Global Non-Volatile Memory (NVM) Market Size, Share, and COVID-19 Impact Analysis, By Type (Traditional, Next-Generation), By Wafer Size (200 mm, 300 mm, and 450 mm), By End-Use (Industrial, Automotive & Transportation, Telecommunication, Energy & Power, Healthcare, Consumer Electronics, Data Centres, Military & Aerospace, Agriculture, Retail, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032

Industry: Semiconductors & ElectronicsGlobal Non-Volatile Memory (NVM) Market Insights Forecasts to 2032

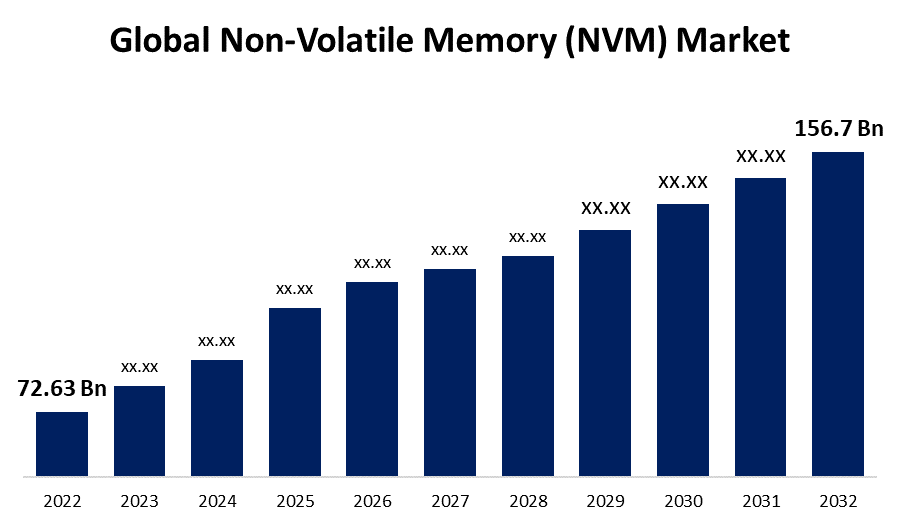

- The Global Non-Volatile Memory (NVM) Market Size was valued at USD 72.63 Billion in 2022.

- The Market is growing at a CAGR of 7.9% from 2022 to 2032

- The Worldwide Non-Volatile Memory (NVM) Market is expected to reach USD 156.7 Billion by 2032

- North America is expected to grow the fastest during the forecast period

Get more details on this report -

The Global Non-Volatile Memory (NVM) Market Size is expected to reach USD 156.7 Billion by 2032, at a CAGR of 7.9% during the forecast period 2022 to 2032.

Non-Volatile Memory (NVM) is a type of memory that preserves its recorded information/data even after power is turned off. Non-volatile memory is most commonly found in flash memory, hard disk drives (HDDs), solid-state drives (SSDs), USB drives, and magnetic tape. NVM is now widely used in data centers and in consumer electronics to improve data transfer speed and reduce data loss. The most commonly used of these types of memories is NAND flash memory, and its application has increased at an exponential rate. Product manufacturers are continuously developing NAND flash technology in order to reduce the cost per bit. Non-volatile memory technology companies are also working on new non-volatile memory technological innovations to cut costs as well, enhance efficiency, expand storage density, boost longevity, and minimize power usage.

The major players in the Global Non-Volatile Memory (NVM) Market include SK Hynix, Micron Technology, Inc., ROHM CO., LTD., STMicroelectronics, Infineon Technologies AG, Samsung Electronics, and Intel Corporation. Currently, expansion methods such as product introduction, acquisition, and collaboration are driving the non-volatile memory market. The competitive competition in the marketplace is essentially dependent on innovation-based long-term competitive advantages, market saturation levels, and the successful execution of marketing strategies.

The phenomenal rise of the portable device market over the past ten years has piqued the semiconductor industry's interest in non-volatile memory technologies for both data and large-scale storage applications. The present-day NVM norm operates on Flash technology, and NOR and NAND Flash are projected to be major contributors to NVM manufacture for a period of time. Emerging technologies that incorporate cutting-edge materials and techniques that extend further Flash technology, allowing for higher scalability and memory efficiency, are gaining industrial demand.

