North America Fabricated Metal Products Market Size, Share, and COVID-19 Impact Analysis, By Material Type (Steel, Aluminium, Others), By End-User (Manufacturing, Power and Utilities, Construction, Oil and Gas, Others), By Country (US, Canada, Mexico, Rest of North America), and North America Fabricated Metal Products Market Insights Forecasts to 2033

Industry: Chemicals & MaterialsNorth America Fabricated Metal Products Market Insights Forecasts to 2033

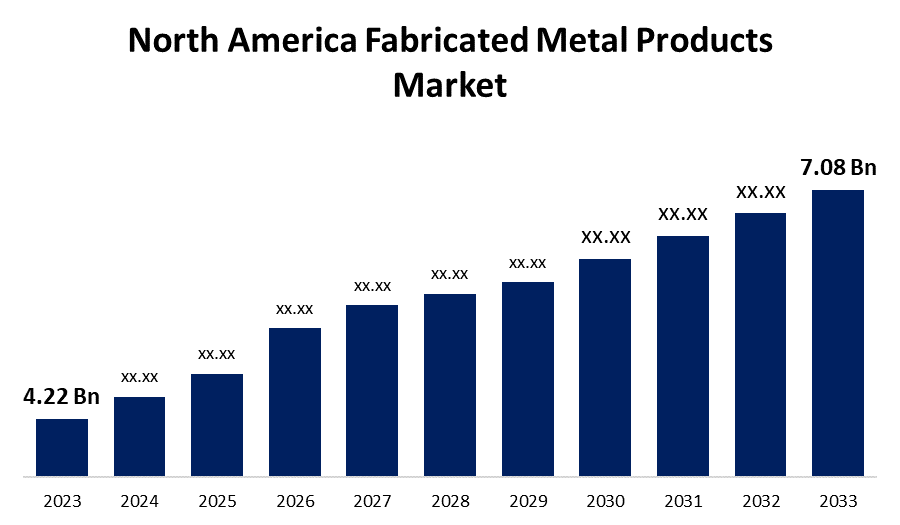

- The North America Fabricated Metal Products Market Size was valued at USD 4.22 Billion in 2023.

- The Market Size is Growing at a CAGR of 5.31% from 2023 to 2033.

- The North America Fabricated Metal Products Market Size is Expected to Reach USD 7.08 Billion by 2033.

Get more details on this report -

The North America Fabricated Metal Products Market Size is expected to reach USD 7.08 Billion by 2033, at a CAGR of 5.31% during the forecast period 2023 to 2033.

Market Overview

Metal fabrication is the process of transforming raw metal into finished items. Hand tools, bolts, nuts, screws, cans, pipe and pipe fittings, and other items are examples of fabricated metal products. A well-established industrial base in North America, combined with a burgeoning construction industry, provides a solid foundation for the region's metal fabrication market to grow over time. The increasing use of contemporary technologies, such as CNC machining and automation, improves precision and efficiency in metal manufacturing processes. The increasing emphasis on sustainable practices is driving the development of environmentally friendly materials and techniques. Furthermore, steady investment in infrastructure development and technological innovation in various sectors across the area is expected to promote North America metal fabrication industry growth in the forecast period. Advances in materials science are expanding the range of metals that can be successfully fabricated. High-strength alloys, composite materials, and even nanostructures are testing the boundaries of metal fabrication. These improvements are expected to give considerable North American metal fabrication market prospects for leading fabricators and providers in the region.

Report Coverage

This research report categorizes the market for North America fabricated metal products market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America fabricated metal products market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the North America fabricated metal products market.

North America Fabricated Metal Products Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 4.22 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 5.31% |

| 023 – 2033 Value Projection: | USD 7.08 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 195 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Material Type, By End-User, By Country |

| Companies covered:: | Valmont Industries, Inc., Mayville Engineering Company, Inc., PMF Industries, Inc, Monti Inc. Manufacturing, Prince Manufacturing, Inc., Neal Manufacturing Services, BTD Manufacturing Inc., United Steel, Inc., Colfax, Komaspec, Matcor Matsu Group Inc., andvik Mining and Construction Canada Inc., Others |

| Pitfalls & Challenges: | Covid-19 Impact, Challenge, Future,Growth and Analysis |

Get more details on this report -

Driving Factors

Perforated metal has made advances in the North America metal fabricating sector. The use of perforation rollers to punch metal evenly and equally is becoming more common in the metal fabrication industry. To meet clients' needs, equipment manufacturers are attempting to develop project-specific rollers. Perforation rollers that can punch cleanly through metal repeatedly while operating cold or heated are in high demand because the heated pin in these rollers forms a strengthened ring around the perforation to increase the metal's strength, and they are opening up new opportunities for metal fabrication businesses. On the other hand, lasers are gaining popularity for their application in metal piercing.

Restraining Factors

The significant cost associated with starting a metal manufacturing business limits industry growth. New important entrants are expected to reduce their investment in fabrication plants. Metal fabrication tools and equipment are often quite pricey. Furthermore, metal fabrication is a costly approach because the fabricated metal pieces require a post-fabrication process.

Market Segment

- In 2023, the steel segment accounted for the largest revenue share over the forecast period.

Based on the material type, the North America fabricated metal products market is segmented into steel, aluminum, and others. Among these, the steel segment has the largest revenue share over the forecast period. Steel is used in all major industries, including energy, construction, automobile and transportation, infrastructure, packaging, and manufacturing. Steel is what allows skyscrapers to stand. The housing and construction sector is currently the major user of steel, accounting for more than half of total production.

- In 2023, the manufacturing segment accounted for the largest revenue share over the forecast period.

On the basis of end user, the North America fabricated metal products market is segmented into manufacturing, power and utilities, construction, oil and gas, and others. Among these, the manufacturing segment has the largest revenue share over the forecast period. Copper's malleability, conductivity, corrosion resistance, and affordability make it a great material for roofing, electrical wiring, telecommunication connections, and the renewable energy industry. Copper's malleability allows metal to be molded into a variety of customizable shapes, expanding its utility in industrial applications.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the North America fabricated metal products market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Valmont Industries, Inc.

- Mayville Engineering Company, Inc.

- PMF Industries, Inc

- Monti Inc. Manufacturing

- Prince Manufacturing, Inc.

- Neal Manufacturing Services

- BTD Manufacturing Inc.

- United Steel, Inc.

- Colfax

- Komaspec

- Matcor Matsu Group Inc.

- andvik Mining and Construction Canada Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In October 2022, Siemens and Desktop Metal have launched a multidimensional alliance to accelerate the adoption of additive manufacturing for production applications, with a focus on the world's major manufacturers. The collaboration will encompass several facets of the desktop metal business. This involves further integration of Siemens technologies, including as operational technology, information technology, and automation, into Desktop Metal's AM 2.0 systems.

Market Segment

This study forecasts revenue at regional, and country levels from 2022 to 2033. Spherical Insights has segmented the North America fabricated metal products market based on the below-mentioned segments:

North America Fabricated Metal Products Market, By Type

- Steel

- Aluminium

- Others

North America Fabricated Metal Products Market, By End User

- Manufacturing

- Power and Utilities

- Construction

- Oil and Gas

- Others

North America Fabricated Metal Products Market, By Country

- US

- Canada

- Mexico

- Rest of North America

Need help to buy this report?