North America Healthcare IT Market Size, Share, and COVID-19 Impact Analysis, By Offerings (Healthcare Provider Solutions, Healthcare Payer Solutions & HCIT Outsourcing Services), By Component (Services, Software, Hardware), End User (Hospitals, ASC, Diagnostic & Imaging Centers, Pharmacies, Healthcare Payers), By Country (U.S., Canada, Mexico), and North America Healthcare IT Market Insights Forecasts to 2032.

Industry: Information & TechnologyNorth America Healthcare IT Market Insights Forecasts to 2032

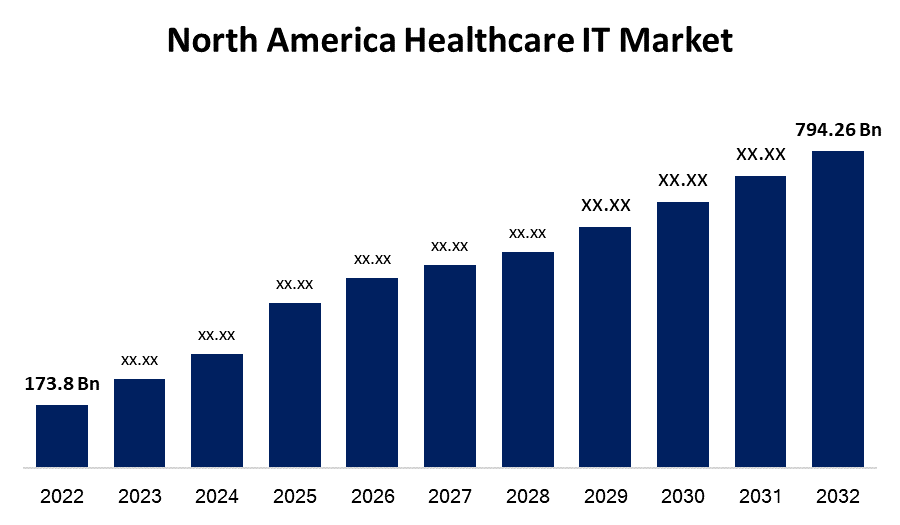

- The North America Healthcare IT Market Size was valued at USD 173.8 Billion in 2022.

- The Market Size is Growing at a CAGR of 16.4% from 2022 to 2032.

- The North America Healthcare IT Market Size is expected to reach USD 794.26 Billion by 2032.

- North America is expected To Grow the fastest during the forecast period.

Get more details on this report -

The North America Healthcare IT Market Size is expected to reach USD 794.26 Billion by 2032, at a CAGR of 16.4% during the forecast period 2022 to 2032.

The North America healthcare information technology market is predicted to grow rapidly throughout the projection period. The demand for advanced healthcare IT solutions is being driven by demographic changes, rising demand for healthcare services, and technological improvements. Hence, the widespread utilization of newly developed and creative healthcare IT solutions is likely to grow rapidly in the healthcare IT market.

Market Overview

Healthcare IT, also known as healthcare information technology, is a discipline of technological innovation that focuses on the development, design, creation, and maintenance of information technology systems in health care facilities, clinics, and other healthcare settings. Healthcare information technology provides several benefits and potential for enhancing and changing healthcare, such as increasing the quality of treatment, minimizing error rates, boosting efficiency in procedures, allowing treatment coordination, and analyzing information continuously. Furthermore, while growing acceptance of e-prescribing, telehealth services, mHealth, and other HCIT solutions increased as a result of COVID-19, higher utilization of mHealth, telehealth, and remote patient monitoring systems, and the requirement to maintain regulatory compliance are expected to drive the demand for North America healthcare IT Market expansion. In addition, the healthcare IT industry is focused on creating solutions that allow medical professionals to deliver better treatment at a cheaper cost. Moreover, devices that enable healthcare practitioners to effectively analyze and oversee the general population's health are required.

The general expense of medical services has risen dramatically in recent years. Rising medical coverage costs, higher demands for excellent healthcare services, an aging population, and an increase in the prevalence of long-term illnesses are boosting the market for healthcare services throughout North America. Patient readmissions, medical errors, and administrative expenditures are also contributors to the high cost of healthcare services. The rapid acceptance and start-up of healthcare IT solutions are predicted to avoid costing hospitals and other medical facilities billions of dollars by assuring more swift workflows, greater care coordination, lower labor costs, and decreased compliance concerns.

However, the expenditure of most healthcare IT solutions is prohibitively expensive, making implementation challenging for small to medium-sized healthcare companies. This is primarily attributable to the difficulty in integrating numerous networks with health configurations, an absence of wireless connectivity alternatives, and the necessity to install additional security layers to prevent data theft.

