North America Hydrogen Fuel Cell Vehicle Market Size, Share, and COVID-19 Impact Analysis, By Technology (Alkaline Fuel Cell, Phosphoric Acid Fuel Cells, Solid Oxide Fuel Cell, Proton Exchange Membrane Fuel Cell, Others), By Range (0-250 Miles, 251-500 Miles, above 500 Miles), By Country (US, Canada, Mexico, Rest of North America), and North America Hydrogen Fuel Cell Vehicle Market Insights Forecasts to 2033

Industry: Automotive & TransportationNorth America Hydrogen Fuel Cell Vehicle Market Insights Forecasts to 2033

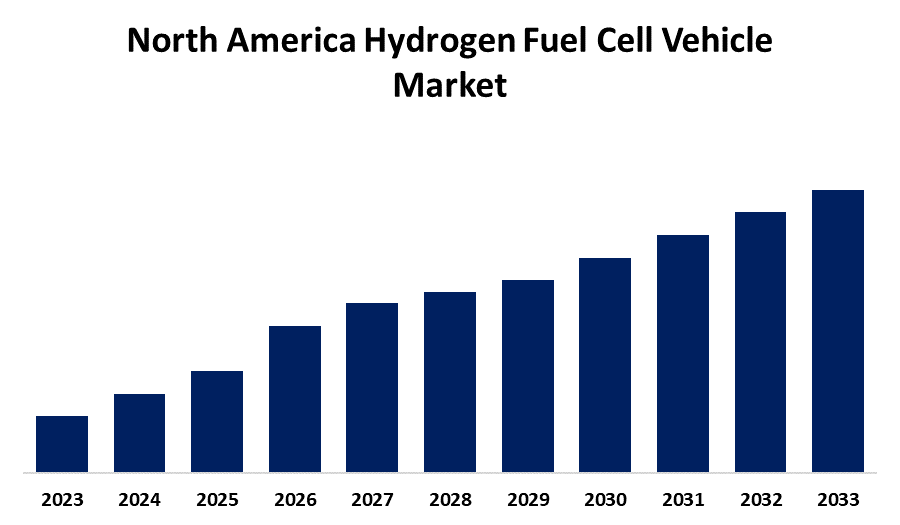

- The Market Size is Growing at a CAGR of XX% from 2023 to 2033.

- The North America Hydrogen Fuel Cell Vehicle Market Size is Expected to Hold a Significant Share by 2033.

Get more details on this report -

The North America Hydrogen Fuel Cell Vehicle Market Size is expected to Hold a Significant Share by 2033, at a CAGR of XX% during the forecast period 2023 to 2033.

Market Overview

An automobile that runs primarily on hydrogen gas is referred to as a hydrogen fuel car, or hydrogen fuel cell vehicle (FCV). Through a chemical process in a fuel cell, hydrogen stored as energy is used to create electricity, which powers an electric motor to move the vehicle. The only byproducts that these green hydrogen cars emit into the atmosphere are warm air and water vapor. When compared to cars with conventional internal combustion engines, they are recognized to be more potent and efficient. Using new and improved technologies to produce green hydrogen from renewable energy sources and plant materials will help North America achieve clean and affordable energy in the future. In comparison to many current electric vehicles on the market, hydrogen fuel cell vehicles have longer driven ranges, can use renewable hydrogen sources for zero-emission driving, and have fast refueling times (similar to a regular gasoline vehicle). Furthermore, the need for sustainable and clean transportation solutions has grown as environmental issues, especially air pollution and climate change, have gained more attention on a global. Furthermore, strict government laws and initiatives supporting emission-free automobiles are crucial in propelling the uptake of hydrogen fuel cell vehicles market in North America.

Report Coverage

This research report categorizes the market for North America hydrogen fuel cell vehicle market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America hydrogen fuel cell vehicle market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the North America hydrogen fuel cell vehicle market.

