Global Non-fungible Token Market Size, Share, and COVID-19 Impact Analysis, By Type (Physical Asset and Digital Asset), By Application (Collectibles, Art, Gaming, Utilities, Metaverse, Sport, and Others), By End-User (Personal and Commercial), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032.

Industry: Information & TechnologyGlobal Non-fungible Token Market Insights Forecasts to 2032

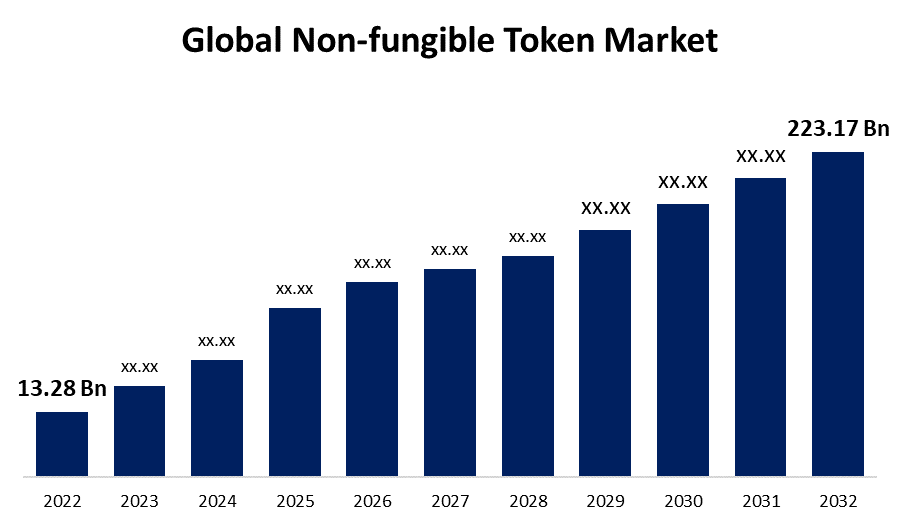

- The Global Non-fungible Token Market Size was valued at USD 13.28 Billion in 2022.

- The Market Size is Growing at a CAGR of 32.6% from 2022 to 2032

- The Worldwide Non-fungible Token Market Size is expected to reach USD 223.17 Billion by 2032

- Asia-Pacific is expected To Grow higher during the forecast period

Get more details on this report -

The Global Non-fungible Token Market Size is expected to reach USD 223.17 Billion by 2032, at a CAGR of 32.6% during the forecast period 2022 to 2032.

Market Overview

A non-fungible token (NFT) is a unique digital asset that is built on blockchain technology, specifically on platforms like Ethereum. Unlike cryptocurrencies such as Bitcoin or Ethereum, which are fungible and can be exchanged on a one-to-one basis, NFTs are indivisible and cannot be exchanged on a like-for-like basis. Each NFT possesses distinct properties, making it distinguishable from any other token. NFTs have gained significant attention due to their ability to represent ownership or proof of authenticity of digital assets such as artwork, music, videos, virtual real estate, and more. They provide creators and collectors with a way to establish verifiable scarcity and ownership in the digital realm, facilitating the creation of new markets and monetization opportunities. NFTs have sparked a surge in digital art and collectibles, with high-profile sales and auctions making headlines, although there are ongoing discussions about their environmental impact and long-term value.

Report Coverage

This research report categorizes the market for global non-fungible token market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global non-fungible token market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the global non-fungible token market.

Global Non-fungible Token Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 13.28 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 32.6% |

| 2032 Value Projection: | USD 223.17 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Application, By End-UserBy Region. |

| Companies covered:: | Axie Infinity, YellowHeart, LLC., Cloudflare, Inc., PLBY Group, Inc., Dolphin Entertainment, Inc., Funko, CryptoKitties, Ozone Networks, Inc., Takung Art Co., Ltd., Dapper Labs, Inc., Gemini Trust Company, LLC., Onchain Labs, and Inc. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The non-fungible token (NFT) market is driven by several key factors due to growing interest in digital ownership and the desire to establish scarcity and provenance in the digital realm. NFTs provide a unique way for creators to monetize their digital content and for collectors to own and trade digital assets. Additionally, the rise of blockchain technology, which provides decentralized and transparent systems, has contributed to the popularity of NFTs as they offer a secure and immutable record of ownership. The increasing adoption of cryptocurrencies and the ease of transacting with NFTs have also propelled market growth. Furthermore, the involvement of high-profile artists, celebrities, and brands in the NFT space has generated significant media attention and attracted a wider audience. Lastly, the emergence of NFT marketplaces and platforms has facilitated the buying, selling, and showcasing of NFTs, creating a vibrant ecosystem for creators and collectors alike.

