North America Air Compressor Market Size, Share, and COVID-19 Impact Analysis, By Technology (Rotary, Screw, Scroll, Reciprocating, Centrifugal, Others), By Product (Portable, Stationery), By Lubrication (Oil-free, Oil-filled, Others), By Country (United States, Canada, Mexico, Rest of North America), and North America Air Compressor Market Insights Forecasts to 2032

Industry: Machinery & EquipmentNorth America Air Compressor Market Size Insights Forecasts to 2032

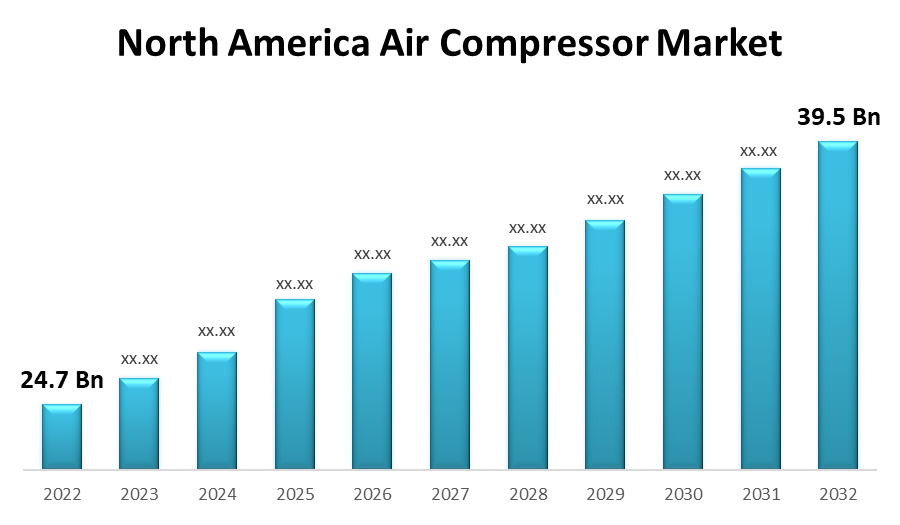

- The North America Air Compressor Market Size was valued at USD 24.7 Billion in 2022.

- The Market Size is growing at a CAGR of 4.8% from 2022 to 2032.

- The North America Air Compressor Market Size is expected to reach USD 39.5 Billion by 2032.

- The United States is expected to grow the fastest during the forecast period.

Get more details on this report -

The North America Air Compressor Market Size is expected to reach USD 39.5 Billion by 2032, at a CAGR of 4.8% during the forecast period 2022 to 2032.

Market Overview

Increasing demand for home appliances such as refrigerators and air conditioners, combined with rising living standards, will have a significant impact on demand for air compressors. Also, rising automobile demand, increased mining and oil exploration, and developments in the energy and power generation sectors are expected to drive North America air compressor market growth during the forecast period. Additionally, high potential energy and healthcare industries in the United States are expected to further boost air compressor demand. Moreover, the North American compressor market is expected to be driven by rising demand from refineries and petrochemical plants, where compressors play an important role in a variety of gas-related operations. On the contrary, the increasing use of renewable energy sources that do not require compressors may pose a constraint. The abundance of proven shale reserves in countries such as Canada and Mexico, on the other hand, is poised to fuel gas transportation needs, opening up numerous opportunities for the North American compressor market.

Report Coverage

This research report categorizes the market for North America Air Compressor Market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America Air Compressor Market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the North America Air Compressor Market.

North America Air Compressor Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 24.7 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 4.8% |

| 2032 Value Projection: | USD 39.5 Billion |

| Historical Data for: | 2019-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Technology, By Product, By Lubrication, By Country |

