Global Next Generation Non-Volatile Memory Market Size, Share, and COVID-19 Impact Analysis, By Type (Hybrid Memory Cube and High-bandwidth Memory), By Wafer Size (200 mm and 300 mm), By Application (BFSI, Consumer Electronics, Government, Telecommunications, Information Technology, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Semiconductors & ElectronicsGlobal Next Generation Non-Volatile Memory Market Insights Forecasts to 2033

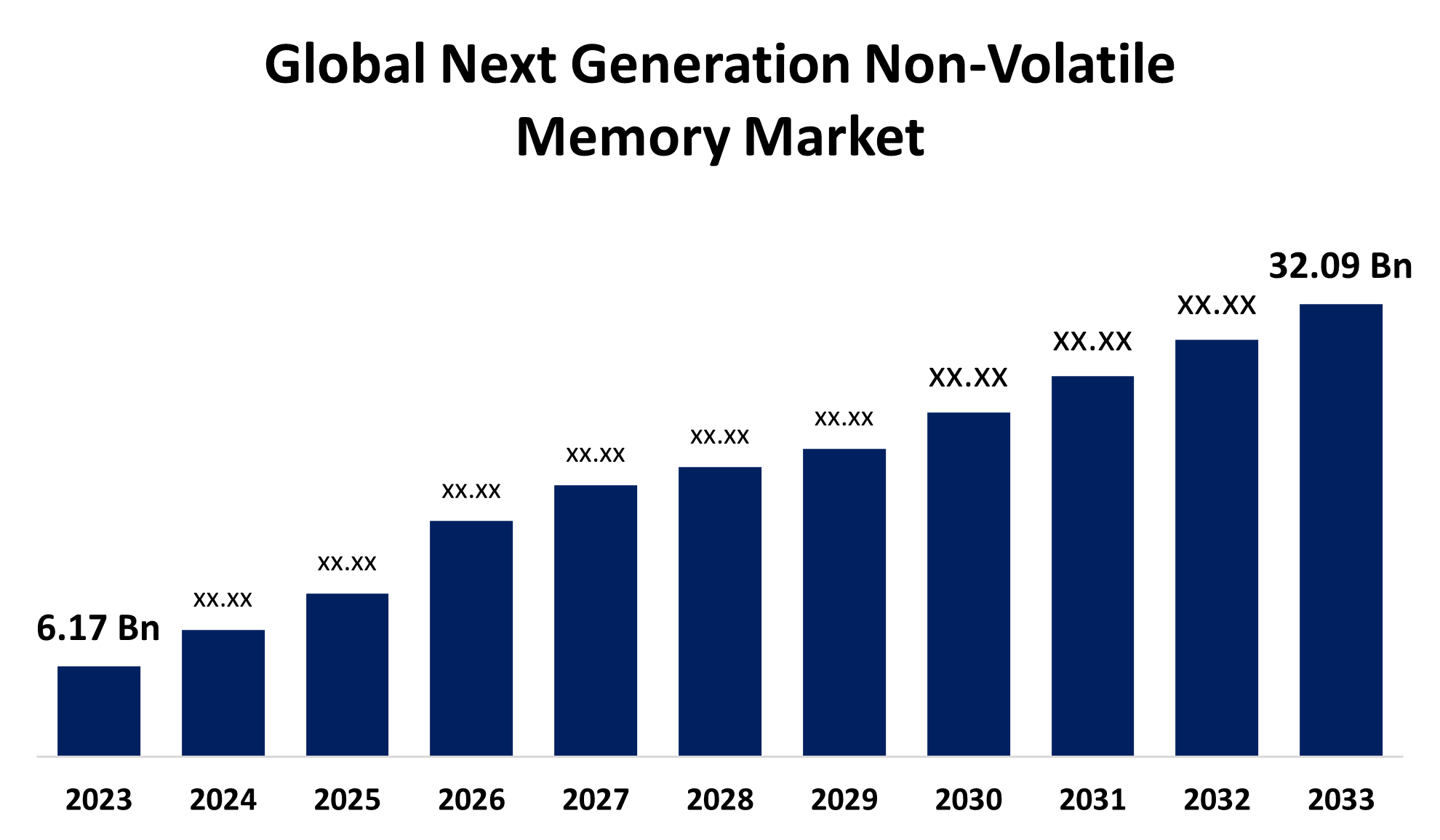

- The Global Next Generation Non-Volatile Memory Market Size was estimated at USD 6.17 Billion in 2023

