Global Naval Gun Market Size, Share, and COVID-19 Impact Analysis, By Technology (Fully Automatic and Semi-automatic), By Platform (Large Surface Combatants and Small Surface Combatants), By Component (Turret System, Radar System, Tracking System, Ammunition Drum, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Aerospace & DefenseGlobal Naval Gun Market Insights Forecasts to 2033

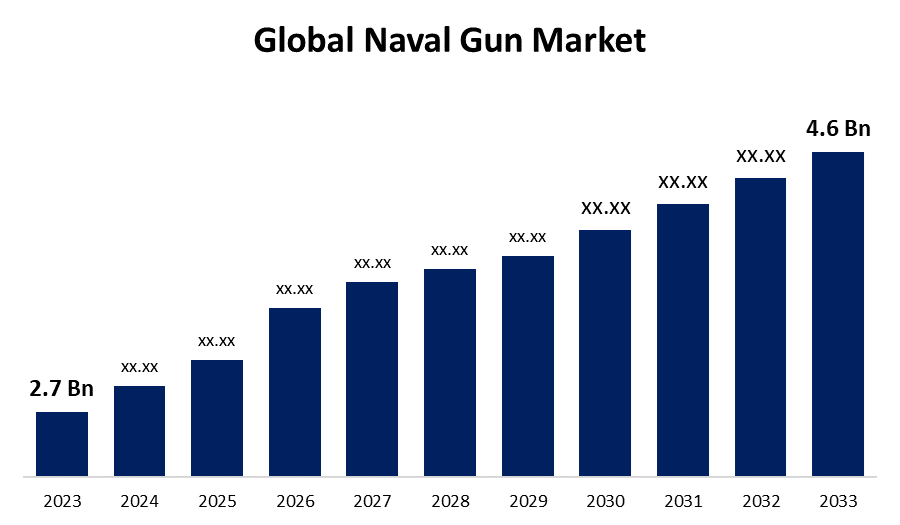

- The Naval Gun Market Size was valued at USD 2.7 Billion in 2023.

- The Market Size is growing at a CAGR of 5.47% from 2023 to 2033

- The Worldwide Naval Gun Market Size is expected to reach USD 4.6 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period

Get more details on this report -

The Global Naval Gun Market is Expected to reach USD 4.6 Billion by 2033, at a CAGR of 5.47% during the forecast period 2023 to 2033.

The global naval gun market is experiencing significant growth, driven by rising defense budgets and the modernisation of naval fleets worldwide. Key factors contributing to this expansion include increased geopolitical tensions and the need for advanced maritime security. Modern naval guns, equipped with cutting-edge technology such as precision targeting and automated firing systems, are essential for coastal defense, anti-aircraft, and surface warfare operations. North America and Europe dominate the market due to their strong naval capabilities and continuous investment in defense technology. Meanwhile, the Asia-Pacific region is witnessing rapid growth, spurred by regional security challenges and naval expansion programs. As nations seek to enhance their naval strength, the demand for sophisticated and reliable naval gun systems is anticipated to remain robust.

Naval Gun Market Value Chain Analysis

The naval gun market value chain involves several critical stages, from raw material suppliers to end-users. Initially, raw materials such as steel, alloys, and electronics are procured from suppliers. These materials are then used by manufacturers to design and produce various components of naval guns, including barrels, mountings, and targeting systems. Advanced technological integration, such as fire control systems and automated loading mechanisms, is often outsourced to specialized technology providers. Once assembled, these systems undergo rigorous testing and quality assurance before being delivered to naval forces. Maintenance, repair, and overhaul services play a vital role in ensuring operational readiness throughout the guns' lifecycle. Collaboration among defense contractors, technology firms, and naval authorities is crucial to addressing evolving security needs and maintaining a competitive edge in the market.

Naval Gun Market Opportunity Analysis

The naval gun market presents significant opportunities driven by technological advancements and evolving maritime security demands. The integration of artificial intelligence and autonomous systems in naval guns offers enhanced precision and operational efficiency, attracting substantial interest from naval forces. The rising geopolitical tensions and maritime disputes underscore the need for robust coastal defense systems, further fueling market growth. Additionally, the modernization programs of aging naval fleets in developed nations and the naval expansion initiatives in emerging economies create a fertile ground for market expansion. Opportunities also exist in the development of lightweight, versatile naval guns suitable for smaller vessels, enhancing their combat capabilities. Defense contractors can capitalize on these trends by investing in research and development, forming strategic alliances, and customizing solutions to meet specific naval requirements.

Global Naval Gun Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 2.7 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 5.47% |

| 2033 Value Projection: | USD 4.6 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Technology, By Platform, By Component, By Region |

| Companies covered:: | Bohemia Simulations, General Dynamics, Northrop Gruman, Kratos Defence, Miggitt Training Systems, The Boeing Company, Combat Training Solutions, Israel Aerospace Industries, Bae Systems, and |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Naval Gun Market Dynamics

Increasing Demand for Electromagnetic (EM) Railguns over Conventional Guns to Drive Market Growth

EM railguns offer significant advantages over conventional naval guns, including greater range, higher velocity, and reduced ammunition costs. These advanced systems use electromagnetic forces to launch projectiles at hypersonic speeds, enhancing their destructive power and precision. The shift towards EM railguns is fueled by the need for superior naval firepower and the ability to counter emerging threats more effectively. Moreover, the reduced logistical burden associated with EM railguns, due to their reliance on electrical energy instead of traditional explosives, appeals to modern naval forces seeking operational efficiency. As nations invest in cutting-edge defense technologies, the adoption of EM railguns is expected to accelerate, transforming naval combat and propelling market growth.

