North America Hair Care Market Size, Share, and COVID-19 Impact Analysis, By Type (Shampoo, Hair Styling, Conditioner, Hair Colorant, Hair Oil), By Treatment (Hair Treatment, Scalp Treatment), By Distribution Channel (Store-Based, Non-Store-Based), By Country (United States, Canada, Mexico, Rest of North America), and North America Hair Care Market Insights Forecasts to 2032

Industry: Consumer GoodsNorth America Hair Care Market Insights Forecasts to 2032

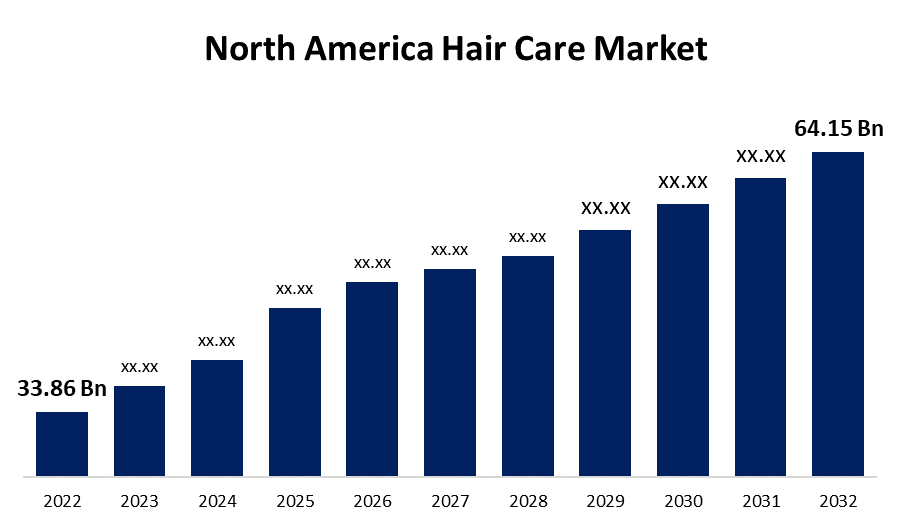

- The North America Hair Care Market Size was valued at USD 33.86 Billion in 2022.

- The Market Size is Growing at a CAGR of 6.60% from 2022 to 2032.

- The North America Hair Care Market Size is Expected To Reach 64.15 Billion by 2032.

Get more details on this report -

The North America Hair Care Market Size is Expected To Reach USD 64.15 Billion by 2032, at a CAGR of 6.60 % during the forecast period 2022 to 2032.

Market Overview

Hair care products help men and women in maintaining the health and cleanliness of their hair as well as protecting it from damage. Shampoo, conditioner, oil, serum, and other hair nourishment products are available in various forms such as liquid, gel, cream, and lotion. Depending on the hair type, various products are available in the market for various applications. Hair care products have captured the consumer's attention in the personal care products industry, as hair is regarded as a symbol of beauty. The hair care market is expected to expand across the North America as more consumers, particularly men, become conscious of their physical appearance and seek natural and traditional methods of hair enrichment and smoothing. The youth demographic that is fashion-conscious and continuously aware of the different hair care options available, like colorant and hair styling products that showcase consumer individuality and habits, is fueling the market's expansion. However, rising consumer health consciousness has presented a challenge to hair care market in North America. Consumers are most concerned about incidental health problems caused by hair gels, dyes, serums, and some hair styling agents. Furthermore, the increased availability of counterfeit hair care products is causing a significant dent in the market shares of the leading brands.

Report Coverage

This research report categorizes the market for North America hair care market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America hair care market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the North America hair care market.

