North America Golf Cart Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Electric Golf Cart, Gasoline Golf Cart, Solar Golf Cart), By Seating Capacity (Small (2–4-seater), Medium (6–8-seater), Large (Above 8 Seats)), By Application (Golf Course, Personal Services, Commercial Services), By Region (US, Canada, Mexico, Rest of North America), and North America Golf Cart Market Insights Forecasts 2023 – 2033

Industry: Automotive & TransportationNorth America Golf Cart Market Insights Forecasts to 2033

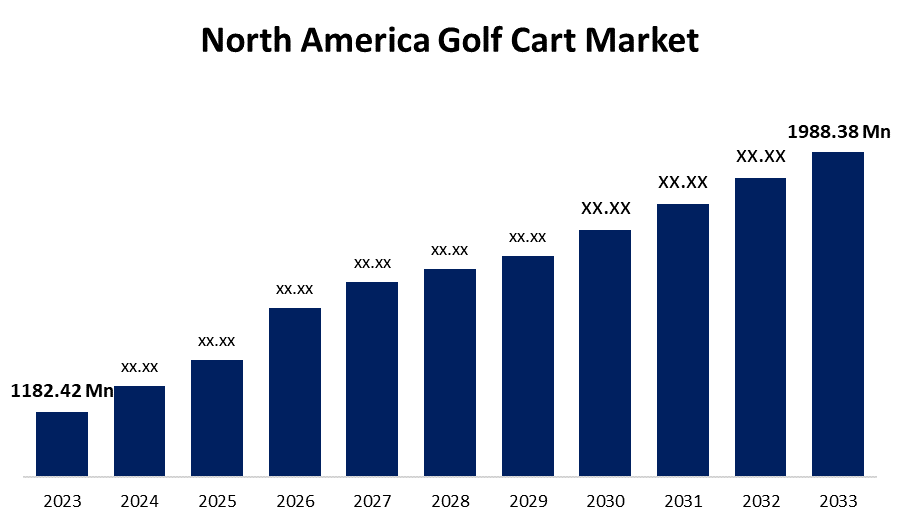

- The North America Golf Cart Market Size was valued at USD 1182.42 Million in 2023

- The Market Size is Growing at a CAGR of 5.34% from 2023 to 2033.

- The North America Golf Cart Market Size Expected to Reach USD 1988.38 Million by 2033.

Get more details on this report -

The North America Golf Cart Market size is expected to reach USD 1988.38 Million by 2033, at a CAGR of 5.34% during the forecast period 2023 to 2033.

Market Overview

Golf carts, also known as golf buggies or golf cars, are small, motorized vehicles designed to transport two golfers around a golf course in less time than walking. When used by two golfers, a golf cart is typically 4 feet wide, 8 feet long, and 6 feet tall, with a weight of 900 to 1000 pounds (410 to 450 kg). It can reach speeds of up to 15 mph (24 km/h). Furthermore, golf cart manufacturers are investing more in the development of a diverse range of products for a variety of applications to increase their sales in North America. Golf carts are increasingly being used in a variety of applications throughout the region, including hotels and resorts, airports, golf courses, and others. Furthermore, the popularity of golf in the region is also increasing due to the changing lifestyle. Furthermore, many golf cart manufacturers provide golf carts configured as small utility vehicles (UTVs), which were originally designed for golf course use. These UTVs came in a variety of configurations, including small golf carts used as pickup beds, flatbeds, dump-style beds, van boxes, coolers, and cabinets. Technological innovations, particularly in electric and solar-powered golf carts, are critical to market growth. Battery technology advancements, the addition of GPS and digital features, and the development of customizable and luxury carts address a wide range of consumer needs. An important trend is the growing preference for electric carts due to their environmental benefits and cost-effectiveness. Additionally, the market is seeing an increase in customizable and luxury carts, which meet specific consumer demands.

Report Coverage

This research report categorizes the market for the North America golf cart market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America golf cart market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the North America golf cart market.

North America Golf Cart Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1182.42 Million |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 5.34% |

| 2033 Value Projection: | USD 1988.38 Million |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product Type, By Seating Capacity, By Application, By Region and COVID-19 Impact Analysis. |

| Companies covered:: | Yamaha Motor Co. Ltd., Platinum Equity Advisors LLC, Textron Specialized Vehicles Inc., Garia Inc., Nordic Group of Companies Ltd., JH Global Services Inc., Cruise Car Inc., Showa Denko, Elite Golf Carts, Suzhou Eagle Electric Vehicle Manufacturing Co. Ltd., and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The primary drivers of this market are the growing popularity of golf as a sport and recreational activity, as well as the increasing use of carts in a variety of commercial and personal settings. Furthermore, in the North American golf cart market, electric golf carts are becoming increasingly popular as governments implement emission regulations to achieve long-term environmental goals. Additionally, the number of clubs and golf courses in the North America is increasing. Furthermore, as disposable income rises, so does the population's expenditure on recreational time and discretionary income. All of these factors boost the growth of the North America golf cart market. Furthermore, the effective integration of technology and workflow by major industry players is expected to boost the adoption of solar-powered golf carts in the coming years. Electric golf cars are slightly more expensive than their counterparts; however, steadily falling battery prices as a result of mass production and advanced cutting-edge manufacturing technologies have reduced the overall cost of electric models. Furthermore, recent advances in lithium-ion batteries have increased their storage capacities, resulting in a longer range for electric vehicles. As a consequence, increasing user preference for electric models is projected to boost North America golf cart market in forecast period.