Global Non-Volatile Memory (NVM) Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 72.63 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 7.9% |

| 2032 Value Projection: | USD 156.7 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Type, By Wafer Size, By End-Use, By Region and COVID-19 Impact Analysis |

| Companies covered:: | Fujitsu, ROHM CO., LTD., SAMSUNG, HT Micron, SK HYNIX INC., Pure Storage, Inc., STMicroelectronics, NVMdurance, Micron Technology, Inc.,SMART Modular Technologies, Intel Corporation, Viking Technology, Avalanche Technology, Infineon Technologies AG, Toshiba Corporation, KIOXIA Holdings Corporation, Renesas Electronics Corporation, Western Digital Technologies, Inc. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Some of the main factors driving the growth of the non-volatile memory market are the rising demand for data retention and processing features, as well as the growing popularity of emerging technologies such as artificial intelligence (AI) and the Internet of Things (IoT). Furthermore, the industry is being driven by rising demand for high-speed, low-power, and dependable memory alternatives.

Furthermore, the ongoing development of emerging memory technologies and applications based on the non-volatile memory market raises consumer demands for performance. To accommodate the expanding global demand, there has been an increase in the demand for smaller feature sizes in microelectronic goods, as well as increased interest in the development of Flash memory devices. The Flash memory marketplace is one of the most vibrant and exciting in the semiconductor industry. The expansion of the consumer electronics market drives the demand for Flash memory, making it an important segment within the non-volatile memory market. Furthermore, the non-volatile memory industry has been steadily rising over a long-time frame, albeit with certain fluctuations, and this trend is projected to continue over the forecasted period.

In the rapidly growing consumer electronics sector, consumers throughout the world demand their devices to continuously increase in power, offer enhanced features at lightning speeds, and retain more music, movies, and photographs. In the rapidly growing consumer electronics sector, consumers throughout the world demand their devices to continuously increase in power, offer enhanced features at lightning speeds, and retain more music, movies, and photographs. Non-volatile memory is used in wearable devices and smartphones to improve data retention and speed up memory utilization. Since it requires less density and non-volatile memory is also employed in printing devices, wireless headphones, and broadcasting electronic devices.

Market Segmentation

By Type Insights

The traditional segment is dominating the market with the largest revenue share over the forecast period.

On the basis of type, the global non-volatile memory (NVM) market is segmented into traditional and next-generation. Among these, the traditional segment is dominating the market with the largest revenue share of 48.6% over the forecast period. The traditional non-volatile memory is further divided into flash memory, EEPROM, nvSRAM, EPROM, and others. In addition, the next-generation non-volatile memory is further divided into 3D NAND, MRAM / STT-MRAM, FRAM, ReRAM/CBRAM, NVDIMM, PCM, NRAM, and Others. Flash memory is a non-volatile electronic data storage technology that can be erased and rewritten electronically. NAND and NOR are the two primary types of flash memory. This non-volatile memory type is utilized in a variety of applications such as laptops, digital cameras, GPS, cell phones, electronic musical instruments, and so on, and is additionally being utilized by data center solution providers as cloud-based services become more popular, driving the flash non-volatile memory (NVM) market growth over the projected time frame.

By Wafer Size Insights

The 300 mm segment is witnessing significant CAGR growth over the forecast period.

On the basis of wafer size, the global non-volatile memory (NVM) market is segmented into 200 mm, 300 mm, and 450 mm. Among these, the 300 mm segment is witnessing significant CAGR growth over the forecast period. Almost all major fab renovations and construction initiatives involve 300 mm wafer fabrication. The use of 300 mm wafers has increased dramatically during the last few years. One 300 mm wafer could usually produce 600 or more chips. The five semiconductor manufacturers that own over seventy percent of the worldwide 300 mm Chip capacity, including SAMSUNG, Micron Technology, Inc., SK HYNIX INC., TSMC, and Western Digital Technologies, Inc., dominate the shipping and distribution of 300 mm wafers.

By End-Use Insights

The consumer electronics segment accounted for the largest revenue share of more than 57.2% over the forecast period.

On the basis of end-use, the global non-volatile memory (NVM) market is segmented into industrial, automotive & transportation, telecommunication, energy & power, healthcare, consumer electronics, data centres, military & aerospace, agriculture, retail, and others. Among these, the consumer electronics segment is dominating the market with the largest revenue share of 57.2% over the forecast period. The market is expected to grow as high-performance smartphones and other consumer electronic gadgets are manufactured around the world. These smartphones combine sophisticated technology and non-volatile memory to improve data accessibility and user satisfaction. NAND flash memory, which enables fast performance, is a standard characteristic of next-generation cell phones. As a result, all of these factors are expected to expand the non-volatile memory market and increase the segment.

Regional Insights

Asia Pacific dominates the market with the largest market share over the forecast period.

