Global Natural Food Colorants Market Size, Share, and COVID-19 Impact Analysis, By Type (Carmine, Anthocyanin, Caramel, Carotenoid, Curcumin, Paprika, Spirulina, Lycopene, Betalain, and Others), By Application (Beverage, Dairy-Based Products, Bakery, Confectionery, Snacks & Cereals, Nutraceutical, Processed Food Products, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Food & BeveragesGlobal Natural Food Colorants Market Insights Forecasts to 2033

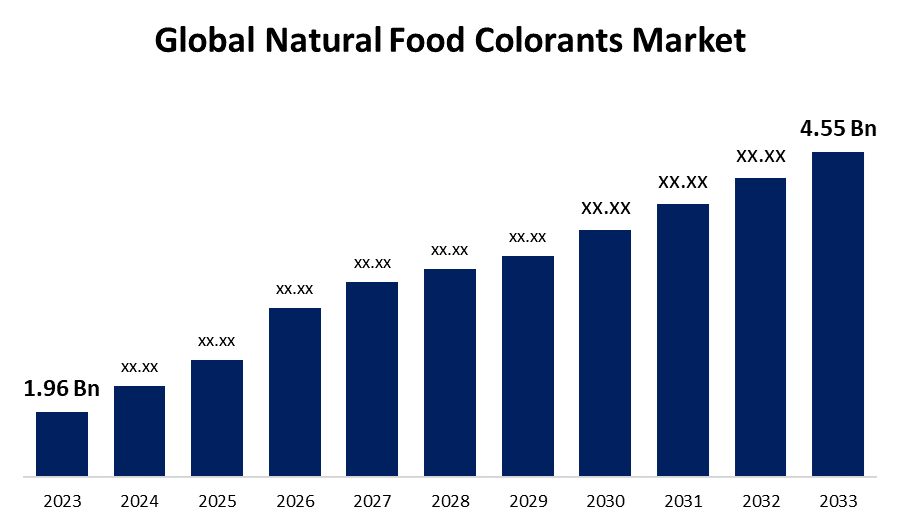

- The Global Natural Food Colorants Market Size was Valued at USD 1.96 Billion in 2023

- The Market Size is Growing at a CAGR of 8.79% from 2023 to 2033

- The Worldwide Natural Food Colorants Market Size is Expected to Reach USD 4.55 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Natural Food Colorants Market Size is Anticipated to Exceed USD 4.55 Billion by 2033, Growing at a CAGR of 8.79% from 2023 to 2033.

Market Overview

Natural food colorants are pigments derived from plants, animals, or minerals that are used to color food and beverages. Natural food colorants are derived from fruits, vegetables, seeds, and spices. Common examples include red beet juice, yellow turmeric, and blue spirulina. These colorants are becoming more popular as consumers demand clean-label products with recognizable and healthier ingredients. Natural food colorants improve the visual appeal of food while also providing additional benefits, such as antioxidants or vitamins, depending on the source. Consumers' preference for more natural, less processed foods, as well as growing awareness of the potential health risks associated with artificial additives, are driving the shift to natural food colorants. To meet this growing demand, many food manufacturers are investing in the development of consistent and vibrant natural color options. The high functionality of superfoods, as well as the positive perception of the term "natural," are driving the market's growing demand for natural food colorants. Food producers are being pushed to choose coloring meals over other options because consumers want to use products with clear and understandable labeling.

Report Coverage

This research report categorizes the market for the global natural food colorants market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global natural food colorants market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global natural food colorants market.

Global Natural Food Colorants Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1.96 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 8.79% |

| 2033 Value Projection: | USD 4.55 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 288 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Application, By Region |

| Companies covered:: | Chr. Hansen Holdings A/s, Symrise AG, FMC Corporation, DDW, The Color House, Synthite Industries Private Ltd, Kalsec Inc., Givaudan SA, Koninklijke DSM NV, Archer Daniels Midland Company, Givaudan (Naturex), Sensient Technologies, ADM, International Flavors and Fragrances Inc., DSM, Naturex, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, and Analysis |

Get more details on this report -

Driving Factors

Increasing consumer awareness of product differentiation

Consumers, particularly in industrialized nations, have improved their ability to determine how a product is manufactured and the quality of the ingredients used. Customers form opinions about the products they want to see on the shelves as they learn more about their food and the ingredients used in processing. This increased consumer demand for goods made solely from natural materials and additives, creating numerous opportunities for natural food coloring in the food processing industry. Also, demand for natural food colorants and coloring is expected to rise during the forecast period as consumers seek to limit the excessive use of artificial colorants in food products.

