North America Food Cold Chain Market Size, Share, and COVID-19 Impact Analysis, By Type (Chilled, Frozen), By Application (Dairy & Frozen products, meat & Seafood, Fruits & Vegetables, Bakery & Confectionary), By Country (US, Canada, Mexico), and North America Food Cold Chain Market Insights Forecasts to 2033

Industry: Consumer GoodsNorth America Food Cold Chain Market Insights Forecasts to 2033

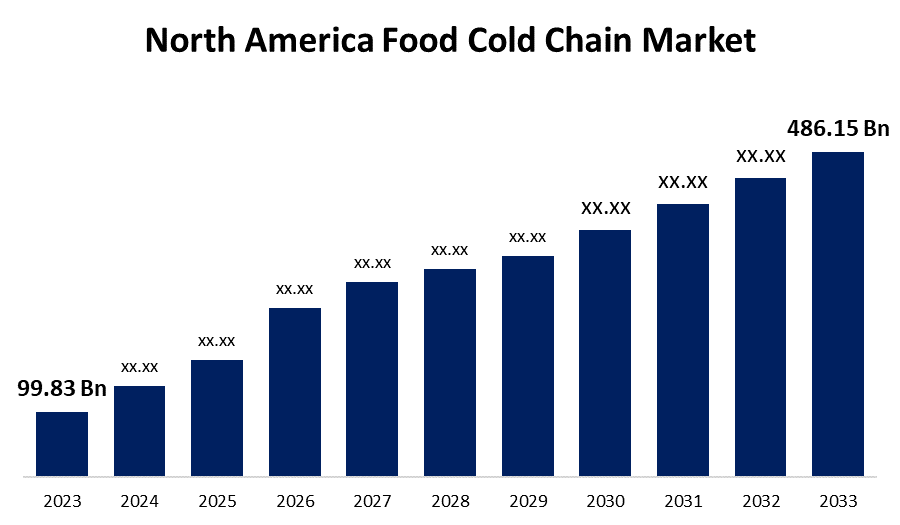

- The North America Food Cold Chain Market Size was valued at USD 99.83 Billion in 2023.

- The Market Size is Growing at a CAGR of 17% from 2023 to 2033.

- The North America Food Cold Chain Market Size is Expected to Reach USD 486.15 Billion by 2033.

Get more details on this report -

The North America Food Cold Chain Market Size is expected to reach USD 486.15 billion by 2033, at a CAGR of 17% during the forecast period 2023 to 2033.

Market Overview

The process of transferring and storing perishable food products at controlled temperatures to maintain their freshness, safety, and nutritional content from production to consumption is referred to as the "food cold chain." This necessitates a number of temperature-controlled logistics, including refrigerated storage, distribution, and transportation. The food cold chain is necessary for many food items, including dairy, meat, fish, and processed meals, to stay intact. There have been substantial investments made by both the public and commercial sectors in the cold chain industry in North America. The development and expansion of transportation networks, logistics services, and refrigerated storage facilities are the main goals of the cold chain business. One of the factors driving the investments is the rising demand for temperature-sensitive goods both domestically and internationally, such as medications and perishable food items. Because these products need to be transported and stored at specific temperatures, there is a growing need for cold chain logistics services in North America. This has encouraged businesses to make investments in the construction of transportation networks and refrigerated storage facilities in order to meet the increasing demand for temperature-controlled logistics.

Report Coverage

This research report categorizes the market for North America food cold chain market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America Food cold chain market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the North America food cold chain market.

North America Food Cold Chain Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 99.83 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 17% |

| 023 – 2033 Value Projection: | USD 486.15 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 212 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Application, By Country |

| Companies covered:: | Americold Logistics, Inc.,, Burris Logistics, LINEAGE LOGISTICS HOLDING, LLC, Wabash National Corporation, United States Refrigerated Storage, Tippmann Group, NFI Industries, Penske, Seafrigo Group, NewCold, CONESTOGA REFRIGERATED STORAGE, Sonoc ThermoSafe (Sonoco Products Company), Others |

| Pitfalls & Challenges: | Covid-19 Impact, Challenge, Future,Growth and Analysis |

Get more details on this report -

Driving Factors

The cold chain market has grown tremendously as a result of ongoing developments in refrigeration and cold chain technologies. The efficiency, dependability, and visibility of the cold chain have all increased because to innovations like real-time temperature monitoring systems, GPS tracking, better insulating materials, and more energy-efficient refrigeration units. These developments make it possible to better manage and control temperature-sensitive products, which lowers losses, guarantees product quality, and lengthens shelf life. Moreover, improved optimization, risk reduction, and proactive maintenance are made possible by the integration of data analytics and automation in cold chain operations, which raises overall operational efficacy and cost-effectiveness.

Restraining Factors

The cold chain could have difficulty reaching isolated and rural areas with inadequate infrastructure. It can be costly and logistically challenging to keep a supply of perishable foods on hand in these kinds of locations.

Market Segment

- In 2023, the chilled segment accounted for the largest revenue share over the forecast period.

Based on the type, the North America food cold chain market is segmented into chilled, and frozen. Among these, the chilled segment has the largest revenue share over the forecast period. Chilled storage is the regulated storage of items above freezing but below room temperature. It meets the needs of items including fruits, vegetables, dairy goods, and drinks that need to be kept at a constant, cool temperature. Chilled storage facilities guarantee the preservation of freshness, quality, and nutritional content of these commodities by offering an ideal atmosphere. Growing customer preferences for fresh and healthful foods, the requirement for effective inventory management, and the growth of e-commerce—which need temperature-controlled storage for prompt deliveries of perishable goods—are the main drivers of the demand for chilled storage.

- In 2023, the meat & seafood segment accounted for the largest revenue share over the forecast period.

On the basis of application, the North America food cold chain market is segmented into dairy & frozen products, meat & seafood, fruits & vegetables, and bakery & confectionary. Among these, the meat & seafood segment has the largest revenue share over the forecast period. It is essential to store fish, meat, and seafood in a refrigerator because when an animal is killed, dangerous bacteria can develop on the meat. When it comes to food poisoning, food, meat, and seafood are some of the things with a higher risk. Therefore, in order to preserve their quality and shelf life, refrigerated storage options are essential. Meat kept between 5°C and 63°C will allow bacteria to grow quickly. Fish, meat, and seafood goods should be stored at a temperature of between 0°C and 5°C.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the North America food cold chain market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Americold Logistics, Inc.,

- Burris Logistics

- LINEAGE LOGISTICS HOLDING, LLC

- Wabash National Corporation

- United States Refrigerated Storage

- Tippmann Group

- NFI Industries

- Penske

- Seafrigo Group

- NewCold

- CONESTOGA REFRIGERATED STORAGE

- Sonoc ThermoSafe (Sonoco Products Company)

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at regional, and country levels from 2022 to 2033. Spherical Insights has segmented the North America food cold chain market based on the below-mentioned segments:

North America Food Cold Chain Market, By Type

- Chilled

- Frozen

North America Food Cold Chain Market, By Application

- Dairy & Frozen products

- meat & Seafood

- Fruits & Vegetables

- Bakery & Confectionary

North America Food Cold Chain Market, By Country

- US

- Canada

- Mexico

Need help to buy this report?