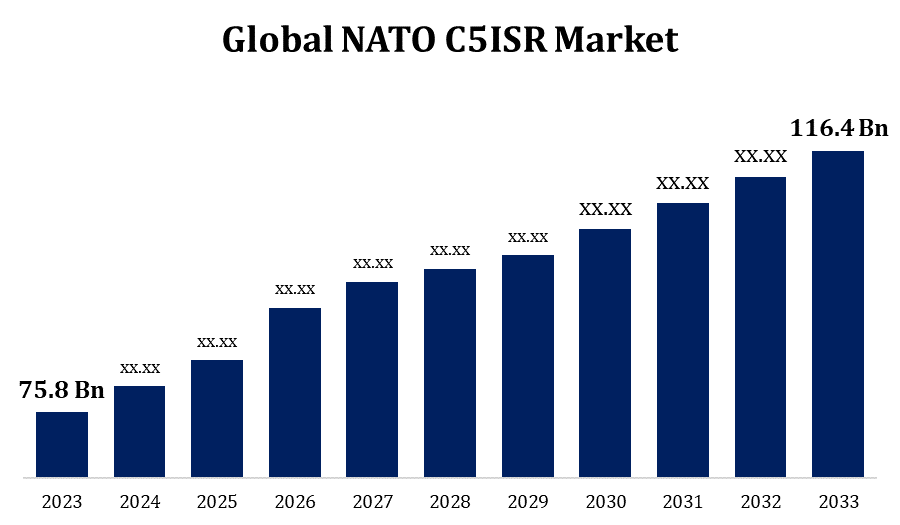

- The Global NATO C5ISR Market Size was valued at USD 75.8 Billion in 2023.

- The Market is Growing at a CAGR of 4.38% from 2023 to 2033

- The Worldwide NATO C5ISR Market Size is Expected to reach USD 116.4 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period

Get more details on this report -

The Global NATO C5ISR Market Size is Expected to reach USD 116.4 billion by 2033, at a CAGR of 4.38% during the forecast period 2023 to 2033.

Innovation in C5ISR systems is being fueled by the rapid improvements in sensor, data analytics, and information technology, which is raising the need for updates and modernization. NATO member states are giving investments in C5ISR capabilities top priority in light of the changing threat picture in order to improve situational awareness, safeguard vital infrastructure, and fend off cyberattacks. The goal of NATO member states is to increase interoperability between their armed forces and with other countries, which means investing in C5ISR systems that can interchange and integrate data across many platforms and domains with ease. The necessity of C5ISR capabilities for a variety of military missions, such as cyber operations, intelligence gathering, command and control, surveillance, and reconnaissance, motivates ongoing investment in these technologies.

NATO C5ISR Market Value Chain Analysis

The government and military agencies of NATO member nations are crucial in establishing the specifications, procurement plans, and financial resources for C5ISR equipment. They set rules, guidelines, and policies that control the procurement, use, and management of C5ISR capabilities. The major defence firms known as prime contractors are in charge of creating, developing, integrating, and supplying C5ISR equipment to the armed forces. These businesses frequently oversee intricate projects with several vendors and subcontractors. They collaborate closely with government organisations to adhere to delivery dates, budgets, and technical requirements. The specialised parts, subsystems, software, and services needed for C5ISR systems are provided by suppliers and subcontractors. Their areas of expertise may include cybersecurity, sensor systems, data analytics, communication technology, and logistics support.

NATO C5ISR Market Opportunity Analysis

Modernising their C5ISR capabilities is a goal shared by many NATO members in order to stay up to date with changing threats and technical developments. Businesses have the chance to offer modernization solutions that improve compatibility across current systems, integrate new technologies, and upgrade legacy systems. The NATO C5ISR industry is seeing a rise in demand for cybersecurity solutions due to the frequency and sophistication of cyberattacks. Cybersecurity technology and service providers can take advantage of this by providing solutions to safeguard vital infrastructure, secure communication networks, and ward off online attacks. ISR capabilities are essential for improving military operations' situational awareness and decision-making. There are opportunities for businesses to create and supply cutting-edge ISR technologies.

Global NATO C5ISR Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 75.8 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.38% |

| 2033 Value Projection: | USD 116.4 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Type, By Application, By Solution, By Region. |

| Companies covered:: | Lockheed Martin Corporation, ST Engineering Ltd., General Dynamics Corporation, Raytheon Technologies Corporation, CACI International Inc., Elbit Systems Ltd., L3Harris Technologies Inc., and other key vendors. |

| Growth Drivers: | Increasing Cross-Border Conflicts Among Nations |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

NATO C5ISR Market Dynamics

Increasing Cross-Border Conflicts Among Nations

Countries need to have heightened situational awareness during cross-border conflicts in order to properly monitor and respond to possible threats. By collecting, evaluating, and sharing intelligence, surveillance, and reconnaissance data, C5ISR systems give armed personnel the essential tools they need to better comprehend the changing security environment and make wise judgements. Coordinated military actions across several domains and geographical locations are frequently necessary in cross-border conflicts. By providing military leaders and units with real-time communication, information sharing, and coordination, C5ISR technologies support command and control and improve the efficacy and efficiency of military operations. Cyber threats pose serious concerns to national security in an increasingly digitalized and networked world, particularly during cross-border conflicts. Cyber defence features for identifying, tracking, and averting cyberattacks on vital infrastructure and communication networks are part of C5ISR systems.

