North America Fertilizer Catalyst Market Size, Share, and COVID-19 Impact Analysis, By Product (Iron Based and Nickel Based), By Process (Haber-Bosch Process, Urea Production, and Nitric Acid Production), and North America Fertilizer Catalyst Market Insights, Industry Trend, Forecasts to 2033

Industry: AgricultureNorth America Fertilizer Catalyst Market Insights Forecasts to 2033

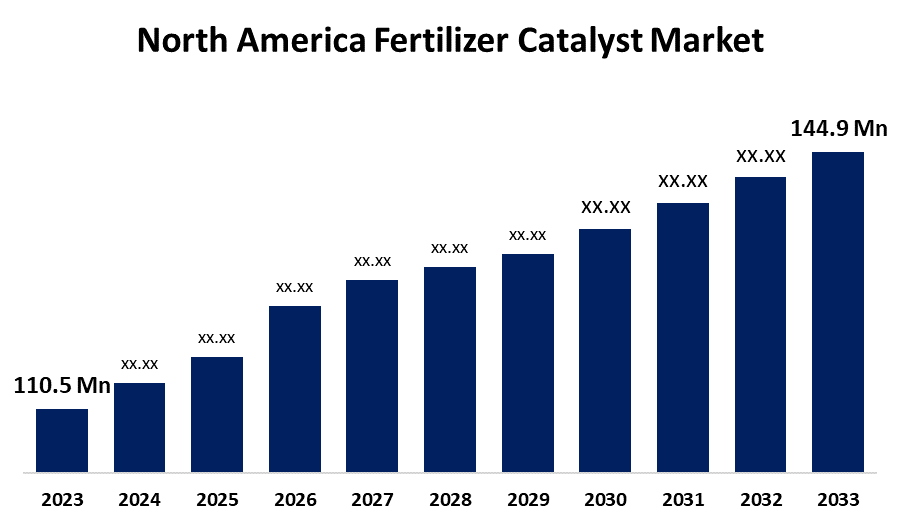

- The North America Fertilizer Catalyst Market Size was valued at USD 110.5 Million in 2023.

- The Market is growing at a CAGR of 2.75% from 2023 to 2033

- The North America Fertilizer Catalyst Market Size is Expected to Reach USD 144.9 Million by 2033

Get more details on this report -

The North America Fertilizer Catalyst Market is Anticipated to Exceed USD 144.9 Million by 2033, growing at a CAGR of 2.75% from 2023 to 2033.

Market Overview

The North America fertilizer catalyst market refers to the segment of specialized chemical compounds used to enhance the efficiency and productivity of fertilizer production processes, particularly in ammonia synthesis and nitric acid production. These catalysts play a crucial role in optimizing reaction rates, reducing energy consumption, and improving overall process sustainability. The market encompasses various catalyst types, including iron-based, platinum-based, and vanadium-based catalysts, which are widely utilized in the production of nitrogen, phosphate, and potash fertilizers. Several factors are driving the growth of this market, including the rising demand for high-yield agricultural practices, increasing fertilizer consumption, and advancements in catalyst technologies. The expanding population and the need to improve crop productivity have intensified the demand for efficient fertilizers, thereby boosting the adoption of fertilizer catalysts. Additionally, innovations in catalyst formulations aimed at reducing emissions and enhancing process efficiency have further contributed to market expansion. Government initiatives supporting sustainable agriculture and environmental regulations promoting energy-efficient fertilizer production have played a significant role in shaping the market. Policies encouraging the adoption of low-emission technologies, research funding for advanced catalysts, and investments in domestic fertilizer production facilities have further strengthened the North America fertilizer catalyst market.

Report Coverage

This research report categorizes the market for the North America fertilizer catalyst market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America fertilizer catalyst market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the North America fertilizer catalyst market.

North America Fertilizer Catalyst Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 110.5 Million |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 2.75 % |

| 023 – 2033 Value Projection: | USD 144.9 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 250 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Product, By Process |

| Companies covered:: | Clariant AG, Johnson Matthey, Unicat Catalyst Technologies, Albemarle Corporation, LKAB Minerals AB, Quality Magnetite, Oham Industries, Axens, Agricen, Thyssenkrupp AG, Others, and |

| Pitfalls & Challenges: | COVID-19 Impact Analysis and Forecast 2023 - 2033 |

Get more details on this report -

Driving Factors

The North America fertilizer catalyst market is driven by the increasing demand for high-efficiency fertilizers to support growing agricultural productivity. Rising population levels and shrinking arable land have intensified the need for enhanced crop yields, thereby boosting fertilizer consumption. Technological advancements in catalyst formulations have improved energy efficiency, reduced emissions, and enhanced overall production processes. Additionally, strict environmental regulations promoting sustainable fertilizer manufacturing have accelerated the adoption of advanced catalysts. Government initiatives supporting domestic fertilizer production, along with investments in research and development for low-emission and high-performance catalyst technologies, further contribute to the market’s expansion and long-term growth.

Restraining Factors

The North America fertilizer catalyst market faces challenges such as high production costs, stringent environmental regulations, and the complexity of catalyst replacement and maintenance. Fluctuations in raw material prices further impact market stability, while the increasing adoption of organic fertilizers poses a potential challenge to the demand for conventional fertilizer catalysts.

Market Segmentation

The North America fertilizer catalyst market share is classified into product and process.

- The iron based segment is expected to hold the largest market share through the forecast period.

The North America fertilizer catalyst market is segmented by product into iron based and nickel based. Among these, the iron based segment is expected to hold the largest market share through the forecast period. This dominance is attributed to its extensive use in ammonia synthesis, a critical process in nitrogen-based fertilizer production. Iron-based catalysts are preferred due to their high durability, cost-effectiveness, and efficiency in facilitating the Haber-Bosch process.

- The haber-bosch process segment dominates the market with the largest market share over the predicted period.

The North America fertilizer catalyst market is segmented by process into haber-bosch process, urea production, and nitric acid production. Among these, the haber-bosch process segment dominates the market with the largest market share over the predicted period. This dominance is driven by the critical role of the Haber-Bosch process in ammonia synthesis, which serves as a key component in nitrogen-based fertilizer production. The increasing demand for ammonia-based fertilizers, coupled with advancements in catalyst efficiency, has further strengthened the growth of this segment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the North America fertilizer catalyst market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Clariant AG

- Johnson Matthey

- Unicat Catalyst Technologies

- Albemarle Corporation

- LKAB Minerals AB

- Quality Magnetite

- Oham Industries

- Axens

- Agricen

- Thyssenkrupp AG

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-added resellers (VARs)

Market Segment

- This study forecasts revenue at North America, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the North America fertilizer catalyst market based on the below-mentioned segments

North America Fertilizer Catalyst Market, By Product

- Iron Based

- Nickel Based

North America Fertilizer Catalyst Market, By Process

- Haber-Bosch Process

- Urea Production

- Nitric Acid Production

Need help to buy this report?