Global Nondestructive Testing Equipment Market Size, Share, and COVID-19 Impact Analysis, By Technology (Radiography Testing Equipment, Ultrasonic Testing Equipment, Magnetic Particle Testing Equipment, Liquid Penetrant Testing Equipment, Visual Inspection Equipment, Eddy Current Equipment, and Other Technologies Equipment), By End-User Industry (Oil and Gas, Power and Energy, Aerospace and Defense, Automotive and Transportation, Construction, and Other End-User Industries), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Semiconductors & ElectronicsGlobal Nondestructive Testing Equipment Market Insights Forecasts to 2033

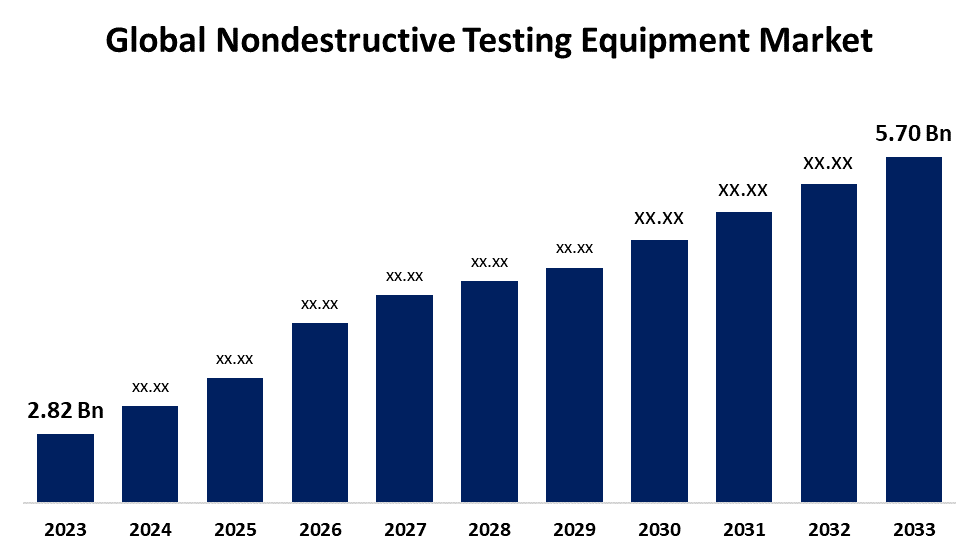

- The Global Nondestructive Testing Equipment Market Size was Estimated at USD 2.82 Billion in 2023

- The Market Size is Expected to Grow at a CAGR of around 7.29% from 2023 to 2033

- The Worldwide Nondestructive Testing Equipment Market Size is Expected to Reach USD 5.70 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Nondestructive Testing Equipment Market Size was worth around USD 2.82 Billion in 2023 and is predicted to Grow to around USD 5.70 Billion by 2033 with a compound annual growth rate (CAGR) of approximately 7.29% between 2023 and 2033. The non-destructive testing (NDT) equipment industry is experiencing a significant transformation driven by technological advancement and automation.

Market Overview

The global nondestructive testing (NDT) equipment market is the market for specialized equipment and instruments to assess the properties, condition, and integrity of materials, systems, or structures without damaging or altering them in any way. NDT plays a significant role across diverse sectors like aerospace, automotive, oil and gas, construction, manufacturing, and energy, as it guarantees the safety, reliability, and durability of goods and infrastructure. Also, substantial growth in the application of NDT inspection equipment by various firms to enhance processes, minimize waste, and restrict liability fuels the expansion of the nondestructive testing equipment market analysis. The industry of non-destructive testing (NDT) equipment is going through a radical change fueled by technological innovation and automation. Artificial intelligence, cloud storage, and wireless connectivity are being integrated into NDT equipment probes and sensors to transform inspection processes in various industries.

Report Coverage

This research report categorizes the global nondestructive testing equipment market based on various segments and regions forecast revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global nondestructive testing equipment market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global nondestructive testing equipment market.

Nondestructive Testing Equipment Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 2.82 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 7.29% |

| 2033 Value Projection: | USD 5.70 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 214 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Technology, By End-User Industry |

| Companies covered:: | Olympus Corporation, Baker Hughes, YXLON International GmbH (COMET Holding AG), OkoNDT Group, Applus+ Laboratories, Mistras Group Inc., Controle Mesure Systemes SA, Fujifilm Corporation, Bureau Veritas SA, Nikon Metrology NV, and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The growing need for safety and quality control in many industries like aerospace, automotive, building construction, energy, and manufacturing are some of the major drivers. NDT methods allow materials and structures to be inspected and assessed with no damage whatsoever, which makes them inevitable to ensure product integrity and compliance with safety standards. Technological innovations, e.g., the production of more accurate and effective test equipment, including automated and robotic systems, are also driving market growth.

