North America Medical Imaging Software Market Size, Share, and COVID-19 Impact Analysis, By Imaging Type (2D Imaging, 3D Imaging, and 4D Imaging), By Applications (Dental, Orthopedic, Cardiology, Obstetrics & Gynecology, Mammography, Urology, and Nephrology), and North America Medical Imaging Software Market Insights, Industry Trend, Forecasts to 2033.

Industry: HealthcareNorth America Medical Imaging Software Market Insights Forecasts to 2033

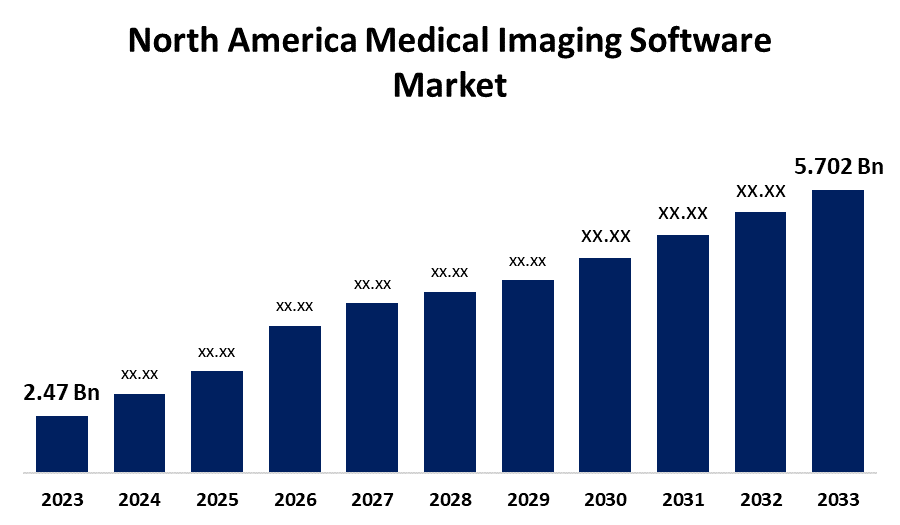

- The North America Medical Imaging Software Market Size was valued at USD 2.47 Billion in 2023.

- The Market Size is Growing at a CAGR of 8.73% from 2023 to 2033

- The North America Medical Imaging Software Market Size is Expected to Reach USD 5.702 Billion by 2033

Get more details on this report -

The North America Medical Imaging Software Market Size is Anticipated to Reach USD 5.702 Billion By 2033, Growing at a CAGR of 8.73% from 2023 to 2033

Market Overview

Designing, manufacturing, and distributing software solutions for processing, analyzing, and imaging medical images is the responsibility of the North America medical imaging software market. Orthopedics, cardiology, oncology, radiography, and other diagnostic and therapeutic procedures all depend heavily on software solutions. The market is expanding due to advancements in imaging technology, the need for precise diagnosis, and the growing use of healthcare IT systems. A growing number of chronic illnesses, including cancer, heart disease, and neurological disorders, are the primary factors propelling the medical imaging software market in North America. As the demand for accurate and prompt diagnoses increases, medical practitioners are using more advanced imaging tools and software to enhance clinical judgment. The demand for medical imaging software in North America is primarily driven by the elderly population, who are susceptible to various ailments that require imaging. Government programs, such as the Health Information Technology for Economic and Clinical Health (HITECH) Act, encourage the digitization of medical records and the use of electronic health records (EHRs). Investments in healthcare infrastructure and research funding for medical imaging technologies drive innovation and enhance the availability of sophisticated software solutions, contributing to the overall growth and development of the North American medical imaging software market.

Report Coverage

This research report categorizes the market for the North America medical imaging software market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America medical imaging software market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the North America medical imaging software market.

North America Medical Imaging Software Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 2.47 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 8.73% |

| 2033 Value Projection: | USD 5.702 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 188 |

| Tables, Charts & Figures: | 102 |

| Segments covered: | By Imaging Type, By Applications |

| Companies covered:: | Toshiba, Riverain Technologies, Siemens Healthineers, Medviso, MIM Software, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The medical imaging software market in North America is impacted by several significant variables. Rising rates of chronic illnesses, such as cancer, heart disease, and neurological problems, which require advanced imaging techniques for accurate diagnosis and treatment, are among the primary causes. The shift to precision medicine and the growing demand for non-invasive diagnostic methods are also propelling the market's expansion. Furthermore, imaging software is becoming more useful due to advancements in machine learning and artificial intelligence (AI), which improve workflow efficiency and diagnostic precision. The need for medical imaging software is also being driven by the growing usage of integrated healthcare systems and electronic health records (EHRs), since efficient data management and teamwork are becoming standard practices in modern healthcare workplaces.

Restraining Factors

Medical imaging software costs and infrastructure requirements can hinder smaller healthcare institutions from adopting sophisticated solutions. Implementing new software into existing IT platforms can be complex and interoperable, posing challenges. Data security and confidentiality issues, especially as healthcare data becomes more digitized, could slow adoption. Regulatory obstacles and the need for continuous updates to adapt to evolving healthcare rules may also slow market expansion.

Market Segmentation

The North America medical imaging software market share is classified into imaging type and applications.

- The 2D imaging segment accounted for the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

The North America medical imaging software market is segmented by imaging type into 2D imaging, 3D imaging, and 4D imaging. Among these, the 2D imaging segment accounted for the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period. This is mostly due to the fact that it is widely used in the diagnosis of many medical conditions using traditional imaging modalities including X-rays, CT scans, and ultrasounds. The foundation of its long-standing dominance is the familiarity, affordability, and sophisticated infrastructure that support 2D imaging technologies for the same purpose.

- The cardiology segment accounted for the highest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the applications, the North America medical imaging software market is divided into dental, orthopedic, cardiology, obstetrics & gynecology, mammography, urology, and nephrology. Among these, the cardiology segment accounted for the highest share in 2023 and is expected to grow at a significant CAGR during the forecast period. This is mainly because it is widely used in traditional imaging modalities, such as CT scans, ultrasounds, and X-rays, which are still very useful in diagnosing a wide range of medical conditions. Its long-standing leadership is supported by its familiarity, cost, and well-developed infrastructure that supports 2D imaging devices for the same purpose.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the North America medical imaging software market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Toshiba

- Riverain Technologies

- Siemens Healthineers

- Medviso

- MIM Software

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In January 2024, the purchase of MIM Software by GE HealthCare has been officially announced. Incorporating MIM Software's cutting-edge imaging analytics and digital workflow solutions into GE HealthCare's portfolio is the goal of this acquisition2. Oncology, urology, neurology, and cardiology are among the disciplines that these solutions are intended to enhance with precision treatment.

Market Segment

This study forecasts revenue at North America, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the North America medical imaging software market based on the below-mentioned segments:

North America Medical Imaging Software Market, By Imaging Type

- 2D Imaging

- 3D Imaging

- 4D Imaging

North America Medical Imaging Software Market, By Applications

- Dental

- Orthopedic

- Cardiology

- Obstetrics & Gynecology

- Mammography

- Urology

- Nephrology

Need help to buy this report?