North America Air Conditioning Systems Market Size, Share, and COVID-19 Impact Analysis, By Type (Unitary, Rooftop, PTAC), By Technology (Inverter, Non-Inverter), By End-Use Industry (Residential, Commercial, Industrial), and North America Air Conditioning Systems Insights Forecasts to 2032

Industry: Consumer GoodsNorth America Air Conditioning Systems Market Insights Forecasts to 2032

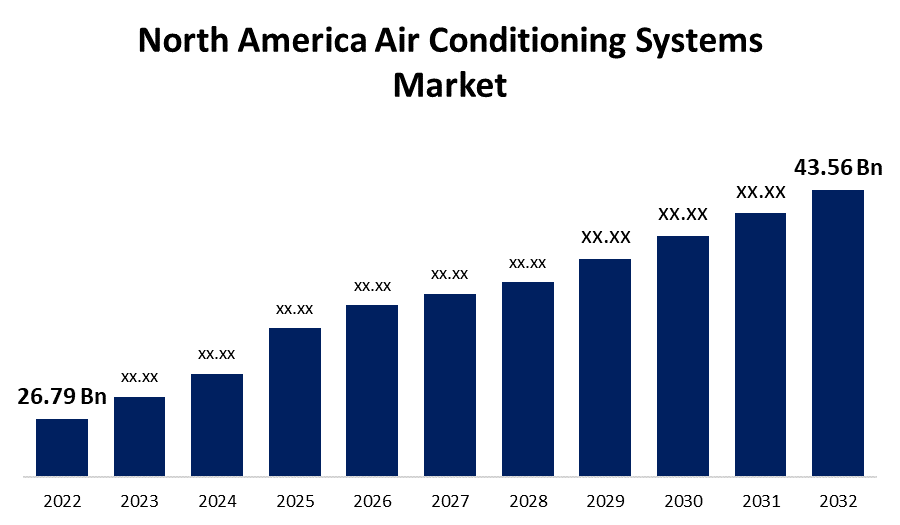

- The North America Air Conditioning Systems Market Size was valued at USD 26.79 Billion in 2022.

- The Market Size is Growing at a CAGR of 4.9% from 2022 to 2032.

- The North America Air Conditioning Systems Market Size is expected to reach USD 43.56 Billion by 2032.

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

The North America Air Conditioning Systems Market Size is expected to reach USD 43.56 Billion by 2032, at a CAGR of 4.9% during the forecast period 2022 to 2032.

Market Overview

The fundamental structure of the air conditioning system is based on coolant, compression, and condensation-based machinery, and its objective is designed to reduce the internal/external air and keep the area at a conditioned level. The air conditioning is part of a system and technique family that provides heating, ventilation, and air conditioning (HVAC). Heating and cooling systems are similar to air conditioners in many ways, except they employ a bidirectional valve to heat and cool an enclosed environment. HVAC systems are projected to consume 39% of the energy utilized in the commercial sector in the United States in the coming years. As a result, most businesses and government agencies have the ability to save significantly simply by enhancing their control of HVAC operations and the operational effectiveness of the system they utilize. Air conditioning systems are widely employed in a variety of settings, including residences, retail places, offices, and entertainment centers. Air conditioning systems have played a significant role in changing the internal atmosphere, particularly in hot and dry locations, and have become an important component of the infrastructure that supports modern structures. Furthermore, rising demand for power-saving ratings, rigorous policies and regulations governing efficient energy use in the United States, and increased customer awareness are expected to drive demand for air conditioning systems.

Report Coverage

This research report categorizes the market for North America Air Conditioning Systems based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America Air Conditioning Systems Market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the North America Air Conditioning Systems Market.

North America Air Conditioning Systems Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 26.79 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 4.9% |

| 2032 Value Projection: | USD 43.56 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Type, By Technology, By End-Use Industry |

| Companies covered:: | Carrier Corporation, Daiki Industries Ltd, Haier Group, LG Electronics, Mitsubishi Electric, Whirlpool Corporation, Arcelik, BSH Group, Electrolux, Hitachi Air Conditioning, Ingersoll Rand, Goodman, Samsung Electronics, Lennox |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

One of the key drivers projected to propel the industry's growth is increasing demand for products that save energy and electricity. The market is expected to see a wide range of innovative products and developments as technology advances. In addition to their energy-efficient characteristics, which help meet rigorous energy laws, inverter-based and solar-based air conditioning systems are projected to see substantial growth over the forecast period. Furthermore, as a result of rising development, the North American air conditioning systems market is predicted to rise in sales.