North America Healthcare IT Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 173.8 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 16.4% |

| 2032 Value Projection: | USD 794.26 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Offerings, By Component, End User, By Country, and Country Statistics (Demand, Price, Growth, Trends, Competitors, Challenges) |

| Companies covered:: | Cerner Corporation, Veradigm, Inc., Mckesson Corporation, Koninklijke Philips N.V., Optum, Inc., Oracle, Change Healthcare, Cognizant, GE Healthcare, Siemens Healthineers, Epic Systems Corporation, Athenahealth, Infor, Dell Technologies, Inc., CVS Health, IBM, EClinical Works, Nextgen Healthcare, Inc., Greenway Health, LLC, Nvidia Corporation, Evreka, Enevo Inc., Sensoneo. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Report Coverage

This research report categorizes the market for North America Healthcare IT Market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America Healthcare IT Market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the North America Healthcare IT Market.

Market Segment

- In 2022, the healthcare provider solutions segment is witnessing a higher growth rate over the forecast period.

On the basis of offerings, the North America Healthcare IT Market is segmented into healthcare provider solutions, healthcare payer solutions, and HCIT outsourcing services. Among these, the healthcare provider solutions segment is expected to develop at a faster rate during the forecast period. This is owing to increased government efforts aimed at enhancing patient care quality and in order to boost the productivity of healthcare services. The healthcare provider solutions market is further subdivided into clinical and non-clinical HCIT solutions. The clinical solutions market is expanding as a result of increasing consumer demand for greater security for patients and medical treatment, stringent laws governing healthcare provider solutions, and increasing demands for integrated healthcare systems.

- In 2022, the hospitals segment accounted for the largest revenue share of more than 57.3% over the forecast period.

On the basis of end user, the North America Healthcare IT Market is segmented into hospitals, ASC, diagnostic & imaging centers, pharmacies, and healthcare payers. Among these, the hospitals segment is dominating the market with the largest revenue share of 57.3% over the forecast period. Stringent mandates from the government, as well as the necessity of improving patient care while enhancing operational efficiency, make for a considerable portion of its contribution. T The growing number of patients, healthcare facilities, and ambulatory care centers, as well as hospitals' significant financial resources, are further supporting the expansion of this end user segment.

- In 2022, the United States segment accounted for the largest revenue share of more than 34.2% over the forecast period.

On the basis of country, the North America Healthcare IT Market is segmented into the United States, Canada, and Mexico. Among these, the United States segment is dominating the market with the largest revenue share of 34.2% over the forecast period. This dominance can be due to the region's widespread use of healthcare IT solutions, tight rules governing the standards of healthcare, and the growing demand to reduce skyrocketing medical expenses through healthcare IT solutions. Furthermore, the adoption of cloud platforms in healthcare has aided in the collection of critical patient records, such as medical data, real-time wellness, health coverage, and financial details. It boosts decision-making processes, increases the well-being of patients, and reduces healthcare expenses.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the North America Healthcare IT Market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Cerner Corporation

- Veradigm, Inc.

- Mckesson Corporation

- Koninklijke Philips N.V.

- Optum, Inc.

- Oracle

- Change Healthcare

- Cognizant

- GE Healthcare

- Siemens Healthineers

- Epic Systems Corporation

- Athenahealth

- Infor

- Dell Technologies, Inc.

- CVS Health

- IBM

- EClinical Works

- Nextgen Healthcare, Inc.

- Greenway Health, LLC

- Nvidia Corporation

- Evreka

- Enevo Inc.

- Sensoneo

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In March 2023, XTM Inc. announced that it has a product ready and is offering monetary bonus incentives for fill-in and surge shifts through its TimelyTM product, a digital feature built on the Today FinancialTM Platform, by leveraging its Payfare relationship for US banking and processing. Today Pay and Timely, an integrated staff management platform based on BookJane's software as a service for healthcare, are two of the associated products supported by XTM's fintech platform.

- On March 2022, Cognizant and Microsoft collaborated to develop a new digital health solution to improve remote patient monitoring and virtual health, utilizing products such as smart watches, blood pressure monitors, and glucose meters to collect and communicate patient health data to providers for better medical care.

- In October 2021, American Healthcare REIT, Inc. (previously Griffin-American Healthcare REIT IV, Inc., or "GAHR IV") stated that its merger with Griffin-American Healthcare REIT III, Inc. was completed. American Healthcare REIT owns and/or operates a 19 million-square-foot international portfolio of healthcare real estate in 36 states and the United Kingdom, including 312 medical office buildings, senior housing communities, skilled nursing facilities, and other real estate-related investments.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2021 to 2032. Spherical Insights has segmented the North America Healthcare IT Market based on the below-mentioned segments:

North America Healthcare IT Market, By Offerings

- Healthcare Provider Solutions

- Clinical Solutions

- Non-Clinical Solutions

- Healthcare Payer Solutions

- Claims Management Solutions

- Payment Management Solutions

- Population Health Management Solutions

- Others

- HCIT Outsourcing Services

- IT Infrastructure Management Services

- Provider HCIT Outsourcing Services

- Operational HCIT Outsourcing Services

North America Healthcare IT Market, By Component

- Services

- Software

- Hardware

North America Healthcare IT Market, By End User

- Hospitals

- ASC

- Diagnostic & Imaging Centers

- Pharmacies

- Healthcare Payers

North America Healthcare IT Market, By Country

- United States

- Canada

- Mexico

Need help to buy this report?