Global Nitrile Gloves Market Size, Share, and COVID-19 Impact Analysis, By Type (Powdered and Powder-Free), By Product (Disposable and Durable), By End-User (Medical and Non-Medical), and by Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2021 - 2030

Industry: Advanced MaterialsGlobal Nitrile Gloves Market Insights Forecasts to 2030

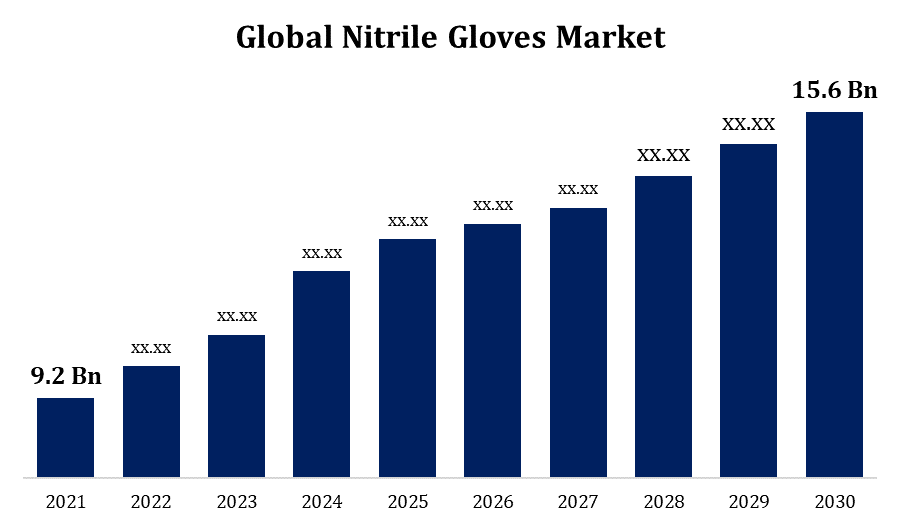

- The global nitrile gloves market was valued at USD 9.2 billion in 2021.

- The market is growing at a CAGR of 6.1% from 2021 to 2030

- The global nitrile gloves market is expected to reach USD 15.6 billion by 2030

- The Asia Pacific is expected to grow the fastest during the forecast period

Get more details on this report -

The Global Nitrile Gloves Market is expected to reach USD 15.6 billion by 2030, at a CAGR of 6.1% during the forecast period 2021 to 2030. The nitrile gloves market has been growing owing to the rising consciousness concerning nitrile gloves’ advantages including puncture-free properties. Also, its increasing adoption in the medical industry is likely to propel the market.

Market Overview:

One of the most popular disposable glove solutions is nitrile, which provides the strength, durability, and flexibility of latex without allergic hazards. Gloves are used extensively throughout all industries in the world to safeguard workers in the industrial sector as well as the products they handle. Nitrile gloves are produced from synthetic rubber that provides reliable, stain-resistant, and safe solutions for end users. In comparison to latex gloves, nitrile gloves are frictionless, puncture-resistant, have a longer shelf life, and provide protection from a variety of dangerous chemicals and viruses. For many different objectives, nitrile gloves are frequently used in the healthcare industry and other sectors. These gloves shield the skin from contamination and prevent cross-contamination for surgeons and other medical staff who frequently encounter sharp objects, blood, diseases, and other harmful materials. The market for nitrile gloves is expected to expand quickly over the next several years because of growing consumer concerns about their own personal health and safety. One of the main reasons nitrile gloves have become more popular in the medical and healthcare fields is the COVID-19 outbreak. Additionally, the rise in COVID-19 boosted demand for gloves in the institutional and domestic markets, including the food service, retail, workplace, school, interior, and outdoor industries. Leading market participants for nitrile gloves are concentrating on clinical research and cutting-edge new product launches to facilitate successful surgeries for trauma and other surgical situations. For instance, CDC data shows that between 1996 and 2006, the number of surgical procedures carried out in ambulatory surgery centers increased by 300% in the United States, greatly driving the demand for nitrile gloves. Additionally, growing worker security awareness in the equipment, chemical, oil & energy, mining, and construction industries would drive the market statistics. On the other hand, the coronavirus epidemic is hampered the industrial value chain.

