Global Network Switches Market Size, Share, and COVID-19 Impact Analysis, By Type (Fixed Configuration Switches, Managed Switches, Unmanaged Switches, PoE Switches, and Modular Switches), By Switching Port (100 MBE & 1 GBE, 2.5 GBE & 5 GBE, 10 GBE, 25 GBE & 50 GBE, 100 GBE, and 200 GBE & 400 GBE), By End-User (Data Center, Cloud Service Providers, Telecom Service Providers, Large Enterprise or Private Cloud, and Non-Data Center), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032)

Industry: Semiconductors & ElectronicsGlobal Network Switches Market Insights Forecasts to 2032

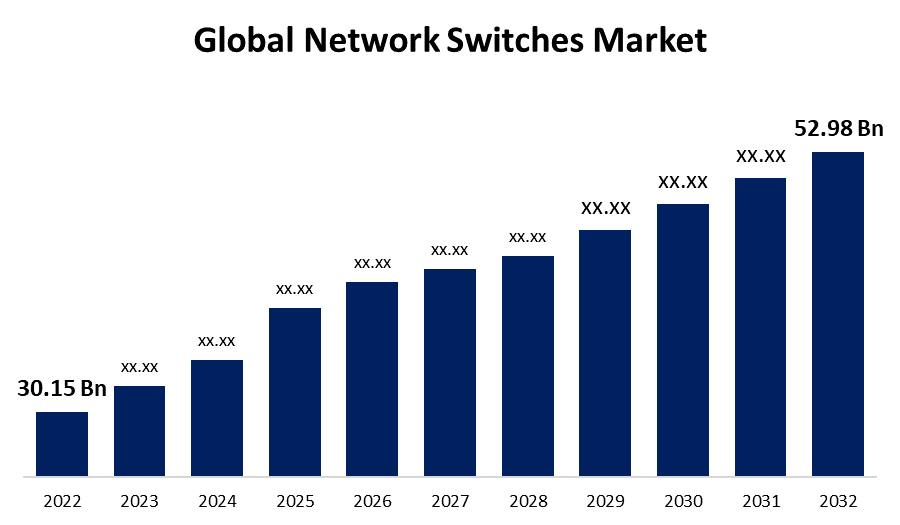

- The Global Network Switches Market Size was valued at USD 30.15 Billion in 2022.

- The Market is Growing at a CAGR of 5.8% from 2022 to 2032

- The Worldwide Network Switches Market Size is expected to reach USD 52.98 Billion by 2032

- Asia-Pacific is estimated to Grow at the fastest during the forecast period

Get more details on this report -

The Global Network Switches Market Size is expected to reach USD 52.98 Billion by 2032, at a CAGR of 5.8% during the forecast period 2022 to 2032.

Market Overview

Network switches are crucial devices used in computer networks to connect multiple devices within a local area network (LAN). They operate at the data link layer of the OSI model, allowing efficient data transfer between connected devices. Switches receive incoming data packets and analyze the destination MAC addresses to determine the appropriate path for forwarding the packets. This enables them to create dedicated communication channels and prevent network congestion. Switches can have varying port capacities and may support different network speeds, such as Fast Ethernet, Gigabit Ethernet, or 10 Gigabit Ethernet. They offer improved performance, security, and scalability compared to hubs or repeaters. With features like VLAN support and Quality of Service (QoS) prioritization, network switches enable efficient and reliable data transmission in modern network environments.

Report Coverage

This research report categorizes the market for network switches market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the network switches market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the network switches market.

Global Network Switches Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 30.15 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 5.8% |

| 2032 Value Projection: | USD 52.98 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Type, By Switching Port, By End-User, By Region. |

| Companies covered:: | Cisco Systems, Huawei Technologies, HPE Aruba, Juniper Networks, Arista Networks, Netgear, D-Link Corporation, Extreme Networks, NVIDIA Corporation, TRENDnet, Lantronix, Alcatel Lucent Enterprise, Dell Technologies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The network switches market is influenced by several key drivers that shape its growth and dynamics. The increasing demand for high-speed and reliable data transmission within organizations drives the adoption of network switches. As businesses continue to expand their digital infrastructure and rely on data-intensive applications, the need for efficient networking solutions becomes paramount. Additionally, the proliferation of cloud computing, IoT devices, and big data analytics fuels the demand for robust network switches that can handle the growing volume of data traffic. Moreover, the rise of virtualization and software-defined networking (SDN) technologies necessitates advanced switches capable of supporting these evolving architectures. Furthermore, the growing focus on network security and the need for enhanced network management drive the demand for switches with built-in security features and advanced management capabilities.

