Global Naval Vessels and Surface Combatants Market Size, Share, and COVID-19 Impact Analysis, By Ship Type (Destroyers, Corvettes, Submarines, Amphibious Ships, Frigates, Auxiliary Vessels, and Others), By System (Marine Engine System, Weapon Launch System, Sensor System, Control System, Electrical System, Auxiliary System, and Communication System), By Solution (Line Fit and Retro Fit), By Application (Search and Rescue, Combat Operations, MCM Operations, Coastal Operations, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Aerospace & DefenseGlobal Naval Vessels and Surface Combatants Market Insights Forecasts to 2033

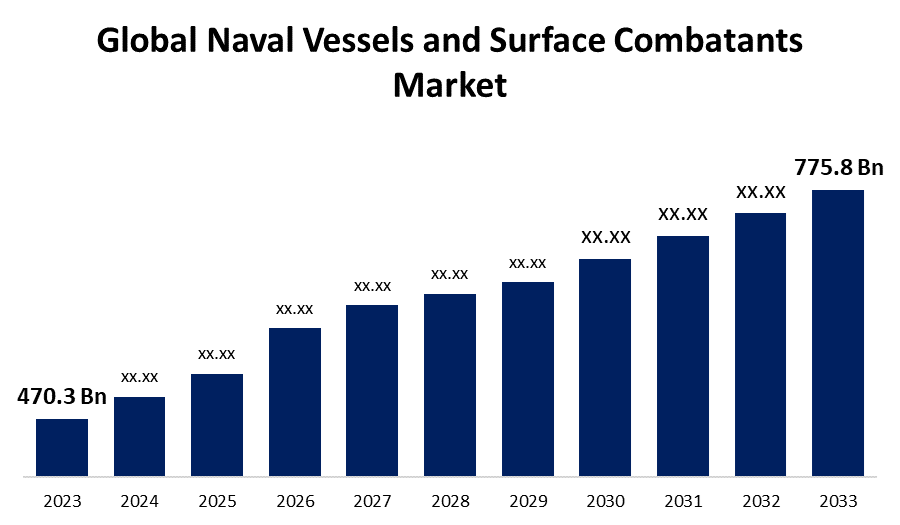

- The Naval Vessels and Surface Combatants Market was valued at USD 470.3 Billion in 2023.

- The Market Size is Growing at a CAGR of 5.13% from 2023 to 2033

- The Worldwide Naval Vessels and Surface Combatants Market Size is Expected to reach USD 775.8 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period

Get more details on this report -

The Global Naval Vessels and Surface Combatants Market Size is expected to reach USD 775.8 Billion by 2033, at a CAGR of 5.13% during the forecast period 2023 to 2033.

The naval vessels and surface combatants market is witnessing significant growth driven by increasing global geopolitical tensions and the need for advanced maritime defense systems. Nations are investing heavily in modernizing their naval fleets, focusing on enhancing capabilities such as stealth, firepower, and electronic warfare. Technological advancements in shipbuilding and the integration of sophisticated weaponry and surveillance systems are further propelling market expansion. Key segments include destroyers, frigates, corvettes, and aircraft carriers, with an emphasis on multi-mission platforms. North America and Asia-Pacific are leading regions due to substantial defense budgets and regional security concerns. The market is also seeing a surge in demand for unmanned surface vehicles (USVs) and autonomous systems, reflecting a shift towards innovative and flexible naval warfare solutions.

Naval Vessels and Surface Combatants Market Value Chain Analysis

The naval vessels and surface combatants market value chain encompasses several critical stages, from raw material procurement to final deployment. It begins with suppliers providing essential materials like steel, aluminum, and advanced composites. Shipbuilders and defense contractors then design and construct vessels, integrating propulsion systems, weapons, and electronic warfare systems from specialized component manufacturers. Key players also include technology providers for radar, sonar, and navigation systems. The assembly phase involves rigorous testing and quality assurance to meet stringent defense standards. Post-manufacture, vessels undergo extensive sea trials before being delivered to naval forces. Maintenance, repair, and overhaul (MRO) services ensure operational readiness throughout the vessel's lifespan. The value chain is supported by collaborations between governments, defense agencies, and private sector entities to enhance innovation and operational capabilities.