Restraining Factors

Costly Processing

The situation differs for natural colorants because the addition does not meet FDA standards for being labeled as "natural." As a result, the high cost of natural food colorants traps small food manufacturers and increases the cost of finished product production.

Market Segmentation

The global natural food colorants market share is classified into type and application.

- The carmine segment is expected to hold the largest share of the global natural food colorants market during the forecast period.

Based on the type, the global natural food colorants market is categorized into carmine, anthocyanin, caramel, carotenoid, curcumin, paprika, spirulina, lycopene, betalain, and others. Among these, the carmine segment is expected to hold the largest share of the global natural food colorants market during the forecast period. Carmine's market growth is expected to be aided by rising consumer demand for natural food colors that can replace synthetic colorants and mitigate their adverse health effects. Food companies that invest in introducing new natural food products and developing enhanced carmine food color formulations are contributing to a more sanitary food future. Carmine has a vibrant scarlet color and is used in a variety of foods, including desserts, ice cream, beverages, meat, fruit-based yogurt, and other dairy products.

- The beverage segment is expected to grow at the fastest CAGR during the forecast period.

Based on the application, the global natural food colorants market is categorized into beverage, dairy-based products, bakery, confectionery, snacks & cereals, nutraceutical, processed food products, and others. Among these, the beverage segment is expected to grow at the fastest CAGR during the forecast period. Beverages include both alcoholic and non-alcoholic products. One of the most noticeable characteristics of alcoholic beverages is the wine's color. The color of the wine may influence acceptance of the product. Further, a wine's color can reveal a lot about its age, quality, level of preservation, and other characteristics. Anthocyanins are the primary components that give the wine its color. They are taken out of the grape skin. Adult consumers seeking an alternative alcoholic beverage to the traditional sweet and fizzy variety have a particularly strong preference for novel soft drink flavor creations.

Regional Segment Analysis of the Global Natural Food Colorants Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is projected to hold the largest share of the global natural food colorants market over the forecast period.

Get more details on this report -

North America is projected to hold the largest share of the global natural food colorants market over the forecast period. The U.S. is the largest contributor to the region, followed by Canada and Mexico. The change to color labeling that must be implemented nationwide by 2021 is expected to boost demand for natural colorants in Canada. According to a directive from the Canadian Food Inspection Agency, food producers must now list food colors by their unique common names in the list of ingredients for prepackaged goods in order to be more honest about colors. One of the region's growing marketing trends is the replacement of artificial food colorants with natural ones, leaving plenty of opportunities for researchers to discover additional natural sources.

Asia Pacific is expected to grow at the fastest CAGR growth of the global superfood market during the forecast period. The region's top natural food colorant manufacturers have various application technologies at their disposal, enabling them to test color performance in a wide range of food and beverage applications, including soft drinks, alcoholic beverages, confectionery, frozen desserts, yogurts, baked goods, and processed foods. Natural food colors serve multiple purposes in the Asian food and beverage industry, enhancing the visual appeal of products while highlighting flavors associated with different applications. Leveraging the region's abundant cultivation of herbs and spices, Asian ingredient companies have started creating food coloring additives from diverse spices such as turmeric, red chilies, and hibiscus.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global natural food colorants market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Chr. Hansen Holdings A/s

- Symrise AG

- FMC Corporation

- DDW, The Color House

- Synthite Industries Private Ltd

- Kalsec Inc.

- Givaudan SA

- Koninklijke DSM NV

- Archer Daniels Midland Company

- Givaudan (Naturex)

- Sensient Technologies

- ADM

- International Flavors and Fragrances Inc.

- DSM

- Naturex

- Others

Key Market Developments

- In July 2022, Symrise AG developed the cosmetic ingredient SymClariol . company is repositioning its multifunctional skin care emollient SymClariol (decylene glycol) to emphasize the ingredient's benefits.

- In June 2022, FMC Corporation completes its acquisition of BioPhero ApS.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global natural food colorants market based on the below-mentioned segments:

Global Natural Food Colorants Market, By Type

- Carmine

- Anthocyanin

- Caramel

- Carotenoid

- Curcumin

- Paprika

- Spirulina

- Lycopene

- Betalain

- Others

Global Natural Food Colorants Market, By Application

- Beverage

- Dairy-based Products

- Bakery

- Confectionery

- Snacks & Cereals

- Nutraceutical

- Processed Food Products

- Others

Global Natural Food Colorants Market, By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?