North America Automotive Foam Market Size, Share, and COVID-19 Impact Analysis, By Type (Polyurethane Foams (PUFs), Polyolefin), By Application (Seating, Bumper Systems), By End Use (Cars, LCVs), By Region (US, Canada, Mexico, Rest of North America), and North America Automotive Foam Market Insights Forecasts to 2033

Industry: Automotive & TransportationNorth America Automotive Foam Market Insights Forecasts to 2033

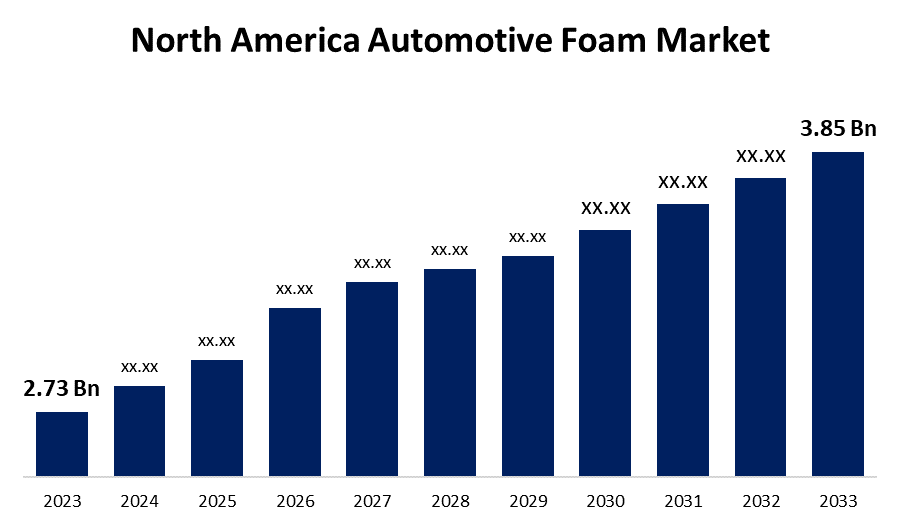

- The North America Automotive Foam Market Size was valued at USD 2.73 Billion in 2023.

- The Market Size is Growing at a CAGR of 3.5% from 2023 to 2033.

- The North America Automotive Foam Market Size is Expected to Reach USD 3.85 Billion by 2033.

Get more details on this report -

The North America Automotive Foam Market Size is expected to reach USD 3.85 Billion by 2033, at a CAGR of 3.5% during the forecast period 2023 to 2033.

Market Overview

Automotive foam refers to polymer foams created by injecting a gas or combining a foaming agent and a solid. Blowing agents, which can be chemical or physical gases, are used to make automotive foam. Automotive foams are supple and flexible, providing passengers with a comfortable ride. Polyols, ethane, propane, and toluene diisocyanate (TDI) are key components in the production of automobile foam. Automotive foams are specialized materials used in vehicle manufacturing that are specifically designed to meet the industry's unique requirements. These foams are designed to have specific properties, like durability, flexibility, and weight reduction. They are used in a variety of settings, including seating, headliners, door panels, instrument panels, and bumper systems. The North American automotive foams market is expanding rapidly due to rising demand for lightweight, fuel-efficient vehicles. Automotive foams are materials used in a variety of applications in the automotive industry, including seating, interior components, insulation, and gaskets. These foams provide a variety of benefits, including noise reduction, vibration damping, thermal insulation, and increased comfort.

Report Coverage

This research report categorizes the market for North America automotive foam market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America automotive foam market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the North America automotive foam market.

North America Automotive Foam Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 2.73 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 3.5% |

| 2033 Value Projection: | USD 3.85 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Application, By End Use, By Region and COVID-19 Impact Analysis. |

| Companies covered:: | BASF SE, ARMACELL, Woodbridge, Wisconsin Foam Products, Dow Inc., Rogers Corp., American Excelsior, Inc., Toray Plastics (America), Inc., Bridgestone Corp., Custom Foam Systems, Grand Rapids Foam Technologies, Saint-Gobain and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The automotive industry's relentless pursuit of improved fuel efficiency and lower greenhouse gas emissions is a key driver of the North American automotive foam market. Also, the automobile manufacturers are constantly under pressure to meet stringent fuel efficiency and emissions regulations. To achieve these objectives, they seek lightweight materials that will reduce vehicle weight and increase overall efficiency. Automotive foam materials, particularly lightweight and low-density foams, are critical to this goal. These foams are used in a variety of vehicle components, including seating, insulation, and body structure, to reduce weight while preserving structural integrity. Furthermore, the reduction in vehicle weight leads to better fuel economy, lower carbon emissions, and compliance with environmental regulations. Another important factor driving the North American automotive foam market is the desire for improved vehicle interior comfort and noise reduction. Customers expect a quiet, comfortable, and enjoyable driving experience. Moreover, automotive foam improves interior acoustics and comfort, which helps to meet these expectations.