North America Hair Care Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 33.86 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 6.60 % |

| 2032 Value Projection: | USD 64.15 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Treatment, By Distribution Channel, By Country and COVID-19 Impact Analysis. |

| Companies covered:: | Amway Corp., Procter & Gamble Company, L’Oréal SA, Unilever PLC,, The Estee Lauder Companies Inc.,, Henkel AG & Co. KGaA, Beiersdorf AG, Amka Products Pvt Ltd., Combe Inc., Coty Inc., Edgewell Personal Care Co, Grove Collaborative Inc., LVMH Moet Hennessy Louis Vuitton SE, Natura & CO Holding SA, and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Consumer preferences are shifting towards organic and herbal products as consumer become more aware of the harmful effects of chemicals on health and the environment, driving up consumption. Market participants who are increasingly focusing on developing and launching new scalp dressing products to meet consumer demand that is diverse in terms of geography, culture, and ethnicity have played an important role in the growth of the hair care market in North America. The affordability and readily accessible nature of hair care products such as shampoos, conditioners, oils, and sprays are exerting an increasing pull on the North America hair care market, resulting in an increased spending pattern in the hair care market. Furthermore, the market has seen an increase in the number of millennials experiencing hair problems, such as hair fall and dandruff, as a result of changing lifestyle patterns, as well as an increase in stress levels among working-class women, which is expected to drive demand for these products during the forecast period.

Restraining Factors

The growing number of people with sensitive hair who are allergic to hair cleansing products such as shampoo, cleanser, serum, and others due to the use of toxic chemicals is a hamper the market growth.

Market Segment

- In 2022, the shampoo segment accounted for the largest revenue share over the forecast period.

Based on the type, the North America hair care market is segmented into shampoo, hair styling, conditioner, hair colorant, and hair oil. Among these, the shampoo segment has the largest revenue share over the forecast period. Shampoo contains vitamins, botanical extracts, minerals, oils, and other hair enrichment ingredients help stimulate hair growth from the scalp follicles. Furthermore, the segment's demand is expected to be boosted by many consumers' frequent use of shampoo.

- In 2022, the scalp treatment segment accounted for the largest revenue share over the forecast period.

On the basis of treatment, the North America hair care market is segmented into hair treatment and scalp treatment. Among these, the scalp segment has the largest revenue share over the forecast period. Scalp treatments are able to improve overall hair health by supplying essential nutrients, vitamins, and minerals required for healthy hair growth. They can also aid in the prevention of hair loss, the promotion of hair growth, and the preservation of the hair's natural shine, volume, and texture.

- In 2022, the store-based segment is expected to hold the largest share of the North America hair care market during the forecast period.

Based on the distribution channel, the North America hair care market is classified into store-based and non-store-based. Among these, the store-based segment is expected to hold the largest share of the North America hair care market during the forecast period. These retailers bring popular products to market quickly and offer customers special deals, which helps to increase sales. Similarly, the ability of consumers to physically see the item increases their chances of purchasing products.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the North America hair care market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Amway Corp.

- Procter & Gamble Company

- L’Oréal SA, Unilever PLC,

- The Estee Lauder Companies Inc.,

- Henkel AG & Co. KGaA

- Beiersdorf AG

- Amka Products Pvt Ltd.

- Combe Inc.

- Coty Inc.

- Edgewell Personal Care Co

- Grove Collaborative Inc.

- LVMH Moet Hennessy Louis Vuitton SE

- Natura & CO Holding SA

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- On December 2022, With the new launch of Ouai's Anti-Dandruff Shampoo, P&G's Ouai improved its anti-dandruff shampoo category, which contains an FDA-approved ingredient such as 2% salicylic acid formulated to relieve dandruff symptoms and break down dandruff-causing bacteria to soothe the scalp. It debuted on the Sephora App and will be available on the Sephora and Ouai websites.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2021 to 2032. Spherical Insights has segmented the North America hair care market based on the below-mentioned segments:

North America Hair Care Market, By Type

- Shampoo

- Hair Styling

- Conditioner

- Hair Colorant

- Hair Oil

North America Hair Care Market, By Treatment

- Hair Treatment

- Scalp Treatment

North America Hair Care Market, By Distribution Channel

- Store-Based

- Non-Store-Based

North America Hair Care Market, By Country

- United States

- Canada

- Mexico

- Rest of North America

Need help to buy this report?