Restraining Factors

The non-fungible token (NFT) market faces certain restraints because there is concern about the environmental impact of NFTs, particularly their energy consumption due to the underlying blockchain technology. This has raised questions about sustainability and carbon footprints. There is a lack of regulation and legal frameworks surrounding NFTs, leading to uncertainties regarding ownership rights, intellectual property protection, and investor safeguards. Additionally, the market has witnessed instances of fraud and scams, undermining trust and confidence. The high volatility and speculative nature of the NFT market also pose risks for investors. Overall, the potential bubble-like behavior and price volatility in the NFT space have raised concerns about long-term value and the sustainability of the market's growth.

Market Segmentation

- In 2022, the digital asset segment accounted for around 64.2% market share

On the basis of the type, the global non-fungible token market is segmented into physical asset and digital asset. The digital asset segment has emerged as a dominant force in the non-fungible token (NFT) market, capturing a significant market share. There are several factors that contribute to the dominance of digital assets in this space. The concept of NFTs is inherently tied to the digital world. NFTs represent ownership and authenticity of digital assets such as artwork, music, videos, virtual real estate, and more. As a result, digital assets are at the forefront of NFT adoption and utilization. The ability to tokenize and sell digital assets as NFTs has opened up new possibilities for creators, artists, and content owners to monetize their digital creations. Moreover, the digital asset segment offers a wide range of diverse and creative content that appeals to a global audience. Digital art, in particular, has seen tremendous growth and popularity in the NFT space. Artists can create unique and visually stunning digital artworks that can be tokenized and sold as NFTs, providing a new avenue for artists to showcase and sell their creations directly to collectors. Additionally, the digital asset segment benefits from the convenience and accessibility of the digital world. NFTs can be easily bought, sold, and traded on various online platforms and marketplaces, making it convenient for collectors to acquire and manage their digital assets. The global nature of the digital market allows for a broader reach and potential customer base, enabling digital assets to gain widespread recognition and demand. Furthermore, the digital asset segment aligns well with the digital native generation and the growing interest in digital ownership and virtual experiences. The rise of virtual reality (VR) and augmented reality (AR) technologies further enhance the appeal and value of digital assets in immersive digital environments.

- In 2022, the collectibles segment dominated with more than 28.5% market share

Based on the application, the global non-fungible token market is segmented into collectibles, art, gaming, utilities, metaverse, sport, and others. The collectibles segment has emerged as a dominant force in the non-fungible token (NFT) market, capturing a significant market share. There are several factors contributing to the dominance of collectibles in this space. NFTs have breathed new life into the world of digital collectibles. Collectibles have always held a special place in the hearts of enthusiasts, and NFTs provide a novel way to collect and trade unique digital items. From digital trading cards to virtual pets, NFT collectibles offer a wide range of unique and scarce assets that appeal to collectors. Moreover, the collectibles segment taps into the nostalgia factor. NFTs allow collectors to acquire digital versions of items they grew up with, such as iconic artwork, vintage video game items, or memorable moments from popular culture. This emotional connection drives demand and fosters a sense of ownership and value. Additionally, the collectibles segment benefits from the social aspect of collecting. NFT marketplaces and communities provide platforms for collectors to showcase their collections, interact with other enthusiasts, and participate in auctions and trading. This sense of community and engagement adds value to the collectibles segment and drives market growth. Furthermore, the limited supply and scarcity of certain collectible NFTs make them highly sought after. Rarity and exclusivity are key drivers in the collectibles market, and NFTs offer a transparent and verifiable way to establish these qualities. The concept of "ownership" in the digital realm adds a new dimension to the collectibles segment, as collectors can truly possess and display their digital assets. Overall, the collectibles segment benefits from celebrity endorsements and collaborations. High-profile artists, musicians, athletes, and brands entering the NFT space bring their fan base and followers, creating a significant market presence and driving interest in collectible NFTs.

