Global Neo and Challenger Bank Market Size, Share, and COVID-19 Impact Analysis, By Type (Neo Banks and Challenger Banks), By Services Offered (Payments, Savings Products, Current Account, Consumers Credits, Loans, and Others), By End-User (Business Organizations, and Personal Consumers), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Banking & FinancialGlobal Neo and Challenger Bank Market Insights Forecasts to 2033

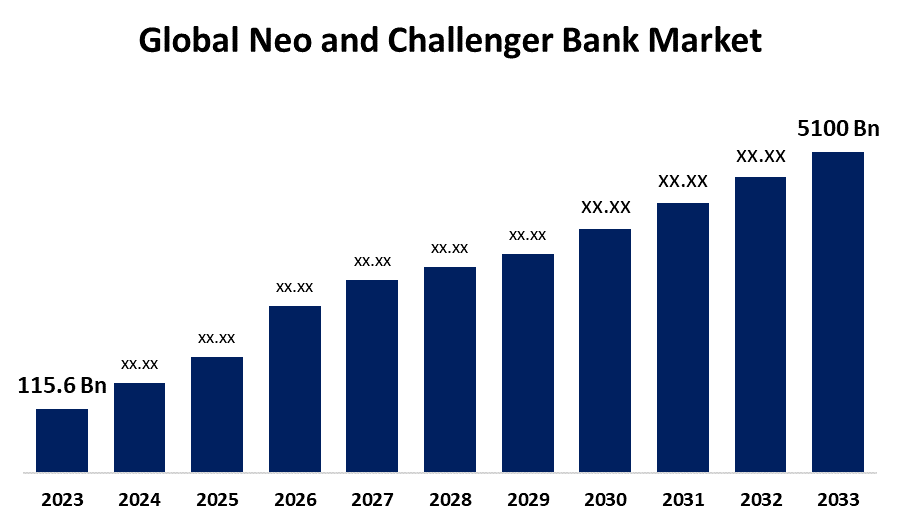

- The Global Neo and Challenger Bank Market Size was Valued at USD 115.6 Billion in 2023

- The Market Size is Growing at a CAGR of 46.04% from 2023 to 2033

- The Worldwide Neo and Challenger Bank Market Size is Expected to Reach USD 5100 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Neo and Challenger Bank Market Size is Anticipated to Exceed USD 5100 Billion by 2033, Growing at a CAGR of 46.04% from 2023 to 2033.

Market Overview

Neobanks and challenger banks are new-age financial institutions that offer banking services online or through mobile apps and aim to provide a better customer experience than traditional banks. They try to execute most processes like registration, account opening, transactions, etc. online instead of offline. Neobanks are digital and technology-driven, while challenger banks are licensed banking entities with some physical presence.

Neobanks focuses on specific customer needs, such as savings accounts, payments, and budgeting tools. They don't have banking licenses and rely on partner banks to operate. Challenger banks offer most banking services like traditional banks, including checking and savings accounts, lending, and payment solutions. They have banking licenses and might have a few physical branches in major cities. Both types of banks provide greater transparency and more competitive pricing and fees than traditional banks.

Benefits of neobanks include user-friendly interfaces, lower fees, innovative features, quick and Convenient services, and fintech collaborations. The benefits of challenger banks include advanced technology, lower fees than traditional banks, a wide range of financial products, personalized customer experiences, easy-to-use digital platforms, innovative products and services, competitive interest rates, agile decision-making, focus on customer needs, and frequent updates and improvements.

Report Coverage

This research report categorizes the market for the global neo and challenger bank market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global neo and challenger bank market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global neo and challenger bank market.

Global Neo and Challenger Bank Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 115.6 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 46.04% |

| 2033 Value Projection: | USD 5100 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 218 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Services Offered, By End-User, By Region |

| Companies covered:: | MyBank, Monzo Bank Limited, Nubank, Movencorp, Inc., UBank limited, Tandem Bank, Fidor Solutions AG, Varo Money, Atom Bank plc, N26, Simple Finance Technology Corporation, Chime, Revolut, Number26 GmbH, WeBank, Starling Bank, and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

Several factors drive the growth of the global neo and challenger bank market. There is an increasing preference for tech-enabled, flexible, and convenient banking services. Neo and challenger banks use technology to offer a seamless online banking experience, prioritizing a customer-centric approach through personalized services, mobile apps with good UI/UX, and quick response times. It appeals to the tech-savvy and busy individuals seeking more responsive banking solutions to use on the go without visiting the bank physically.