Restraining Factors

The declining number of golfers owing to the high cost of playing, the game's incompatibility with modern lifestyles, and the difficulty of the game may hamper market growth over the forecast period. According to the United States consumer product safety commission, this results in limited vehicle usage. The government lacks regulations and strategies for golf cart accessibility, which is limited to private property and resorts. This limitation could hamper the widespread use of golf cart as a mode of transportation for short distances in urban areas.

Market Segment

- In 2023, the electric golf cart segment accounted for the largest revenue share over the forecast period.

Based on product type, the North America golf cart market is segmented into electric golf carts, gasoline golf cart, and solar golf cart. Among these, the electric golf cart segment has the largest revenue share over the forecast period. Electric golf carts are the largest segment in the North American market, owing to their environmental friendliness, cost-effectiveness, and low noise levels. These carts run on rechargeable batteries, making them more environmentally friendly than their gasoline counterparts. Battery technology has advanced significantly, increasing efficiency, range, and power, making it appealing to both golf courses and individual users. Electric carts are also popular to their low operational and maintenance costs, as they have fewer moving parts and do not require fuel. Furthermore, their quieter operation makes them ideal for use in residential and resort environments.

- In 2023, the small (2–4-seater) segment is witnessing the largest growth over the forecast period.

Based on seating capacity, the North America golf cart market is segmented into small (2–4-seater), medium (6–8-seater), and large (above 8 seats). Among these, the small (2–4-seater) segment is witnessing the largest growth over the forecast period. It is popular for personal use as well as on traditional golf courses. These compact carts are ideal for individual golfers or small groups, with enough room for players and their golf equipment. Their size makes them easy to move around the golf course and store. Aside from golf courses, this size is popular in residential communities, where it serves as an efficient mode of short-distance transportation. The small seating capacity suits the needs of individual families or couples, making it an excellent choice for personal use.

- In 2023, the golf course segment is witnessing the largest growth over the forecast period.

Based on application, the North America golf cart market is segmented into golf course, personal services, and commercial services. Among these, the golf course segment is witnessing the largest growth over the forecast period. This growth can be attributed to the inherent link between carts and their traditional use on golf courses. Furthermore, golf carts are essential for transporting players and equipment across the vast terrain of golf courses, which improves the overall playing experience. Also, the increasing number of golf courses around the world, the growing popularity of golf as a sport, and the growing trend of golf tourism all contribute to the growth of this segment. Moreover, golf courses invest in cart fleets, prioritizing models with advanced features such as GPS tracking and increased comfort to attract and retain members and visitors.

- The United States is projected to have the largest share of the North America golf cart market over the forecast period.

Based on region, the United States is projected to have the largest share of the North America golf cart market over the forecast period. Golf is becoming increasingly popular in the United States, which is driving up demand for golf carts. Technological advancements and changes in vehicle standards across the United States, such as strict emission limits, all help to grow the golf cart electric vehicle market there. With the prevalence of various vehicle emission protocols, manufacturers plan to build low-cost, lightweight golf carts for use in hotels, golf courses, and residential and commercial settings. Furthermore, high disposable income, an increase in the majority of the United States safety protocols, and an increase in vehicle standards are boosting market growth in United States.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the North America golf cart market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Yamaha Motor Co. Ltd.

- Platinum Equity Advisors LLC

- Textron Specialized Vehicles Inc.

- Garia Inc.

- Nordic Group of Companies Ltd.

- JH Global Services Inc.

- Cruise Car Inc.

- Showa Denko

- Elite Golf Carts

- Suzhou Eagle Electric Vehicle Manufacturing Co. Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In March 2023, Club Car, the world's leading producer of small-wheel zero-emission electric vehicles, launched the Club Car urban LSV and the Club Car XR through the company's North American commercial distributor network.

This study forecasts revenue at regional, and country levels from 2022 to 2033. Spherical Insights has segmented the North America golf cart market based on the below-mentioned segments:

North America Golf Cart Market, By Product Type

- Electric Golf Cart

- Gasoline Golf Cart

- Solar Golf Cart

North America Golf Cart Market, By Seating Capacity

- Small (2–4-Seater)

- Medium (6–8-Seater)

- Large (Above 8 Seats)

North America Golf Cart Market, By Application

- Golf Course

- Personal Services

- Commercial Services

North America Golf Cart Market, By Region

- US

- Canada

- Mexico

- Rest of North America

Need help to buy this report?