North America Food Service Market Size, Share, and COVID-19 Impact Analysis, By Type (Cafes & Bars, Cloud Kitchen, Full-Service Restaurants, Quick Service Restaurants), By Outlets (Chained Outlets and Independent Outlets), and North America Food Service Market Insights, Industry Trend, Forecasts to 2033.

Industry: Food & BeveragesNorth America Food Service Market Insights Forecasts to 2033

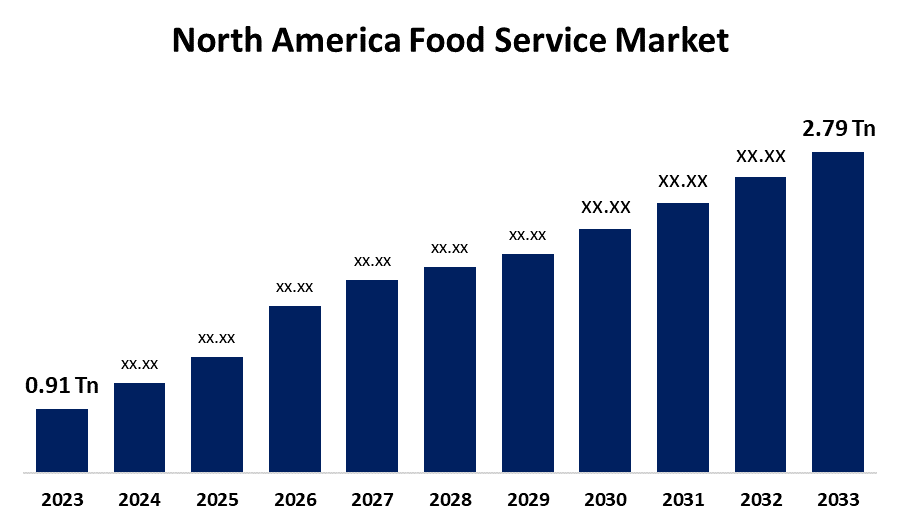

- The North America Food Service Market Size was valued at USD 0.91 Trillion in 2023.

- The North America Food Service Market Size is Growing at a CAGR of 11.86% from 2023 to 2033

- The North America Food Service Market Size is Expected to Reach USD 2.79 Trillion By 2033

Get more details on this report -

The North America Foodservice Market Size is Anticipated to reach USD 2.79 Trillion By 2033, Growing at a CAGR of 11.86 % from 2023 to 2033. The North America foodservice market is fueled by rising demand for convenience, health-oriented customer tastes, technological innovation (mobile ordering and AI), rising disposable income, expansion of quick-service restaurants, and a move towards sustainable approaches, and innovation in menu innovation and eating occasions.

Market Overview

The North America foodservice market is the industry in the economy that entails the preparation, sale, and serving of food and beverages away from home. It encompasses a broad array of food service outlets including restaurants, cafés, quick-service restaurants (QSRs), full-service restaurants (FSRs), food trucks, catering services, and institutional food services such as those in schools, hospitals, and corporate environments. Consumers are demanding healthier, more sustainable, and more diverse foods, prompting restaurants and food service providers to make menu changes. Growth has also been driven by the expansion of online ordering, food delivery, and cloud kitchens, responding to busy lifestyles. Consumer demand is increasingly moving towards healthier and more sustainable eating options, as well as a general awareness of environmental and health concerns. In addition, technological innovations in food preparation and service automation and AI are improving efficiency. All these driving forces are collectively contributing to the growth of North America's food service industry, making it a competitive and innovative market.

Report Coverage

This research report categorizes the market for the North America foodservice market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America foodservice market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the North American foodservice market.

North America Food Service Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 0.91 Trillion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 11.86% |

| 2033 Value Projection: | USD 2.79 Trillion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 96 |

| Segments covered: | By Type, By Outlets and COVID-19 Impact Analysis |

| Companies covered:: | Yum! Brands, Starbucks Corporation, Darden Restaurants, Doctors Associates, Inc., Inspire Brands, Inc., and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Consumers are Increasingly seeking out healthier, organic, and plant-based menu options. Foodservice operators are responding by providing more healthful options, including vegan, gluten-free, and low-calorie options, in response to the growing consumer trend driving the demand for north America foodservice market. Additionally, mobile app, website, and self-ordering kiosk adoption increase the convenience and speed of ordering, further propelling growth in the market.

Restraining Factors

The foodservice sector is subject to strict health and safety legislation, notably concerning food hygiene and working practices. They are prone to making operation more expensive and complex, particularly for those small independent operations which would otherwise limit the expansion of North America food service market.

Market Segmentation

The North America foodservice market share is classified by type and outlets.

- The quick-service restaurants segment accounted for the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the type, the North America foodservice market is segmented into, quick-service restaurants. Among these, the quick-service restaurants segment accounted for the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period. The growth is attributed to quick service restaurants emphasizing offering quick service, which mirrors the hectic lifestyle of most North American consumers. Their capacity to offer fast, ready-to-consume meals makes them a perfect option for busy individuals.

- The independent outlets segment accounted for the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the outlets, the North American foodservice market is divided into chained outlets and independent outlets. Among these, the independent outlets segment accounted for the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is due to independent outlets that tend to differentiate themselves by providing unique, locally driven menus or specialist dishes that address niche tastes and preferences. Such personalization is attractive to customers seeking differentiated dining experiences.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the North America foodservice market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Yum! Brands

- Starbucks Corporation

- Darden Restaurants

- Doctors Associates, Inc.

- Inspire Brands, Inc.

- Others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In August 2024, Performance Food Group (PFG) announced that it has entered into its agreement to acquire Cheney Brothers, a prominent Southeastern U.S. foodservice distributor, for $2.1 billion. The acquisition will extend PFG's coverage, adding five modern distribution centers in strategic states such as Florida and Georgia, and increase its customer base.

Market Segment

This study forecasts revenue at North America, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the North America foodservice market based on the below-mentioned segments

North America Food Service Market, By Type

- Cafes & Bars

- Cloud Kitchen

- Full-Service Restaurants

- Quick Service Restaurants

North America Food Service Market, By Outlet

- Chained Outlets

- Independent Outlets

Need help to buy this report?