Naval Vessels and Surface Combatants Market Opportunity Analysis

The naval vessels and surface combatants market presents substantial opportunities driven by escalating maritime security threats and technological advancements. Increased defense budgets, particularly in Asia-Pacific and the Middle East, fuel demand for new and upgraded vessels. Innovations in stealth technology, autonomous systems, and advanced weaponry offer lucrative prospects for manufacturers. The shift towards multi-mission and modular platforms enhances operational flexibility, appealing to modern navies. Emerging markets, including unmanned surface vehicles (USVs) and cyber warfare capabilities, create additional growth avenues. Collaborative ventures between defense contractors and technology firms further spur innovation. Moreover, the growing emphasis on naval modernization programs globally provides sustained opportunities for long-term contracts and strategic partnerships, ensuring steady market expansion.

Global Naval Vessels and Surface Combatants Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 470.3 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.13% |

| 2033 Value Projection: | USD 775.8 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 245 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Ship Type, By System, By Solution, By Application, By Region |

| Companies covered:: | General Dynamics, Huntington Ingalls Industries, Austal, Naval Group, Larsen & Toubro (L&T), Lockheed Martin, Incntieri, BAE Systems, Hyundai Heavy Industries, Daewoo Shipbuilding & Marine Engineering, Abu Dhabi Ship Building, PO Sevmash, ThyssenKrupp, CSSC, Mazagon Docks, MDL, DSME, CSIC, Thales, HHI, ASC, Damen Schelde Naval Shipbuilding (DSNS), Navantia and others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Naval Vessels and Surface Combatants Market Dynamics

Several technological advancements in naval vessels and surface combatants will aid market growth

Technological advancements are pivotal in driving growth in the naval vessels and surface combatants market. Innovations in stealth technology reduce detectability, enhancing operational security. The integration of advanced radar, sonar, and electronic warfare systems improves situational awareness and threat detection. Autonomous systems and unmanned surface vehicles (USVs) enable remote operations and reduce crew risk. Enhanced propulsion technologies, such as hybrid and electric systems, offer greater efficiency and reduced environmental impact. The development of modular and multi-mission platforms allows navies to adapt vessels for various roles, increasing their utility. Advanced missile and laser weapon systems provide superior offensive and defensive capabilities. These technological strides not only bolster naval power but also attract substantial investments, propelling market growth.

Restraints & Challenges

High costs associated with the development, construction, and maintenance of advanced naval vessels strain defense budgets, particularly in smaller nations. Technological complexity and the need for continuous upgrades pose significant logistical and financial burdens. The long lifecycle of naval ships means that modernization efforts must constantly keep pace with rapid advancements in technology. Geopolitical instability and shifting defense priorities can disrupt procurement plans and international collaborations. Additionally, stringent regulatory requirements and lengthy approval processes can delay project timelines. Cybersecurity threats also present a growing risk, as increasing digitalization makes vessels more vulnerable to cyber-attacks.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Naval Vessels and Surface Combatants Market from 2023 to 2033. The United States, with its significant naval modernization programs, is the primary contributor, focusing on expanding and upgrading its fleet with next-generation destroyers, aircraft carriers, and unmanned surface vehicles (USVs). Investments in advanced weapon systems, stealth technology, and electronic warfare enhance combat readiness and operational efficiency. Collaboration between the U.S. Navy, defense contractors, and technology firms fosters innovation and accelerates development. Canada's investments in multi-mission frigates and Arctic patrol vessels further contribute to regional market growth. The strong emphasis on maritime security and defense preparedness in North America ensures a robust and dynamic market landscape.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. Countries like China, India, Japan, and South Korea are heavily investing in expanding and modernizing their naval fleets to enhance maritime dominance and protect strategic interests. Technological advancements in indigenous shipbuilding capabilities and the development of advanced stealth, missile, and electronic warfare systems are key growth drivers. Regional tensions and territorial disputes in the South China Sea and Indian Ocean spur demand for advanced destroyers, frigates, and submarines. Additionally, collaborations with Western defense contractors and technological transfers bolster regional capabilities. This dynamic environment fosters robust market expansion and innovation in naval warfare technologies in the Asia-Pacific.

Segmentation Analysis

Insights by Ship Type

The destroyers segment accounted for the largest market share over the forecast period 2023 to 2033. These vessels are equipped with advanced missile systems, radar, and electronic warfare technologies, making them essential for air defense, anti-submarine warfare, and surface combat operations. Increasing geopolitical tensions and the need for fleet modernization drive investments in next-generation destroyers with enhanced stealth, firepower, and multi-mission capabilities. Key markets, including the United States, China, and Japan, are focusing on expanding and upgrading their destroyer fleets.

