North America Feeding Tubes Market Size, Share, and COVID-19 Impact Analysis, By Type (Nasojejunal Feeding Tube, Jejunostomy Tube (J Tube), Gastric Tube (G Tube), Orogastric Tube, and Nasogastric Tube), By Age (Pediatric and Adult), By Application (Diabetes, Oncology, Gastroenterology, and Others), By End-User (Specialty Clinics, Hospitals, Homecare, and Others), and North America Feeding Tubes Market Insights, Industry Trend, Forecasts to 2033.

Industry: HealthcareNorth America Feeding Tubes Market Insights Forecasts to 2033

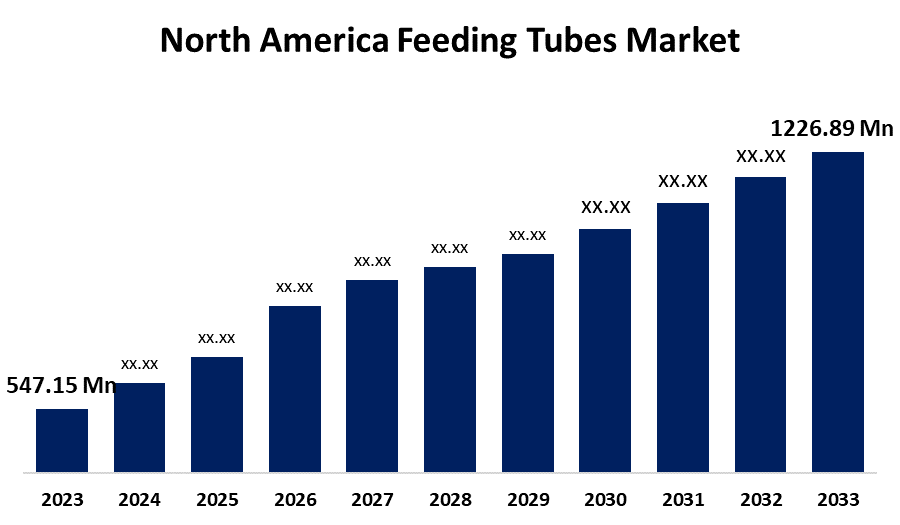

- The North America Feeding Tubes Market Size was valued at USD 547.15 Million in 2023.

- The Market is Growing at a CAGR of 8.41% from 2023 to 2033

- The North America Feeding Tubes Market Size is Expected to Reach USD 1226.89 Million by 2033

Get more details on this report -

The North America Feeding Tubes Market is anticipated to reach USD 1226.89 million by 2033, growing at a CAGR of 8.41% from 2023 to 2033

Market Overview

The North America feeding tube market emphasizes the manufacturing and commercialization of feeding tubes that are utilized for the provision of nutrients to individuals suffering from chronic conditions such as cancer, neurological disorders, and gastrointestinal conflicts. Feeding tubes are flexible plastic tubes that are inserted into the gastrointestinal tract to provide enteral nutrition and are available in various sizes, lengths, and materials.

Chronic diseases are the leading cause of illness, disability, and death in America, primarily resulting from risk factors such as smoking, poor nutrition, physical inactivity, and excessive alcohol use. For instance, the data provided by the United Health Foundation’s America’s Health Rankings 2023 revealed that in 2022, more than 29 million adults in the U.S. have chronic conditions. Therefore, the increasing prevalence of chronic diseases such as cancer, diabetes, central nervous system disorders, and digestive issues led to unstable conditions, including swallowing difficulties, immobile activities, and weakness, resulting in inadequate intake of nutrients. Considering these complications, feeding tubes were developed, and wide commercialization and usage of feeding tubes among North Americans resulted in the expansion of the North America feeding tubes market. The innovations and technological development of feeding tubes drive the market growth.

Report Coverage

This research report categorizes the North America feeding tubes market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America feeding tubes market. Recent market developments and competitive strategies such as expansion, product launch and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the North America feeding tubes market.

North America Feeding Tubes Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 547.15 Million |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 8.41% |

| 023 – 2033 Value Projection: | USD 1226.89 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 250 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Type, By Age, By Application, By End-User |

| Companies covered:: | ALCOR Scientific, Cardinal Health, Avanos Medical Inc., Applied Medical Technology, Baxter International Inc., Becton, Dickinson, and Company, Amsino International, Inc., CONMED Corporation, Cook Medical, Medline Industries Inc., Vesco Medical LLC, Others, and |

| Pitfalls & Challenges: | COVID-19 Impact Analysis and Forecast 2023 - 2033 |

Get more details on this report -

Driving Factors

The use of feeding tubes is essential for vital nutrition and hydration since chronic diseases like cancer, neurological problems, and gastrointestinal conditions frequently result in malnutrition and difficulty swallowing. In North America, chronic diseases are increasing due to aging populations, shifting lifestyles, and better access to healthcare, which is driving up demand for feeding tubes in a variety of healthcare circumstances. It is anticipated this emerging tendency would keep propelling market expansion in the future. Manufacturing, healthcare, and research institutions collaboration renders it more feasible to develop new products and technology, which strengthens distribution networks and makes innovative feeding tube solutions affordable.

