North America Bakery Product Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Bread, Cakes & Pastries, Biscuits & Cookies, Others), By Form (Fresh, Frozen), By Distribution Channel (Supermarkets/Hypermarkets, Specialty Stores, Convenience Stores, Others), By Country (United States, Canada, Mexico, Rest of North America), and North America Bakery Product Market Insights Forecasts to 2032

Industry: Food & BeveragesNorth America Bakery Product Market Size Insights Forecasts to 2032

-

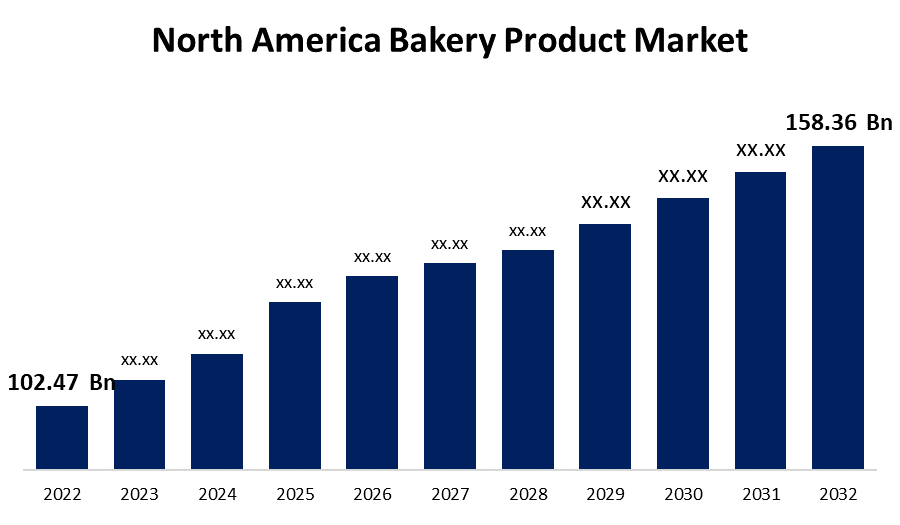

The North America Bakery Product Market Size was valued at USD 102.47 Billion in 2022.

- The Market is Growing at a CAGR of 4.45% from 2022 to 2032.

- The North America Bakery Product Market size is expected to reach 158.36 Billion by 2032.

Get more details on this report -

The North America Bakery Product Market Size is expected to reach USD 158.36 Billion by 2032, at a CAGR of 4.45% during the Forecast Period 2022 to 2032.

Market Overview

Bread, biscuits, pretzels, crackers, buns, rolls, macaroni or similar pastes, pastries, cakes, doughnuts, pies, or other food products containing flour or meal are examples of bakery products but do not include pre-packaged mixes. Buyers are more willing to adopt Western cuisines, including baking, which is driving the bakery products market's expansion. Furthermore, consumer demand for on-the-go snack options, such as baked goods, has been steadily rising. In North America, the industry includes a variety of products that cater to different consumer preferences, such as bread, pastries, cakes, and cookies. This segment is distinguished by a rising demand for healthier and artisanal baked goods, which is being driven by changing consumer tastes and a priority on quality ingredients. Furthermore, in response to consumer demand, several large or private label manufacturers are producing various types of bread such as gluten-free bread, anadama bread, cookies, cakes, whole wheat bread, multi-grain biscuits, and bread. In addition, bakery products are in substantial demand due to their accessibility and low cost. Furthermore, the bakery industry continues to change with the introduction of new products, resulting in additional growth. The growing influence of Western diets, increased urbanization, and an increase in the number of working women all contribute significantly to market growth in the forecast period.

Report Coverage

This research report categorizes the market for North America bakery products based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America bakery product market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the North America bakery product.

