North America Electric Vehicles Market Size, Share, and COVID-19 Impact Analysis, By Vehicle Type (Battery Electric Vehicle (BEV), Plug-In Hybrid Electric Vehicle (PHEV), Fuel Cell Electric Vehicle (FCEV)), By Power Output (Less Than 100kW, 100 kW to 250 kW, Greater Than 250kW), By End-Use Applications (PCLT, Commercial Vehicles, Others), and North America Electric Vehicles Market Insights Forecasts to 2032

Industry: Automotive & TransportationNorth America Electric Vehicles Market Insights Forecasts to 2032

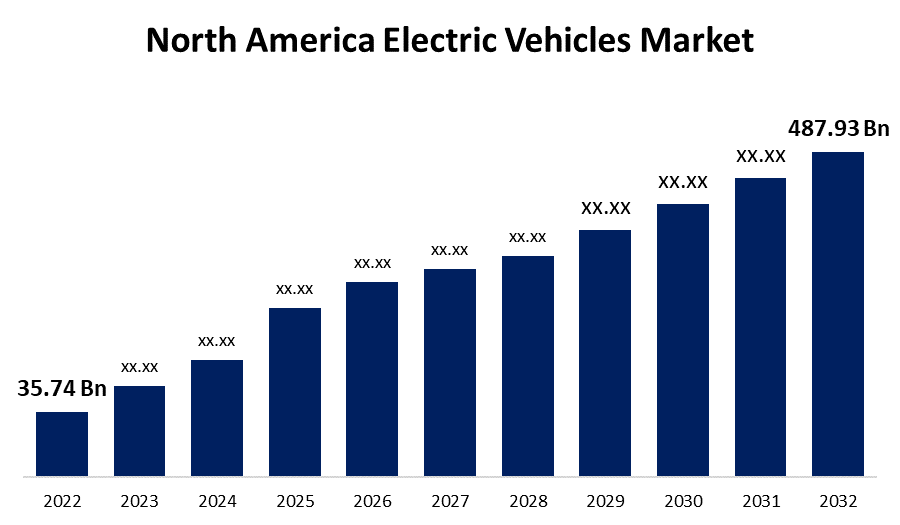

- The North America Electric Vehicles Market Size was valued at USD 35.74 Billion in 2022.

- The Market Size is Growing at a CAGR of 29.87% from 2022 to 2032.

- The North America Electric Vehicles Market Size is expected to reach 487.93 Billion by 2032.

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

The North America Electric Vehicles Market Size is expected to reach USD 487.93 Billion by 2032, at a CAGR of 29.87% during the forecast period 2022 to 2032. Increasing adoption of electric vehicles to control pollution and carbon emissions and growing awareness about the use of electric vehicles to reduce emissions, and stringent government rules and emissions regulations towards vehicle emissions are driving the demand for EVs and contributing to the overall market growth.

Market Overview

Electric vehicles (EVs) symbolize as the critical technology for decarbonizing road transportation, which accounts for 16% of world emissions. Electric car sales have expanded exponentially in the past few decades, owing to the enhanced variety, increased product availability, and higher efficiency. As critical global warming concerns evolve more strongly, governments across North America have doubled their efforts to promote transportation decarbonization. Canada, Mexico, and the United States collectively are eager to shift the present manufacturing facilities presence for electric cars (EVs) and their lithium-ion batteries.

Furthermore, North American automakers have increased production, making electric automobiles marginally cheaper. North American companies produced 2,19,000 electric cars and trucks in the first three months of 2023, a 39 % rise over the same period last year. In the United States, 7.2 percent of automobiles sold are electric, although only 5.7 percent are manufactured in North America. Tesla leads the electric vehicle manufacturing market, having boosted the output of four of its models sold during the first quarter. Tesla produced 150,000 vehicles in North America, sparking a price war in the worldwide EV market.

Report Coverage

This research report categorizes the market for North America Electric Vehicles Market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America Electric Vehicles Market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the North America Electric Vehicles Market.

