North America Chocolate Market Size, Share, and COVID-19 Impact Analysis, By Product (Traditional, Artificial), By Type (Dark Chocolate, Milk Chocolate, Unsweetened Chocolate, White Chocolate), By Application (Food & Beverage, Cosmetics, Pharmaceuticals, Others), By Distribution Channel (Online, Offline), By Country (United States, Canada, Mexico, Rest of North America) and North America Chocolate Market Insights Forecasts to 2032

Industry: Food & BeveragesNorth America Chocolate Market Insights Forecasts to 2032

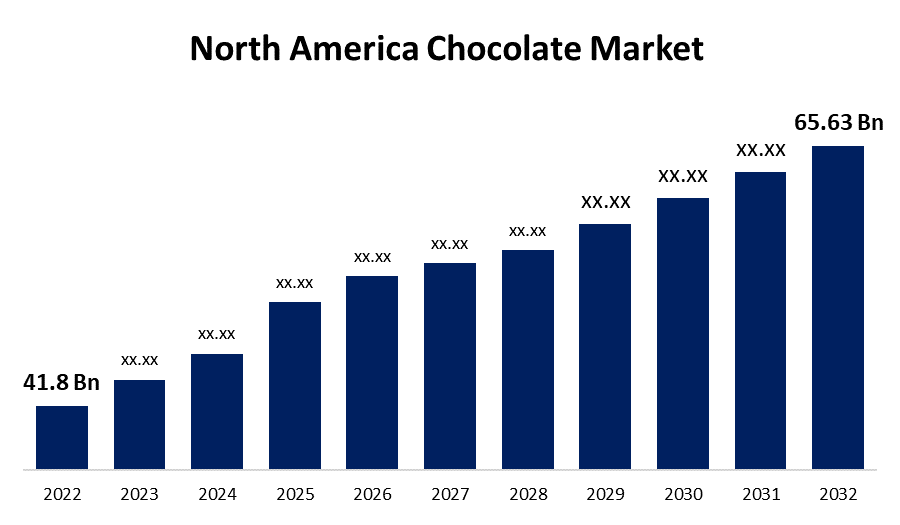

- The North America Chocolate Market Size was valued at USD 41.8 Billion in 2022.

- The market is growing at a CAGR of 4.6% from 2022 to 2032.

- The North America Chocolate Market Size is expected to reach USD 65.63 Billion by 2032.

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

The North America Chocolate Market Size is expected to reach USD 65.63 Billion by 2032, at a CAGR of 4.6% during the forecast period 2022 to 2032.

Market Overview

The North American chocolate market is considered one of the world's largest and most developed markets. Chocolate is a popular food that people of all ages appreciate, and its consumption is firmly engrained in the culture. It contains chocolate bars, boxed chocolates, chocolate candy, chocolate spreads, and other items. The region's strong chocolate affinities, combined with high discretionary incomes, make it an appealing market for chocolate producers. Mars, Hershey's, Nestlé, Lindt, and Ferrero are among the major companies in the North American chocolate market. Consumers are increasingly preferring high-quality, premium chocolates with distinctive flavors and ingredients. Customers enjoy the workmanship and unique experiences that artisanal and craft chocolate makers provide. In addition, the growing consumer consciousness of their physical and mental well-being has resulted in a need for better chocolate alternatives. This has fueled the demand for dark chocolate, which is regarded to be healthier because of its higher cocoa quantity and lower sugar levels. Furthermore, chocolates are a preferred gifting option for a variety of events such as holidays, birthdays, and celebrations. This increases the demand for visually appealing and well-packaged chocolate gift products.

Report Coverage

This research report categorizes the market for North America Chocolate Market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America Chocolate Market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the North America Chocolate Market.

North America Chocolate Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 41.8 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 4.6% |

| 2032 Value Projection: | USD 65.63 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Product, By Type, By Application, By Distribution Channel, By Country, and COVID-19 Impact Analysis |

| Companies covered:: | Panasonic Corporation, Toshiba Corporation, Nissan Motor Co., Ltd., Hitachi Chemical Co., Ltd., FDK Corporation, ELIIY-Power, KYOCERA, NEC Corporation, Murata, EV Energy, Marubeni Corporation, and and GS Yuasa International Ltd And Other Key Venders And Other Key Venders. |

| Pitfalls & Challenges: | COVID-19 has the potential to impact the global market |

Get more details on this report -

Driving Factors

Consumers' preference for high-quality confections made from chocolate, especially single-origin chocolates, organic chocolates, handcrafted chocolates, dark chocolates, and other chocolate products is a major element driving the region's chocolate market. Customer demand for premium chocolates has increased as a result of greater consumer buying power and intensified advertising and promotional efforts. Furthermore, higher-end brands contain additional components such as almonds, raspberry chunks, or alcohol, and their packaging conveys a more refined sense. Chocolate makers are becoming more involved in the development of low-sugar or sugar-free products as customers grow more health-conscious, especially since the prevalence of diabetes and overweight individuals rises.