New developments in feeding tubes have improved their safety, effectiveness, and minimal invasiveness. Smart technology like sensors and connections enhance real-time data transfer and patient nutrition monitoring. These technological developments promote market expansion and acceptance by minimizing problems and improving nutrition delivery. The features that improve insertion ease, lower problems, and maximize nutritional delivery are frequently included in new product introductions to promote adoption in patients and healthcare professionals.

Restraining Factors

The advantages of feeding tubes are often unknown to individuals with disabilities, although they can enhance nutritional intake and health outcomes. Medical insurance and high costs limit widespread adoption, which might limit patient access and hinder market expansion.

Market Segmentation

The North America feeding tubes market share is classified into type, age, application, and end-user.

- The nasogastric tube segment held a significant share in 2023 and is expected to grow at a remarkable CAGR during the forecast period.

The North America feeding tubes market is segmented by type into nasojejunal feeding tube, jejunostomy tube (J tube), gastric tube (G tube), orogastric tube, and nasogastric tube. Among these, the nasogastric tube segment held a significant share in 2023 and is expected to grow at a remarkable CAGR during the forecast period. This segment growth is attributed to its flexibility, smooth texture, increasing prevalence of digestive issues in pediatrics, rising cases of dysphagia, patient convenience, safety of use, intense sterility, no anesthetics are required for the insertion of the tube,

- The adult segment held the largest share in 2023 and is predicted to grow at a significant CAGR during the forecast period.

The North America feeding tubes market is segmented by age into pediatric and adult. Among these, the adult segment held the largest share in 2023 and is predicted to grow at a significant CAGR during the forecast period. The segment expansion is owing to the rising cases of chronic diseases in adults derived from sedentary lifestyles and unhealthy living culture, lack of exercise, stroke conditions, raised swallowing difficulties, and nutritional needs in adults due to abnormal health conditions.

- The gastroenterology segment accounted for the largest share in 2023 and is expected to grow at a substantial CAGR during the forecast period.

The North America feeding tubes market is segmented by application into diabetes, oncology, gastroenterology, and others. Among these, the gastroenterology segment accounted for the largest share in 2023 and is expected to grow at a substantial CAGR during the forecast period. This segment growth is attributed to the increasing incidence of gastrointestinal diseases. Gastrointestinal diseases, including inflammatory bowel disease (IBD), gastroesophageal reflux disease (GERD), and irritable bowel syndrome (IBS) are more prevalent in the American population. For instance, In America, 70 million of the population are affected by gastrointestinal diseases.

- The hospitals segment accounted for the largest share in 2023 and is predicted to grow at a significant CAGR during the forecast period.

The North America feeding tubes market is segmented by end-user into specialty clinics, hospitals, homecare, and others. Among these, the hospitals segment accounted for the largest share in 2023 and is predicted to grow at a significant CAGR during the forecast period. The segment growth is ascribed to proper healthcare setup facilities, the availability of skilled nurses, personalized treatment, maintaining the sterility of consumables used for diagnostic purposes, a rising proportion of emergency care patients, and provisions of advanced technological equipment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the North America feeding tubes market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- ALCOR Scientific

- Cardinal Health

- Avanos Medical Inc.

- Applied Medical Technology

- Baxter International Inc.

- Becton, Dickinson, and Company

- Amsino International, Inc.

- CONMED Corporation

- Cook Medical

- Medline Industries Inc.

- Vesco Medical LLC

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In November 2024, Avanos Medical Inc. launched a novel CORGRIP SR Nasogastric/Nasointestinal Tube Retention System, further expanding its comprehensive Enteral Feeding portfolio. The CORGRIP SR nasal bridle solution offers advantages over tape, reduces dislodgement risk, enhances visibility and flexibility, and includes features like a yellow-tipped retrieval catheter, color-coded clips, and an orange opening tool.

Market Segment

- This study forecasts revenue at North America, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the North America feeding tubes market based on the below-mentioned segments

North America Feeding Tubes Market, By Type

- Nasojejunal Feeding Tube

- Jejunostomy Tube (J Tube)

- Gastric Tube (G Tube)

- Orogastric Tube

- Nasogastric Tube

North America Feeding Tubes Market, By Age

- Pediatric

- Adult

North America Feeding Tubes Market, By Application

- Diabetes

- Oncology

- Gastroenterology

- Others

North America Feeding Tubes Market, By End-User

- Specialty Clinics

- Hospitals

- Homecare

- Others

Need help to buy this report?