Global Nitrile Gloves Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2021 |

| Market Size in 2021: | USD 9.2 Billion |

| Forecast Period: | 2021 - 2030 |

| Forecast Period CAGR 2021 - 2030 : | 6.1% |

| 2030 Value Projection: | USD 15.6 Billion |

| Historical Data for: | 2017 - 2020 |

| No. of Pages: | 199 |

| Tables, Charts & Figures: | 125 |

| Segments covered: | By Type, By Product, By End-User, by Region |

| Companies covered:: | Ansell Ltd, Top Glove Corporation Bhd, Showa Group, Unigloves (UK) Limited, Adenna LLC, Supermax Corporation Berhad, Hartalega Holdings Berhad, Kossan Rubber Industries Bhd, Ammex Corporation, MCR Safety, Superior Gloves, Cardinal Health, Medline Industries, Inc., |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Report Coverage

This research report on nitrile gloves categorizes the market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarkets. The report analyses the key growth drivers, opportunities, and challenges influencing the nitrile gloves market. Recent market developments and competitive strategies such as expansion, product launch and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the nitrile gloves market.

Segmentation Analysis

- In 2021, the powder-free segment dominated the market with the largest market share of 72% and market revenue of 6.62 billion.

Based on the type, the nitrile gloves market is bifurcated into powdered and powder-free nitrile gloves. In 2021, the powder-free segment dominated the market with the largest market share of 72% and market revenue of 6.62 billion. The FDA's ban on the use of powdered nitrile gloves in healthcare facilities further limits the need for these gloves; as a result, this development benefits the development of powder-free nitrile gloves in the medical and healthcare sectors. Additionally, the food and beverage industry is beginning to accept powder-free gloves more and more. Powder gloves are predicted to expand at a high pace throughout the projection period as they give better grip and are moisture and sweat-free. However, given the presence of maize starch and other ingredients, it is anticipated that allergic reactions may reduce consumer demand for the product.

- In 2021, the disposable segment accounted for the largest share of the market, with 79% and a market revenue of 7.2 billion.

Based on product, the nitrile gloves market is categorized into disposable and durable. In 2021, the disposable segment dominated the market with the largest market share of 79% and market revenue of 7.2 billion. The disposable segment has accounted for the highest revenue in the market since disposable nitrile gloves are designed for single use and are thrown away after each usage. Disposable nitrile gloves come with several advantages, such as safety assurance and cost-effectiveness. In the upcoming years, these elements are anticipated to fuel product demand. Nitrile gloves are thinner when compared to durable gloves; thus, they provide greater sensitivity and protect against mild chemicals.

- In 2021, the medical segment accounted for the largest share of the market, with 83% and a market revenue of 7.6 billion.

Based on end-user, the nitrile gloves market is categorized into medical and non-medical. In 2021, the medical segment dominated the market with the largest market share of 83% and market revenue of 7.6 billion. To prevent pathogen transmission and cross-contamination during medical procedures and examinations, the demand for nitrile gloves increased exponentially. As nitrile gloves lessen the contamination hazard, they are in high demand. Other end-use industries, particularly those in the food and beverage, chemical and petrochemical, and pharmaceutical sectors, are also anticipated to drive up demand for this product. Increased investments in the chemical and pharmaceutical industries and stricter quality control and hygiene rules in the food processing industries are projected to support market expansion.