Restraining Factors

The network switches market faces certain restraints that impact its growth. One significant restraint is the high initial investment required for deploying network switches, including the cost of the hardware, installation, and network infrastructure upgrades. This can be a deterrent for small and medium-sized businesses with limited budgets. Additionally, the complexity of network switches and the need for skilled IT personnel for installation, configuration, and maintenance can pose challenges for organizations lacking technical expertise. Furthermore, the market faces competition from alternative networking solutions such as wireless networks and software-defined networking (SDN), which offer flexibility and cost savings.

Market Segmentation

- In 2022, the managed switches segment accounted for around 32.6% market share

On the basis of the type, the global network switches market is segmented into fixed-configuration switches, managed switches, unmanaged switches, PoE switches, and modular switches. The managed switches segment currently holds the largest market share in the networking industry. This dominance can be attributed to several factors such as managed switches providing advanced features and functionalities that cater to the complex networking requirements of enterprises. They offer capabilities such as VLAN support, Quality of Service (QoS) prioritization, link aggregation, and advanced security features, enabling efficient network management and enhanced performance. The managed switches provide greater control and configurability, allowing network administrators to monitor and control network traffic, troubleshoot issues, and optimize network performance. This level of control is particularly crucial for businesses with large and diverse network infrastructures. Furthermore, managed switches offer scalability, allowing organizations to expand their networks as their needs grow. The ability to customize and manage networks effectively makes managed switches the preferred choice for enterprises seeking comprehensive control and performance optimization, leading to their significant market share.

- In 2022, the 100 GBE segment dominated with more than 28.7% market share

Based on switching port, the global network switches market is segmented into 100 MBE & 1 GBE, 2.5 GBE & 5 GBE, 10 GBE, 25 GBE & 50 GBE, 100 GBE, and 200 GBE & 400 GBE. The 100 GBE (Gigabit Ethernet) segment currently holds the largest market share in the networking industry. This can be attributed to several factors driving its widespread adoption due to the exponential growth in data traffic and the increasing demand for high-speed data transmission necessitate network infrastructure capable of handling massive volumes of data. The 100 GBE technology provides substantial bandwidth capacity, allowing for faster and more efficient data transfer. The rise of bandwidth-intensive applications such as video streaming, cloud computing, and virtualization fuels the demand for higher network speeds. Additionally, the cost per gigabit of bandwidth for 100 GBE has become more affordable over time, making it a viable choice for enterprises. Furthermore, advancements in optical fiber technology and the availability of 100 GBE-compatible networking equipment contribute to the segment's dominance. As businesses strive for enhanced performance and scalability, the 100 GBE segment continues to hold a significant market share in the networking industry.

Regional Segment Analysis of the Network Switches Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America held a significant market share with more than 38.3% in 2022.

Get more details on this report -

North America has held a significant market share in the network switches market. Several factors contribute to this dominance because of technology hubs and a thriving IT industry, driving the adoption of advanced networking solutions. Large enterprises and organizations in sectors such as finance, healthcare, and manufacturing require robust network infrastructure, leading to a higher demand for network switches. North America has been at the forefront of technological advancements, including the early adoption of cloud computing, IoT, and digital transformation initiatives. This has further propelled the need for high-performance network switches to handle the increasing data traffic. Moreover, the presence of key market players, research and development facilities, and favorable government regulations supporting technological innovation and infrastructure development contribute to the region's market dominance in network switches.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global network switches market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Companies:

- Cisco Systems

- Huawei Technologies

- HPE Aruba

- Juniper Networks

- Arista Networks

- Netgear

- D-Link Corporation

- Extreme Networks

- NVIDIA Corporation

- TRENDnet

- Lantronix

- Alcatel Lucent Enterprise

- Dell Technologies

Key Target Audience

- Market Players

- Investors

- End-Users

- Government Authorities

- Consulting and Research Firm

- Venture Capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In June 2022, HPE Aruba (US) has unveiled high-performance 400GbE switches tailored for challenging environments. The Aruba CX 9300-32D represents a cutting-edge 1U fixed configuration switch, capable of delivering an impressive 12.8Tbps throughput. It features 32 ports of 400GbE, offering the flexibility to support port breakouts for various speeds including 200G, 100G, and 25G. With its design focused on adaptability and cost efficiency, the switch facilitates dense and reliable 100/200/400GbE connectivity for servers, storage, and intra-fabric communication.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2032. Spherical Insights has segmented the global network switches market based on the below-mentioned segments:

Network Switches Market, By Type

- Fixed Configuration Switches

- Managed Switches

- Unmanaged Switches

- PoE Switches

- Modular Switches

Network Switches Market, By Switching Port

- 100 MBE & 1 GBE

- 2.5 GBE & 5 GBE

- 10 GBE

- 25 GBE & 50 GBE

- 100 GBE

- 200 GBE & 400 GBE

Network Switches Market, By End-User

- Data Center

- Cloud Service Providers

- Telecom Service Providers

- Large Enterprise or Private Cloud

- Non-Data Center

Network Switches Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?