North America Data Centre Server Market Size, Share, and COVID-19 Impact Analysis, By Product (Rack Servers, Blade Servers, Micro Servers, Tower Servers), By Organization Size (Small, Medium, Large), By Application (Industrial, Commercial), By Country (United States, Canada, Mexico, Rest of North America), and North America Data Center Server Market Insights Forecasts to 2032.

Industry: Information & TechnologyNorth America Data Centre Server Market Insights Forecasts to 2032

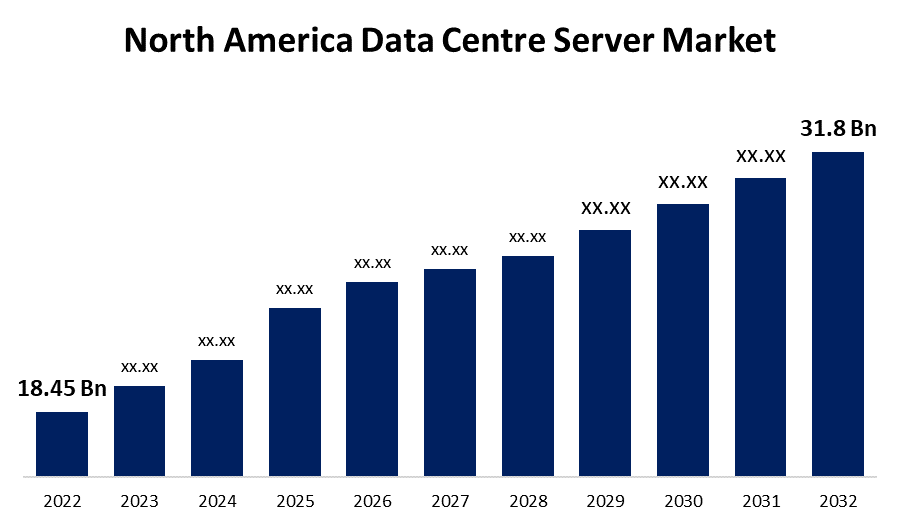

- The North America Data Centre Server Market Size was valued at USD 18.45 Billion in 2022.

- The Market is growing at a CAGR of 5.6% from 2022 to 2032.

- The North America Data Centre Server Market Size is expected to reach 31.8 Billion by 2032.

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

The North America Data Centre Server Market Size is expected to reach USD 31.8 Billion by 2032, at a CAGR of 5.6% during the forecast period 2022 to 2032.

Market Overview

A data centre server, particularly in the simplest of terms, is a physical structure that businesses access to store their essential programs and data. The design of a data centre is built on a network of storage and computing assets that allow for the delivery of shared applications and data. Routers, switches, firewalls, storage systems, servers, and application servers are crucial components of a data centre design. As more individuals adopt the practice of transferring data across public clouds and other commercial facilities, such as colocation sites and network providers' points of the present location. Furthermore, the North American region currently leads the data centre server market. As a result, the demand for the Internet of Things (IoT), which needs the usage of data centre servers, is expanding. The data centre servers uses in North America is increasing. For the industry, which is presently experiencing rapid expansion, the United States of America is a dominating market. The growing popularity of the Internet of Things (IoT) is contributing to the country's progress. The US is one of the major markets for IoT technologies such as IoT devices, security for IoT devices, IoT information and analysis, IoT interaction, and IoT AI. The country's use of cloud computing services and applications is increasing, culminating in the development of massive hyperscale cloud-based data centres.

Report Coverage

This research report categorizes the market for North America data centre server market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America data centre server market. recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the North America data centre server market.

