Global Net-Zero Energy Buildings Market Size, Share, and COVID-19 Impact Analysis, By Equipment (Lighting, Walls & Roofs, HVAC Systems, and Others), By Services (Software, and Consulting & Designing), By Building Type (Commercial, and Residential), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Energy & PowerGlobal Net-Zero Energy Buildings Market Insights Forecasts to 2033

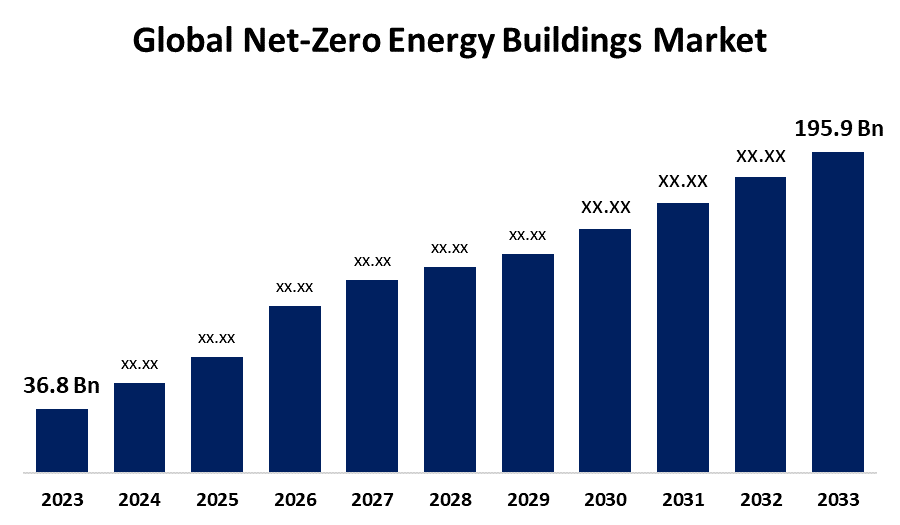

- The Global Net-Zero Energy Buildings Market Size was Valued at USD 36.8 Billion in 2023

- The Market Size is Growing at a CAGR of 18.20% from 2023 to 2033

- The Worldwide Net-Zero Energy Buildings Market Size is Expected to Reach USD 195.9 Billion by 2033

- Europe is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Net-Zero Energy Buildings Market Size is Anticipated to Exceed USD 195.9 Billion by 2033, Growing at a CAGR of 18.20% from 2023 to 2033.

Market Overview

An ideally efficient building that produces energy on-site utilizing clean, renewable resources over the course of a year in an amount equal to or greater than the total energy consumed on-site is known as a zero net energy building (ZNEB).

According to the National Renewable Energy Laboratory, Buildings have a big impact on the environment and energy use. Nearly 40% of primary energy and 70% of electricity in the US are used by commercial and residential structures. The building industry continues to use more energy, mostly because new buildings are being built at a faster rate than existing ones are being demolished. By 2025, the sector of commercial buildings is predicted to have doubled its electricity consumption. The amount of energy used in commercial buildings will keep rising until such time as structures are engineered to generate enough amount of energy to balance their increasing energy requirements. The U.S. Department of Energy (DOE) has set an ambitious target to develop the knowledge foundation and technologies necessary for affordable zero-energy commercial buildings (ZEBs) by 2025 in order to achieve this.

According to the World Economic Forum, up to 37% of energy-related CO2 emissions come from the building industry, and by 2050, half of the stock of buildings currently in use will still be in operation. The best way to modernize existing buildings and meet the 2030 decarbonization goals is through digital technology. For instance, Accenture has installed more than 3,000 submeters in more than 25 locations worldwide, illustrating how energy management may be carried out on a single, worldwide platform that is used for a variety of leased offices. Digital solutions are often applicable across building types and may be installed with relatively little impact from an operational standpoint. According to estimates, digital and electric technology can reduce CO2 emissions from existing buildings by up to 70%. By 2035, the global market for prospective retrofits is expected to reach $1 trillion yearly.

Report Coverage

This research report categorizes the market for net-zero energy buildings based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the net-zero energy buildings market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the net-zero energy buildings market.