| Companies covered:: | Ingersoll Rand, Atlas Copco, Gardner Denver, Sullair, Kaeser Compressors, Quincy Compressor, Chicago Pneumatic, FS-Elliott, Mattei Compressors, Powerex, Saylor-Beall Manufacturing, AireTex Compressors, Sauer Compressors, ELGi Compressors, Eaton Compressor, Air Technologies, C-Aire Compressors, Air Compressor Works, Air Centers of Florida and Other Key Players. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The adoption of energy-efficient air compressors is being driven by increased awareness of energy conservation and stringent environmental regulations. Companies strive to reduce energy consumption and emissions, which contributes to the growth of the North America air compressor market during the forecast period. The thriving industrial sectors of North America, such as manufacturing, oil and gas, and automotive, are critical drivers of the North American air compressor market. Furthermore, this demand is being driven by the increasing need for compressed air in a variety of applications such as machinery operation and pneumatic tools. Across North America, organizations prioritize sustainable practices. This has resulted in a shift toward oil-free compressors, which reduce the risk of oil contamination while also aligning with environmentally friendly initiatives.

Restraining Factors

Air Compressors have become prohibitively expensive, which is hindering market growth during the forecast period. In addition to the high initial cost, the upfront investment for high-quality air compressors, particularly for advanced technologies, can be a significant barrier for small and medium-sized businesses.

Market Segment

- In 2022, the rotary segment accounted for the largest revenue share over the forecast period.

Based on the technology, the North America air compressor market is segmented into rotary, screw, scroll, reciprocating, centrifugal, and others. Among these, the rotary segment has the largest revenue share over the forecast period. This prominence is attributed to the increasing demand for rotary air compressors, which are driven by their inherent advantages of high efficiency, low installation costs, and low maintenance costs. As a result, the market's trajectory highlights the incredible expansion and access of these air compressors during the forecast period.

- In 2022, the portable segment accounted for the highest revenue share over the forecast period.

Based on the product, the North America air compressor market is segmented into portable and stationery. Among these, the portable segment has the largest revenue share over the forecast period, owing to the increasing adoption of these products in construction and mining activities. Portable air compressors provide dependable power to machines and tools in the construction industry, among others. In addition, because these compressors require less maintenance and are simple to operate, their popularity in low-duty applications is growing.

- In 2022, the oil-filled segment accounted for the significant revenue growth over the forecast period.

Based on application, the North America air compressor market is segmented into oil-free, oil-filled, and others. Among these, the oil-filled segment has the largest revenue share over the forecast period. Oil-filled air compressors are widely used in a variety of commercial sectors, including energy, manufacturing, and production. These compressors have gained widespread acceptance due to their durability and low noise emission when compared to their oil-free counterparts.

- In 2022, the United States (U.S.) nation is expected to grow at a substantial CAGR in the North America air purifier market during the forecast period.

Based on the countries, the United States is expected to dominate the North America air compressor market growth over the forecast period. Its high capacity for oil and gas refining, combined with robust manufacturing and industrial sectors, drives demand for air compressors. Leading players in the United States, such as Ingersoll Rand, Atlas Copco, and Gardner Denver, have established a strong foothold, adding to the competitive landscape. The United States is also concerned with sustainability, encouraging the use of oil-free compressors to comply with stringent environmental regulations.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the North America air compressor market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Ingersoll Rand

- Atlas Copco

- Gardner Denver

- Sullair

- Kaeser Compressors

- Quincy Compressor

- Chicago Pneumatic

- FS-Elliott

- Mattei Compressors

- Powerex

- Saylor-Beall Manufacturing

- AireTex Compressors

- Sauer Compressors

- ELGi Compressors

- Eaton Compressor

- Air Technologies

- C-Aire Compressors

- Air Compressor Works

- Air Centers of Florida

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In March 2023, Atlas Copco announced the acquisition of Quincy Compressor, a US manufacturer of air compressors.

- In February 2023, Kaeser Kompressoren launched a new oil-free air compressor line for the North American market.

- In January 2023, Ingersoll-Rand announced the release of its new portable air compressor line for the North American market.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2021 to 2032. Spherical Insights has segmented the North America air compressor market based on the below-mentioned segments:

North America Air Compressor Market, By Technology

- Rotary

- Screw

- Scroll

- Reciprocating

- Centrifugal

- Others

North America Air Compressor Market, By Product

- Portable

- Stationery

North America Air Compressor Market, By Lubrication

- Oil-free

- Oil-filled

North America Air Compressor Market, By Country

- United States

- Canada

- Mexico

- Rest of North America

Need help to buy this report?