North America Gunshot Detection Market Size, Share, and COVID-19 Impact Analysis, By Sensing Technology (Acoustic-Based Technology, Acoustic-plus IR, Seismic-Based Detection), By Installation (Fixed Installation, Soldier Worn, Vehicle Mounted), By Application (Indoor, Outdoor), and North America Gunshot Detection Market Insights Forecasts to 2033

Industry: Aerospace & DefenseNorth America Gunshot Detection Market Insights Forecasts to 2033

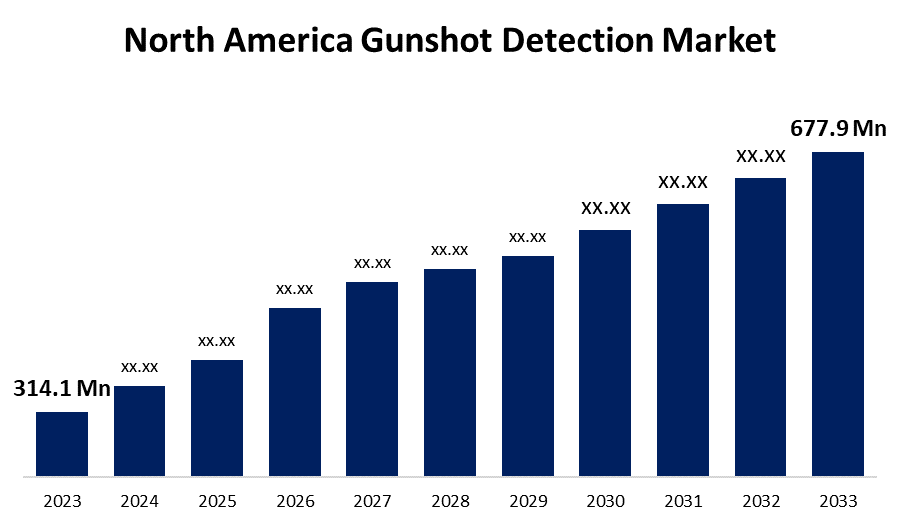

- The North America Gunshot Detection Market Size was valued at USD 314.1 Million in 2023.

- The Market Size is Growing at a CAGR of 8.0% from 2023 to 2033.

- The North America Gunshot Detection Market Size is Expected to Reach USD 677.9 Million by 2033.

Get more details on this report -

The North America Gunshot Detection Market Size is expected to reach USD 677.9 Million by 2033, at a CAGR of 8.0% during the forecast period 2023 to 2033.

Market Overview

The gunshot detection market in North America is a major market associated with the defense sector. A typical gunshot detection system uses a series of acoustic sensors to detect and transmit the firing position of gunshots. These systems use a combination of audio sensors, acoustic analysis, and advanced algorithms to detect the sound signatures associated with gunfire. These systems can be used by internal security agencies, law enforcement agencies, and the military to detect the shooting. The system can be installed in high-security buildings, strategic facilities, and other areas to accurately warn about potential enemy fires. In addition, the gunshot detection system uses acoustic detection technology to identify, and report gunshots to the police within seconds of being fired. A gunshot detection system consists of a sensor that detects gunshots, a transmitter that sends a message to a police control center, and a computer that receives and displays the message. Rising gun violence has been a persistent issue in the U.S., leading to increased demand for products that can help law enforcement agencies respond effectively.

Report Coverage

This research report categorizes the market for North America gunshot detection market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America gunshot detection market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the North America gunshot detection market.