Lower operating costs also give these banks a competitive edge. They operate primarily online, and by utilizing cloud-based infrastructure, they significantly reduce the expenses associated with physical branches, enabling them to offer high interest rates and low fees. The new financial products, such as flexible savings options, real-time payment notifications, and budgeting tools, further enhance their appeal.

Additionally, these banks target tech-savvy and underbanked demographics dissatisfied with traditional banking institutions. Strategic partnerships with fintech companies drive market growth and innovation, while supportive regulatory frameworks encourage open banking and data sharing to ensure a competitive and innovative banking environment. Lastly, the shift towards digital banking accelerated by the COVID-19 pandemic has further boosted the adoption of neo and challenger banks, catering to the demand for contactless banking solutions.

Restraining Factors

Some challenges could restrain the growth of the global neo and challenger bank market. Regulatory challenges are a big hurdle, as different regulations across various regions can limit the ability of these banks to operate freely and scale globally.

Additionally, security concerns are a challenge, as the digital nature of these banks makes them an attractive target for cyber-attacks, necessitating investment, research, and development in robust security measures for neo and challenger bank markets.

Also, intense competition from traditional banks and other fintech entities forces neo and challenger banks to improve and innovate, draining their resources. These factors collectively pose significant challenges to sustained market growth.

Market Segmentation

The global neo and challenger bank market share is classified into type, services offered, and end-user.

- The challenger banks segment is expected to hold the largest share of the global neo and challenger bank market during the forecast period.

Based on the type, the global neo and challenger bank market is divided into neo banks and challenger banks. Among these, the challenger banks segment is expected to hold the largest share of the global neo and challenger bank market during the forecast period. Challenger banks offer easier consumer access, lower rates, and all the services like a regular bank. Unlike pure neo banks, challenger banks have a few physical branches, which cater to customers who still prefer some in-person banking services. Additionally, challenger banks offer high interest rates and lower fees than traditional banks, leveraging cost savings from their streamlined operations. Their customer-centric approach, such as tailored financial products and user-friendly mobile apps, attracts tech-savvy consumers.

- The payments segment is expected to hold the largest share of the global neo and challenger bank market during the forecast period.

Based on the services offered, the global neo and challenger bank market is divided into payments, savings products, current accounts, consumer credits, loans, and others. Among these, the payments segment is expected to hold the largest share of the global neo and challenger bank market during the forecast period. It is driven by the increasing consumer demand for fast, efficient, and convenient payment solutions. Neo and challenger banks offer seamless digital payment services, which appeal to busy customers seeking alternatives to traditional banking methods. Their mobile apps enable instant money transfers, peer-to-peer payments, and real-time payment notifications, improving user experience and convenience. These banks also provide competitive fees or even fee-free transactions, making them a primary choice for regular payment activities. Moreover, the shift towards a cashless economy has fueled the growth of the payments segment.

- The business organizations segment is expected to grow at the fastest CAGR in the global neo and challenger bank market during the forecast period.

Based on the end-user, the global neo and challenger bank market is divided into business organizations and personal consumers. Among these, the business organizations segment is expected to grow at the fastest CAGR in the global neo and challenger bank market during the forecast period. The increasing demand from businesses for innovative banking solutions that offer better efficiency and cost savings drives the rapid growth of this segment. Neo and challenger banks provide tailored financial products and services specially designed for businesses, like streamlined payment processing, easy access to credit, and advanced analytics. The digital-first approach allows organizations to manage finances seamlessly through platforms that integrate with existing business software. Additionally, these banks offer competitive rates and lower fees than traditional banks, which is advantageous for small and medium-sized enterprises (SMEs). The flexibility and scalability of services provided by neo and challenger banks make them highly attractive to businesses.

Regional Segment Analysis of the Global Neo and Challenger Bank Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

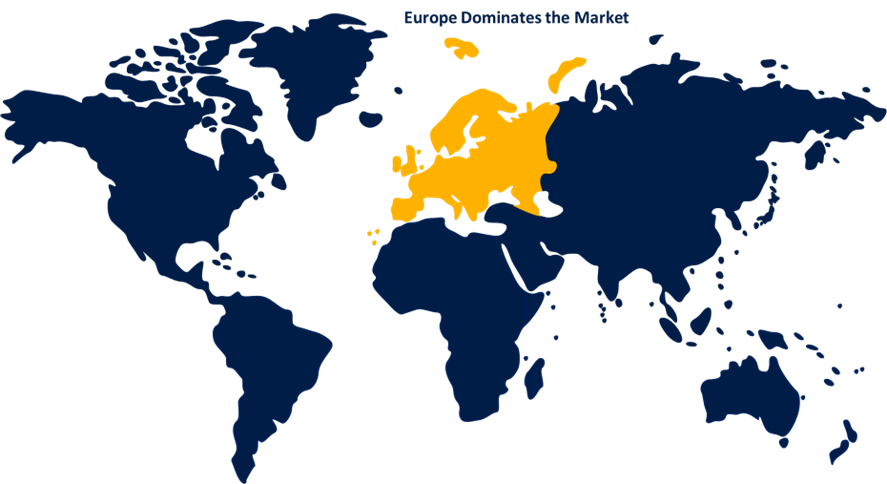

Europe is anticipated to hold the largest share of the global neo and challenger bank market over the predicted timeframe.