North America Electric Vehicles Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022 : | USD 35.74 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 29.87% |

| 2032 Value Projection: | USD 487.93 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 125 |

| Segments covered: | By Vehicle Type, By Power Output, By End-Use |

| Companies covered:: | Daimler AG, Canoo Inc., Bollinger Motors, Ford Motor Company, General Motors Company, Rivian Automotive, LLC, Lucid Motors, Inc., Lightning eMotors Inc., Xos Trucks Inc., Workhorse Group Inc., Nissan Motor Company, Tesla, Inc., Karma Automotive LLC, Atlis Motor Vehicles, Inc., Fisker Inc., Lordstown Motors Corp., Nikola Corporation, Faraday Future Inc., Proterra Inc., Lion Electric Co., Zero Electric Vehicles Inc. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

North America's automobile manufacturing sector is rapidly transitioning from gasoline-powered automobiles to electric ones. Increased expenditures and the inclusion of innovative technology into electric vehicles by automobile manufacturing companies, as well as the development of improved charging systems and batteries, are driving North America electric vehicle market expansion. In addition, regulations and government policies that encourage the construction and operation of electric vehicle (EV) charging stations by transportation system operators, as well as increased investments in the EV ecosystem, is boosting the growth of this industry. Furthermore, the United States government recently established a net-zero carbon dioxide emissions goal for 2050, associated with substantial impacts, and implemented tough greenhouse gas emissions limitations for vehicles with engines. This functions as a market driver since automobile manufacturers will be forced to accept, produce, and sell electric automobiles in the years to come.

Moreover, the adoption of electric vehicles has expanded in a number of places and countries as fuel costs have risen. These vehicles emit no pollutants and are non-toxic to the environment. Electricity is far less expensive than fossil fuels. This reduces the cost associated with running electric vehicles as compared to traditional gasoline and diesel vehicles. Additionally, over the past decade, the overall price of EV batteries has decreased due to technological advances and the widespread manufacturing of EV batteries in large quantities. As an outcome, the cost of electric vehicles has come down. This feature has an impact on consumer demand for electric vehicle models. Furthermore, various economic advantages of electrically powered vehicles over traditional automobiles are expected to encourage market expansion over the projection period.

Restraining Factors

However, the shortage of rapid EV charging stations is projected to hamper the expansion of the electric vehicle sector. North American countries have a restricted number of EV charging stations. As a result, there are currently a smaller number of public EV charging points available, lowering electric vehicle adoption. A lot of consumers have avoided buying electric vehicles due to the lack of EV charging facilities, stifling market expansion in North America.

Market Segment

- In 2022, the Battery Electric Vehicle (BEV) segment accounted for the largest revenue share of more than 77.3% over the forecast period.

On the basis of vehicle type, the North America Electric Vehicles Market is segmented into Battery Electric Vehicle (BEV), Plug-In Hybrid Electric Vehicle (PHEV), and Fuel Cell Electric Vehicle (FCEV). Among these, the Battery Electric Vehicle (BEV) segment has the largest revenue share of 77.3% over the forecast period. The increased concern about the environment, as well as the advantages of BEVs among end users, can be linked to this rising demand for electric vehicles (EVs) in North America. Furthermore, the typical driving range of BEVs has constantly increased. In 2022, the typical range of BEVs was over 480 km, an increase from 320 km in 2021. Battery electric vehicles provide advantages such as improved efficiency, cheaper repair expenses, and fewer noises and vibrations which are aided by being capable of rapid torque and power output. Furthermore, BEVs produce no emissions or noise pollution.

- In 2022, the greater than 250kW segment is influencing the largest CAGR over the forecast period.

Based on the power output, the North America Electric Vehicles Market is segmented into less than 100kW, 100 kW to 250 kW, and greater than 250kW. Among these segments, the greater than 250kW segment dominates the largest market share over the forecast period. The growth of this segment is attributed to the increasing adoption of electric buses and trucks for heavy applications, the implementation of numerous wireless EV charging pilot projects for heavy commercial vehicles, and the increasing adoption of electric mobility in the region.