Insights by System

The marine engine segment accounted for the largest market share over the forecast period 2023 to 2033. Increased demand for high-speed, powerful engines supports the operational capabilities of modern naval fleets, enabling faster deployment and maneuverability. Investments in research and development focus on optimizing engine performance for various vessel types, from destroyers to unmanned surface vehicles (USVs). This segment's growth is bolstered by the continuous modernization of naval fleets worldwide and the integration of cutting-edge propulsion technologies to meet evolving defense requirements.

Insights by Solution

The line fit segment accounted for the largest market share over the forecast period 2023 to 2033. Line fit, involving the installation of components and systems during the initial shipbuilding process, ensures seamless integration and operational efficiency. The trend towards modular and multi-mission platforms enhances the appeal of line fit solutions, as they allow for customization and scalability. This segment benefits from the rising investments in naval modernization programs, particularly in regions like North America and Asia-Pacific. Key components such as propulsion systems, weaponry, and electronic warfare systems are being pre-fitted to meet the stringent requirements of modern navies.

Insights by Application

The coastal operations segment accounted for the largest market share over the forecast period 2023 to 2033. Coastal operations vessels are designed for operations close to shorelines and in shallow waters, offering enhanced maneuverability and responsiveness for various missions such as coastal surveillance, anti-smuggling operations, and protection of exclusive economic zones (EEZ). Nations with extensive coastlines, such as the United States, China, and India, are investing in specialized vessels equipped with advanced sensor suites, small caliber weapons, and unmanned systems tailored for littoral combat. This segment's growth is also propelled by advancements in stealth technology and the integration of network-centric warfare capabilities, ensuring effective maritime defense and coastal security operations.

Recent Market Developments

- In April 2023, The United Kingdom Ministry of Defence awarded BAE System a contract to support engineers for communication, command, control, computing, and intelligence (C4I) services for surface vessels. The overall contract value was USD 57 million.

Competitive Landscape

Major players in the market

- General Dynamics

- Huntington Ingalls Industries

- Austal, Naval Group

- Larsen & Toubro (L&T)

- Lockheed Martin

- Incntieri

- BAE Systems

- Hyundai Heavy Industries

- Daewoo Shipbuilding & Marine Engineering

- Abu Dhabi Ship Building

- PO Sevmash

- ThyssenKrupp

- CSSC

- Mazagon Docks

- MDL

- DSME

- CSIC

- Thales

- HHI

- ASC

- Damen Schelde Naval Shipbuilding (DSNS)

- Navantia

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Naval Vessels and Surface Combatants Market, Ship Type Analysis

- Destroyers

- Corvettes

- Submarines

- Amphibious Ships

- Frigates

- Auxiliary Vessels

- Others

Naval Vessels and Surface Combatants Market, System Analysis

- Marine Engine System

- Weapon Launch System

- Sensor System

- Control System

- Electrical System

- Auxiliary System

- Communication System

Naval Vessels and Surface Combatants Market, Solution Analysis

- Line Fit

- Retro Fit

Naval Vessels and Surface Combatants Market, Application Analysis

- Search and Rescue

- Combat Operations

- MCM Operations

- Coastal Operations

- Others

Naval Vessels and Surface Combatants Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.What is the market size of the Naval Vessels and Surface Combatants?The global Naval Vessels and Surface Combatants Market is expected to grow from USD 470.3 billion in 2023 to USD 775.8 billion by 2033, at a CAGR of 5.13% during the forecast period 2023-2033.

-

2.Who are the key market players of the Naval Vessels and Surface Combatants Market?Some of the key market players of the market are General Dynamics, Huntington Ingalls Industries, Austal, Naval Group, Larsen & Toubro (L&T), Lockheed Martin, Incntieri, BAE Systems, Hyundai Heavy Industries, Daewoo Shipbuilding & Marine Engineering, Abu Dhabi Ship Building, PO Sevmash, ThyssenKrupp, CSSC, Mazagon Docks, MDL, DSME, CSIC, Thales, HHI, ASC, Damen Schelde Naval Shipbuilding (DSNS), Navantia.

-

3.Which segment holds the largest market share?The line fit segment holds the largest market share and is going to continue its dominance.

-

4.Which region dominates the Naval Vessels and Surface Combatants market?North America dominates the Naval Vessels and Surface Combatants market and has the highest market share.

Need help to buy this report?