North America Hydrogen Fuel Cell Vehicle Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | XX% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Technology, By Range, By Country |

| Companies covered:: | Tesla Motors Inc., Toyota Motor Corporation, Honda Motor Co. Ltd, Ford Motor Company, Hyundai Motor Company, Volkswagen AG Daimler AG, Nikola Corporation, Stellantis NV, and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Alternative-fuel vehicles such as electric and fuel cells are examples of sustainable transportation, which is often defined as low- and zero-emission, energy-efficient, and affordable modes of transportation. The advantages of environmentally friendly transportation have grown in importance in the US and inspire the government to adopt a long-term plan. Strong demand for these low- and zero-emission vehicles has been found to be primarily driven by fuel and vehicle cost savings. Additionally, as alternative fuel production increases, more jobs will be attracted, leading to a rise in the manufacturing of vehicles, batteries, and fuel. Also, the use of hydrogen fuel cell technology is not just for vehicles. It will find use in vehicles such as trucks, buses, trains, and even stationary power plants for structures.

Restraining Factors

The initial cost of hydrogen fuel cell vehicles (FCVs) is relatively high when compared to traditional internal combustion engines and electric vehicles. The cost component continues to be a major deterrent for many customers, which prevents widespread adoption.

Market Segment

- In 2023, the proton exchange membrane fuel cell segment accounted for the largest revenue share over the forecast period.

based on the technology, the North America hydrogen fuel cell vehicle market is segmented into alkaline fuel cell, phosphoric acid fuel cells, solid oxide fuel cell, proton exchange membrane fuel cell, and others. Among these, the proton exchange membrane fuel cell segment has the largest revenue share over the forecast period. PEM fuel cells are well-known for their high efficiency and fast response to changes in power demand. Because of this feature, they work well in automotive applications where rapid acceleration and deceleration are necessary to achieve the best possible vehicle performance. Compared to other fuel cell technologies, PEM fuel cells operate at a somewhat lower temperature. This feature makes the fuel cell system more efficient overall and enables quicker startup times, which makes it more appropriate for use in on-road automobiles. In addition, compared to other fuel cell types, PEM fuel cells have a relatively lightweight and compact design. This feature comes beneficial when putting fuel cell systems into passenger cars, where weight and space are important factors.

- In 2023, the 251-500 miles segment accounted for the largest revenue share over the forecast period.

On the basis of range, the North America hydrogen fuel cell vehicle market is segmented into 0-250 miles, 251-500 miles, and above 500 miles. Among these, the 251-500 miles segment has the largest revenue share over the forecast period. The 251–500-mile range segment is consistent with consumer expectations for vehicle range. Customers frequently search for cars with a long driving range before needing to refuel, and the 251–500-mile range offers a good mix of functionality and affordability. Concerns about range anxiety—the possibility of a car running out of fuel before arriving at its destination—are common among buyers of hydrogen fuel cell automobiles. This anxiety is lessened by the 251–500-mile range, which offers a comfortable buffer for a range of driving conditions. Furthermore, long-distance travel without frequent stops for refueling is well suited for hydrogen fuel cell vehicles, which have a range of 251–500 miles. Since they are more appealing to customers who frequently need to travel long distances because they are more versatile.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the North America hydrogen fuel cell vehicle market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Tesla Motors Inc.

- Toyota Motor Corporation

- Honda Motor Co. Ltd

- Ford Motor Company

- Hyundai Motor Company

- Volkswagen AG Daimler AG

- Nikola Corporation

- Stellantis NV

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In November 2022, Volkswagen AG declared its intention to produce hydrogen-powered vehicles for the US and EU markets. The company is currently working on lowering the cost of fuel cells relative to its other products by offering competitive pricing.

Market Segment

This study forecasts revenue at regional, and country levels from 2022 to 2033. Spherical Insights has segmented the North America Hydrogen Fuel Cell Vehicle Market based on the below-mentioned segments:

North America Hydrogen Fuel Cell Vehicle Market, By Technology

- Alkaline Fuel Cell

- Phosphoric Acid Fuel Cells

- Solid Oxide Fuel Cell

- Proton Exchange Membrane Fuel Cell

- Others

North America Hydrogen Fuel Cell Vehicle Market, By Range

- 0-250 Miles

- 251-500 Miles

- above 500 Miles

North America Hydrogen Fuel Cell Vehicle Market, By Country

- US

- Canada

- Mexico

- Rest of North America

Need help to buy this report?