Furthermore, as the importance of social media platforms in a shopper's decision-making process grows, businesses are adjusting and ramping up their marketing, campaigning, and endorsement techniques across various distribution channels to gain consumer interest. With the greatest revenue in the region in 2022, the United States dominated the North America Chocolate market. Chocolate festivals are prevalent in the United States, where they highlight the inventions and recipes of restaurants, bakeries, and chocolatiers. In addition, these events help to establish new trends in the chocolate industry, which increases demand for cocoa-based products. Also, the rising demand for naturally produced chocolate owing to its health benefits increases the country's need for cocoa. Moreover, the food and beverage industry in Canada generates a significant amount, making it the country's second-largest manufacturing industry. In addition, the country has an extensive number of bakeries, cafes, and restaurants, which boosts the demand for cocoa products.

Market Segment

- In 2022, the milk chocolate segment accounted for the largest revenue share of more than 61.3% over the forecast period.

Based on the Type, the North America Chocolate Market is segmented into dark chocolate, milk chocolate, unsweetened chocolate, and white chocolate. Among these, the milk chocolate segment has the largest revenue share of 61.3% over the forecast period. Milk chocolates contain an exceptionally high milk content and a low cocoa concentration, thus leaving them creamy in texture with a delicate taste. This is predicted to be recognized as the product's key growth driver throughout the forecast period. Growth of this segment is also expected to be driven by rising demand for the product as an ingredient in icing on cakes, cupcakes, puddings, and other sweets. Chocolate consumption also improves cognition, lowers the risk of heart strokes and attacks, and enhances the immune system's effectiveness. It's also high in flavonoids, which are inhibitors that fight free radicals while also improving the circulatory system.

- In 2022, the artificial segment is influencing the largest CAGR over the forecast period.

On the basis of product, the North America Chocolate Market is segmented into traditional and artificial. Among these segments, the artificial segment dominates the largest market share over the forecast period. Carob candy is without any caffeine making it perfect for caffeine-sensitive people. According to Caffeine Informer, about 10% of the global population is caffeine sensitive. Furthermore, carob has about three times the calcium content of cocoa. This makes it particularly common among calcium-deficient people and women.

- In 2022, the food & beverage segment accounted for the largest revenue share of more than 64.2% over the forecast period.

On the basis of application, the North America Chocolate Market is segmented into food & beverage, cosmetics, pharmaceuticals, and others. Among these, the food & beverage segment has the largest revenue share of 64.2% over the forecast period. Chocolate is still a popular flavor in new beverage, bread, and confectionery product releases. It continues to be a popular ingredient in the desserts and refreshments industries. This development is expected to drive demand for cocoa butter and cocoa powder in the coming years. The rising gourmet and specialty cocoa-based options are being aided by the North American food service business. Foodservice huge corporations require more customized, value-added, and multifunctional solutions, which are expected to fuel the North America Chocolate Market.

- In 2022, the offline segment dominated with more than 57.8% market share

Based on the distribution channel, the North America Chocolate Market is segmented into online and offline. Offline distribution channel has captured the highest market share in the offline in chocolate market. Offline stores provide substantial benefits to customers, such as greater range, reduced costs, and increased awareness of globally recognized brands, making them an ideal platform for all sorts of buyers. Furthermore, people prefer physical stores since they can gain fast enjoyment of the product and choose it in person for greater satisfaction. Moreover, as consumer demand grows, manufacturers are opening outlets in malls, which will enhance chocolate sales in offline domains such as supermarkets and hypermarkets over the forecast period.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the North America Chocolate Market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- The Hershey Company

- Mars, Incorporated

- Nestlé

- Ferrero

- Chocoladefabriken Lindt & Sprüngli AG

- Godiva

- Ghirardelli Chocolate Company

- Mondelēz International

- General Mills Inc.

- Clif Bar & Company

- Cargill, Inc.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- On June 2023, Puratos Canada has announced the acquisition of Foley's Chocolate, a prominent producer of genuine and compound chocolate to North American industrial firms. Puratos is now one of the country's leading chocolate makers, as well as the only indigenous manufacturer of bakery, patisserie, and chocolate ingredients. In addition to extending the company's market footprint, the merged company will introduce a variety of health and well-being-focused ingredients to meet changing consumer demands.

- On May 2022, Barry Callebaut, the world's largest manufacturer of high-quality chocolate and cocoa products, announced the addition of dairy-free organic chocolate to its North American portfolio as part of its latest development of its plant-based portfolio. Dairy-free organic chocolate and the full Plant Craft portfolio meet the growing demand in the sweets and snacking industries for vegan and dairy-free solutions.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2021 to 2032. Spherical Insights has segmented the North America Chocolate Market based on the below-mentioned segments:

North America Chocolate Market, By Product

- Traditional

- Artificial

North America Chocolate Market, By Type

- Dark Chocolate

- Milk Chocolate

- Unsweetened Chocolate

- White Chocolate

North America Chocolate Market, By Application

- Food & Beverage

- Cosmetics

- Pharmaceuticals

- Others

North America Chocolate Market, By Distribution Channel

- Online

- Offline

North America Chocolate Market, By Country

- United States

- Canada

- Mexico

Need help to buy this report?