North America Bakery Product Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 102.47 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 4.45% |

| 2032 Value Projection: | USD 158.36 Billion |

| Historical Data for: | 2019-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | COVID-19 Impact Analysis, By Product Type, By Form, By Distribution Channel, By Country |

| Companies covered:: | Cole's Quality Foods Inc., Dawn Food Products Inc, General Mills Inc., United Biscuits, Barilla Holding S.p.A., Britannia Industries Limited, Dunkin' Donuts LLC, Grupo Bimbo S.A.B. de C.V, Mondelez International Inc., and Other key vendors |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The North American region is expected to the reach fastest growth in the bakery products market. The bakery market is primarily driven by convenience. The need for convenient solutions in all aspects of life is increased by a fast-paced lifestyle. Long work days make it difficult for consumers to devote more time to cooking. As a result, a busy lifestyle increases the consumption of ready-to-eat bakery products such as bread, cookies, cakes, tortillas, frozen pizza, and biscuits. The high spending power and growing urbanization, which result in a fast-paced lifestyle, play an important role in increasing demand for convenient food. Furthermore, the rising popularity of natural nutrition, healthy living, and organic products has increased demand for whole wheat, natural, light (low calorie), and additive-free bakery products. In addition, increased demand for whole wheat, gluten-free, and multigrain bakery products is driving demand. The increased availability of such specialized bakery products will contribute to the revenue growth of the bakery products market growth in North America.

Restraining Factors

The strong brand loyalty and the requirement for significant capital investments, the bakery industry faces significant competition, resulting in high barriers to entry. Major corporations use a variety of strategies to achieve optimal business growth, including joint ventures, mergers and acquisitions, strategic partnerships with regional manufacturers, and distribution channel diversification.

Market Segment

- In 2022, the bread segment accounted for the largest revenue share over the forecast period.

Based on the product type, the North America bakery product market is segmented into bread, cakes & pastries, biscuits & cookies, and others. Among these, the bread segment has the largest revenue share over the forecast period. Bread contains a lot of salt, but it can also provide a lot of fiber to the diet. The use of bread labels may encourage consumers to choose bread with higher nutritional value. In North America bread is mostly used for breakfast such a factor boosts market growth during the forecast period.

- In 2022, the frozen segment accounted for the largest revenue share over the forecast period.

On the basis of form, the North America bakery product market is segmented into fresh and frozen. Among these, the frozen segment has the largest revenue share over the forecast period. Because frozen bakery products require less time and effort, the rise in consumer preference for convenience foods indirectly boosts demand for them. The processed food market is being driven by the increased need for convenience as a result of busy customer lifestyles. As a result, demand for frozen bakery products has increased. Furthermore, rapid growth in the frozen food industry due to rapidly growing urban households in developing countries is expected to drive demand for frozen bakery products.

- In 2022, the speciality stores segment is expected to hold the largest share of the North America bakery product market during the forecast period.

Based on the distribution channel, the North America bakery product market is classified into supermarkets/hypermarkets, speciality stores, convenience stores, and others. Among these, the speciality stores segment is expected to hold the largest share of the North America bakery product market during the forecast period. The market's key players are focusing on the research and development of new products to meet rising consumer demand for speciality bakeries. Artisanal bakery products are primarily sold in speciality stores, such as independent stores. Rising health consciousness has prompted bakery manufacturers to include functional ingredients in their products such as legumes, oats, probiotics, fortified margarine, and cereals. As a result, continuous product development will aid industry growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the North America bakery product market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies.

- Cole's Quality Foods Inc.

- Dawn Food Products Inc

- General Mills Inc.

- United Biscuits

- Barilla Holding S.p.A.

- Britannia Industries Limited

- Dunkin' Donuts LLC

- Grupo Bimbo S.A.B. de C.V

- Mondelez International Inc.

- other key vendors

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In January 2023, Sara Lee, a brand of Bimbo Bakeries in the United States, introduced new white bread made with vegetables. According to the company, the product is baked with one cup of vegetables per loaf and fortified with vitamins A, D, and E.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2021 to 2032. Spherical Insights has segmented the North America bakery product market based on the below-mentioned segments:

North America Bakery Product, By Product Type

- Bread

- Cakes & Pastries

- Biscuits & Cookies

- Others

North America Bakery Product Market, By Form

- Fresh

- Frozen

North America Bakery Product Market, By Distribution Channel

- Supermarkets/Hypermarkets

- Specialty Stores

- Convenience Stores

- Others

North America Bakery Product Market, By Country

- United States

- Canada

- Mexico

- Rest of North America

Need help to buy this report?