Regional Segment Analysis of the Non-fungible Token Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

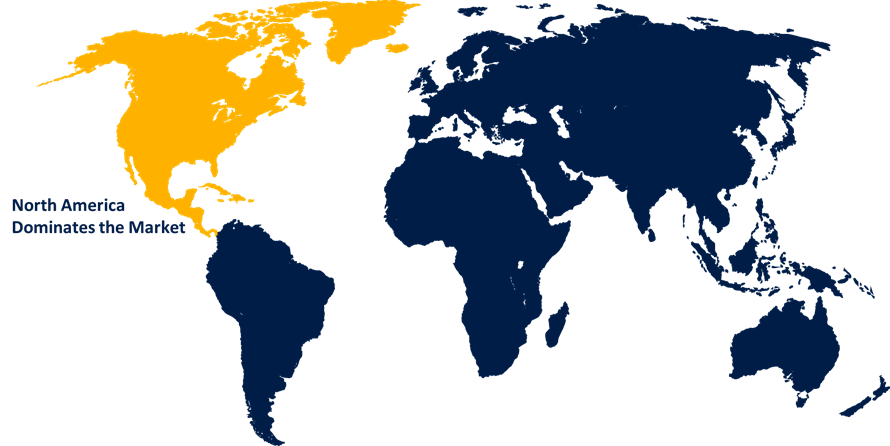

North America dominated the market with more than 43.7% revenue share in 2022.

Get more details on this report -

Based on region, North America has emerged as a dominant player in the non-fungible token (NFT) market, holding the largest market share. North America has a highly developed and technologically advanced economy, with a strong presence of tech-savvy individuals and innovative companies. This ecosystem provides a conducive environment for the adoption and growth of NFTs. Additionally, the region is home to a large number of prominent artists, musicians, and celebrities who have embraced NFTs, attracting attention and driving market demand. Moreover, North America boasts well-established digital marketplaces and platforms that facilitate the buying and selling of NFTs, providing infrastructure and accessibility for creators and collectors. Overall, regulatory frameworks in North America have shown relatively more progress in addressing legal considerations around NFTs, fostering an environment of trust and legitimacy for market participants.

Recent Developments

- In March 2022, The Sandbox, a virtual gaming platform, has formed a partnership with World of Women, an NFT community focused on promoting women's representation in digital spaces. The Sandbox has allocated a substantial funding amount of USD 25 million to support and amplify this mission. This collaboration aims to empower and highlight the contributions of women in the NFT and gaming industries, fostering diversity and inclusivity in the digital realm.

- In January 2022, Dapper Labs has finally introduced its much anticipated NFT collectible product, UFC Strike, in cooperation with UFC, the world's foremost mixed martial arts organization. The UFC Strike Moment NFT is intended to chronicle, memorialize, and honor a key moment in UFC history.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global non-fungible token market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Companies:

- Axie Infinity

- YellowHeart, LLC.

- Cloudflare, Inc.

- PLBY Group, Inc.

- Dolphin Entertainment, Inc.

- Funko

- CryptoKitties

- Ozone Networks, Inc.

- Takung Art Co., Ltd.

- Dapper Labs, Inc.

- Gemini Trust Company, LLC.

- Onchain Labs, Inc.

Key Target Audience

- Market Players

- Investors

- End-Users

- Government Authorities

- Consulting and Research Firm

- Venture Capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2032. Spherical Insights has segmented the Global Non-fungible Token Market based on the below-mentioned segments:

Non-fungible Token Market, By Type

- Physical Asset

- Digital Asset

Non-fungible Token Market, By Application

- Collectibles

- Art

- Gaming

- Utilities

- Metaverse

- Sport

- Others

Non-fungible Token Market, By End-User

- Personal

- Commercial

Non-fungible Token Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?