Global Net-Zero Energy Buildings Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 36.8 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 18.20% |

| 2033 Value Projection: | USD 195.9 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 224 |

| Tables, Charts & Figures: | 121 |

| Segments covered: | By Equipment, By Services, By Building Type, By Region and COVID-19 Impact Analysis. |

| Companies covered:: | Altura Associates LLC, Daikin Industries Ltd., Saint-Gobain, General Electric Company, NEO LLC, Integrated Environmental Solutions Ltd., Johnson Controls International plc,, Kingspan Group Plc, Sage Electrochromics Inc. (Compagnie de Saint-Gobain S.A),, Schneider Electric,, Siemens Aktiengesellschaft, Solatube International Inc., Sunpower Corporation (Total SE), Honeywell International Inc, Trane Technologies plc,, Green Tree Global, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

A number of important factors are driving the market of net-zero energy buildings. First of all, stronger laws and policies requiring the use of energy-efficient building techniques have been implemented as a result of the growing emphasis on sustainability and environmental protection. Second, building owners and developers are adopting net-zero energy solutions due to increased energy costs and the desire to save operating expenses. Achieving net-zero energy targets is now more realistic because of advancements in renewable energy technology like energy storage and solar photovoltaics. Global demand for net-zero energy buildings has also been driven by rising consumer awareness and the need for affordable, environmentally friendly construction solutions.Top of FormBottom of Form

Restraining Factors

The growth of the net-zero energy-building market is faced with several restraining factors. The higher initial expenses of designing, building, and installing net-zero energy solutions in comparison to conventional building techniques are one of the main obstacles. This may discourage some developers and building owners from implementing these solutions, particularly in areas where financial incentives and subsidies are few. Furthermore, a barrier to the widespread adoption of net-zero energy-building practices among construction professionals may be a lack of technical understanding and general awareness.

Market Segmentation

The net-zero energy buildings market share is classified into type and application.

- The HVAC systems segment is estimated to hold the highest market revenue share through the projected period.

Based on the equipment, the net-zero energy buildings market is classified into lighting, walls & roofs, HVAC systems, and others. Among these, the HVAC systems segment is estimated to hold the highest market revenue share through the projected period. The importance of HVAC (heating, ventilation, and air conditioning) systems in attaining net-zero energy performance explains their dominance. A building's energy consumption is mostly attributed to its HVAC systems. To achieve net-zero energy status and lower overall energy demand, energy-efficient HVAC technologies like geothermal heat pumps, heat recovery systems, and advanced control mechanisms must be integrated. The growing emphasis on enhancing thermal comfort and indoor air quality, together with the expanding use of smart HVAC technologies, further adds to the HVAC systems segment's large market share in the net-zero energy buildings market.

- The software segment is anticipated to hold the largest market share through the forecast period.

Based on the services, the net-zero energy buildings market is divided into software, and consulting & designing. Among these, the software segment is anticipated to hold the largest market share through the forecast period. Due to the increasing significance of software and integrated building management systems in the planning, execution, and oversight of net-zero energy buildings. To achieve the best possible energy efficiency and performance, these software platforms make it possible to seamlessly coordinate and regulate a variety of building systems, including HVAC, lighting, and renewable energy generation. Furthermore, real-time optimization, predictive maintenance, and sophisticated energy consumption tracking are made possible by the growing integration of machine learning, artificial intelligence, and data analytics technologies in building management software. These features are essential for preserving net-zero energy status. The software segment within the net-zero energy buildings market is expanding due to the growing demand for user-friendly and intuitive software interfaces that can offer building owners and facility managers extensive insights into energy usage and performance.

- The residential segment dominates the market with the largest market share through the forecast period.

