Global Next-generation Anode Materials Market Size, Share, and COVID-19 Impact Analysis, By Type (Silicon Oxide Blend, Lithium Metal, Lithium Titanium Oxide, Silicon-Carbon Composite, and Silicone-Graphene Composite), By End-User (Electrical & Electronics, Transportation, Energy Storage, Aerospace & Defense, Industrial, Automotive, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Advanced MaterialsGlobal Next-generation Anode Materials Market Insights Forecasts to 2033

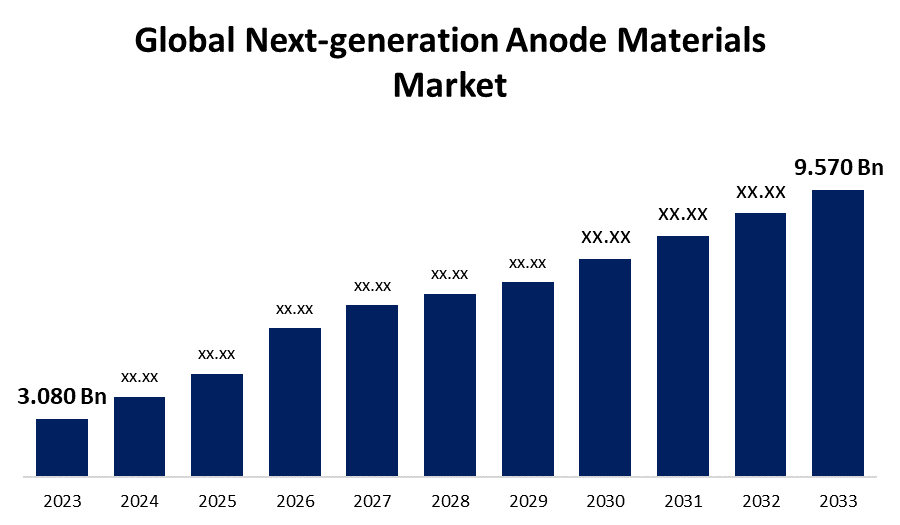

- The Global Next-generation Anode Materials Market Size was Valued at USD 3.080 Billion in 2023

- The Market Size is Growing at a CAGR of 12.00% from 2023 to 2033

- The Worldwide Next-generation Anode Materials Market Size is Expected to Reach USD 9.570 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Next-generation Anode Materials Market Size is Anticipated to Exceed USD 9.570 Billion by 2033, Growing at a CAGR of 12.00% from 2023 to 2033.

Market Overview

Next-generation anode materials are advanced substances designed to enhance the performance of energy storage devices, such as lithium-ion batteries, beyond the capabilities of current anode materials. Next-generation anode materials enhance the performance of various electrochemical devices, including fuel cells and batteries, which is the main goal of employing these goods.Next-generation anode materials, like advanced silicon-based compounds, enhance energy storage by increasing battery capacity, reducing charging times, and improving efficiency. These advancements benefit electric vehicles, consumer electronics, grid storage, and aerospace applications, leading to longer-lasting, faster-charging batteries and more efficient energy management across various sectors. Next-generation anode materials are composed to drive significant advancements in energy storage, contributing to a more sustainable and efficient future.For Instance, In August 2024, Paraclete Energy, a leading silicon anode materials company, announced the launch of SILO Silicon, the next-generation silicon anode material that is expected to revolutionize the Li-ion battery market, particularly the electric vehicle (EV) battery sector.

Report Coverage

This research report categorizes the market for next-generation anode materials based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the next-generation anode materials market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the next-generation anode materials market.

Global Next-generation Anode Materials Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 3.080 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 12.00% |

| 023 – 2033 Value Projection: | USD 9.570 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 234 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By End-User, By Region |

| Companies covered:: | AMPRIUS TECHNOLOGIES, Nexeon Ltd., Sila Nanotechnologies Inc., Shanghai Shanshan Technology Co. Ltd., NanoGraf Corporation, JSR Corporation, Enovix Corporation, Sunrun, Resonac Holdings Corporation, OneD Battery Sciences, Leydenjar Technologies B.V., Talga Group, Paraclete Energy Inc., Albemarle Corporation, Others |

| Pitfalls & Challenges: | Covid-19 Impact, Challenge, Future,Growth and Analysis |

Get more details on this report -

Driving Factors

The next-generation anode materials market is driven by the growing demand for advanced batteries with higher energy densities and faster charging capabilities, largely fueled by the rise of electric vehicles and the need for efficient renewable energy storage. Technological innovations in material science, such as silicon-based and solid-state batteries, play a crucial role, while environmental regulations push for more sustainable and eco-friendly solutions. Additionally, government support and funding accelerate development, and competitive pressures encourage companies to invest in the next-generation anode materials market.