Regional Segment Analysis of the nitrile gloves Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Get more details on this report -

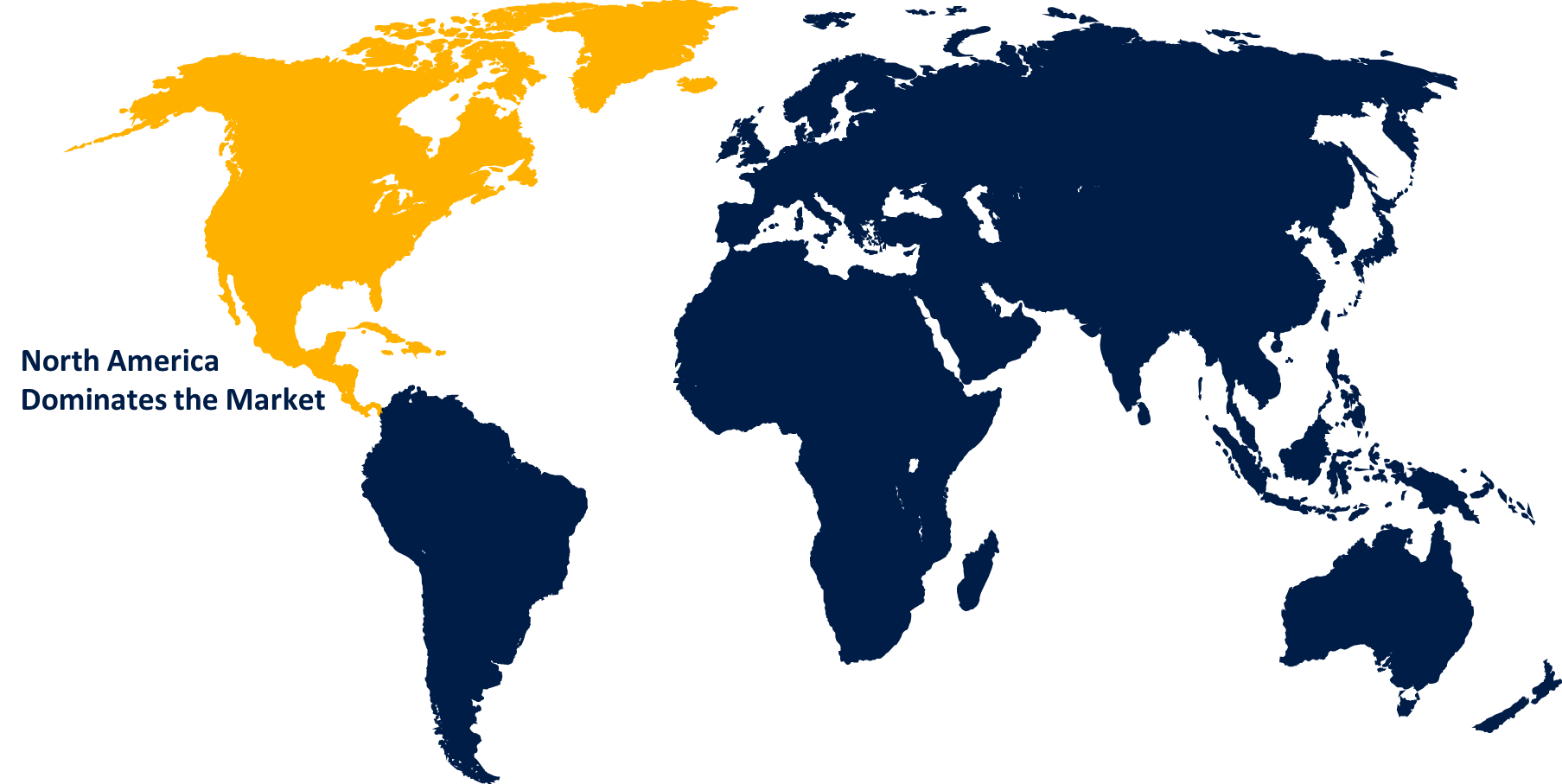

North America emerged as the largest market for the global nitrile gloves market, with a market share of around 39% and 3.5 billion of the market revenue in 2021.