Restraining Factors

The prices of raw materials used to make automotive foams, such as polyurethane and polystyrene, fluctuate. Price volatility can have an impact on manufacturers' profitability. Also, the production of automotive foams necessitates significant capital investment in manufacturing facilities and equipment. Furthermore, this high initial investment may serve as a barrier to entry for new market participants. Moreover, automotive foams are difficult to recycle owing to their complex composition and inclusion of additives. Limited recycling options for automotive foams pose environmental risks and may hamper market growth.

Market Segment

- In 2023, the polyurethane foams (PUFs) segment accounted for the largest revenue share over the forecast period.

Based on the type, the North America automotive foam market is segmented into polyurethane foams (PUFs) and polyolefin. Among these, the polyurethane foams (PUFs) segment has the largest revenue share over the forecast period. Low density, durability, high load-bearing capacity, good compressibility, water resistance, and excellent sound absorption properties make them suitable for Noise, Vibration, and Harshness (NVH) solutions, as well as in various automobile components such as seats, armrests, and headrests.

- In 2023, the seating segment accounted for the largest revenue share over the forecast period.

Based on the application, the North America automotive foam market is segmented into seating and bumper systems. Among these, the seating segment has the largest revenue share over the forecast period. The automotive industry encourages designers and engineers to improve automotive seating for greater comfort, safety, flexibility, durability, and ergonomics. This has driven up product consumption in seating applications. The chemistry used in the production of PUFs allows it to be molded into unusual shapes, making it suitable for seating applications.

- In 2023, the cars segment accounted for the largest revenue share over the forecast period.

Based on the end use, the North America automotive foam market is segmented into cars and LCVs. Among these, the cars segment has the largest revenue share over the forecast period. The growing demand for low-emission vehicles has driven manufacturers to innovate and develop new technologies to reduce their environmental impact. This has boosted the EV segment. The presence of leading EV manufacturers in North America, such as Tesla, BYD Company Ltd., Daimler AG, Ford Motor Company, and General Motors, has increased demand for automotive foams used in the production of vehicle seats, arms, headrests, headliners, door panels, and bumper systems.

- In 2023, the United States accounted for the largest revenue share over the forecast period.

Based on region, the United States segment has the largest revenue share over the forecast period, due to its advanced manufacturing facilities, technological prowess, and high consumer demand for vehicle comfort and luxury. The market in this region is also being driven by the presence of major automobile manufacturers and the increased use of polyurethane foams for seating, insulation, and cushioning applications. According to OICA statistics, the United States is the leading producer of automobiles and commercial vehicles in North America. Ford Motors' F-Series truck maintained its dominance, followed by pickups from General Motors and Fiat Chrysler.

The automotive sector is an important part of Canada's economy and one of the country's largest manufacturing industries. The presence of automotive OEMs such as General Motors, Honda Motor Co., Ltd., Ford Motor Company, TOYOTA MOTOR CORPORATION, and Stellantis N.V. has established Canada as one of the top 12 light vehicle producers. Furthermore, the elimination of tariffs on imported passenger vehicles as part of the Trans-Pacific Partnership trade agreement is expected to boost the passenger vehicle market while also propelling the automotive foam market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the North America automotive foam market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- BASF SE

- ARMACELL

- Woodbridge

- Wisconsin Foam Products

- Dow Inc.

- Rogers Corp.

- American Excelsior, Inc.

- Toray Plastics (America), Inc.

- Bridgestone Corp.

- Custom Foam Systems

- Grand Rapids Foam Technologies

- Saint-Gobain

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In September 2022, Covestro AG introduced polyether polyols made from bio-circular feedstocks such as renewable toluene diisocyanate (TDI), which can be used as key raw materials in the production of flexible polyurethane foams used in automobile seats.

Market Segment

This study forecasts country revenue from 2022 to 2033. Spherical Insights has segmented the North America Automotive Foam Market based on the below-mentioned segments:

North America Automotive Foam Market, By Type

- Polyurethane Foams (PUFs)

- Polyolefin

North America Automotive Foam Market, By Application

- Seating

- Bumper Systems

North America Automotive Foam Market, By End-User

- Cars

- LCVs

North America Automotive Foam Market, By Region

- US

- Canada

- Mexico

- Rest of North America

Need help to buy this report?