Restraining Factors

The next-generation anode materials market faces several constraints including high production costs and technical challenges related to material stability and manufacturing complexity. Issues with raw material supply chains and stringent regulatory requirements can also hinder development and commercialization. Additionally, market uncertainty and the rapid pace of technological advancements might deter investment in the next-generation anode materials market.

Market Segmentation

The next-generation anode materials market share is classified into type and end-user.

- The silicone-graphene composite segment is estimated to hold the highest market revenue share through the projected period.

Based on the type, the next-generation anode materials market is classified into silicon oxide blend, lithium metal, lithium titanium oxide, silicon-carbon composite, and silicone-graphene composite. Among these, the silicone-graphene composite segment is estimated to hold the highest market revenue share through the projected period. This segment benefits from graphene's high electrical conductivity and silicone's capacity for expansion and contraction, leading to anodes with improved charge capacity, cycling stability, and overall performance. Technological advancements and cost-effective manufacturing processes are making these composites more viable. The increasing need for high-performance batteries in consumer devices and electric cars also contributes to their expanding appeal. The market dominance of silicone-graphene composites is probably going to be maintained by continued research and development.

- The aerospace & defense segment is anticipated to hold the largest market share through the forecast period.

Based on the end-user, the next-generation anode materials market is divided into electrical & electronics, transportation, energy storage, aerospace & defense, industrial, automotive, and others. Among these, the aerospace & defense segment is anticipated to hold the largest market share through the forecast period. This growth is attributed to the sector's high demand for advanced battery technologies that offer exceptional performance, reliability, and safety. Aerospace and defense applications require materials with superior energy density, thermal stability, and long cycle life to encounter stringent performance standards and operational conditions. The demand for next-generation anode materials used in aerospace and defense applications is expected to rise significantly as these industries continue to pursue innovations and enhancements in battery technology for both aircraft and defense systems, driving the sector's dominant market position.

Regional Segment Analysis of the Next-generation Anode Materials Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the next-generation anode materials market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the next-generation anode materials market over the predicted timeframe. Top of FormThe region benefits from strong technological infrastructure and significant investments in research and development, which foster innovation in battery technologies. Additionally, the growing adoption of electric vehicles (EVs) and advancements in renewable energy storage are driving demand for high-performance batteries, further boosting the need for next-generation anode materials. North America's robust automotive and consumer electronics industries also contribute to the market's growth.

Bottom of Form

Asia Pacific is expected to grow at the fastest CAGR growth of the next-generation anode materials market during the forecast period. The region is a major hub for electronics manufacturing and automotive production, particularly with the rapid expansion of electric vehicle (EV) adoption in countries like China and India. Strong investments in renewable energy infrastructure and technological advancements further fuel demand for high-performance batteries, including next-generation anode materials. Additionally, supportive government policies and incentives aimed at boosting clean energy and sustainable technologies contribute to market growth in the Asia Pacific region.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the next-generation anode materials market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- AMPRIUS TECHNOLOGIES

- Nexeon Ltd.

- Sila Nanotechnologies Inc.

- Shanghai Shanshan Technology Co. Ltd.

- NanoGraf Corporation

- JSR Corporation

- Enovix Corporation

- Sunrun

- Resonac Holdings Corporation

- OneD Battery Sciences

- Leydenjar Technologies B.V.

- Talga Group, Paraclete Energy Inc.

- Albemarle Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In July 2024, Sunrise New Energy Co., Ltd. announced the development of two innovative silicon-carbon anode products designed to meet the rapidly growing demands of electric vehicles and high-end 3C digital products.

- In June 2024, Toshiba Corporation, Sojitz Corporation, and CBMM announced the development of a next-generation lithium-ion battery that uses niobium titanium oxide (NTO) in the anode.

- In January 2024, Amprius Technologies, announced its brand-new SiCore product platform, an extension of its product portfolio of industry-leading silicon anode batteries targeted to revolutionize electric mobility.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the next-generation anode materials market based on the below-mentioned segments:

Global Next-generation Anode Materials Market, By Type

- Silicon Oxide Blend

- Lithium Metal

- Lithium Titanium Oxide

- Silicon-Carbon Composite

- Silicone-Graphene Composite

Global Next-generation Anode Materials Market, By End-User

- Electrical & Electronics

- Transportation

- Energy Storage

- Aerospace & Defense

- Industrial

- Automotive

- Others

Global Next-generation Anode Materials Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the next-generation anode materials market over the forecast period?The next-generation anode materials market is projected to expand at a CAGR of 12.00% during the forecast period.

-

2. What is the market size of the next-generation anode materials market?The Global Next-generation Anode Materials Market Size is Expected to Grow from USD 3.080 Billion in 2023 to USD 9.570 Billion by 2033, at a CAGR of 12.00% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the next-generation anode materials market?North America is anticipated to hold the largest share of the next-generation anode materials market over the predicted timeframe.

Need help to buy this report?