Global Neurovascular Devices Market Size, Share, and COVID-19 Impact Analysis, By Device Type (Stenting Systems, Embolization Devices, Neurothrombectomy Devices, and Support Devices), By Size (0.027 inch, 0.021 inch), By Application (Cerebral Aneurysms, Ischemic Stroke, and Others), By End-user (Hospitals, Specialty Clinics, and Others), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032

Industry: HealthcareGlobal Neurovascular Devices Market Insights Forecasts to 2032

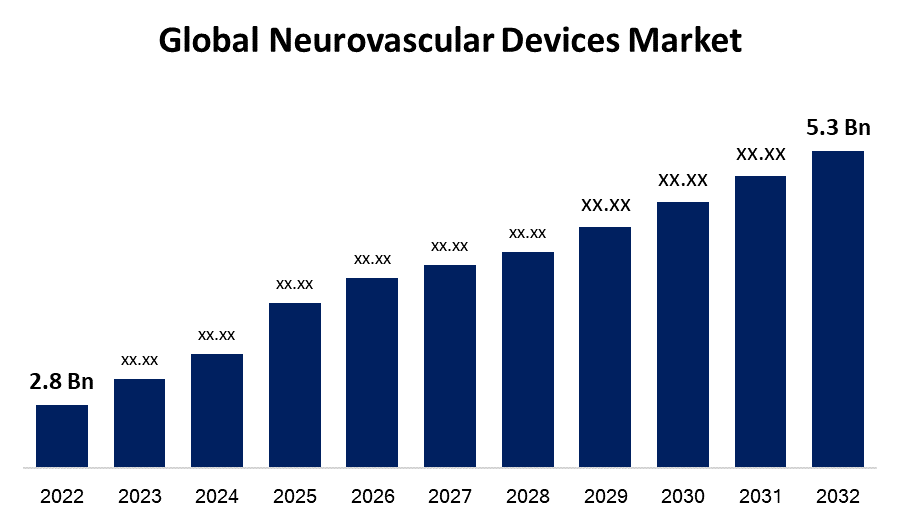

- The Global Neurovascular Devices Market Size was valued at USD 2.8 Billion in 2022.

- The Market Size is Growing at a CAGR of 6.5% from 2022 to 2032.

- The Worldwide Neurovascular Devices Market size is expected to reach USD 5.3 Billion by 2032.

- Asia Pacific is expected To Grow the fastest during the forecast period.

Get more details on this report -

The Global Neurovascular Devices Market Size is expected to reach USD 5.3 Billion by 2032, at a CAGR of 6.5% during the forecast period 2022 to 2032.

Market Overview

Interventional neurology devices are used to diagnose and treat problems of the central nervous system and brain vascular system. Interventional neurology includes endovascular and catheter-based techniques, as well as angiography and fluoroscopy. Catheter angiography is one of the earliest in-vivo brain vascular imaging procedures used to identify several neurological illnesses such as cerebral aneurysms, arteriovenous malformations, intracranial stenosis, arteriovenous fistula, and vasculitis. Every year, the illness kills half a million individuals worldwide. roughly 40.0% of ruptures end in death, while roughly 66.0% of those who survive have some irreversible brain injury. Thus, the fast and vastly rising patient population base for the target disorders throughout the main markets is primarily responsible for the high volume consumption of neurovascular devices, resulting in market growth. Furthermore, many businesses have been consistently spending in R&D to focus on underserved areas of neurovascular therapies and deliver new products to the market. The development of new embolic coils, aspiration catheters based on advanced technologies, and revascularization devices for ischemic strokes are some of the leading examples of a strong shift toward advanced neurovascular devices. Also, market players are heavily engaged in conducting clinical trials to establish the clinical efficiency of their pipeline products in the treatment of different neurovascular conditions.

Report Coverage

This research report categorizes the global neurovascular devices market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global neurovascular devices market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global neurovascular devices market. Technological innovation and advancement will further optimize the performance of the product, enabling it to acquire a wider range of applications in the downstream market.

Global Neurovascular Devices Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 2.8 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 6.5% |

| 2032 Value Projection: | USD 5.3 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Device Type, By Size, By Application, By End-user, By Region. |

| Companies covered:: | Medtronic, Penumbra, Inc., Stryker, Johnson and Johnson Services, Inc., MicroPort Scientific Corporation, Acandis GmbH, MicroVention, Inc., NeuroVasc Technologies, Inc., Asahi Intecc USA, Inc., Perflow Medical Ltd. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increased prevalence of neurovascular disorders such as stroke, cerebral aneurysms, and others is one of the major reasons contributing to the world's growing patient population. The prevalence of these neurovascular diseases is greater in the elderly population. Moreover, key players' strategic initiatives, such as R&D to develop an innovative device and rising product launches, approvals, and technological advancements in devices to meet the increasing demand for neurovascular devices, are expected to drive market growth. For example, Cerus Endovascular Ltd., a privately held commercial-stage medical device business, got Breakthrough Device Designation from the US Food and Drug Administration in February 2021 for its Contour Neurovascular System. The classification of breakthrough devices expedites the traditional development, evaluation, and review processes, and such products become available early.