Get more details on this report -

Asia Pacific is dominating the market with more than 38.7% market share over the forecast period. The region's large population density contributes to market growth, resulting in a highly-potential marketplace for consumer electrical and electronic products. The Asia Pacific market is being driven by rising demand for non-volatile memory (NVM) in consumer electronics. China, South Korea, Japan, Taiwan, and India are among the most prominent nations in the development of electronics in the Asia Pacific region. The region is a major semiconductor and electronics manufacturing center. This is one of the key elements driving the regional non-volatile memory market.

North America, on the contrary, is expected to grow the fastest during the forecast period. The construction of unique new facilities, including data centers, has been developing in North America in response to increasing demand for digital recreation, videoconferencing, and video and phone call services. Because of the rapid growth of the e-commerce sector, it is now critical to create large-scale big data centers in the region. Additionally, the existence of prominent manufacturers in the region providing non-volatile memory technologies, such as Boradcom Inc., Micron Technologies, and Machine Corporation, stimulates market expansion.

List of Key Market Players

- Fujitsu

- ROHM CO., LTD.

- SAMSUNG

- HT Micron

- SK HYNIX INC.

- Pure Storage, Inc.

- STMicroelectronics

- NVMdurance

- Micron Technology, Inc.

- SMART Modular Technologies

- Intel Corporation

- Viking Technology

- Avalanche Technology

- Infineon Technologies AG

- Toshiba Corporation

- KIOXIA Holdings Corporation

- Renesas Electronics Corporation

- Western Digital Technologies, Inc.

Key Market Developments

- On March 2023, ANAFLASH, a Silicon Valley-based smart microcontroller developer for edge computing, has obtained an exclusive license from the University of Minnesota for a single-poly based embedded flash memory technology. The company intends to commercialize this low-cost, low-energy non-volatile memory technology, which is now available for licensing to collaborative partners and has a primary application for a variety of battery-powered devices such as medical wearables, wireless sensors, and autonomous robots.

- On February 2023, GlobalFoundries has announced the acquisition of Renesas Electronics Corporation's unique and production-proven Conductive Bridging Random Access Memory (CBRAM) technology, a low-power memory solution designed to enable a variety of applications in residential and industrial IoT and smart mobile devices. By adding another dependable, customized embedded memory solution that is reasonably straightforward to integrate into other technological nodes, the transaction expands GF's memory portfolio and extends its roadmap of embedded non-volatile memory (NVM) solutions.

- In August 2022, SAMSUNG announced a slew of next-generation flash memory technologies, including Petabyte Storage, Memory-semantic SSD, and two business SSDs. SAMSUNG also created a second generation SmartSSD storage device with enhanced processing capabilities.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2032. Spherical Insights has segmented the Global Non-Volatile Memory (NVM) Market based on the below-mentioned segments:

Non-Volatile Memory (NVM) Market, Type Analysis

- Traditional

- Flash Memory

- EEPROM

- nvSRAM

- EPRoM,

- Others

- Next-Generation

- 3D NAND

- MRAM / STT-MRAM

- FRAM

- ReRAM/CBRAM

- NVDIMM

- PCM

- NRAM

- Others

Non-Volatile Memory (NVM) Market, Wafer Size Analysis

- 200 mm

- 300 mm

- 450 mm

Non-Volatile Memory (NVM) Market, End-Use Analysis

- Industrial

- Automotive & Transportation

- Telecommunication

- Energy & Power

- Healthcare

- Consumer Electronics

- Data Centres

- Military & Aerospace

- Agriculture

- Retail

- Others

Non-Volatile Memory (NVM) Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Non-Volatile Memory (NVM) market?The Global Non-Volatile Memory (NVM) Market is expected to grow from USD 72.63 billion in 2022 to USD 156.7 billion by 2032, at a CAGR of 7.9% during the forecast period 2022-2032.

-

2. Which are the key companies in the market?The major companies in the global non-volatile memory (NVM) market include SK Hynix, Micron Technology, Inc., ROHM CO., LTD., STMicroelectronics, Infineon Technologies AG, Samsung Electronics, and Intel Corporation.

-

3. Which segment dominated the Non-Volatile Memory (NVM) market share?The consumer electronics segment in end-use type dominated the Non-Volatile Memory (NVM) market in 2022 and accounted for a revenue share of over 57.2%.

-

4. What are the elements driving the growth of the Non-Volatile Memory (NVM) market?The market for non-volatile memory is being driven by rising consumer electronics demand and the shift away from HDDs toward SSDs.

-

5. Which region is dominating the Non-Volatile Memory (NVM) market?Asia Pacific is dominating the Non-Volatile Memory (NVM) market with more than 38.7% market share.

-

6. Which segment holds the largest market share of the Non-Volatile Memory (NVM) market?The 300 mm segment based on wafer size type holds the maximum market share of the Non-Volatile Memory (NVM) market.

Need help to buy this report?