Temperatures in American cities, as well as cities spread over the sun zone of South Western and Southern America, are gradually rising as a result of rising temperatures and changing weather patterns, which is also driving an increase in the use of various air conditioners in the region. Furthermore, because it is a huge industrialized country with a diverse range of large, medium, and small firms, the United States leads the global marketplace for air conditioning equipment. Significant growth in e-commerce, transportation, and extremely cost-effective designs for huge towers, as well as the proposed construction of roughly 460 structures, are increasing the demand for air conditioning systems in the United States.

Restraining Factors

However, increasing competition among well-established companies and Chinese suppliers selling items at lower prices may provide an obstruction to expansion in North American countries such as the United States and Canada. Furthermore, tough competition from Chinese manufacturers such as Haier, Gree, and Midea is expected to be a source of have implications for local manufacturers, resulting in lower earnings. As a result, these factors are projected to limit the projected expansion of the North America air conditioning systems market over the forecast period.

Market Segment

- In 2022, the unitary gallons segment is witnessing a higher growth rate over the forecast period.

On the basis of type, the North America Air Conditioning Systems Market is segmented into unitary, rooftop, and PTAC. Among these, the unitary segment is expected to develop at a faster rate during the forecast period. The significant benefits of unitary air conditioners include minimal installation costs, which include labor expenses for setup and assembly. Rising temperatures and increased demand for household air conditioning systems are predicted to drive up the market for unitary air conditioners. The usage of unitary air conditioning in schools, workplaces, and hospitals is likely to boost demand for North America air conditioning system market.

- In 2022, the inverter segment accounted for the largest revenue share of more than 27.3% over the forecast period.

On the basis of technology, the North America Air Conditioning Systems Market is segmented into inverter and non-inverter. Among these, the inverter segment is dominating the market with the largest revenue share of 58.3% over the forecast period. Inverter technology is used by air conditioner system makers due to benefits such as the flexibility to alter the power source frequency used by the compressors. Because of the compressor speed modification for adjusting the gas flow rate, inverter-based ACs spend considerably less energy, allowing the inverter-powered ACs to precisely regulate their working capacity. As a result, the combination of low energy usage and low costs favors demand for the air conditioning systems market.

- In 2022, the online segment accounted for the largest revenue share of more than 34.2% over the forecast period.

On the basis of end-use industry, the North America Air Conditioning Systems Market is segmented into residential, commercial, and industrial. Among these, the online segment is dominating the market with the largest revenue share of 34.2% over the forecast period. The residential category is expected to develop faster than average due to innovative end-use applications such as air conditioners in tents. The increased demand for mobile systems for camping vacations and outdoor activities might be traced to the rising demand for domestic air conditioning systems. A rise in consumer spending paired with falling house finance rates in the region is also expected to benefit market expansion.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the North America Air Conditioning Systems along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Carrier Corporation

- Daiki Industries Ltd

- Haier Group

- LG Electronics

- Mitsubishi Electric

- Whirlpool Corporation

- Arcelik

- BSH Group

- Electrolux

- Hitachi Air Conditioning

- Ingersoll Rand

- Goodman

- Samsung Electronics

- Lennox

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In January 2023, Daikin Comfort Technologies North America, Inc. (Daikin) has acquired Williams Distributing, Co. (Williams). This strategic acquisition complements Daikin's objective of expanding the use of inverter heat pump technology in cold climates, as Williams' market covers a substantial chunk of the Midwest.

- In December 2022, Daikin Comfort Technologies, the Japanese air conditioning firm's division in North America for unitary, ductless, light commercial, and VRV products, has purchased US controls manufacturer Venstar Inc.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2021 to 2032. Spherical Insights has segmented the North America Air Conditioning Systems based on the below-mentioned segments:

North America Air Conditioning Systems Market, By Type

- Unitary

- Rooftop

- PTAC

North America Air Conditioning Systems Market, By Technology

- Inverter

- Non-Inverter

North America Air Conditioning Systems Market, By End-Use Industry

- Residential

- Commercial

- Industrial

North America Air Conditioning Systems Market, By Country

- United States

- Canada

- Mexico

Need help to buy this report?