- The Market Size is Expected to Grow at a CAGR of around 17.93% from 2023 to 2033

- The Worldwide Next Generation Non-Volatile Memory Market Size is Expected to Reach USD 32.09 Billion by 2033

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Next Generation Non-Volatile Memory market size was worth around USD 6.17 Billion in 2023 and is predicted to grow to around USD 32.09 Billion by 2033 with a compound annual growth rate (CAGR) of around 17.93% between 2023 and 2033. The increasing need for data storage as well as the growing use of new technologies are propelling the next generation non-volatile memory market.

Market Overview

Next next-generation non-volatile memory (NVM) market is used to describe cutting-edge memory technologies that preserve data even when the power is switched off, integrating the advantages of speed, density, and non-volatility. Next-generation non-volatile memory (NVM) technologies are emerging storage technologies that support fast data access and data persistence upon power loss. The market has a broad range of next-generation memory prospects, including phase-change Memory (PCM), resistive random-access memory (ReRAM), and magnetic random-access memory (MRAM). They provide faster access times, larger storage capacities, and better endurance than conventional non-volatile memories such as Flash. With the increasing demand for high-performance data storage in industries such as consumer electronics, automotive, and enterprise storage, these technologies offer significant benefits over conventional memory solutions. Additionally, the growth of emerging technologies such as the Internet of Things (IoT), Big Data analytics, and machine learning has generated a huge demand for efficient and reliable storage solutions.

Report Coverage

This research report categorizes the global next generation non-volatile memory market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global next generation non-volatile memory market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global next generation non-volatile memory market.

Global Next Generation Non-Volatile Memory Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 6.17 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 17.93% |

| 2033 Value Projection: | USD 32.09 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 211 |

| Tables, Charts & Figures: | 112 |

| Segments covered: | By Type, By Wafer Size, By Application, By Region |

| Companies covered:: | Micron Technology, Inc., Samsung Electronics Co. Ltd, Toshiba Electronic Devices & Storage Corporation, Rohm Co. Ltd, Western Digital Technologies, Inc., Honeywell International Inc., Crossbar Inc., Fujitsu Ltd., Japan Semiconductor Corporation, HDD Manufacturers, and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The growth of the market is fueled by the rising demand of increased need for data storage, semiconductor technology improvements, and rising adoption of new technologies like autonomous vehicles and AI. Additionally, the growing amount of big data in business and the broad use of cloud storage solutions have also created a growing need for high-capacity and high-speed storage memory.

Restraining Factors

The advanced technology used in next-generation non-volatile memory solutions often comes with a higher price tag compared to traditional memory technologies.

Market Segmentation

The global next generation non-volatile memory market share is classified into type, wafer size, and application.

- The high-bandwidth memory segment accounted for the leading revenue share in 2023 and is projected to grow at a significant CAGR during the forecast period.

In the terms of type, the global next generation non-volatile memory market is divided into hybrid memory cube and high-bandwidth memory. Among these, the high-bandwidth memory segment accounted for the leading revenue share in 2023 and is projected to grow at a significant CAGR during the forecast period. The segment growth is due to the increasing demand for high bandwidth, low power consumption, and uptake of next-generation technologies such as AI & big data analytics and the growing trend of consumer electronic devices. Additionally, technological advancement in the automotive sector is driving the growth of high-bandwidth memory which has high performance and higher data transfer rates.

- The 300 mm segment accounted for the largest share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period.

In the terms of wafer size, the global next generation non-volatile memory market is divided into 200 mm and 300 mm. Among these, the 300 mm segment accounted for the largest share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period. The growth segment can be largely credited to an upsurge in AI, 5G, and high-performance computing is expected to drive semiconductor demand substantially over the next decade. This provides massive opportunities in 300mm segments.

- The BFSI segment accounted for the largest share in 2023 and is projected to grow at a substantial CAGR during the forecast period.

In the terms of application, the global next generation non-volatile memory market is divided into BFSI, consumer electronics, government, telecommunications, information technology, and others. Among these, the BFSI segment accounted for the largest share in 2023 and is projected to grow at a substantial CAGR during the forecast period. The expansion can be fueled as the BFSI industry heavily uses IoT and AI technologies to reap significant advantages. Big data is being used more and more in BFSI to support investor decision-making and guarantee consistent returns.

