Global Non-woven Fabrics Market Size By Product (Polyester, Polypropylene, Nylon, and Others); By Application (Disposables and Durables) By Region , And Segment Forecasts, By Geographic Scope And Forecast 2022-2032.

Industry: Advanced MaterialsGlobal Non-woven Fabrics Market Size Insights Forecasts to 2032

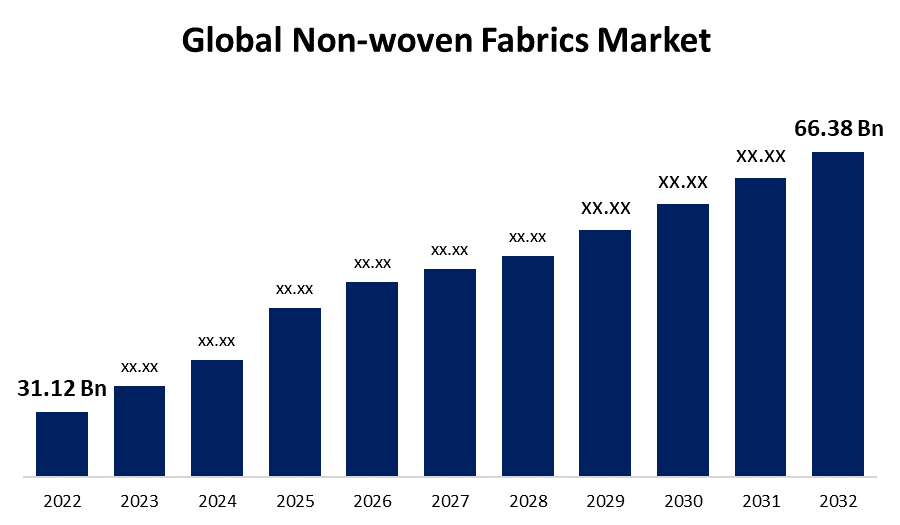

- The Non-woven Fabrics Market Size was valued at USD 31.12 Billion in 2022.

- The Market Size is Growing at a CAGR of 7.5% from 2022 to 2032

- The global Non-woven Fabrics Market Size is expected to reach USD 66.38 Billion by 2032

- Asia Pacific is expected to Grow the fastest during the forecast period

Get more details on this report -

The global Non-woven Fabrics Market Size is expected to reach USD 66.38 Billion by 2032, at a CAGR of 7.5% during the forecast period 2022 to 2032.

Non-woven fabrics are manufactured from fibres that are joined together chemically rather than being woven. These fabrics are made by entwining fibres, frequently using mechanical, thermal, or chemical bonding techniques. Due to the adaptability of non-woven materials, this industry has experienced tremendous expansion in numerous industries. They are utilised in a variety of items, including those for hygiene (like diapers and sanitary napkins), medicine (like surgical masks and gowns), geotextiles, and automobile interiors. Technology advances, environmental concerns, and the particular requirements of the industries that use these materials all have an impact on the demand for non-woven fabrics.

Non-woven Fabrics Market Price Analysis

Synthetic fibres like polypropylene and polyester, as well as natural fibres like cotton, are the main raw ingredients for non-woven fabrics. Variations in the pricing of these basic components can affect how much non-woven fabrics cost altogether. Costs for various manufacturing procedures, including spunbond, meltblown, and needle punch, vary. For instance, meltblown technology, which is frequently used to create medical-grade non-wovens, can require specialised equipment and be more expensive than other processes. The fundamental economic tenet of supply and demand is very important. Prices may rise if there is a surge in demand for non-woven materials. On the other hand, market oversupply can result in price drops. Due to elements including transportation costs, local laws, and currency fluctuations, prices might also differ regionally.

Non-woven Fabrics Market Opportunity Analysis

Non-woven fabrics are increasingly in demand in the hygiene and medical industries, where they are used in things like diapers, feminine hygiene items, and medical textiles. There are opportunities for manufacturers to provide specialised and high-performance non-wovens for medical uses including surgical gowns and wound dressings. To address the demand for sustainable products, businesses might investigate options to develop biodegradable or recyclable non-woven materials. Significant development potential can be found by expanding into developing regions where the use of non-woven materials is still relatively untapped. The market for non-woven products may be driven by developing nations with rising disposable incomes and evolving lifestyles. Non-woven fabrics can be customised for specialised markets or uses, such as filtration, agriculture, or the automotive industry, to provide new revenue streams.

Global Non-woven Fabrics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 31.12 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 7.5% |

| 2032 Value Projection: | USD 66.38 Billion |

| Historical Data for: | 2019-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By Application, By Region and COVID 19 Impact. |

| Companies covered:: | Nolato AB, Freudenberg Medical LLC, Rochling Group, GW Plastics Inc., MedPlast Inc., Phillips Medisisze Corporation, C&J Industries Inc., Tekni-Plex, Inc., Pexco LLC, Medical Plastic Devices Inc., and Other Key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth & Analysis. |

Get more details on this report -

Market Dynamics

Non-woven Fabrics Market Dynamics

Rising awareness related to personal hygiene products

Disposable hygiene items including diapers, sanitary napkins, and adult incontinence products are in higher demand as a result of rising personal hygiene awareness. Due to its softness, breathability, and moisture-wicking qualities, non-woven fabrics are a favoured option for these products. The demand for personal protective equipment (PPE), including non-woven medical textiles, has increased due to increased awareness of health and safety, particularly in the wake of global health crises. Manufacturers have been inspired to create and enhance the functionality of hygiene items as a result of greater awareness. The market for non-woven fabrics has Grown as a result of the increase in demand for hygienic goods brought on by increased awareness, and new players have entered the market to fill the gap. In response, producers of nonwoven fabrics are creating recyclable and biodegradable materials for use in hygienic applications.

