North America Medical Cannabis Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Solids, Dissolvable/Powders, Oil and Ointments, and Creams), By Derivative (Cannabidiol, Tetrahydrocannabinol), By Route of Administration (Inhalation, Oral, & Topical), By Application (Pain Management, Neurological Health Management, Mental Health Management), and North America Medical Cannabis Market Insights, Industry Trend, Forecasts to 2032.

Industry: HealthcareNorth America Medical Cannabis Market Insights Forecasts to 2032

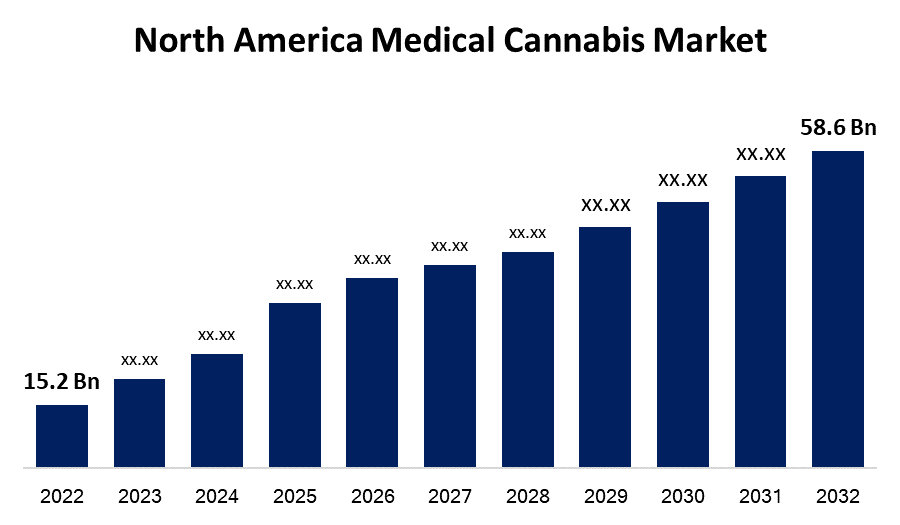

- The North America Medical Cannabis Market Size was valued at USD 15.2 Billion in 2022.

- The Market Size Is Growing at a CAGR of 14.4% from 2022 to 2032

- The North America Medical Cannabis Market Size is expected To reach USD 58.6 Billion by 2032.

Get more details on this report -

The North America Medical Cannabis Market Size was valued at USD 15.2 Billion in 2022 to USD 58.6 Billion by 2032 at a CAGR of 14.4% during the forecast period 2022-2032.

Market Overview

Medical cannabis, often known as medical marijuana, is a herbal treatment derived from Cannabis plants that are used to treat certain symptoms or conditions such as cancer, chronic pain, and mental problems. THC and CBD are the major cannabinoids derived from this plant that give medical effects. The market is increasing as a result of increased R&D activities and funding help from a variety of corporate and governmental entities. The medical cannabis industry is growing due to increased chronic illness incidence and consumer acceptance of cannabis-based therapies. Due to government prohibitions, the use of cannabis as medicine is not fully investigated, resulting in limited clinical research to identify the efficacy of cannabis in medicinal and therapeutic applications. However, preliminary research suggests that cannabis decreases nausea and vomiting in chemotherapy patients and aids with appetite stimulation.

Report Coverage

This research report categorizes the market of the North America medical cannabis market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America medical cannabis market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the North America medical cannabis market.

North America Medical Cannabis Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 15.2 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 14.4% |

| 2032 Value Projection: | USD 58.6 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Product Type, By Derivative, By Route of Administration, By Application, and Country Statistics (Demand, Price, Growth, Trends, Competitors, Challenges) |

| Companies covered:: | Vireo Health, Acreage Holdings, Green Thumb Company, MedMen, Cronos Group, Aphria. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

In North America, several chronic diseases impact people, including glaucoma, multiple sclerosis, epilepsy, spasticity caused by multiple sclerosis or spinal cord damage, fibromyalgia, and chemotherapy-induced nausea and vomiting. Because there is compelling evidence that cannabis is an excellent therapy for a wide range of disorders, the demand for cannabis-based pharmaceuticals is growing in tandem with the incidence of these conditions. Also, the recreational category is expected to increase at the fastest pace of 19.5% throughout the forecast period. Recreational cannabis usage is already legal in Canada and certain states in the United States; hence, favorable government initiatives, together with rising recreational cannabis use, are expected to drive market growth. Furthermore, governments are striving to minimize illicit drug transactions, and strong steps in this respect may aid expand recreational cannabis use in the coming years.