Restraining Factors

High equipment costs and shortage of skilled technicians hold back the market share of nondestructive testing equipment.

Market Segmentation

The global nondestructive testing equipment market share is classified into technology and end-user industry.

- The ultrasonic testing equipment segment accounted for the largest revenue share in 2023 and is projected to grow at a substantial CAGR during the forecast period.

Based on technology, the global nondestructive testing equipment market is divided into radiography testing equipment, ultrasonic testing equipment, magnetic particle testing equipment, liquid penetrant testing equipment, visual inspection equipment, eddy current equipment, and other technologies equipment. Among these, the ultrasonic testing equipment segment accounted for the largest revenue share in 2023 and is projected to grow at a substantial CAGR during the forecast period. The growth of the segment can be credited to its extensive usage in different industries because of its non-hazardous nature and affordability. Ultrasonic testing has emerged as the end-users preferred option for fault detection as it does not have any influence on the tested material while ensuring accurate results.

- The oil and gas segment accounted for the leading revenue share in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

Based on end-user industry, the global nondestructive testing equipment market is divided into oil and gas, power and energy, aerospace and defense, automotive and transportation, construction, and other end-user industries. Among these, the oil and gas segment accounted for the leading revenue share in 2023 and is anticipated to grow at a significant CAGR during the forecast period. The growth segment can be accredited to the integral function of NDT testing equipment in both the safety and integrity of petroleum extraction and refining processes. Ultrasonic and eddy current NDT testing solutions are widely applied within the industry to examine welds and metals in detail for faults and corrosion, thus preventing possibly dangerous chemicals and liquids safely enclosed in pipes and pressure vessels.

Regional Segment Analysis of the Global Nondestructive Testing Equipment Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the global nondestructive testing equipment market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the global nondestructive testing equipment market over the predicted timeframe. The market of the region is dominated by high research and development activities, which result in large-scale uptake of advanced technologies for NDT equipment. Both the United States and Canada have strong market presence in different end-user segments, most notably in aerospace, oil and gas, and power generation industries.

Asia Pacific is expected to grow at the fastest CAGR in the global nondestructive testing equipment market during the forecast period. The growth in the region is fueled by the fast pace of industrialization and growing investments in the development of infrastructure. Regional market dynamics are led by nations such as China, India, South Korea, and Australia. With the region's growing manufacturing base and a stronger focus on quality control and safety standards, a high potential for the deployment of NDT equipment across industries exists.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global nondestructive testing equipment market along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Olympus Corporation

- Baker Hughes

- YXLON International GmbH (COMET Holding AG)

- OkoNDT Group

- Applus+ Laboratories

- Mistras Group Inc.

- Controle Mesure Systemes SA

- Fujifilm Corporation

- Bureau Veritas SA

- Nikon Metrology NV

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In March 2024, IIT Kharagpur has introduced AI-powered non-destructive testing (NDT) for weld defect analysis through their Centre of Excellence in Advanced Manufacturing Technology (CoEAMT). This initiative, led by Prof. Surjya K Pal, includes two pioneering projects: "iWeld" and "iToFD".

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the global nondestructive testing equipment market based on the below-mentioned segments:

Global Nondestructive Testing Equipment Market, By Technology

- Radiography Testing Equipment

- Ultrasonic Testing Equipment

- Magnetic Particle Testing Equipment

- Liquid Penetrant Testing Equipment

- Visual Inspection Equipment

- Eddy Current Equipment

- Other Technologies Equipment

Global Nondestructive Testing Equipment Market, By End-User Industry

- Oil and Gas

- Power and Energy

- Aerospace and Defense

- Automotive and Transportation

- Construction

- Other End-User Industries

Global Nondestructive Testing Equipment Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. How big is the nondestructive testing equipment market?The global nondestructive testing equipment market size is expected to grow from USD 2.82 billion in 2023 to USD 5.70 billion by 2033.

-

2. Who are the key players in nondestructive testing equipment market?Key players are Olympus Corporation, Baker Hughes, YXLON International GmbH (COMET Holding AG), OkoNDT Group, Applus+ Laboratories, Mistras Group Inc., Controle Mesure Systemes SA, Fujifilm Corporation, Bureau Veritas SA, Nikon Metrology NV, and Others.

-

3. Which is the fastest-growing region in nondestructive testing equipment market?Asia Pacific is expected to grow at the fastest CAGR in the global nondestructive testing equipment market during the forecast period.

Need help to buy this report?