Regional Segment Analysis of the Global Next Generation Non-Volatile Memory Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

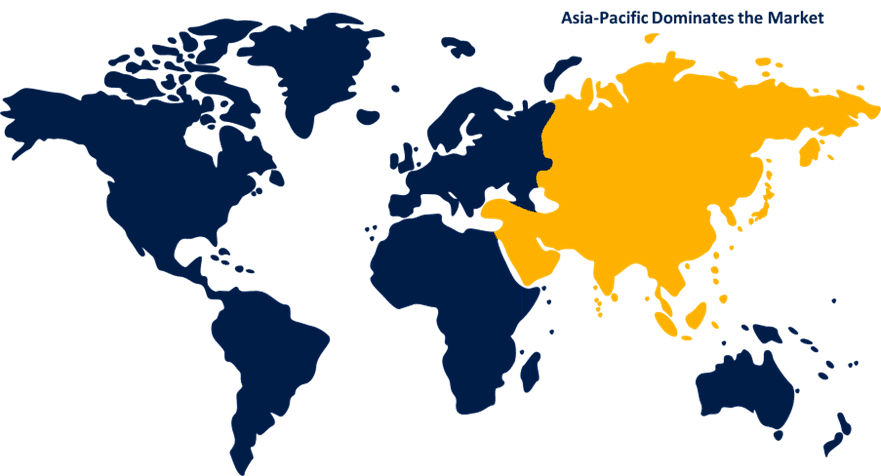

Asia Pacific is anticipated to hold the largest share of the global next generation non-volatile memory market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the global next generation non-volatile memory market over the predicted timeframe. Regional growth is fueled due to the huge consumption of consumer electronics, combined with the rising level of penetration for Internet of Things (IoT) devices, and the demand for safe and dependable memory solutions. Moreover, to combat the growing demand for services like phone and video communications, telework, and home entertainment China is constructing new infrastructures, some of which include data centers that will serve the demand.

North America is expected to grow at the fastest CAGR in the global next generation non-volatile memory market during the forecast period. The regional growth is fueled by factors the rising development of the latest infrastructures such as data centers and the accelerated expansion of the digital economy in nations like the U.S. and Canada. In addition, increased investments in research and development of non-volatile memory devices by leading market players in the region seek to address the need for sophisticated devices, further increasing growth in the foreseeable future.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global next generation non-volatile memory market along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Micron Technology, Inc.

- Samsung Electronics Co. Ltd

- Toshiba Electronic Devices & Storage Corporation

- Rohm Co. Ltd

- Western Digital Technologies, Inc.

- Honeywell International Inc.

- Crossbar Inc.

- Fujitsu Ltd.

- Japan Semiconductor Corporation

- HDD Manufacturers

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In April 2024, Samsung Electronics Co., Ltd., the world leader in advanced memory technology, announced that it has begun mass production for its one-terabit (Tb) triple-level cell (TLC) 9th-generation vertical NAND (V-NAND), solidifying its leadership in the NAND flash market.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the global next generation non-volatile memory market based on the below-mentioned segments:

Global Next Generation Non-Volatile Memory Market, By Type

- Hybrid Memory Cube

- High-bandwidth Memory

Global Next Generation Non-Volatile Memory Market, By Wafer Size

- 200 mm

- 300 mm

Global Next Generation Non-Volatile Memory Market, By Application

- BFSI

- Consumer Electronics

- Government

- Telecommunications

- Information Technology

- Others

Global Next Generation Non-Volatile Memory Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

How big is the next generation non-volatile memory market?The global next generation non-volatile memory market size is expected to grow from USD 6.17 billion in 2023 to USD 32.09 billion by 2033.

-

What factors are driving the growth of the next generation non-volatile memory market?The growth of the market is fueled by the rising demand of increased need for data storage, semiconductor technology improvements, and rising adoption of new technologies like autonomous vehicles and AI.

-

Who are the major players in the next generation non-volatile memory market?Key players are Micron Technology, Inc., Samsung Electronics Co. Ltd, Toshiba Electronic Devices & Storage Corporation, Rohm Co. Ltd, Western Digital Technologies, Inc., Honeywell International Inc., Crossbar Inc., Fujitsu Ltd., Japan Semiconductor Corporation, HDD Manufacturers, and Others.

Need help to buy this report?