- In 2022, the PCLT segment accounted for the largest revenue share of more than 46.2% over the forecast period.

On the basis of end-use applications, the North America Electric Vehicles Market is segmented into PCLT, commercial vehicles, and others. Among these, the PCLT segment has the largest revenue share of 79.2% over the forecast period. Passenger automobiles and light trucks are included in the PCLT sector. The light truck market is expected to grow at the fastest CAGR because SUVs provide sophisticated features, cost-efficiency, ease of use, and long-term reliability, among other benefits. Furthermore, several major automakers are planning to develop electric vehicles in the light truck segment. Some of the light trucks that will be offered on the market in the coming years include the BMW iX, Tesla Cybertruck, Audi Q4 e-tron, and GMC Hummer, several others.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the North America Electric Vehicles Market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Daimler AG

- Canoo Inc.

- Bollinger Motors

- Ford Motor Company

- General Motors Company

- Rivian Automotive, LLC

- Lucid Motors, Inc.

- Lightning eMotors Inc.

- Xos Trucks Inc.

- Workhorse Group Inc.

- Nissan Motor Company

- Tesla, Inc.

- Karma Automotive LLC

- Atlis Motor Vehicles, Inc.

- Fisker Inc.

- Lordstown Motors Corp.

- Nikola Corporation

- Faraday Future Inc.

- Proterra Inc.

- Lion Electric Co.

- Zero Electric Vehicles Inc.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- On June 2023, Rivian recently acquired Swedish EV route planning software company Iternio in order to incorporate its technology into its electric pickups and SUVs, as well as leverage its data to help build its own charging network. The A Better Routeplanner (ABRP) app from Iternio, which is popular among EV owners in North America and Europe, provides route computation services that take into consideration weather conditions, charging pauses, vehicle weight, and other aspects.

- On June 2023, General Motors (GM) and South Korean advanced EV battery materials business Posco Future M announced an extra $1 billion investment in their new cathode production in Ontario, Canada. The new financing will assist in increasing Cathode active material (CAM) and precursor materials (pCAM) production in North America. CAM is the key raw material, comprised of lithium plus a secondary metal (or metals), that drives a substantial amount of the output and accounts for approximately 40% of the cost of EV batteries.

- On June 2023, Rivian announced that it would use Tesla's electric vehicle charging standard in its future vehicle lineup. The agreement gives Rivian owners access to thousands of Tesla Supercharger stations around the country, bringing Tesla closer to becoming the de facto EV charging standard in the United States.

- On March 2023, Ford has announced that it will increase EV production at its North American manufacturing locations to satisfy high customer demand. Ford will increase production of the Mustang Mach-E, F-150 Lightning, and E-Transit electric vehicles at its plants in Cuautitlan (Mexico), Detroit, and Kansas City, as electric vehicle sales increased by 68 percent in February. Ford plans to increase manufacturing of the F-150 Lightning at the Rouge Electric Vehicle Center this year, with a 150,000-unit annual production run rate by the end of 2023. With 15,617 sales in 2022 and 3,600 in the first two months of this year, the F-150 Lightning is the best-selling electric pickup truck in the United States.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2021 to 2032. Spherical Insights has segmented the North America Electric Vehicles Market based on the below-mentioned segments:

North America Electric Vehicles Market, By Vehicle Type

- Battery Electric Vehicle (BEV)

- Plug-In Hybrid Electric Vehicle (PHEV)

- Fuel Cell Electric Vehicle (FCEV)

North America Electric Vehicles Market, By Power Output

- Less Than 100kW

- 100 kW to 250 kW

- Greater Than 250kW

North America Electric Vehicles Market, By Power Output

- PCLT

- Commercial Vehicles

- Others

North America Electric Vehicles Market, By Country

- United States

- Canada

- Mexico

Need help to buy this report?