North America Data Centre Server Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 18.45 Bn |

| Forecast Period: | 2022 – 2032 |

| Forecast Period CAGR 2022 – 2032 : | 5.6% |

| 022 – 2032 Value Projection: | USD 31.8 Bn |

| Historical Data for: | 2020-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 150 |

| Segments covered: | By Product, By Organization Size, By Application, By Country. |

| Companies covered:: | Cisco Systems, Dell Technologies Inc., Oracle Corporation, IBM corporation, Hewlett Packard Enterprise Co, ATOS SE, Racklive, Hivelocity Inc., Donwil Company, Delta Power Solutions, AT&T Mobility, and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increased demand for cloud services in the United States is likely to spur the development of cloud-based data centres. Amazon Web Services (AWS), Google, and Microsoft are increasing their investments in data centre building, which contributes to the general expansion of the business in North America. For instance, in August 2023, Dell Inc. is switching its servers from OSA to ESA using next-generation Dell PowerEdge Servers powered by 4th generation Intel Xeon Processors. Furthermore, the implementation of modern technologies such as AI, machine learning, and big data, as well as the increasing penetration of data-generating devices such as wearables, smartphones, IoT sensors, and remote patient monitoring devices, is considerably propelling market growth. Businesses use data analysis tools to evaluate and manage large volumes of data that can reveal insights and trends about their business performance, industry trends, and customer preferences, all of which are likely to accelerate the market growth.

Restraining Factors

The rise in cyber security concerns and hardware failures that cause system outages are expected to be the main restraints on the growth of data center servers during the forecast period, whereas the high demand for maintenance and auxiliary equipment may pose a growth challenge for the data center server market during the forecast period.

Market Segment

- In 2022, the rack servers segment accounted for the largest revenue share over the forecast period.

Based on the type, the North America data centre server market is segmented into rack servers, blade servers, micro servers, and tower servers. Among these, the rack servers segment has the largest revenue share over the forecast period. They are intended to be highly adaptable, dependable, and efficient. Rack servers are built for density, with many fittings into a single rack, making economical use of data centre space. The surge in deployment in colocation or data centre whitespace amenities, increasing server density, higher data centre investments and adoption of the data centre rack architecture, the need for incorporating Software-defined Data Centers (SDDC) in order to handle network services efficiently, data centre optimization initiative(s) adopted to address critical infrastructure inefficiencies, are a few of the major driving factors for expected market growth.

- In 2022, the small segment accounted for the largest revenue share over the forecast period.

On the basis of organization size, the North America data centre server market is segmented into small, medium, and large. Among these, the small segment has the largest revenue share over the forecast period. The forecast can be attributed to the small industry since the increasing adoption of technologies like artificial intelligence (AI) and cloud computing, which are being driven by the placement of servers throughout data centre facilities. Furthermore, the number of micro data centre installations that fulfil the needs of small-scale organizations is increasing. This will encourage key industry participants to produce sophisticated and high-performance small servers.

- In 2022, the commercial segment accounted for the largest revenue share over the forecast period.

Based on the application, the North America data centre server market is segmented into industrial and commercial. Among these, the commercial segment has the largest revenue share over the forecast period. In addiion, the demand of the commercial sector to sustain operations around the clock in order to maintain trade and economic activity is a crucial driver driving the rise of the data centre server industry. As a result of the increased Internet banking, as well as the growing use of mobile wallets and online payment services the use of data servers is increasing in the commercial sector.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the North America data centre server market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Cisco Systems

- Dell Technologies Inc.

- Oracle Corporation

- IBM corporation

- Hewlett Packard Enterprise Co

- ATOS SE

- Racklive

- Hivelocity Inc.

- Donwil Company

- Delta Power Solutions

- AT&T Mobility

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In October 2022, PhonePe announced the opening of India's first Green Data Center, utilizing technologies and solutions from Dell Technologies and NTT Data.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2021 to 2032. Spherical Insights has segmented the North America data centre server market based on the below-mentioned segments:

North America Data Centre Server Market, By Product

- Rack Servers

- Blade Servers

- Micro Servers

- Tower Servers

North America Data Centre Server Market, By Organization Size

- Small

- Medium

- Large

North America Data Centre Server Market, By Application

- Industrial

- Commercial

North America Data Centre Server Market, By Country

- United States

- Canada

- Mexico

- Rest of North America

Need help to buy this report?