Restraining Factors

Medical cannabis devices can be costly to develop and acquire, and the operation itself might be costly owing to the specific equipment and training necessary. This may limit the availability of medicinal cannabis therapies for patients and healthcare institutions, particularly in low-income areas. Furthermore, the exorbitant expense of medical cannabis gadgets and procedures may prevent some patients from pursuing these therapies, particularly if they must pay out of pocket. Insurance coverage for medicinal cannabis therapies might also be limited, restricting its use.

Market Segment

- In 2022, the cannabidiol (CBD) segment is influencing a higher growth rate during the forecast period

Based on the derivatives, the North America medical cannabis market is segmented into cannabidiol (CBD), and tetrahydrocannabinol. Among these, the cannabidiol (CBD) segment is expected to have a higher market share value over the forecast period, due to the expanding public knowledge about the health advantages of cannabidiol, good legislative regulations, and the increased use of CBD oil in many businesses along with its application in several pharmaceuticals. This growth may be attributed to a shift in the general public's perspective of these items as well as an increase in demand for products derived from natural components. For example, it is widely utilized in the cosmetic sector in lotions, serums, and other products that have been shown helpful for treating dry skin, inflammatory skin diseases, and others. Moreover, the growing demand and spike in the quantity of CBD-infused goods available in the market are driving the expansion of this category. Other cannabis plants derivatives, such as minor cannabinoids, terpenes, and flavonoids, are covered in this section.

- In 2022, dissolvable/powders are dominating the largest market share over the forecast period.

Based on the product type, the North America medical cannabis market is segmented into solids, dissolvable/powders, oil and ointments, and creams. Among these, the dissolvable/powders segment held the largest market share during the forecast period.

- In 2022, pain management is leading the largest market share over the forecast period.

Based on the application, the North America medical cannabis market is segmented into pain management, neurological health management, and mental health management. Among these, the pain management segment dominated the largest market share during the forecast period.

- In 2022, the United States segment is dominating the highest growth rate during the forecast period

Based on country, the North America medical cannabis market is divided into Canada, Mexico, United States. Among these, the United States segment dominates the largest market growth during the forecast period, due to the legalization of medicinal cannabis in various states, the sector in the United States is growing. Also, the target market is expected to expand as more states legalize medicinal cannabis. Furthermore, regulatory norm improvements are expected to make conducting business easier. In Oregon, for example, cannabis licenses are related to a specific step of the manufacturing chain, such as producer, processor, distributor, laboratory, retailer, or researcher. In Colorado, the 70/30 rule, which obliged merchants to cultivate 70% of the medicinal cannabis they sold, was repealed. In Florida and Hawaii, vertical integration of medicinal marijuana enterprises is still required. Around 32 states in the United States have enacted or had measures about cannabis introduced in either chamber. This bill attempted to legalize medicinal marijuana, raise the quantity of THC in therapeutic goods, and accomplish other goals.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the North America medical cannabis market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Vireo Health

- Acreage Holdings

- Green Thumb Company

- MedMen

- Cronos Group

- Aphria

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In Feb 2023, Cronos group stated that it has partnered with Ginkgo Bioworks to create and market cannabis-based products to treat several ailments. This collaboration represents a significant advance toward the creation of cannabis-based therapies.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2022 to 2032. Spherical Insights has segmented the North America Medical Cannabis Market based on the below-mentioned segments:

North America Medical Cannabis Market, By Product Type

- Solids

- Dissolvable/Powders

- Oil and Ointments

- Creams

North America Medical Cannabis Market, By Derivatives

- Cannabidiol

- Tetrahydrocannabinol

North America Medical Cannabis Market, By Route of Administration

- Inhalation

- Oral

- Topical

North America Medical Cannabis Market, By Application

- Pain Management

- Neurological Health Management

- Mental Health Management

North America Medical Cannabis Market, By Country

- Canada

- Mexico

- United States

Need help to buy this report?