Restraints & Challenges

High raw material cost and operational cost

Manufacturers' profit margins may be impacted by high raw material costs, especially for synthetic fibres like polyester and polypropylene. Due to pressure from competitors' pricing strategies, manufacturers may have trouble passing these increased costs forward to customers. The total cost-effectiveness of production processes can be impacted by high operational costs, including labour, energy, and maintenance costs. If operational efficiency is impaired, manufacturers can find it difficult to sustain competitiveness. Smaller businesses, in particular, may have a harder time managing high costs than larger, more established organisations do. This is especially true of non-woven fabric industry participants who are smaller. Industries that rely largely on non-woven materials, such those that produce hygiene products, may be especially vulnerable to pricing changes. High expenses could result in higher pricing for finished goods, which might affect consumer demand.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Non-woven Fabrics market from 2023 to 2032. Non-woven fabrics are in high demand in the North American market for hygiene items such adult incontinence products, feminine hygiene products, and diapers. The market has Grown as a result of the usage of non-woven fabrics in medical and healthcare applications, such as surgical gowns, masks, and other medical textiles. Strategic partnerships and investments have been made by businesses in North America to increase their manufacturing capacity and meet the rising demand for non-woven materials. Market trends are still being influenced by consumer knowledge of the advantages of non-woven materials in many applications and an emphasis on comfort and performance. The North American non-woven fabric industry is cutthroat, with major competitors concentrating on product development, innovation, and market expansion plans.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market Growth between 2023 to 2032. Asia-Pacific nations like China and India have been rapidly industrialising and urbanising, which has increased demand for non-woven materials in a variety of applications. A significant centre for the production of non-woven fabrics is Asia-Pacific. China, among other nations, is a major producer and consumer of nonwoven fabrics on the international market. In the Asia-Pacific area, continuous improvements in production techniques have improved the quality and functionality of non-woven materials. The market for non-woven fabrics in the Asia-Pacific area is highly competitive, with both local and international firms present.

Segmentation Analysis

Insights by Product

The Polypropylene segment accounted for the largest market share over the forecast period 2023 to 2032. The fabrication of non-woven fabrics favours polypropylene because it is a versatile and affordable material. Its extensive use in several applications is facilitated by its accessibility. Medical and healthcare applications involving surgical gowns, masks, and other medical textiles are driving Growth in the polypropylene category. Because of its barrier qualities and sterilisation capabilities, polypropylene is frequently used. Because of their convenience and increased demand, throwaway products are becoming more and more popular. Since it is a thermoplastic polymer, polypropylene is ideal for making single-use, disposable non-woven products. Non-woven geotextiles, which are utilised in construction, landscaping, and civil engineering projects, are made with polypropylene. These geotextiles provide stabilisation and erosion control.

Insights by Application

Durable application segment is witnessing the fastest market Growth over the forecast period 2023 to 2032. For uses including upholstery, carpets, and interior trims, non-woven materials are utilised in automobile interiors. They are appropriate for this market because of their strength and wear resistance. Geotextiles, which are employed in soil stabilisation, erosion management, and drainage systems, find applications for non-woven fabrics in the construction industry. For these fabrics to work effectively over time in building projects, durability is essential. Where strength and durability are essential, non-woven fabrics are used in durable packaging applications, such as bulk bags and Non-woven Fabrics materials. For purposes like shoe linings and interlinings, durable non-woven materials are utilised in footwear and garments, which improves the longevity and functionality of the finished goods. Non-woven materials are used in a variety of specialised textile applications where sturdiness is crucial.

Recent Market Developments

- In August 2022, one of the top producers of geosynthetic and erosion control products in the US, Willacoochee Industrial Fabrics, Inc. (WINFAB), recently announced its investment in a brand-new, cutting-edge production line for nonwoven geotextiles in Nashville, Georgia.

Competitive Landscape

Major players in the market

- Nolato AB

- Freudenberg Medical LLC

- Rochling Group

- GW Plastics Inc.

- MedPlast Inc.

- Phillips Medisisze Corporation

- C&J Industries Inc.

- Tekni-Plex, Inc.

- Pexco LLC

- Medical Plastic Devices Inc.

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2032.

Non-woven Fabrics Market, Product Analysis

- Polyester

- Polypropylene

- Nylon

- Others

Non-woven Fabrics Market, Application Analysis

- Disposables

- Durables

Non-woven Fabrics Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

Frequently Asked Questions (FAQ)

-

What is the market size of the Non-woven Fabrics Market?The global Non-woven Fabrics Market is expected to Grow from USD 31.12 Billion in 2023 to USD 66.38 Billion by 2032, at a CAGR of 7.5% during the forecast period 2023-2032.

-

Who are the key market players of the Non-woven Fabrics Market?Some of the key market players of market are Nolato AB, Freudenberg Medical LLC, Rochling Group, GW Plastics Inc., MedPlast Inc., Phillips Medisisze Corporation, C&J Industries Inc., Tekni-Plex, Inc., Pexco LLC, and Medical Plastic Devices Inc.

-

Which segment holds the largest market share?Polypropylene segment holds the largest market share and is going to continue its dominance.

-

Which region is dominating the Non-woven Fabrics Market?North America is dominating the Non-woven Fabrics Market with the highest market share.

Need help to buy this report?