Based on the building type, the net-zero energy buildings market is divided into commercial, and residential. Among these, the pipe-in-pipe segment is anticipated to hold the largest market share through the forecast period. This is because homeowners and developers are placing a greater emphasis on energy-efficient and sustainable housing solutions as a result of growing environmental consciousness and a desire to save energy expenses. The use of net-zero energy technologies in the residential sector is being encouraged by regulations and incentives being implemented by governments in different regions, which is contributing to the growth of the industry. Furthermore, it is now more practical and affordable for homeowners to attain net-zero energy performance in their homes thanks to the availability of cutting-edge building materials, energy-efficient appliances, and renewable energy systems like solar photovoltaic panels. The emphasis on designing cozy, healthful, and energy-efficient living areas has grown to be a key factor in the residential segment's market domination for net-zero energy buildings.

Regional Segment Analysis of the Net-Zero Energy Buildings Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the net-zero energy buildings market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the net-zero energy buildings market over the predicted timeframe. This is due to a number of important factors. Primarily, the region has been leading the way in the adoption of sustainable building techniques, and there are numerous government programs and incentives in place to encourage the construction of net-zero energy buildings. For example, the Energy Independence and Security Act and the Better Buildings Initiative, two US laws, have encouraged the building industry to incorporate renewable energy sources and energy-efficient technologies. Furthermore, the development and integration of cutting-edge net-zero energy building systems and software has been made easier in North America by the presence of major technological companies and a thriving construction sector. Additionally, the area's well-established grid systems and infrastructure, together with consumers' increasing knowledge of and willingness to pay for eco-friendly housing.

Europe is expected to grow at the fastest CAGR growth of the net-zero energy buildings market during the forecast period. This is because of the region's constant commitment to the EU's energy efficiency and sustainability goals. Policies from the EU, such as the European Green Deal and the Energy Performance of Buildings Directive, have pushed for the adoption of net-zero energy building standards and laws throughout the continent. Furthermore, the region's emphasis on decarbonizing the construction industry, along with financial programs and incentives like the Renovation Wave program, have increased the allure of investing in net-zero energy solutions for building owners and developers. Throughout the forecast period, the net-zero energy buildings market in Europe is expected to grow at a rapid pace due to a number of factors, including the growing consumer awareness and demand for eco-friendly buildings, the increasing availability of advanced building materials, energy-efficient technologies, and renewable energy systems.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the net-zero energy buildings market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Altura Associates LLC

- Daikin Industries Ltd.

- Saint-Gobain

- General Electric Company

- NEO LLC

- Integrated Environmental Solutions Ltd.

- Johnson Controls International plc,

- Kingspan Group Plc

- Sage Electrochromics Inc. (Compagnie de Saint-Gobain S.A),

- Schneider Electric,

- Siemens Aktiengesellschaft

- Solatube International Inc.

- Sunpower Corporation (Total SE)

- Honeywell International Inc

- Trane Technologies plc,

- Green Tree Global

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In July 2024, to meet the Center's objective, BMC intends to construct a Rupees 116-cr net-zero building in Mumbai. It will try to lower its carbon footprint by using net-zero energy, water, and waste.

- In March 2024, India's Net Zero Buildings initiative is launched by Johnson Controls and Mahindra Group to reduce building carbon emissions.

- In January 2024, in order to develop an administrative and visitor center for the Lake Superior National Marine Conservation Area in Nipigon, Ontario, the Canadian government announced that it would provide over $37 million in funding. This will be Parks Canada's first Passive House Plus, net-zero carbon building.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the net-zero energy buildings market based on the below-mentioned segments:

Global Net-Zero Energy Buildings Market, By Equipment

- Lighting

- Walls & Roofs

- HVAC Systems

- Others

Global Net-Zero Energy Buildings Market, By Services

- Software

- Consulting & Designing

Global Net-Zero Energy Buildings Market, By Building Type

- Commercial

- Residential

Global Net-Zero Energy Buildings Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the net-zero energy buildings market over the forecast period?The net-zero energy buildings market is projected to expand at a CAGR of 18.20% during the forecast period.

-

2. What is the market size of the net-zero energy buildings market?The Global Net-Zero Energy Buildings Market Size is Expected to Grow from USD 36.8 Billion in 2023 to USD 195.9 Billion by 2033, at a CAGR of 18.20% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the net-zero energy buildings market?North America is anticipated to hold the largest share of the net-zero energy buildings market over the predicted timeframe.

Need help to buy this report?