North America Gunshot Detection Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 314.1 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 8.0% |

| 2033 Value Projection: | USD 677.9 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Sensing Technology, By Installation, By Application |

| Companies covered:: | SoundThinking Inc., Qinetiq Group, Amberbox Inc, Omnilert, Raytheon Technologies Corporation, Itron Inc., ZeroEyes, Eagl Technologies, 3XLOGIC, Shooter Detection Systems LLC and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Consumers are increasingly turning to automation-based solutions and services. This has resulted in a greater emphasis on IoT-based devices due to their innovative and advanced applications. IoT is a technology that enables internet or internetworking for almost all applications, including smartphones, microwaves, wearable devices, and buildings. IoT connects all of these devices to a common network via electronic software, sensors, and actuators. IoT uses a variety of sensors, including touch, proximity, and temperature sensors. IoT-based devices facilitate machine-to-machine (M2M) and human-to-computer communication. In addition, these devices help people capture and transmit electronic data. Furthermore, these sensors detect gunshots quickly, allowing security officials to arrest criminals or issue alarm alerts in public places, reducing the consequences. Increasing growth in the IoT industry and government initiatives to adopt sensors are expected to drive market growth in the North American gunshot detection market during the forecast period.

Restraining Factors

Gunshot detection systems have high installation and integration costs. Sensors, power sources, cameras, ethernet data cables, and each detector are connected to the on-site server via power over ethernet (PoE) switches. As a result, the installation process sustains significant labor and material costs. Furthermore, configuration and connectivity issues cause significant complications in existing corporate networks. As a result of the high cost of gunshot detection technology, most cities are unable to implement it. As a result, these factors are expected to hamper market growth over the forecast period.

Market Segment

- In 2023, the acoustic-based technology segment accounted for the largest revenue share over the forecast period.

Based on the sensing technology, the North America gunshot detection market is segmented into acoustic-based technology, acoustic-plus IR, and seismic-based detection. Among these, the acoustic-based technology segment has the largest revenue share over the forecast period. Acoustic-based systems detect gunshots in real time, allowing law enforcement and emergency services to respond quickly. They can detect gunshots within seconds of them being fired, giving valuable time to respond to the situation.

- In 2023, the fixed installation segment accounted for the largest revenue share over the forecast period.

Based on the installation, the North America gunshot detection market is segmented into fixed installation, soldier worn, and vehicle mounted. Among these, the fixed installation segment has the largest revenue share over the forecast period. The segmental growth is being driven by an increase in gun violence and terrorist activities, as well as a growing need for quick and accurate responses to such threats without false alarms. The growing number of mass shootings and urban violence has raised awareness and demand for technologies that can aid in the rapid response to active shooter situations.

- In 2023, the outdoor segment accounted for the largest revenue share over the forecast period.

Based on the application, the North America gunshot detection market is segmented into indoor and outdoor. Among these, the outdoor segment has the largest revenue share over the forecast period owing to an increase in public safety and the need to respond to incidents quickly. The growing use of the product in outdoor spaces such as parks, public events and gatherings, and transportation hubs is motivated by the desire to improve security, protect occupants, and respond effectively to potential threats.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the North America gunshot detection market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- SoundThinking Inc.

- Qinetiq Group

- Amberbox Inc

- Omnilert

- Raytheon Technologies Corporation

- Itron Inc.

- ZeroEyes

- Eagl Technologies

- 3XLOGIC

- Shooter Detection Systems LLC

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In September 2023, The United States Patent and Trademark Office (USPTO) has granted Shooter Detection Systems (SDS) two additional patents for its indoor gunshot detection technologies: Patent No. US 11,604,248 (Low Power Gunshot Sensor Testing) and Patent No. US 11,688,414 (Low Power Gunshot Detection).

Market Segment

This study forecasts country revenue from 2022 to 2033. Spherical Insights has segmented the North America gunshot detection market based on the below-mentioned segments:

North America Gunshot Detection Market, By Sensing Technology

- Acoustic-Based Technology

- Acoustic-plus IR

- Seismic-Based Detection

North America Gunshot Detection Market, By Installation

- Fixed Installation

- Soldier Worn

- Vehicle Mounted

North America Gunshot Detection Market, By Application

- Indoor

- Outdoor

Need help to buy this report?