Restraints & Challenges

One primary issue is the high cost of development and procurement of advanced naval gun systems, which can strain defense budgets. Additionally, integrating new technologies like electromagnetic railguns and advanced targeting systems into existing naval platforms is complex and requires significant investment in infrastructure and training. The lengthy development and testing phases also pose challenges, potentially delaying deployment and operational readiness. Furthermore, stringent regulatory and safety standards must be met, adding to the development time and cost. Geopolitical uncertainties and shifting defense priorities can lead to fluctuations in demand, affecting market stability. Lastly, competition from alternative weapons systems, such as missiles and drones, presents a significant challenge to the traditional naval gun market.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Naval Gun Market from 2023 to 2033. The naval gun market in North America is characterized by robust growth, driven by substantial defense budgets and advanced technological capabilities. The United States, in particular, is a key player, investing heavily in the modernization of its naval fleet and the development of cutting-edge weaponry. The U.S. Navy's focus on enhancing its maritime combat readiness and maintaining naval superiority is fueling demand for advanced naval guns, including the latest electromagnetic railguns and precision-guided munitions. Collaboration with leading defense contractors ensures continuous innovation and the integration of sophisticated technologies. Additionally, Canada's efforts to upgrade its naval capabilities contribute to regional market growth. The emphasis on research and development, coupled with strategic defense initiatives, positions North America as a critical hub for naval gun advancements and market expansion.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. Countries such as China, India, Japan, and South Korea are significantly enhancing their naval capabilities to safeguard maritime interests and assert regional dominance. China's ambitious naval expansion and development of advanced naval guns, including electromagnetic railguns, are particularly noteworthy. Similarly, India's focus on modernizing its navy with state-of-the-art weaponry and Japan's strategic defense initiatives are contributing to market expansion. The increasing frequency of maritime disputes and the need for coastal defense are further propelling demand for advanced naval gun systems. Collaborative efforts with global defense contractors and indigenous defense production initiatives are also bolstering the market, positioning the Asia-Pacific region as a dynamic and rapidly evolving segment of the global naval gun market.

Segmentation Analysis

Insights by Technology

The fully automatic segment accounted for the largest market share over the forecast period 2023 to 2033. The fully automatic segment of the naval gun market is experiencing robust growth due to its enhanced firepower, precision, and operational efficiency. These guns offer rapid-fire capabilities, essential for high-intensity combat scenarios, and reduce manual intervention through advanced automation. Key advancements include improved fire control systems, automated loading mechanisms, and sophisticated targeting integration. Global navies are increasingly adopting fully automatic naval guns to ensure rapid threat response and reduce crew workload, driven by the need for superior defensive and offensive capabilities. Ongoing research and development are focused on enhancing reliability and accuracy, further propelling market expansion. As defense budgets prioritize modernization, the fully automatic naval gun segment is poised to become a critical component of future naval operations.

Insights by Platform

The large surface combatants segment is dominating the market with the largest market share over the forecast period 2023 to 2033. The growth of large surface combatants in the naval gun market is significant, driven by the increasing demand for versatile and powerful warships capable of undertaking a wide range of maritime missions. Large surface combatants, such as destroyers and cruisers, require advanced naval guns to enhance their firepower, precision, and operational capabilities. These vessels are central to modern naval fleets, providing critical support in coastal defense, anti-aircraft, and surface warfare operations. The ongoing modernization and expansion programs in major navies, especially in the United States, China, and Russia, are fueling this growth.

Insights by Component

The radar systems segment is dominating the market with the largest market share over the forecast period 2023 to 2033. Radar systems play a critical role in modern naval warfare by providing real-time information about surface, air, and subsurface threats, thereby enhancing the effectiveness of naval guns in engaging hostile targets. Advancements in radar technology, such as phased array radars and active electronically scanned array (AESA) radars, offer improved detection capabilities, higher resolution, and enhanced tracking of multiple targets simultaneously. Moreover, integration with other sensor systems and weapon platforms enables seamless coordination and engagement in complex naval environments. With navies worldwide prioritizing modernization and enhancing their maritime capabilities, the demand for advanced radar systems within the naval gun market is poised for sustained growth.

Recent Market Developments

- In November 2023, M/s Bharat Heavy Electricals Limited (BHEL) has been awarded a contract by the Ministry of Defence under the Purchase (India) category to supply the Indian Navy with 16 Upgraded Super Rapid Fire Gun Mounts (SRGM) and related equipment/accessories.

Competitive Landscape

Major players in the market

- Bohemia Simulations

- General Dynamics

- Northrop Gruman

- Kratos Defence

- Miggitt Training Systems

- The Boeing Company

- Combat Training Solutions

- Israel Aerospace Industries

- Bae Systems

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Naval Gun Market, Technology Analysis

- Fully Automatic

- Semi-automatic

Naval Gun Market, Platform Analysis

- Large Surface Combatants

- Small Surface Combatants

Naval Gun Market, Component Analysis

- Turret System

- Radar System

- Tracking System

- Ammunition Drum

- Others

Naval Gun Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?