Get more details on this report -

Europe is anticipated to hold the largest share of the global neo and challenger bank market over the predicted timeframe. The region has been witnessing increasing demand for digital banking solutions and the growing popularity of neo and challenger banks among startups and online businesses. The high number of smartphone users has enabled neo and challenger banks to reach a wider audience. This is due to the region's early and widespread adoption of digital banking technologies and a highly supportive regulatory environment. For instance, the European Union's implementation of the Revised Payment Services Directive (PSD2) has created a conducive framework for open banking, allowing neo and challenger banks to thrive. Furthermore, Europe boasts a tech-savvy population with high internet penetration rates, facilitating the rapid rise of digital financial services. The presence of several leading fintech hubs, such as London, Berlin, and Amsterdam, has also supported innovation and competition within the sector. Additionally, European consumers increasingly demand more convenient, transparent, and cost-effective banking solutions, which neo and challenger banks are well-positioned to provide.

Asia Pacific is expected to grow at the fastest pace in the global neo and challenger bank market during the forecast period. The presence of the economically fastest-growing countries in the world, with a substantial population base and its growth, are the primary reasons for regional growth. This rapid growth is driven by several factors, including the region’s massive, underbanked population which is increasingly turning to digital financial solutions. The rise of smartphone penetration and internet connectivity in countries like India, China, and other countries facilitates access to digital banking services. Furthermore, supportive regulatory environments in several countries are encouraging innovation and competition in the financial sector. The young, tech-savvy demographic across the region prefers the convenience and agility of digital banking over traditional methods. Furthermore, significant investments and partnerships between fintech firms and conventional banks are accelerating the growth of neo and challenger banks.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global neo and challenger bank market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- MyBank

- Monzo Bank Limited

- Nubank

- Movencorp, Inc.

- UBank limited

- Tandem Bank

- Fidor Solutions AG

- Varo Money

- Atom Bank plc

- N26

- Simple Finance Technology Corporation

- Chime

- Revolut

- Number26 GmbH

- WeBank

- Starling Bank

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In August 2024, Fingular, a Singapore-based global neobank, made waves in the fintech industry by announcing a major customer acquisition milestone. In July, the neobank reached 4 million registered customers across South and Southeast Asia, making it a serious competitor to both traditional and neobanks in the region and globally.

- In August 2024, For Klarna, buy now, pay later (BNPL) might serve as an onramp toward building a wider financial ecosystem tied to its app. And perhaps, will give banks a run for their money (literally).

- In May 2024, SilverRock Bank recently obtained its banking authorisation with restrictions from the Prudential Regulation Authority, marking a significant milestone following a successful £50m funding round. With its unique business model and strategy, SilverRock aims to collaborate with non-bank and other lenders to enhance their competitiveness in the long run.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global neo and challenger bank market based on the below-mentioned segments:

Global Neo and Challenger Bank Market, By Type

- Neo Banks

- Challenger Banks

Global Neo and Challenger Bank Market, By Services Offered

- Payments

- Savings Products

- Current Account

- Consumer Credits

- Loans

- Others

Global Neo and Challenger Bank Market, By End-User

- Business Organizations

- Personal Consumers

Global Neo and Challenger Bank Market, Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. Which are the key companies that are currently operating within the market?MyBank, Monzo Bank Limited, Nubank, Movencorp, Inc., UBank limited, Tandem Bank, Fidor Solutions AG, Varo Money, Atom Bank plc, N26, Simple Finance Technology Corporation, Chime, Revolut, Number26 GmbH, WeBank, Starling Bank, and Others.

-

2. What is the size of the global neo and challenger bank market?The Global Neo and Challenger Bank Market is expected to grow from USD 115.6 Billion in 2023 to USD 5100 Billion by 2033, at a CAGR of 46.04% during the forecast period 2023-2033.

-

3. Which region is holding the largest share of the market?Europe is anticipated to hold the largest share of the global neo and challenger bank market over the predicted timeframe.

Need help to buy this report?