- In 2021, North America emerged as the largest market for the global nitrile gloves market, with a market share of around 39% and 3.5 billion of the market revenue. The market for nitrile gloves in the North American region has been expanding owing to the rising healthcare costs in the area, together with an aging population and a rise in the knowledge of healthcare-acquired infections among healthcare professionals The market penetration in North America is anticipated to increase during the forecast period due to an increase in occupational injuries and a rising demand for highly effective protective gloves in the majority of core industries, such as metal manufacturing, oil & gas, food & beverage, automotive, and chemical.

- The Asia-Pacific market is expected to grow at the fastest CAGR over the forecast period, owing to the fast increase in coronavirus across countries including Japan, China, India, and Indonesia. Furthermore, it is anticipated that rapid industrialization and rising hygiene and safety standards across a variety of healthcare settings in developing nations will favorably affect the industry's expansion. Due to a number of factors, including an aging population, urbanization, an increasing standard of living, and expanding healthcare infrastructure, the medical and healthcare sector in China is predicted to increase quickly. Rising healthcare costs are anticipated to fuel the country's healthcare sector's expansion, which in turn is anticipated to support industrial growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global nitrile gloves market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Market Players:

- Ansell Ltd

- Top Glove Corporation Bhd

- Showa Group

- Unigloves (UK) Limited

- Adenna LLC

- Supermax Corporation Berhad

- Hartalega Holdings Berhad

- Kossan Rubber Industries Bhd

- Ammex Corporation

- MCR Safety

- Superior Gloves

- Cardinal Health

- Medline Industries, Inc.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Third-party knowledge providers

- Value-Added Resellers (VARs)

Recent Development

- In January 2021, Showa Group, a major producer of gloves in Japan, declared plans to increase nitrile glove output by three times by 2022. This capacity increase will increase the availability of nitrile gloves in North America and help the business take the lead position in the industry.

- In March 2020, Hartalega Holdings proclaimed the acquisition of land to expand its glove production facility in Sepang, Malaysia. Due to the COVID-19 outbreak, there has been an increase in demand for hand protection.

- In November 2019, Ansell Limited proclaimed its partnership with a major manufacturer of nitrile gloves, ProGlove, to make hand protection solutions incorporating new technology to ensure compliance with the right personal protective equipment (PPE).

Market Segment

This study forecasts revenue at global, regional, and country levels from 2021 to 2030. Spherical Insights has segmented the global nitrile gloves market based on the below-mentioned segments:

Nitrile Gloves Market, By Type

- Powdered

- Powder-Free

Nitrile Gloves Market, By Product

- Disposable

- Durable

Nitrile Gloves Market, By End-User

- Medical

- Non-Medical

Nitrile Gloves Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Frequently Asked Questions (FAQ)

-

What is the market size of the global nitrile gloves market?As per Spherical Insights, the size of the nitrile gloves market was valued at USD 9.2 billion in 2021 to USD 15.6 billion by 2030.

-

What is the market growth rate of the global nitrile gloves market?The global nitrile gloves market is growing at a CAGR of 6.1% during the forecast period 2021-2030.

-

Which region dominates the global nitrile gloves market?North America emerged as the largest market for nitrile gloves.

-

What is the significant driving factor for the global nitrile gloves market?Expanding healthcare and chemicals sectors will influence the market's growth.

-

Which factor is limiting the growth of the global nitrile gloves market?The possibility of allergies due to additive chemicals could hamper the market growth.

-

Who are the key players in the global nitrile gloves market?Key players in the nitrile gloves market are Ansell Ltd, Top Glove Corporation Bhd, Showa Group, Unigloves (UK) Limited, Adenna LLC, Supermax Corporation Berhad, Hartalega Holdings Berhad, Kossan Rubber Industries Bhd, Ammex Corporation, MCR Safety, Superior Gloves, Cardinal Health, and Medline Industries, Inc.

Need help to buy this report?