Restraining Factors

Neurovascular devices are high-tech equipment used in surgery, diagnosis, and treatment of neurological illnesses. The U.S. FDA often recalls neurovascular devices due to technical flaws, which is projected to impede the global neurovascular devices market growth over the forecast period. Despite these organizations' efforts, there are numerous occurrences of delayed or misdiagnosed brain aneurysms owing to failure to do brain imaging tests, a lack of experience among physicians, and mistakes, particularly in emergency rooms.

Market Segmentation

- In 2022, the embolization devices segment is dominating the market with the largest market share over the forecast period.

Based on the device type, the global neurovascular devices market is segmented into stenting systems, embolization devices, neurothrombectomy devices, and support devices. Among these segments, the embolization devices segment is dominating the market with the largest revenue share during the forecast period because the number of patients having treatment for cerebral aneurysms grows. Furthermore, a rising number of innovative devices with enhanced characteristics, such as the POD Embolization Anchoring Device (Penumbra Inc.), have spurred demand for this category during neurovascular intervention operations.

The neurothrombectomy devices sector is predicted to grow at the fastest CAGR throughout the forecast period due to the increasing number of growth methods used by leading market competitors, such as product launches, mergers and acquisitions, and others, together with the rising frequency of acute ischemic stroke, will drive segment expansion shortly.

- In 2022, the 0.027-inch segment is influencing the largest market share over the forecast period.

Based on the size, the global neurovascular devices market is classified into 0.027 inches and 0.021 inches. Among these segments, the 0.027-inch segment is dominating the market. The multiple benefits given by the 0.021" devices, as well as different product launches and product approvals, can be contributed to segment growth. Bendit Technologies' 0.021" Bendit21 microcatheter, for example, was certified by the US FDA for use in the brain, peripheral, and coronary vasculature in April 2021. The approval came many months after the Bendit21 microcatheter was successfully utilized in two life-saving procedures in the United States.

- In 2022, the cerebral aneurysms segment is influencing the largest market share over the forecast period.

On the basis of application, the global neurovascular devices market is classified into cerebral aneurysms, ischemic stroke, and others. Among these segments, the cerebral aneurysms segment is dominating the market. Coil embolization is a minimally invasive treatment for aneurysms in which the material fills the sac and reduces the risk of bleeding. A steerable catheter is placed via the groin and directed to the brain. The rising prevalence of aneurysms is likely to drive the sector throughout the predicted period. These devices are further classed as embolic coils, flow diversion devices, and liquid embolic agents.

- In 2022, the hospital segment is dominating the largest market share over the forecast period.

On the basis of end users, the global neurovascular devices market is classified into hospitals, specialty clinics, and others. Among these segments, the hospital segment is dominating the market. The rising patient pool suffering from neurovascular illnesses such as ischemic and hemorrhagic stroke, brain aneurysm, traumatic brain injury (TBI), and arteriovenous malformation (AVM) is largely responsible for the segment's growth. Furthermore, the growing number of patients admitted to hospitals as a result of surgeries, therapies, and treatments is likely to benefit the neurovascular device market. As a result of the following growth in the number of patients worldwide, the introduction of technologically improved products, and attractive payment policies, there is a growing demand for hospital treatments.

Regional Segment Analysis of the neurovascular devices market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America dominated the market with the largest market revenue during the forecast period

Get more details on this report -

North America is dominating the significant market growth during the forecast period owing to the presence of significant manufacturers in the region such as Penumbra, Inc., Stryker Corporation, Johnson & Johnson, and Merit medical systems, Inc. Phenox Inc. announced in February 2023 that its pRESET Thrombectomy Device has been cleared by the FDA for use in the treatment of acute ischemic stroke. The drug pRESET, which has been on the market in Europe for almost a decade, has now been approved for use in the United States. Furthermore, the increasing frequency of neurological illnesses, as well as the increasing demand for less invasive surgical techniques, are driving the growth of the neurovascular devices market in this area.

Asia Pacific is expected to experience high revenue market growth during the forecast period, because of considerations such as increasing target disease burden. It is estimated that over 30 million individuals in India suffer from different neurological illnesses, with an average prevalence rate of 2,394 cases per 100,000 people. Furthermore, factors such as increased healthcare expenditure and the entry of important competitors in the area are adding to market expansion.

Competitive Analysis

The report offers the appropriate analysis of the key organizations/companies involved within the global neurovascular devices market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Medtronic

- Penumbra, Inc.

- Stryker

- Johnson and Johnson Services, Inc.

- MicroPort Scientific Corporation

- Acandis GmbH

- MicroVention, Inc.

- NeuroVasc Technologies, Inc.

- Asahi Intecc USA, Inc.

- Perflow Medical Ltd.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In October 2022, Medtronic launched the Neurovascular Co-Lab Platform, which aims to speed much-needed innovation in stroke care and treatment.

- In September 2022, Penumbra, Inc. announced the availability of RED reperfusion catheters for stroke therapy in Europe.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2022 to 2032. Spherical Insights has segmented the Global Neurovascular Devices Market based on the below-mentioned segments:

Global Neurovascular Devices Market, By Device Type

- Stenting Systems

- Embolization Devices

- Neurothrombectomy Devices

- Support Devices

Global Neurovascular Devices Market, By Size

- 0.027 inch

- 0.021 inch

Global Neurovascular Devices Market, By Application

- Cerebral Aneurysms

- Ischemic Stroke

- Others

Global Neurovascular Devices Market, By End Users

- Hospitals

- Specialty Clinics

- Others

Neurovascular Devices Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?