Restraints & Challenges

Numerous platforms, technologies, and other parts are used in C5ISR systems, and they all need to work and integrate together flawlessly. It can be difficult to achieve compatibility and interoperability among several systems from various suppliers, which can cause problems with integration, performance constraints, and deployment delays. Since C5ISR systems are frequently networked and dependent on digital networks, they face substantial problems from the sophistication and frequency of cyberattacks, which are growing. Strong cybersecurity procedures and ongoing monitoring are required to reduce risks since cyber threats like malware, ransomware, and insider assaults can erode operational security, disrupt communication networks, and threaten data integrity. Massive volumes of data are produced by C5ISR systems via sensors, communication networks, surveillance platforms, and intelligence sources.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the NATO C5ISR Market from 2023 to 2033. NATO members in North America, especially the US and Canada, are working on defence modernization projects to improve C5ISR capabilities in order to meet new threats and difficulties. In order to facilitate cooperative and international operations, these programmes concentrate on acquiring cutting-edge technology, boosting cybersecurity, increasing interoperability, and optimising command and control architectures. In order to improve cyber defence capabilities throughout the alliance, North America is essential to NATO's cybersecurity activities, which include information sharing, threat intelligence exchanges, and cooperative exercises. Within the NATO C5ISR ecosystem, close cooperation between North American allies and NATO organisations like the NATO Communications and Information Agency (NCIA) improves cyber resilience and incident response capabilities.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. In response to regional security difficulties and shifting perceptions of threats, a number of Asia-Pacific nations, notably Australia, Japan, South Korea, and India, have been augmenting their defence budgets. To improve their military preparedness, situational awareness, and deterrence capabilities, these nations are investing in cutting-edge C5ISR capabilities. Defence modernization initiatives are underway in many Asia-Pacific nations with the goal of enhancing C5ISR capabilities. In order to strengthen capabilities in intelligence gathering, cyber defence, communication networks, and command and control, these programmes entail the procurement of new technologies, platforms, and systems.

Segmentation Analysis

Insights by Type

The land segment accounted for the largest market share over the forecast period 2023 to 2033. In order to sustain military readiness and improve operational capabilities, numerous NATO member nations are investing in the upgrade of their land-based C5ISR systems. This entails modernising land-based surveillance technology, communication networks, intelligence collection systems, and command and control centres. The need for land-based surveillance and reconnaissance capabilities has surged due to heightened security concerns, which include cross-border threats including illegal immigration, terrorism, and smuggling. To improve border security and monitoring, NATO member nations are investing in unmanned aerial vehicles (UAVs), ground-based surveillance systems, and cutting-edge sensor technology. The need for C5ISR systems optimised for land-based operations has been highlighted by the prevalence of counterinsurgency and urban warfare in diverse countries.

Insights by Application

The theater command and control segment accounted for the largest market share over the forecast period 2023 to 2033. NATO member nations are placing a greater emphasis on integrated theatre operations, which entail coordinating military operations within a designated theatre of operations across several domains, including cyberspace, land, air, sea, and space. Systems for theatre command and control (C2) are essential for coordinating and coordinating these actions in order to successfully accomplish mission goals. Effective theatre command and control in NATO-led operations depends on ally troops' interoperability. Theatre C2 systems enable effective and cohesive joint and coalition operations by promoting smooth communication, coordination, and collaboration amongst international forces. Theatre C2 systems give commanders the decision-support resources and skills they need to evaluate various options, analyse complicated data, and successfully plan and carry out operations.

Insights by Solution

The hardware segment accounted for the largest market share over the forecast period 2023 to 2033. The expansion of the C5ISR hardware industry is largely determined by how NATO member nations allocate their defence spending. Increasing the amount allocated to defence allows for the purchase of more sophisticated hardware. More sophisticated hardware solutions must be developed and put into use in order to defend against and secure against evolving threats. Hardware that can efficiently detect, analyse, and respond to threats is becoming more and more necessary as they get more sophisticated. A crucial component of C5ISR hardware is cybersecurity as military operations become more digitally intensive. Hardware with strong cybersecurity features and capabilities must be purchased in order to protect sensitive data and preserve operational integrity.

Recent Market Developments

- In February 2022, Kratos Defence & Security Solutions Inc. declared that it has been granted a USD 50 million contract value extension for an ongoing C5ISR programme.

Competitive Landscape

Major players in the market

- Lockheed Martin Corporation

- ST Engineering Ltd.

- General Dynamics Corporation

- Raytheon Technologies Corporation

- CACI International Inc.

- Elbit Systems Ltd.

- L3Harris Technologies Inc.

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

NATO C5ISR Market, Type Analysis

- Land

- Naval

- Airborne

- Space

NATO C5ISR Market, Application Analysis

- Electronic Warfare

- ISR (Intelligence, Surveillance, and Reconnaissance)

- Weapon Systems,

- Theater Command and Control

- Information Security and Assurance

- Computing

- Others

NATO C5ISR Market, Solution Analysis

- Hardware

- Software

- Services

NATO C5ISR Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the NATO C5ISR Market?The global NATO C5ISR Market is expected to grow from USD 75.8 billion in 2023 to USD 116.4 billion by 2033, at a CAGR of 4.38% during the forecast period 2023-2033.

-

2. Who are the key market players of the NATO C5ISR Market?Some of the key market players of the market are Lockheed Martin Corporation, ST Engineering Ltd., General Dynamics Corporation, Raytheon Technologies Corporation, CACI International Inc., Elbit Systems Ltd., and L3Harris Technologies Inc.

-

3. Which segment holds the largest market share?The hardware segment holds the largest market share and is going to continue its dominance.

-

4. Which region is dominating the NATO C5ISR Market?North America is dominating the NATO C5ISR Market with the highest market share.

Need help to buy this report?